Current Report Filing (8-k)

April 16 2020 - 4:37PM

Edgar (US Regulatory)

TX false 0001334978 0001334978 2020-04-10 2020-04-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 10, 2020

CLEAR CHANNEL OUTDOOR HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-32663

|

|

88-0318078

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

4830 North Loop 1604W, Suite 111

San Antonio, Texas 78249

(Address of principal executive offices)

Registrant’s telephone number, including area code: (210) 547-8800

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock

|

|

“CCO”

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

☐

|

Emerging growth company

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 3.01.

|

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

|

On April 10, 2020, Clear Channel Outdoor Holdings, Inc. (the “Company”) was notified by the New York Stock Exchange (the “NYSE”) that the average closing price of the Company’s common stock, par value $0.01 (the “Common Stock”), over the prior 30 consecutive trading day period was below $1.00 per share, which is the minimum average closing price per share required to maintain listing on the NYSE under Section 802.01C of the NYSE Listed Company Manual (“Section 802.01C”).

Pursuant to Section 802.01C, the Company has a period of six months following the receipt of the notice to regain compliance with the minimum share price requirement. In order to regain compliance, on the last trading day of any calendar month during the cure period, the Common Stock must have (i) a closing price of at least $1.00 per share and (ii) an average closing price of at least $1.00 per share over the 30-trading day period ending on the last trading day of such month.

As required by the NYSE, the Company intends to timely respond to the NYSE with respect to its intent to cure the deficiency to regain compliance with the price criteria. The Company intends to consider all available options to regain compliance with the requirements of Section 802.01C, including, if necessary, by implementing a reverse stock split, subject to approval by the Company’s board of directors and stockholders.

The notice has no immediate impact on the listing of the Common Stock, which will continue to be listed and traded on the NYSE during this period, subject to the Company’s compliance with the other continued listing requirements of the NYSE. The Common Stock will continue to trade on the NYSE under the symbol “CCO” but will have an added designation of “.BC” to indicate the Company is not in compliance with the NYSE’s continued listing standards. Failure to satisfy the conditions of the cure period or to maintain other listing requirements could lead to a delisting.

The notice does not affect ongoing business operations of the Company or its reporting requirements with the Securities and Exchange Commission nor does it trigger any violation of its debt obligations.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On April 16, 2020, the Company issued a press release announcing its receipt of the NYSE notice. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information under this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall such information, including Exhibit 99.1, be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements in this Current Report on Form 8-K constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results to be materially different from any future results expressed or implied by such forward-looking statements. Any statements that refer to or implicate future events are forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. Risks and uncertainties include the Company’s ability to regain compliance with the continued listing criteria of the NYSE and continue to comply with other applicable listing standards within the available cure period; and other factors set forth under “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019. You are cautioned not to place undue reliance on these forward-looking statements. The Company does not undertake any obligation to publicly update or revise any forward-looking statements because of new information, future events or otherwise.

|

Item 9.01

|

Financial Statements and Exhibits.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CLEAR CHANNEL OUTDOOR HOLDINGS, INC.

|

|

|

|

|

|

|

|

|

|

Date: April 16, 2020

|

|

|

|

By:

|

|

/s/ Brian D. Coleman

|

|

|

|

|

|

|

|

Brian D. Coleman

|

|

|

|

|

|

|

|

Chief Financial Officer and Treasurer

|

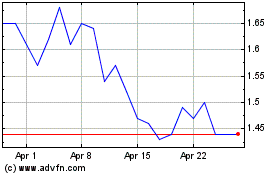

Clear Channel Outdoor (NYSE:CCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

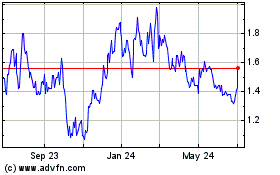

Clear Channel Outdoor (NYSE:CCO)

Historical Stock Chart

From Apr 2023 to Apr 2024