CBL Properties (NYSE:CBL) announced results for the fourth

quarter and year ended December 31, 2019. A description of each

supplemental non-GAAP financial measure and the related

reconciliation to the comparable GAAP financial measure is located

at the end of this news release.

Three Months Ended

December 31,

Year Ended

December 31,

2019

2018

%

2019

2018

%

Net income (loss) attributable to common

shareholders per diluted share

$

0.27

$

(0.38

)

170.6

%

$

(0.74

)

$

(0.72

)

(4.1

)%

Funds from Operations (“FFO”) per diluted

share

$

0.39

$

0.44

(12.4

)%

$

1.40

$

1.70

(17.7

)%

FFO, as adjusted, per diluted share

(1)

$

0.37

$

0.45

(17.1

)%

$

1.36

$

1.73

(21.6

)%

(1) For a reconciliation of FFO to FFO, as

adjusted, for the periods presented, please refer to the footnotes

to the Company’s reconciliation of net income (loss) attributable

to common shareholders to FFO allocable to Operating Partnership

common unitholders on page 9 of this news release.

KEY TAKEAWAYS:

- Same-center sales per square foot for the stabilized mall

portfolio for the fourth quarter 2019 improved 3%. For the

twelve-months ended December 31, 2019, same-center sales increased

2% to $386 per square foot compared with the prior-year

period.

- During 2019, CBL made significant progress on its anchor

redevelopment program, completing a dozen redevelopment projects.

CBL currently has 27 former anchor spaces committed, under

construction or with replacements already open featuring dining,

entertainment, fitness and other mixed-use components.

- FFO per diluted share, as adjusted, was $0.37 for the fourth

quarter 2019, compared with $0.45 per share for the fourth quarter

2018. Fourth quarter 2019 FFO per share was impacted by $0.02 per

share of dilution from asset sales completed since the prior-year

period and $0.06 per share of lower property NOI.

- FFO per diluted share, as adjusted, was $1.36 for 2019,

compared with $1.73 for 2018. 2019 FFO per share was impacted by

$0.06 per share of dilution from asset sales completed since the

prior-year period, $0.04 lower gains on the sale of outparcels and

$0.20 per share of lower property NOI.

- Total Portfolio Same-center NOI declined 6.5% for 2019, as

compared with 2018.

- Portfolio occupancy as of December 31, 2019, was 91.2%,

representing a 70-basis point improvement sequentially and a

190-basis point decline compared with 93.1% as of December 31,

2018. Same-center mall occupancy was 89.8% as of December 31, 2019,

a 110-basis point improvement sequentially and a 210-basis point

decline compared with 91.9% as of December 31, 2018.

- During 2019, CBL completed gross asset sales totaling $185.7

million (details herein).

“As our results indicate, our properties are facing ongoing

challenges as retailers struggle to adapt to today’s consumer

preferences. For the year 2019, our financial results were at the

high end of our guidance range with same-center NOI of (6.5%) and

adjusted FFO of $1.36 per share,” said Stephen D. Lebovitz, Chief

Executive Officer. “2019 results, as well as 2020 guidance, reflect

the significant impact of retailer bankruptcies and store closings

on revenues and occupancy. Our guidance range for 2020 incorporates

the carryover from 2019 plus anticipated challenges by retailers in

2020 and a reserve for unbudgeted impacts.

“At the same time, we are working to diversify and stabilize

revenues. In recent months, we have opened 15 new tenants in former

anchor locations, adding more productive, higher traffic-driving

uses. And, we have another dozen committed replacements either

under construction or with planning underway. We are proactively

reducing our exposure to apparel retailers with more than 76% of

2019 mall leasing completed with non-apparel tenants. As we

approach our redevelopments, we are evaluating our capital

investments closely and successfully stretching our dollars through

ground leases, joint ventures and other creative structures. The

steps we took in December 2019 to suspend our common and preferred

dividends in 2020 are key elements of our strategy to preserve our

significant level of internally generated cash flow, providing us

with the capital to execute on our redevelopment and leasing

strategies that will lead to stabilized future revenues and

growth.”

