Property Investors See Fiber-Optic Cables as 'Railroads of the Future'

May 05 2020 - 8:29AM

Dow Jones News

By Konrad Putzier

Business closures and stay-at-home orders have hit the

real-estate sector hard. But an obscure corner of the industry is

benefiting from people staying at home.

Fiber-optic cables are drawing a growing interest from

investors. These cables, which transmit data through light and are

a crucial component of high-speed internet, aren't technically real

estate. But they are often owned by property investment firms and

leased out to users under long-term deals, much like office or

retail space.

The Internal Revenue Service treats income from leasing out

cables as property income, which has allowed publicly traded

real-estate investments trusts to build up sizeable portfolios.

Now, as the coronavirus pandemic causes more people to work

remotely and cloud-based applications such as Zoom Video

Communications Inc. become a crucial part of the economy, demand

for fiber-optic cables is increasing.

"These are literally the railroads of the future," said Marc

Ganzi, chief executive officer-elect of investment firm Colony

Capital Inc.

While the stocks of most real-estate investment trusts are down

this year amid concern over plummeting rental income, share prices

of companies that invest exclusively in digital-economy-related

real estate have rallied.

Shares of Crown Castle International Corp., a Houston-based

owner of cell towers and fiber-optic cables, are up 11% this year,

while the Vanguard Real Estate ETF is down 21%, according to

FactSet.

Crown Castle has invested $14 billion in fiber over the past

five years and plans to invest around $2 billion annually in the

coming years, said CEO Jay Brown. The company is betting that the

rollout of faster 5G internet across the U.S. creates the need for

more fiber and small cell towers, particularly in large, densely

populated cities.

Crown Castle and fiber-cable company Zayo Group Holdings Inc.,

which was recently acquired by a Colony affiliate and EQT, are

among the biggest owners of fiber. Tech giants such as Google

parent Alphabet Inc. have also invested in the sector.

In March, Digital Colony and EQT took Zayo private in a $14.3

billion deal -- one of the largest leveraged buyouts since the

financial crisis. More than a quarter of Digital Colony's $4.1

billion fund is invested in fiber, Mr. Ganzi said, and the company

plans to invest more than $1 billion in fiber over the coming

year.

In 2017, Deloitte estimated that the U.S. would need to invest

$130 billion to $150 billion in fiber over five to seven years to

roll out 5G across the country effectively. Now an increase in

remote work is giving fiber owners another boost.

"Working from home has really shifted how the internet is

working," said David Guarino, an analyst at Green Street Advisors.

Within large offices, data is often sent around through internal

networks. When people work remotely and do much of their work over

cloud-based applications, they send more data through fiber cables

owned by investment firms, Mr. Guarino said.

Much of the increase in remote work is likely temporary, but

more companies say they want employees to spend more time working

from home or from smaller satellite offices even after the pandemic

is over.

And while government orders halted construction of office or

apartment buildings in some cities, Mr. Brown said Crown Castle was

deemed an essential business and could continue laying cables

throughout the pandemic.

Some traditional real-estate investors began shifting to a

digital strategy well before the pandemic. Colony Capital said last

year it planned to sell most of its traditional property holdings,

including hotels and warehouses, and invest more in data centers,

fiber and cell towers through its platform Digital Colony

Management.

Tesh Durvasula, interim CEO of data center owner CyrusOne Inc.,

said the sector has benefited from investors fleeing industries

such as oil extraction, hospitality and airlines, which were hit

particularly hard by the pandemic.

"All of that capital had to relocate out of that," he said, "and

it's relocated into digital infrastructure."

Write to Konrad Putzier at konrad.putzier@wsj.com

(END) Dow Jones Newswires

May 05, 2020 08:14 ET (12:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

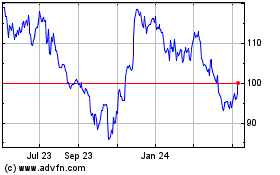

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

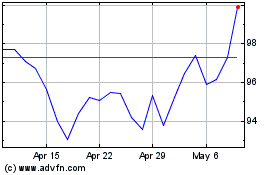

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Apr 2023 to Apr 2024