Current Report Filing (8-k)

July 01 2020 - 6:36AM

Edgar (US Regulatory)

false

0000910612

0000915140

0000910612

2020-06-30

2020-06-30

0000910612

cbl:CBLAssociatesLimitedPartnershipMember

2020-06-30

2020-06-30

0000910612

us-gaap:CommonClassAMember

2020-06-30

2020-06-30

0000910612

us-gaap:SeriesDPreferredStockMember

2020-06-30

2020-06-30

0000910612

us-gaap:SeriesEPreferredStockMember

2020-06-30

2020-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): June 30, 2020

CBL & ASSOCIATES PROPERTIES, INC.

CBL & ASSOCIATES LIMITED PARTNERSHIP

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-12494

|

|

62-1545718

|

|

Delaware

|

|

333-182515-01

|

|

62-1542285

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

2030 Hamilton Place Blvd., Suite 500, Chattanooga, TN 37421-6000

(Address of principal executive office, including zip code)

423-855-0001

(Registrant's telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered under Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each Class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

|

CBL

|

|

New York Stock Exchange

|

|

7.375% Series D Cumulative Redeemable Preferred Stock, $0.01 par value

|

|

CBLprD

|

|

New York Stock Exchange

|

|

6.625% Series E Cumulative Redeemable Preferred Stock, $0.01 par value

|

|

CBLprE

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 1.01 Entry into a Material Definitive Agreement

On June 30, 2020, CBL & Associates Limited Partnership (the “Operating Partnership”), the majority owned subsidiary of CBL & Associates Properties, Inc. (the “REIT”) (collectively, the Operating Partnership and the REIT are referred to as the “Company”), and certain subsidiary guarantors (the “Subsidiary Guarantors”) entered into the following forbearance agreements.

Forbearance Agreement with Respect to the 2023 Notes

The Operating Partnership, the Subsidiary Guarantors and the REIT, as a limited guarantor, entered into a Forbearance Agreement (the “Notes Forbearance Agreement”) with certain beneficial owners and/or investment advisors or managers of discretionary funds, accounts or other entities for the holders or beneficial owners (the “Holders”) of in excess of 50% of the aggregate principal amount of the Operating Partnership’s 5.25% senior unsecured notes due 2023 (the “2023 Notes”). Pursuant to the Notes Forbearance Agreement, among other provisions, the Holders have agreed to forbear from exercising any rights and remedies under the indenture governing the 2023 Notes solely with respect to the default resulting from the nonpayment of the $11.8 million interest payment that was due and payable on June 1, 2020 (the “Interest Payment”), including the failure to pay the Interest Payment by the end of the 30-day grace period (the “Interest Default”).

The forbearance period under the Notes Forbearance Agreement ends on the earlier of July 15, 2020 and the occurrence of any of the specified early termination events described therein.

Forbearance Agreement with Respect to the Credit Agreement

The Operating Partnership, the Subsidiary Guarantors and the REIT, as a limited guarantor, entered into a Forbearance Agreement (the “Bank Forbearance Agreement”) with Wells Fargo Bank, National Association, as administrative agent (the “Agent”) for the lenders (the “Lenders”) party to the Credit Agreement, dated as of January 30, 2019 (as the same may be amended, restated, supplemented, replaced or otherwise modified from time to time, the “Credit Agreement”). Pursuant to the Bank Forbearance Agreement, among other provisions, the Agent, on behalf of itself and the Lenders, has agreed to forbear from exercising any rights and remedies under the Credit Agreement solely with respect to the Specified Defaults (as defined in the Bank Forbearance Agreement), including the cross-default resulting from the Interest Default.

The forbearance period under the Bank Forbearance Agreement ends on the earlier of July 15, 2020 and the occurrence of any of the specified early termination events described therein.

The foregoing description of the Forbearance Agreements does not purport to be complete and is qualified in its entirety by reference to the full text of the Forbearance Agreements, copies of which are filed as Exhibits 10.1 and 10.2 and incorporated herein by reference.

ITEM 7.01 Regulation FD Disclosure

As previously reported, the Company elected to not make the Interest Payment with respect to the 2023 Notes and, as provided for in the indenture governing the 2023 Notes, to enter the 30-day grace period to make such payment. The Operating Partnership did not make the Interest Payment on the last day of such 30-day grace period. The Operating Partnership’s failure to make the Interest Payment is considered an “event of default” with respect to the 2023 Notes, which results in a cross default under the Credit Agreement. While the event of default is continuing under the indenture, the Trustee or the holders of at least 25% in principal amount of the 2023 Notes may declare the 2023 Notes to be due and payable immediately. While the event of default is continuing under the Credit Agreement, the Agent may and shall upon the direction of the requisite lenders, declare the loans thereunder to be immediately due and payable. Further, if either the 2023 Notes or the Credit Agreement were accelerated, it would trigger an “event of default” under the Operating Partnership’s 4.60% senior unsecured notes due 2024 and the Operating Partnership’s 5.95% senior unsecured notes due 2026, which could lead to the acceleration of all amounts due under those notes.

The Company is continuing to engage in negotiations and discussions with the holders and lenders of the Company’s indebtedness. There can be no assurance, however, that the Company will be able to negotiate acceptable terms or to reach any agreement with respect to its indebtedness.

The information disclosed in this Item 7.01 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such a filing.

ITEM 9.01 Financial Statements and Exhibits

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

10.1

|

|

Forbearance Agreement, dated as of June 30, 2020, by and among CBL & Associates Limited Partnership, each of the subsidiary guarantors party thereto, CBL & Associates Properties, Inc., and each of the beneficial owners and/or investment advisors or managers of discretionary funds, accounts or other entities for the holders or beneficial owners of the 2023 Notes

|

|

10.2

|

|

Forbearance Agreement, dated as of June 30, 2020, by and among CBL & Associates Limited Partnership, each of the subsidiary guarantors and pledgors party thereto, CBL & Associates Properties, Inc. and Wells Fargo Bank, National Association, as administrative agent

|

|

104

|

|

Cover Page Interactive Data File (formatted as Inline XBRL with applicable taxonomy extension information contained in Exhibits 101.*). (Filed herewith)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

CBL & ASSOCIATES PROPERTIES, INC.

|

|

|

|

|

|

|

|

|

/s/ Farzana Khaleel

|

|

|

|

|

|

Farzana Khaleel

|

|

|

Executive Vice President -

|

|

|

Chief Financial Officer and Treasurer

|

|

|

|

|

|

CBL & ASSOCIATES LIMITED PARTNERSHIP

|

|

|

|

|

|

By: CBL HOLDINGS I, INC., its general partner

|

|

|

|

|

|

|

|

|

/s/ Farzana Khaleel

|

|

|

|

|

|

Farzana Khaleel

|

|

|

Executive Vice President -

|

|

|

Chief Financial Officer and Treasurer

|

|

|

|

|

Date: July 1, 2020

|

|

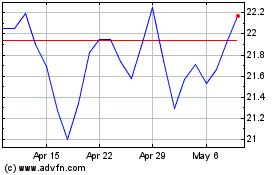

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

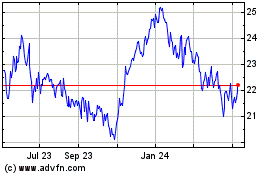

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Apr 2023 to Apr 2024