Net income attributable to common shareholders for the fourth

quarter 2019 was $46.5 million, or $0.27 per diluted share,

compared with a net loss of $65.5 million, or a loss of $0.38 per

diluted share, for the fourth quarter of 2018. Net income for the

fourth quarter 2019 was impacted by a $37.4 million loss on

impairment of real estate to write down the carrying value of Park

Plaza to the property’s estimated fair value.

Net loss attributable to common shareholders for 2019 was $129.2

million, or a loss of $0.74 per diluted share, compared with a net

loss of $123.5 million, or a loss of $0.72 per diluted share, for

2018. Net loss for the full-year 2019 included a $26.4 million

reduction to the class-action litigation expense recorded in the

first quarter 2019. The majority of the reduction relates to past

tenants that did not submit a claim pursuant to the terms of the

settlement agreement with the remainder relating to tenants that

opted out of the lawsuit.

FFO allocable to common shareholders, as adjusted, for the

fourth quarter 2019 was $64.7 million, or $0.37 per diluted share,

compared with $77.0 million, or $0.45 per diluted share, for the

fourth quarter 2018. FFO allocable to the Operating Partnership

common unitholders, as adjusted, for the fourth quarter 2019 was

$74.6 million compared with $89.0 million for the fourth quarter

2018.

FFO allocable to common shareholders, as adjusted, for 2019 was

$235.2 million, or $1.36 per diluted share, compared with $298.2

million, or $1.73 per diluted share, for 2018. FFO allocable to the

Operating Partnership common unitholders, as adjusted, for 2019 was

$271.5 million compared with $345.1 million for 2018.

Percentage change in same-center Net Operating Income (“NOI”)

(1):

Three Months Ended

December 31,

Year Ended

December 31,

2019

2019

Portfolio same-center NOI

(9.1

)%

(6.5

)%

Mall same-center NOI

(9.8

)%

(7.3

)%

(1) CBL’s definition of same-center NOI

excludes the impact of lease termination fees and certain non-cash

items such as straight-line rents and reimbursements, write-offs of

landlord inducements and net amortization of acquired above and

below market leases.

Major variances impacting same-center NOI for the year ended

December 31, 2019, include:

- Same-center NOI declined $38.9 million, due to a $48.8 million

decrease in revenues offset by a $9.9 million decline in operating

expenses.

- Rental revenues declined $57.9 million, including a $26.5

million decline in tenant reimbursements and a $32.8 million

decline in minimum and other rents. Percentage rents improved $1.4

million.

- Property operating expenses declined $5.8 million compared with

the prior year. Maintenance and repair expenses were flat. Real

estate tax expenses declined $4.1 million.

PORTFOLIO OPERATIONAL RESULTS

Occupancy(1):

As of December 31,

2019

2018

Total portfolio

91.2

%

93.1

%

Malls:

Total Mall portfolio

89.8

%

91.8

%

Same-center Malls

89.8

%

91.9

%

Stabilized Malls

90.0

%

92.1

%

Non-stabilized Malls (2)

83.8

%

76.7

%

Associated centers

95.6

%

97.4

%

Community centers

96.0

%

97.2

%

(1) Occupancy for malls represents

percentage of mall store gross leasable area under 20,000 square

feet occupied. Occupancy for associated and community centers

represents percentage of gross leasable area occupied.

(2) Represents occupancy for The Outlet

Shoppes at Laredo.

