Current Report Filing (8-k)

August 25 2020 - 4:22PM

Edgar (US Regulatory)

false

0000910612

0000915140

0000910612

2020-08-19

2020-08-19

0000910612

cbl:CBLAssociatesLimitedPartnershipMember

2020-08-19

2020-08-19

0000910612

us-gaap:CommonClassAMember

2020-08-19

2020-08-19

0000910612

us-gaap:SeriesDPreferredStockMember

2020-08-19

2020-08-19

0000910612

us-gaap:SeriesEPreferredStockMember

2020-08-19

2020-08-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 19, 2020

CBL & ASSOCIATES PROPERTIES, INC.

CBL & ASSOCIATES LIMITED PARTNERSHIP

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-12494

|

|

62-1545718

|

|

Delaware

|

|

333-182515-01

|

|

62-1542285

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

2030 Hamilton Place Blvd., Suite 500, Chattanooga, TN 37421-6000

(Address of principal executive office, including zip code)

423-855-0001

(Registrant's telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered under Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each Class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

|

CBL

|

|

New York Stock Exchange

|

|

7.375% Series D Cumulative Redeemable Preferred Stock, $0.01 par value

|

|

CBLprD

|

|

New York Stock Exchange

|

|

6.625% Series E Cumulative Redeemable Preferred Stock, $0.01 par value

|

|

CBLprE

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement

As previously disclosed, CBL & Associates Limited Partnership (the “Operating Partnership”), the majority owned subsidiary of CBL & Associates Properties, Inc. (the “REIT” and collectively with the Operating Partnership, the “Company”), received notices of default and reservation of rights letters from Wells Fargo Bank, National Association, the administrative agent (the “Administrative Agent”) under the Operating Partnership’s Credit Agreement, dated as of January 30, 2019 (as the same may be amended, restated, supplemented, replaced or otherwise modified from time to time, the “Credit Agreement”) on each of May 26, 2020, June 2, 2020, June 16, 2020 and August 6, 2020. The notices asserted that certain defaults and events of default occurred and continue to exist by reason of the Operating Partnership’s failure to comply with certain restrictive covenants, including the liquidity covenant, in the Credit Agreement and resulting from the failure to make the $11.8 million interest payment that was due and payable on June 1, 2020 to holders of the Operating Partnership’s $450 million outstanding principal amount of 5.25% senior unsecured notes due 2023 (the “2023 Notes”) and the $18.6 million interest payment that was due and payable on June 15, 2020 to holders of the Operating Partnership’s $625 million outstanding principal amount of 5.95% senior unsecured notes due 2026 (the “2026 Notes”) prior to the expiration of the applicable grace periods. In addition, as previously disclosed, on August 6, 2020, the Operating Partnership received a notice of imposition of base rate and post-default rate letter from the Administrative Agent, which (i) informed the Operating Partnership that following an asserted event of default on March 19, 2020, all outstanding loans were converted to base rate loans at the expiration of the applicable interest periods and (ii) sought payment of approximately $4.8 million related thereto for April through June 2020 (the “Demand Interest”).

On August 19, 2020, the Operating Partnership received a notice of default and reservation of rights letter from the Administrative Agent, which asserted that each of the failure to pay the Demand Interest and the entry into the previously disclosed Restructuring Support Agreement dated August 18, 2020 by the Company with certain beneficial owners and/or investment advisors or managers of discretionary funds, accounts or other entities for the holders of beneficial owners of the 2023 Notes, the 2026 Notes and the Operating Partnership’s $300 million outstanding principal amount of 4.60% notes due 2024 (the “2024 Notes” and, together with the 2023 Notes and the 2026 Notes, the “Notes”) constituted events of default under the Credit Agreement.

