|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On May 19, 2020, the Board of Directors of Clear Channel Outdoor Holdings, Inc. (the “Company”) declared a dividend of one preferred share purchase right (a “Right”), payable on May 29, 2020, for each share of common stock, par value $0.01 per share, of the Company (the “Common Shares”) outstanding on May 29, 2020 (the “Record Date”) to the stockholders of record on that date. In connection with the distribution of the Rights, the Company entered into a Rights Agreement (the “Rights Agreement”), dated as of May 19, 2020, between the Company and Computershare Trust Company, N.A., as rights agent. Each Right entitles the registered holder to purchase from the Company one one-thousandth of a share of Series B Preferred Stock, par value $0.01 per share (the “Series B Preferred Stock”), of the Company at a price of $5.75 per one one-thousandth of a Preferred Share represented by a Right (the “Purchase Price”), subject to adjustment.

The Rights are in all respects subject to and governed by the provisions of the Rights Agreement. The following description of the Rights Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Rights Agreement, which is attached hereto as Exhibit 4.1 and incorporated herein by reference.

Distribution Date; Exercisability; Expiration

Initially, the Rights will be attached to all Common Share certificates and no separate certificates evidencing the Rights (“Right Certificates”) will be issued. Until the Distribution Date (as defined below), the Rights will be transferred with and only with the Common Shares. As long as the Rights are attached to the Common Shares, the Company will issue one Right with each new Common Share so that all such Common Shares will have Rights attached.

The Rights will separate and begin trading separately from the Common Shares, and Right Certificates will be issued to evidence the Rights, on the earlier to occur of (i) the Close of Business (as such term is defined in the Rights Agreement) on the tenth day following a public announcement, or the public disclosure of facts indicating, that a Person (as such term is defined in the Rights Agreement) or group of affiliated or associated Persons has acquired Beneficial Ownership (as defined below) of 10% or more of the outstanding Common Shares (an “Acquiring Person”) (or, in the event the Board of Directors determines to effect an exchange in accordance with Section 24 of the Rights Agreement and the Board of Directors determines that a later date is advisable, then such later date) or (ii) the Close of Business on the tenth Business Day (as such term is defined in the Rights Agreement) (or such later date as may be determined by action of the Board of Directors prior to such time as any Person becomes an Acquiring Person) following the commencement of a tender offer or exchange offer the consummation of which would result in the Beneficial Ownership by a Person or group of 10% or more of the outstanding Common Shares (the earlier of such dates, the “Distribution Date”). As soon as practicable after the Distribution Date, unless the Rights are recorded in book-entry or other uncertificated form, the Company will prepare and cause the Right Certificates to be sent to each record holder of Common Shares as of the Distribution Date.

An “Acquiring Person” will not include (i) the Company, (ii) any Subsidiary (as such term is defined in the Rights Agreement) of the Company, (iii) any employee benefit plan of the Company or of any Subsidiary of the Company, (iv) any entity holding Common Shares for or pursuant to the terms of any such employee benefit plan or (v) any Person who or which, together with all Affiliates and Associates (as such terms are defined in the Rights Agreement) of such Person, at the time of the first public announcement of the Rights Agreement, is a Beneficial Owner of 10% or more of the Common Shares then outstanding (a “Grandfathered Stockholder”). However, if a Grandfathered Stockholder becomes, after such time, the Beneficial Owner of any additional Common Shares (regardless of whether, thereafter or as a result thereof, there is an increase, decrease or no change in the percentage of Common Shares then outstanding Beneficially Owned (as such term is defined in the Rights Agreement) by such Grandfathered Stockholder) then such Grandfathered Stockholder shall be deemed to be an Acquiring Person unless, upon such acquisition of Beneficial Ownership of additional Common Shares, such person is not the Beneficial Owner of 10% or more of the Common Shares then outstanding. In addition, upon the first decrease of a Grandfathered Stockholder’s Beneficial Ownership below 10%, such Grandfathered Stockholder will no longer be deemed to be a Grandfathered Stockholder. In the event that after the time of the first public announcement of the Rights Agreement, any agreement, arrangement or understanding pursuant to which any Grandfathered Stockholder is deemed to be the Beneficial Owner of Common Shares expires, is settled in whole or in part, terminates or no longer confers any benefit to or imposes any obligation on the Grandfathered Stockholder, any direct or indirect replacement, extension or substitution of such agreement, arrangement or understanding with respect to the same or different Common Shares that confers Beneficial Ownership of Common Shares shall be considered the acquisition of Beneficial Ownership of additional Common Shares by the Grandfathered Stockholder and render such Grandfathered Stockholder an Acquiring Person for purposes of the Rights Agreement unless, upon such acquisition of Beneficial Ownership of additional Common Shares, such person is not the Beneficial Owner of 10% or more of the Common Shares then outstanding.