New and Renewal Leasing Activity of Same Small Shop Space

Less Than 10,000 Square Feet:

% Change in Average Gross Rent Per

Square Foot:

Three Months Ended

December 31,

Year Ended

December 31,

2019

2019

Stabilized Malls

(12.1

)%

(8.6

)%

New leases

8.8

%

9.1

%

Renewal leases

(15.7

)%

(11.5

)%

Same-Center Sales Per Square Foot for Mall Tenants 10,000

Square Feet or Less:

Year Ended December

31,

2019

2018

% Change

Stabilized mall same-center sales per

square foot

$

386

$

379

2

%

Stabilized mall sales per square foot

$

386

$

377

2

%

DISPOSITIONS Year-to-date, CBL has closed on $185.7

million in asset sales, as detailed below.

In December, CBL closed on the sale of a 15% interest in The

Outlet Shoppes at Atlanta to its existing joint venture partner,

Horizon Group Properties (“Horizon”), for $20.8 million, including

cash of $9.4 million and the assumption of 15% interest in the

existing loan (representing $11.4 million at closing). Following

the completion of the sale, CBL and Horizon each own a 50%

interest, with Horizon continuing to lease and manage the

asset.

Property

Location

Date Closed

Gross Sales Price (M)

Cary Towne Center(1)

Cary, NC

January

$

31.5

Honey Creek Mall (1)

Terre Haute, IN

April

14.6

The Shoppes at Hickory Point

Forsyth, IL

April

2.5

Courtyard by Marriott at Pearland Town

Center

Pearland, TX

June

15.1

The Forum at Grandview

Madison, MS

July

31.8

850 Greenbrier Circle

Chesapeake, VA

July

10.5

Various parcels

Various

Various

31.1

25% interest in The Outlet Shoppes at El

Paso (2)

El Paso, TX

August

27.8

15% interest in The Outlet Shoppes at

Atlanta (3)

Woodstock, GA

December

20.8

Total

$

185.7

(1) 100% of sale proceeds utilized to

retire existing secured loans.

(2) Gross amount shown above is comprised

of $9.3 million in equity and 25% interest in loan balance at

closing of $18.5 million.

(3) Gross amount shown above is comprised

of $9.4 million in equity and 15% interest in loan balance at

closing of $11.4 million.

ANCHOR REPLACEMENT PROGRESS AND REDEVELOPMENT During

2019, CBL completed a dozen redevelopment projects and had five

additional projects under construction at year-end. Anchor

replacements recently opened or pending include (complete list and

additional information can be found in the financial

supplement):

Property

Prior Tenant

New Tenant(s)

Construction/Opening

Status

Eastland Mall

JCPenney

H&M, Planet Fitness

Open

Jefferson Mall

Macy’s

Round1

Open

Northwoods Mall

Sears

Burlington

Open

Kentucky Oaks Mall

Sears

Burlington, Ross Dress for Less

Open

West Towne

Sears

Dave & Busters, Total Wine

Open

Hanes Mall

Shops

Dave & Busters

Open

Parkdale Mall

Macy’s

Dick’s, Five Below, HomeGoods

Open

Brookfield Square

Sears

Marcus Theatres, Whirlyball

Open

Laurel Park Place

Carson’s

Dunham’s Sports

Open

Meridian Mall

Younkers

High Caliber Karts

Open

Stroud Mall

Boston

Shoprite

Open

Kentucky Oaks Mall

Elder Beerman

HomeGoods and Five Below

Open

Frontier Mall

Sears

Jax Outdoor Gear

Open

Stroud Mall

Sears

EFO Furniture Outlet

Open

Dakota Square

Herberger’s

Ross Dress for Less

Open

Hamilton Place

Sears

Dick’s Sporting Goods, Dave & Busters,

Aloft Hotel, Malones

Under construction - Spring 2020/

2021 (Aloft)