On August 19, 2020, the Operating Partnership received a notice of acceleration of obligations under the Credit Agreement (the “Notice of Acceleration”) from the Administrative Agent based on the events of default previously asserted by the Administrative Agent. Pursuant to the Notice of Acceleration, the Administrative Agent declared the $1.123 billion principal amount of the loans together with interest accruing at the base rate and the post-default rate, which as previously disclosed are rates being disputed by the Company, $1.3 million of outstanding letters of credit and all other obligations under the Credit Agreement to be immediately due and payable. The Administrative Agent also terminated the revolving and swingline commitments and the obligation to issue letters of credit under the Credit Agreement and instructed the Operating Partnership to deliver approximately $1.3 million to cash collateralize outstanding letters of credit.

The Company disagrees with the assertions made by the Administrative Agent as the basis for the Notice of Acceleration and, accordingly, the validity of the Notice of Acceleration. The Company continues to dispute the alleged defaults asserted by the Administrative Agent and has engaged with the Administrative Agent since receipt of the Notice of Acceleration. The Administrative Agent has indicated that the lenders intend to continue good faith negotiations with the Company surrounding a consensual restructuring of the Company’s balance sheet. In the event that the Administrative Agent were to attempt to seek to exercise remedies based on these disputed defaults, however, it is the Company’s intention to seek an immediate stay of any such action in a court of appropriate jurisdiction.

If it is determined that an event of default exists under the Credit Agreement and the Notice of Acceleration was properly provided by the Administrative Agent, all unpaid principal, interest and other obligations under the Credit Agreement described above would be due and payable immediately unless the Operating Partnership negotiates an amendment or waiver with the requisite lenders under the Credit Agreement.

An acceleration of the Operating Partnership’s obligations under the Credit Agreement will result in an event of default under the indenture governing the Operating Partnership’s outstanding Notes if the indebtedness under the Credit Agreement is not discharged or the acceleration is not rescinded or annulled within a period of 30 days after notice has been given to the Operating Partnership by the trustee under the indenture governing the Notes or the holders of at least 25% in aggregate principal amount of the applicable series of Notes specifying such default and requiring that the indebtedness under the Credit Agreement be discharged or such acceleration be rescinded. Following the occurrence of any such event of default, the trustee or the holders of at least 25% in aggregate principal amount of the applicable series of Notes may declare all outstanding principal of such series of Notes and accrued and unpaid interest to be due and payable immediately.

ITEM 7.01 Regulation FD Disclosure

On August 25, 2020, CBL Holdings I, Inc., acting in its capacity as the sole general partner of CBL & Associates Limited Partnership, the Operating Partnership (the “Operating Partnership”) of CBL & Associates Properties, Inc. (the

“Company”), issued a letter to all holders of limited partnership interests other than the Company, directing their attention to certain of the Company’s prior public disclosures concerning the implications for limited partners of the Company’s previously announced restructuring process. A copy of the letter is furnished as Exhibit 99.1 to this Report.

The information in this Report and the Exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

ITEM 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

CBL & ASSOCIATES PROPERTIES, INC.

|

|

|

|

|

|

|

|

|

/s/ Farzana Khaleel

|

|

|

|

|

|

Farzana Khaleel

|

|

|

Executive Vice President -

|

|

|

Chief Financial Officer and Treasurer

|

|

|

|

|

|

CBL & ASSOCIATES LIMITED PARTNERSHIP

|

|

|

|

|

|

By: CBL HOLDINGS I, INC., its general partner

|

|

|

|

|

|

|

|

|

/s/ Farzana Khaleel

|

|

|

|

|

|

Farzana Khaleel

|

|

|

Executive Vice President -

|

|

|

Chief Financial Officer and Treasurer

|

|

|

|

|

Date: August 25, 2020

|

|

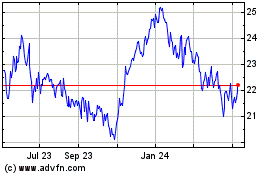

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

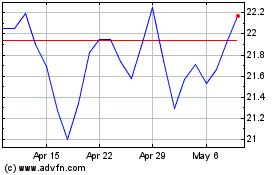

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Apr 2023 to Apr 2024