Current Report Filing (8-k)

July 31 2020 - 6:29AM

Edgar (US Regulatory)

false

0000910612

0000915140

0000910612

2020-07-24

2020-07-24

0000910612

cbl:CBLAssociatesLimitedPartnershipMember

2020-07-24

2020-07-24

0000910612

us-gaap:CommonClassAMember

2020-07-24

2020-07-24

0000910612

us-gaap:SeriesDPreferredStockMember

2020-07-24

2020-07-24

0000910612

us-gaap:SeriesEPreferredStockMember

2020-07-24

2020-07-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): July 24, 2020

CBL & ASSOCIATES PROPERTIES, INC.

CBL & ASSOCIATES LIMITED PARTNERSHIP

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-12494

|

|

62-1545718

|

|

Delaware

|

|

333-182515-01

|

|

62-1542285

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

2030 Hamilton Place Blvd., Suite 500, Chattanooga, TN 37421-6000

(Address of principal executive office, including zip code)

423-855-0001

(Registrant's telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered under Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each Class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

|

CBL

|

|

New York Stock Exchange

|

|

7.375% Series D Cumulative Redeemable Preferred Stock, $0.01 par value

|

|

CBLprD

|

|

New York Stock Exchange

|

|

6.625% Series E Cumulative Redeemable Preferred Stock, $0.01 par value

|

|

CBLprE

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 3.02 Unregistered Sales of Equity Securities.

Effective July 24, 2020, CBL & Associates Properties, Inc. (herein the “Company” or “CBL”), acting through its wholly owned subsidiary that serves as the general partner of CBL & Associates Limited Partnership, the Company’s operating partnership (the “Operating Partnership”), approved the issuance, pursuant to the terms of the Fourth Amended and Restated Agreement of Limited Partnership (the “Partnership Agreement”) of the Operating Partnership of an aggregate of 1,783,403 shares of the Company’s common stock, par value $.01 per share (the “Common Stock”) in response to exchange notices previously received from the following limited partners who may be considered affiliates of the Company (other than Ben S. Landress, who became an emeritus officer of the Company effective May 8, 2020), covering a like number of common units of limited partnership in the Operating Partnership:

|

Limited Partner Exercising

Common Unit Exchange Rights

|

Number of Common Units Exchanged / Shares Issued

|

|

Ben S. Landress

|

120,480

|

|

Charles B. Lebovitz

|

756,350

|

|

Alan L. Lebovitz

|

155,847

|

|

Alan L. Lebovitz and Allison G. Lebovitz Irrevocable Trust U/A dated 3/24/2003, Michael I. Lebovitz, Trustee

|

52,980

|

|

College Station Associates

|

489,071

|

|

CBL/Employees Partnership/Conway

|

58,203

|

|

Foothills Plaza Partnership

|

92,793

|

|

Girvin Road Partnership

|

7,254

|

|

Warehouse Partnership

|

50,425

|

|

TOTAL

|

1,783,403

|

These exchanges are expected to close July 31, 2020.

In addition, effective July 23, 2020, pursuant to an exchange notice previously received from non-affiliate John N. Foy, the Company issued, pursuant to the terms of the Partnership Agreement, 338,331 shares of the Company’s Common Stock in exchange for a like number of common units of limited partnership in the Operating Partnership. The pending July 31 closing on the exchanges listed in the table above, in combination with the previous closing on shares issued to Mr. Foy, will result in an aggregate of 2,121,784 shares of Common Stock having been issued in such exchange transactions since the filing of the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2020.

The Company’s election to issue shares of Common Stock pursuant to these exchange transactions was made in accordance with the Company’s right to deliver either shares of Common Stock, or their cash equivalent (as determined pursuant to the Partnership Agreement), to complete such exchanges. We believe these share issuances are exempt from the registration requirements of the Securities Act of 1933, as amended, pursuant to Section 4(a)(2) thereof, because they did not involve a public offering or sale. No underwriters, brokers or finders were involved in any of these transactions.

The issuance of these shares of Common Stock does not impact the fully diluted ownership of the Company by the exchanging holders listed in the table above, as disclosed in the beneficial ownership tables in the Company’s annual meeting proxy statements, because ownership of Operating Partnership units potentially convertible into shares of the Company’s Common Stock is already reflected in such calculations of fully diluted ownership.

The Company has been advised that certain Company executives who were involved in these transactions, either directly or through their ownership of a portion of the equity in CBL’s Predecessor, may elect in the future to sell shares of Common Stock that they held prior to the completion of these exchange transactions for tax planning purposes, and some of those sales may occur pursuant to one or more trading plans entered into pursuant to Securities and Exchange Commission Rule 10b5-1 promulgated under the Securities Exchange Act of 1934, as amended.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

CBL & ASSOCIATES PROPERTIES, INC.

|

|

|

|

|

|

|

|

|

/s/ Farzana Khaleel

|

|

|

|

|

|

Farzana Khaleel

|

|

|

Executive Vice President -

|

|

|

Chief Financial Officer and Treasurer

|

|

|

|

|

|

CBL & ASSOCIATES LIMITED PARTNERSHIP

|

|

|

|

|

|

By: CBL HOLDINGS I, INC., its general partner

|

|

|

|

|

|

|

|

|

/s/ Farzana Khaleel

|

|

|

|

|

|

Farzana Khaleel

|

|

|

Executive Vice President -

|

|

|

Chief Financial Officer and Treasurer

|

|

|

|

|

Date: July 30, 2020

|

|

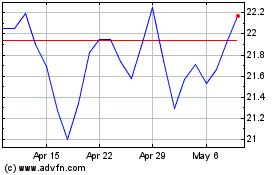

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

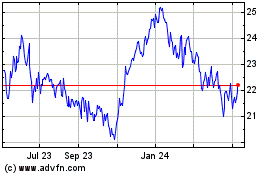

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Apr 2023 to Apr 2024