CherryVale Mall

Sears

Tilt

Under construction - Q1/Q2

‘20

Richland Mall

Sears

Dillard’s

Under construction - 2020

Post Oak Mall

Sears

Conn’s HomePlus

Under construction - 2020

Kirkwood Mall

BonTon

Restaurants

2020

Imperial Valley

Sears

Hobby Lobby

2020

Westmoreland Mall

BonTon

Stadium Live! Casino

2020

York Galleria

Sears

Hollywood Casino

2020

Cross Creek Mall

Sears

Dave & Busters

Construction start in 2020

South County Center

Sears

Round1

Opening TBD

Hanes Mall

Sears

Novant Health

Opening TBD

West Towne Mall

Sears

Von Maur

2021

DIVIDENDS In December 2019, CBL announced that it is

suspending all future dividends on its common stock, 7.375% Series

D Cumulative Redeemable Preferred Stock and 6.625% Series E

Cumulative Redeemable Preferred Stock. The dividend suspension will

be reviewed quarterly by the Board of Directors, but is expected to

remain in place until year-end 2020. The Company made this

determination following a review of taxable income projections for

2019 and 2020. The Company will review taxable income on a regular

basis and take measures, if necessary, to ensure that it meets the

minimum distribution requirements to maintain its status as a Real

Estate Investment Trust (REIT).

OUTLOOK AND GUIDANCE CBL is providing 2020 FFO, as

adjusted, guidance in the range of $1.03 - $1.13 per diluted share.

Guidance incorporates a reserve in the range of $8.0 - $18.0

million (the “Reserve”) for potential future unbudgeted loss in

rent from tenant bankruptcies, store closures or lease

modifications that may occur in 2020.

Key assumptions underlying guidance are as follows:

Low

High

2020 FFO, as adjusted, per share (includes

the Reserve)

$

1.03

$

1.13

2020 Change in Same-Center NOI (“SC NOI”)

(includes the Reserve)

(9.5

)%

(8.0

)%

Reserve for unbudgeted lost rents included

in SC NOI and FFO

$18.0 million

$8.0 million

Updated expectation for gains on outparcel

sales

$2.0 million

$5.0 million

Assumptions underlying the change in 2020 SC NOI are as

follows:

Estimated Impact to 2020 SC

NOI

Explanation

New Leasing/Contractual Rent Increases

2.30

%

Specialty Retail/Branding

(0.50

)%

2019 actual and 2020 budgeted closures

Store Closures/Non-renewals

(4.00

)%

2019 actual and 2020 budgeted store

closures at natural lease maturity as well as mid-term store

closures primarily due to tenants in bankruptcy

Lease Renewals

(1.50

)%

Impact of new renewals completed in 2019

and budgeted for 2020, including certain tenants in bankruptcy

reorganization

Lease Modifications/Co-tenancy

(2.10

)%

Mid-term lease modifications and

co-tenancy rents triggered in 2019 or budgeted in 2020

Expenses

(0.65

)%

Increases in operating expenses

Reserve for lost rents

(2.30

)%

Mid-point of reserve for unbudgeted lost

rents

Total 2020 SC NOI Change at

Midpoint

(8.75

)%

Reconciliation of GAAP net income (loss) to 2020 FFO, as

adjusted, per share guidance:

Low

High

Expected diluted earnings per common

share

$

(0.26

)

$

(0.16

)

Adjust to fully converted shares from

common shares

0.02

0.02

Expected earnings per diluted, fully

converted common share

(0.24

)

(0.14

)

Add: depreciation and amortization

1.28

1.28

Add: noncontrolling interest in loss of

Operating Partnership

(0.01

)

(0.01

)

Expected FFO, as adjusted, per diluted,

fully converted common share

$

1.03

$

1.13

INVESTOR CONFERENCE CALL AND WEBCAST CBL Properties will

host a conference call on Friday, February 7, 2020, at 11:00 a.m.

ET. To access this interactive teleconference, dial (888) 317-6003

or (412) 317-6061 and enter the confirmation number, 1982728. A

replay of the conference call will be available through February

14, 2020, by dialing (877) 344-7529 or (412) 317-0088 and entering

the confirmation number, 10136909.

