Oil-Market Turbulence Whipsaws Junk Bonds

September 17 2019 - 4:10PM

Dow Jones News

By Matt Wirz

Volatility in oil prices is whipsawing the U.S. high-yield bond

market.

Junk bonds of U.S. oil-and-natural gas companies were the most

actively traded corporate securities Tuesday as they retraced much

of their gains from Monday, when oil prices jumped 15% on concerns

about disrupted Saudi Arabian production.

Energy companies account for about 6% of debt outstanding in the

high-yield market, according to data from S&P Global

Ratings.

Even if Saudi Arabia restores oil output faster than

anticipated, high-yield investors are ambivalent about buying back

into the energy sector because of their broader anxiety about

potential deterioration in the economy and credit markets, analysts

said.

"Monday's oil price spike should help somewhat, but the move is

a double-edged sword given escalating recessionary concerns,"

Michael Anderson, a strategist at Citigroup Inc. wrote in a

report.

California Resources Corp. and Chesapeake Energy Corp. were the

top-traded high-yield bond issuers Tuesday as oil prices swung

lower with about $265 million of debt changing hands, according to

data from MarketAxess. California Resources' bond due 2022 dropped

as much as 4.50 cents on the dollar to 58.50 cents on the dollar

Tuesday before rebounding to around 60, while Chesapeake's bond due

2025 dropped as much as 3 cents to 84 cents on the dollar before

rebounding to 86.

A string of bankruptcies in the oil patch triggered a steep junk

bond selloff in late 2015 and many investors fear a permanent

decline in oil prices could set off another round of defaults.

The oil and gas sector has the highest distress ratio -- defined

as the proportion of bonds yielding more than 10 percentage points

over U.S. Treasurys -- of any industry in the junk bond market,

according to data from S&P. The overall junk bond distress

ratio rose to 9.4% in August from about 6% in July, in large part

because of a surge in energy-company bond yields. The distress

ratio for oil and gas producers jumped to 36% from 18% in August,

according to S&P.

The steep increase in borrowing costs for energy companies

coincided with a sharp decline in new bond issuance from the

industry to $5.5 billion through Aug. 16, the lowest level since

2006, according to S&P. Higher borrowing costs can become a

critical problem for companies with below investment-grade credit

ratings because most of them lack the cash to pay debt as it comes

due.

U.S. government-bond yields fell, with the yield on the

benchmark 10-year Treasury note settled at 1.805% Tuesday, compared

with 1.843% Monday. Yields fall as bond prices rise.

The WSJ Dollar Index, which measures the U.S. currency against a

basket of 16 others, fell to 91.17 Tuesday from 91.39.

Write to Matt Wirz at matthieu.wirz@wsj.com

(END) Dow Jones Newswires

September 17, 2019 15:55 ET (19:55 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

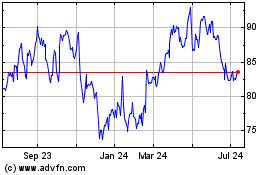

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

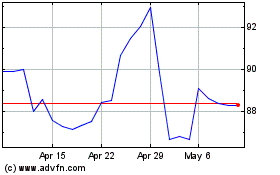

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024