“Acquiring Person” shall not include any Person which, together with all Affiliates and Associates of such Person, is the Beneficial Owner of Common Shares representing less than 20% of the Common Shares then outstanding, and which is entitled to file, and files, a statement on Schedule 13G pursuant to Rule 13d-1(b) or Rule 13d(1)(c) of the General Rules and Regulations under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with respect to the Common Shares Beneficially Owned by

such Person (a “13G Investor”); provided, that a Person who was a 13G Investor shall no longer be a 13G Investor if it either (i) files a statement on Schedule 13D (“Schedule 13D”) pursuant to Rule 13d-1(a), 13d-1(e), 13d-1(f) or 13d-1(g) of the General Rules and Regulations under the Exchange Act or (ii) becomes no longer entitled to file a statement on Schedule 13G (the earlier to occur of (i) and (ii), the “13D Event”), and such Person shall be an Acquiring Person if it is the Beneficial Owner (together with all Affiliates and Associates) of 10% or more of the Common Shares then outstanding at any point from and after the time of the 13D Event; provided, however, such Person shall not be an Acquiring Person if (i) on the first Business Day after the 13D Event such Person notifies the Company of its intent to reduce its Beneficial Ownership to below 10% as promptly as practicable and (ii) such Person reduces its Beneficial Ownership (together with all Affiliates and Associates of such Person) to below 10% of the Common Shares as promptly as practicable (but in any event not later than 10 days from such time); provided, further that such Person shall become an “Acquiring Person” if after reducing its Beneficial Ownership to below 10%, it subsequently becomes the Beneficial Owner of 10% or more of the Common Shares or if, prior to reducing its Beneficial Ownership to below 10%, it increases (or makes any offer or takes any other action that would increase) its Beneficial Ownership of the then-outstanding Common Shares above the lowest Beneficial Ownership of such Person at any time during such 10-day period.

“Beneficial Ownership” is defined in the Rights Agreement to include any securities (i) which a Person or any of such Person’s Affiliates or Associates beneficially owns, directly or indirectly, within the meaning of Rules 13d-3 or 13d-5 promulgated under the Exchange Act or has the right or ability to vote, or the right to acquire, pursuant to any agreement, arrangement or understanding (except under limited circumstances), (ii) which are directly or indirectly Beneficially Owned by any other Person with which a Person has any agreement, arrangement or understanding for the purpose of acquiring, holding, voting or disposing of such securities, or obtaining, changing or influencing control of the Company or (iii) which are the subject of, or the reference securities for, or that underlie, certain derivative positions of any Person or any of such Person’s Affiliates or Associates.

The Rights are not exercisable until the Distribution Date. The Rights will expire on the Close of Business on May 14, 2021.

Exempt Persons and Transactions

The Board of Directors may, in its sole and absolute discretion, determine that a Person is exempt from the Rights Agreement (an “Exempt Person”) so long as such determination is made prior to such time as such Person becomes an Acquiring Person. Any Person will cease to be an Exempt Person if the Board of Directors makes a contrary determination with respect to such Person regardless of the reason therefor. In addition, the Board of Directors may, in its sole and absolute discretion, exempt any transaction from triggering the Rights Agreement so long as the determination in respect of such exemption is made prior to such time as any Person becomes an Acquiring Person.

Flip-in Event

If a Person or group becomes an Acquiring Person at any time after the date of the Rights Agreement (with certain limited exceptions), the Rights will become exercisable for Common Shares having a value equal to two times the exercise price of the Right. From and after the announcement that any Person has become an Acquiring Person, if the Rights evidenced by a Right Certificate are or were acquired or Beneficially Owned by an Acquiring Person or any Associate or Affiliate of an Acquiring Person, such Rights shall become void, and any holder of such Rights shall thereafter have no right to exercise such Rights. If the Board of Directors so elects, the Company may deliver upon payment of the exercise price of a Right an amount of cash, securities, or other property equivalent in value to the Common Shares issuable upon exercise of a Right.

Exchange

At any time after any Person becomes an Acquiring Person, the Board of Directors may exchange the Rights (other than Rights owned by any Person which have become void), in whole or in part, at an exchange ratio of one Common Share per Right (subject to adjustment). The Company may issue, transfer or deposit such Common Shares (or other property as permitted under the Rights Agreement) to or into a trust or other entity created upon such terms as the Board of Directors may determine and may direct that all holders of Rights receive such Common Shares or other property only from the trust. In the event the Board of Directors determines, before the Distribution Date, to effect an exchange, the Board of Directors may delay the occurrence of the Distribution Date to such time as it deems advisable.