The Company will also provide an online webcast and rebroadcast

of its fourth quarter 2019 earnings release conference call. The

live broadcast of the quarterly conference call will be available

online at cblproperties.com on Friday, February 7, 2020, beginning

at 11:00 a.m. ET. The online replay will follow shortly after the

call.

To receive the CBL Properties fourth quarter earnings release

and supplemental information, please visit the Invest section of

our website at cblproperties.com.

ABOUT CBL PROPERTIES Headquartered in Chattanooga, TN,

CBL Properties owns and manages a national portfolio of

market-dominant properties located in dynamic and growing

communities. CBL’s portfolio is comprised of 108 properties

totaling 68.2 million square feet across 26 states, including 68

high-quality enclosed, outlet and open-air retail centers and 9

properties managed for third parties. CBL seeks to continuously

strengthen its company and portfolio through active management,

aggressive leasing and profitable reinvestment in its properties.

For more information visit cblproperties.com.

ADOPTION OF NEW LEASE ACCOUNTING STANDARD The Company

adopted Accounting Standards Codification (“ASC”) 842, Leases,

effective January 1, 2019, which resulted in the Company revising

the presentation of rental revenues in its consolidated statements

of operations. In the past, certain components of rental revenues

were shown separately in the consolidated statements of operations.

Upon the adoption of ASC 842, these amounts have been combined into

a single line item. Please see the Company’s Supplemental Financial

and Operating Information located in the Invest section of the

Company’s website for more information regarding the components of

rental revenues.

NON-GAAP FINANCIAL MEASURES Funds From Operations FFO is

a widely used non-GAAP measure of the operating performance of real

estate companies that supplements net income (loss) determined in

accordance with GAAP. The National Association of Real Estate

Investment Trusts (“NAREIT”) defines FFO as net income (loss)

(computed in accordance with GAAP) excluding gains or losses on

sales of depreciable operating properties and impairment losses of

depreciable properties, plus depreciation and amortization, and

after adjustments for unconsolidated partnerships and joint

ventures and noncontrolling interests. Adjustments for

unconsolidated partnerships and joint ventures and noncontrolling

interests are calculated on the same basis. We define FFO as

defined above by NAREIT less dividends on preferred stock of the

Company or distributions on preferred units of the Operating

Partnership, as applicable. The Company’s method of calculating FFO

may be different from methods used by other REITs and, accordingly,

may not be comparable to such other REITs.

The Company believes that FFO provides an additional indicator

of the operating performance of its properties without giving

effect to real estate depreciation and amortization, which assumes

the value of real estate assets declines predictably over time.

Since values of well-maintained real estate assets have

historically risen with market conditions, the Company believes

that FFO enhances investors’ understanding of its operating

performance. The use of FFO as an indicator of financial

performance is influenced not only by the operations of the

Company’s properties and interest rates, but also by its capital

structure.

The Company presents both FFO allocable to Operating Partnership

common unitholders and FFO allocable to common shareholders, as it

believes that both are useful performance measures. The Company

believes FFO allocable to Operating Partnership common unitholders

is a useful performance measure since it conducts substantially all

of its business through its Operating Partnership and, therefore,

it reflects the performance of the properties in absolute terms

regardless of the ratio of ownership interests of the Company’s

common shareholders and the noncontrolling interest in the

Operating Partnership. The Company believes FFO allocable to its

common shareholders is a useful performance measure because it is

the performance measure that is most directly comparable to net

income (loss) attributable to its common shareholders.

In the reconciliation of net income (loss) attributable to the

Company’s common shareholders to FFO allocable to Operating

Partnership common unitholders, located in this earnings release,

the Company makes an adjustment to add back noncontrolling interest

in income (loss) of its Operating Partnership in order to arrive at

FFO of the Operating Partnership common unitholders. The Company

then applies a percentage to FFO of the Operating Partnership

common unitholders to arrive at FFO allocable to its common

shareholders. The percentage is computed by taking the

weighted-average number of common shares outstanding for the period

and dividing it by the sum of the weighted-average number of common

shares and the weighted-average number of Operating Partnership

units held by noncontrolling interests during the period.

FFO does not represent cash flows from operations as defined by

GAAP, is not necessarily indicative of cash available to fund all

cash flow needs and should not be considered as an alternative to

net income (loss) for purposes of evaluating the Company’s

operating performance or to cash flow as a measure of

liquidity.

The Company believes that it is important to identify the impact

of certain significant items on its FFO measures for a reader to

have a complete understanding of the Company’s results of

operations. Therefore, the Company has also presented adjusted FFO

measures excluding these items from the applicable periods. Please

refer to the reconciliation of net income (loss) attributable to

common shareholders to FFO allocable to Operating Partnership

common unitholders on page 9 of this news release for a description

of these adjustments.

Same-center Net Operating Income NOI is a supplemental

non-GAAP measure of the operating performance of the Company’s

shopping centers and other properties. The Company defines NOI as

property operating revenues (rental revenues, tenant reimbursements

and other income) less property operating expenses (property

operating, real estate taxes and maintenance and repairs).

The Company computes NOI based on the Operating Partnership’s

pro rata share of both consolidated and unconsolidated properties.

The Company believes that presenting NOI and same-center NOI

(described below) based on its Operating Partnership’s pro rata

share of both consolidated and unconsolidated properties is useful

since the Company conducts substantially all of its business

through its Operating Partnership and, therefore, it reflects the

performance of the properties in absolute terms regardless of the

ratio of ownership interests of the Company’s common shareholders

and the noncontrolling interest in the Operating Partnership. The

Company’s definition of NOI may be different than that used by

other companies and, accordingly, the Company’s calculation of NOI

may not be comparable to that of other companies.

Since NOI includes only those revenues and expenses related to

the operations of the Company’s shopping center properties, the

Company believes that same-center NOI provides a measure that

reflects trends in occupancy rates, rental rates, sales at the

malls and operating costs and the impact of those trends on the

Company’s results of operations. The Company’s calculation of

same-center NOI excludes lease termination income, straight-line

rent adjustments, amortization of above and below market lease

intangibles and write-off of landlord inducement assets in order to

enhance the comparability of results from one period to another. A

reconciliation of same-center NOI to net income is located at the

end of this earnings release.

Pro Rata Share of Debt The Company presents debt based on

its pro rata ownership share (including the Company’s pro rata

share of unconsolidated affiliates and excluding noncontrolling

interests’ share of consolidated properties) because it believes

this provides investors a clearer understanding of the Company’s

total debt obligations which affect the Company’s liquidity. A

reconciliation of the Company’s pro rata share of debt to the

amount of debt on the Company’s condensed consolidated balance

sheet is located at the end of this earnings release.

Information included herein contains “forward-looking

statements” within the meaning of the federal securities laws. Such

statements are inherently subject to risks and uncertainties, many

of which cannot be predicted with accuracy and some of which might

not even be anticipated. Future events and actual events, financial

and otherwise, may differ materially from the events and results

discussed in the forward-looking statements. The reader is directed

to the Company’s various filings with the Securities and Exchange

Commission, including without limitation the Company’s Annual

Report on Form 10-K, and the “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” included therein,

for a discussion of such risks and uncertainties.

Consolidated Statements of Operations (Unaudited; in

thousands, except per share amounts)

Three Months Ended

December 31,

Year Ended

December 31,

2019

2018

2019

2018

REVENUES (1):

Rental revenues

$

180,464

$

201,907

$

737,453

$

829,113

Management, development and leasing

fees

2,025

2,520

9,350

10,542

Other

7,016

12,454

21,360

18,902

Total revenues

189,505

216,881

768,163

858,557

OPERATING EXPENSES:

Property operating

(26,049

)

(29,660

)

(108,905

)

(122,017

)

Depreciation and amortization

(59,308

)

(68,140

)

(257,746

)

(285,401

)