Flip-over Event

If, at any time after a Person becomes an Acquiring Person, (i) the Company consolidates with, or merges with, any other Person (or any Person consolidates with, or merges with, the Company) and, in connection with such consolidation or merger, all or part of the Common Shares are or will be changed into or exchanged for stock or other securities of any other Person or cash or any other property; or (ii) 50% or more of the Company’s consolidated assets or Earning Power (as defined in the Rights Agreement) are

sold, then proper provision will be made so that each holder of a Right will thereafter have the right to receive, upon the exercise thereof at the then current exercise price of the Right, that number of shares of common stock of the acquiring company which at the time of such transaction will have a market value of two times the exercise price of the Right.

Redemption

At any time prior to the time any Person becomes an Acquiring Person, the Board of Directors may redeem the Rights in whole, but not in part, at a price of $0.001 per Right (the “Redemption Price”). The redemption of the Rights may be made effective at such time, on such basis and with such conditions as the Board of Directors in its sole discretion may establish. Immediately upon any redemption of the Rights, the right to exercise the Rights will terminate and the only right of the holders of Rights will be to receive the Redemption Price.

Amendment

The terms of the Rights may be amended by the Board of Directors without the consent of the holders of the Rights, except that from and after such time as any Person becomes an Acquiring Person no such amendment may adversely affect the interests of the holders of the Rights (other than the Acquiring Person and its Affiliates and Associates).

Preferred Stock Rights

Each one-thousandth of a Preferred Share will entitle the holder thereof to the same dividends and liquidation rights as if the holder held one Common Share and will be treated the same as a Common Share in the event of a merger, consolidation or other share exchange.

Rights of Holders

Until a Right is exercised, the holder thereof, as such, will have no rights as a stockholder of the Company, including, without limitation, the right to vote or to receive dividends.

|

Item 3.03.

|

Material Modifications to Rights of Security Holders.

|

The information set forth in Items 1.01 and 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

|

Item 5.03.

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

In connection with the adoption of the Rights Agreement, on May 19, 2020, the Company filed a Certificate of Designations of Series B Preferred Stock with the Secretary of State of the State of Delaware. A copy of the Certificate of Designations of Series B Preferred Stock is attached hereto as Exhibit 3.1 and incorporated herein by reference.

CCIBV Note

On May 15, 2020, Clear Channel International, B.V., a subsidiary of the Company (“CCIBV”), issued a promissory note (the “CCIBV Note”) in principal amount of approximately $53.0 million. The CCIBV Note was transferred to the holder of the Company’s Series A Perpetual Preferred Stock, par value $0.01 per share (the “Series A Preferred Stock”), with an aggregate liquidation preference of approximately $47 million, in exchange for the Series A Preferred Stock, which will remain outstanding and be held by an affiliate of the Company. The transfer of the Series A Preferred Stock to an affiliate of the Company will effectively eliminate certain restrictions on the Company’s future flexibility to potentially pursue one or more liquidity enhancing capital structure transactions.

The CCIBV Note bears interest at a rate of 14.00% per annum in cash (or 16.00% per annum if paid-in-kind), paid quarterly. The CCIBV Note contains restrictions on restricted payments and incurrence of indebtedness by CCIBV and its subsidiaries. The CCIBV Note matures on May 15, 2022. The CCIBV Note is guaranteed by the Company, a certain other parent entity of CCIBV and certain subsidiaries of CCIBV.

Press Release

On May 19, 2020, the Company issued a press release, which is attached hereto as Exhibit 99.1 and incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit

No.

|

|

|

Description of Exhibit

|

|

|

|

|

|

|

|

|

3.1

|

|

|

Certificate of Designations of Series B Preferred Stock of Clear Channel Outdoor Holdings, Inc., as filed with the Secretary of State of the State of Delaware on May 19, 2020.

|

|

|

|

|

|

|

|

|

4.1

|

|

|

Rights Agreement, dated as of May 19, 2020, between Clear Channel Outdoor Holdings, Inc. and Computershare Trust Company, N.A., as rights agent.

|

|

|

|

|

|

|

|

|

99.1

|

|

|

Press Release dated May 19, 2020.

|

|

|

|

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File (formatted as inline XBRL).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CLEAR CHANNEL OUTDOOR HOLDINGS, INC.

|

|

|

|

|

|

|

|

|

|

Date: May 19, 2020

|

|

|

|

By:

|

|

/s/ Brian D. Coleman

|

|

|

|

|

|

Name:

|

|

Brian D. Coleman

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer and Treasurer

|

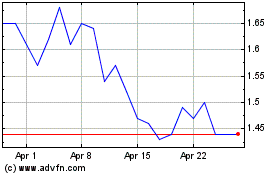

Clear Channel Outdoor (NYSE:CCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

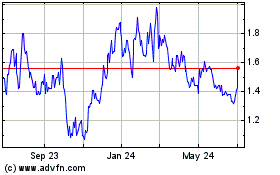

Clear Channel Outdoor (NYSE:CCO)

Historical Stock Chart

From Apr 2023 to Apr 2024