Real estate taxes

(17,699

)

(20,554

)

(75,465

)

(82,291

)

Maintenance and repairs

(11,955

)

(11,591

)

(46,282

)

(48,304

)

General and administrative

(15,280

)

(13,661

)

(64,181

)

(61,506

)

Loss on impairment

(37,400

)

(89,885

)

(239,521

)

(174,529

)

Litigation settlement

3,708

—

(61,754

)

—

Other

(50

)

(410

)

(91

)

(787

)

Total operating expenses

(164,033

)

(233,901

)

(853,945

)

(774,835

)

OTHER INCOME (EXPENSES):

Interest and other income

552

1,144

2,764

1,858

Interest expense

(49,266

)

(56,874

)

(206,261

)

(220,038

)

Gain on extinguishment of debt

—

—

71,722

—

Gain on investments/deconsolidation

84,356

—

95,530

—

Gain on sales of real estate assets

2,463

2,616

16,274

19,001

Income tax benefit (provision)

(32

)

(295

)

(2,654

)

1,551

Equity in earnings of unconsolidated

affiliates

1,519

4,808

4,940

14,677

Total other income (expenses)

39,592

(48,601

)

(17,685

)

(182,951

)

Net income (loss)

65,064

(65,621

)

(103,467

)

(99,229

)

Net (income) loss attributable to

noncontrolling interests in:

Operating Partnership

(7,210

)

10,710

19,906

19,688

Other consolidated subsidiaries

(108

)

604

(739

)

973

Net income (loss) attributable to the

Company

57,746

(54,307

)

(84,300

)

(78,568

)

Preferred dividends declared

—

(11,223

)

(33,669

)

(44,892

)

Preferred dividends undeclared

(11,223

)

—

(11,223

)

—

Net income (loss) attributable to

common shareholders

$

46,523

$

(65,530

)

$

(129,192

)

$

(123,460

)

Basic and diluted per share data

attributable to common shareholders:

Net income (loss) attributable to common

shareholders

$

0.27

$

(0.38

)

$

(0.74

)

$

(0.72

)

Weighted-average common and potential

dilutive common shares outstanding

173,578

172,665

173,445

172,486

(1) See "Adoption of Lease Accounting

Standard" on page 5 for further information on the presentation of

rental revenues in accordance with the new standard adopted

effective January 1, 2019.

The Company's reconciliation of net income (loss)

attributable to common shareholders to FFO allocable to Operating

Partnership common unitholders is as follows: (in thousands,

except per share data)

Three Months Ended

December 31,

Year Ended

December 31,

2019

2018

2019

2018

Net income (loss) attributable to common

shareholders

$

46,523

$

(65,530

)

$

(129,192

)

$

(123,460

)

Noncontrolling interest in income (loss)

of Operating Partnership

7,210

(10,710

)

(19,906

)

(19,688

)

Depreciation and amortization expense

of:

Consolidated properties

59,308

68,140

257,746

285,401

Unconsolidated affiliates

12,835

10,681

49,434

41,858

Non-real estate assets

(931

)

(913

)

(3,650

)

(3,661

)

Noncontrolling interests' share of

depreciation and amortization in other consolidated

subsidiaries

(1,355

)

(2,177

)

(8,191

)

(8,601

)

Loss on impairment, net of taxes

37,400

89,773

239,521

174,416

Loss on impairment of unconsolidated

affiliates

—

—

—

1,022

Gain on depreciable property, net of

taxes

(83,783

)

(1,941

)

(105,538

)

(7,484

)

FFO allocable to Operating Partnership

common unitholders

77,207

87,323

280,224

339,803

Litigation settlement, net of taxes

(1)

(3,708

)

—

61,271

—

Non-cash default interest expense (2)

1,146

1,669

1,688

5,285

Gain on extinguishment of debt (3)

—

—

(71,722

)

—

FFO allocable to Operating Partnership

common unitholders, as adjusted

$

74,645

$

88,992

$

271,461

$

345,088

FFO per diluted share

$

0.39

$

0.44

$

1.40

$

1.70

FFO, as adjusted, per diluted

share

$

0.37

$

0.45

$

1.36

$

1.73

Weighted-average common and potential

dilutive common shares outstanding with Operating Partnership units

fully converted

200,201

199,430

200,169

199,580

(1) The three months ended December 31,

2019 represents a reduction of $3,708 to the accrued expense

related to the settlement of a class action lawsuit that was

recorded in the three months ended March 31, 2019. The year ended

December 31, 2019 is comprised of the accrued maximum expense of

$88,150 recorded in the three months ended March 31, 2019 less

total subsequent reductions of $26,396 pursuant to the terms of the

settlement agreement related to past tenants that did not submit a

claim pursuant to the terms of the settlement agreement, tenants

that opted out of the lawsuit and other permissible reductions.

(2) The three months ended December 31,

2019 includes default interest expense related to Greenbrier Mall

and Hickory Point Mall. The year ended December 31, 2019 includes

default interest expense related to Acadiana Mall, Cary Towne

Center, Greenbrier Mall and Hickory Point Mall. The three months

and year ended December 31, 2018 include default interest expense

related to Acadiana Mall, Cary Towne Center and Triangle Town

Center.

(3) The year ended December 31, 2019

includes a gain on extinguishment of debt related to the

non-recourse loan secured by Acadiana Mall, which was conveyed to

the lender in the first quarter of 2019, and a gain on

extinguishment of debt related to the non-recourse loan secured by

Cary Towne Center, which was sold in the first quarter of 2019.

The reconciliation of diluted EPS to FFO per diluted share is as

follows:

Three Months Ended

December 31,

Year Ended

December 31,

2019

2018

2019

2018

Diluted EPS attributable to common

shareholders

$

0.27

$

(0.38

)

$

(0.74

)

$

(0.72

)

Eliminate amounts per share excluded from

FFO:

Depreciation and amortization expense,

including amounts from consolidated properties, unconsolidated

affiliates, non-real estate assets and excluding amounts allocated

to noncontrolling interests

0.35

0.38

1.48

1.58

Loss on impairment, net of taxes

0.19

0.45

1.19

0.88

Gain on depreciable property, net of

taxes

(0.42

)

(0.01

)

(0.53

)

(0.04

)

FFO per diluted share

$

0.39

$

0.44

$

1.40

$

1.70

The reconciliations of FFO allocable to Operating Partnership

common unitholders to FFO allocable to common shareholders,

including and excluding the adjustments noted above, are as

follows:

Three Months Ended

December 31,

Year Ended

December 31,

2019

2018

2019

2018

FFO allocable to Operating Partnership

common unitholders

$

77,207

$

87,323

$

280,224

$

339,803

Percentage allocable to common

shareholders (1)

86.70

%

86.58

%

86.65

%

86.42

%

FFO allocable to common

shareholders

$

66,938

$

75,604

$

242,814

$

293,658

FFO allocable to Operating Partnership

common unitholders, as adjusted

$

74,645

$

88,992

$

271,461

$

345,088

Percentage allocable to common

shareholders (1)

86.70

%

86.58

%

86.65

%

86.42

%

FFO allocable to common shareholders,

as adjusted

$

64,717

$

77,049

$

235,221

$

298,225

(1) Represents the weighted-average number

of common shares outstanding for the period divided by the sum of

the weighted-average number of common shares and the

weighted-average number of Operating Partnership units outstanding

during the period. See the reconciliation of shares and Operating

Partnership units outstanding on page 13.

Three Months Ended

December 31,

Year Ended

December 31,

2019

2018

2019

2018

SUPPLEMENTAL FFO INFORMATION:

Lease termination fees

$

856

$

317

$

3,794

$

10,105

Lease termination fees per share

$

—

$

—

$

0.02

$

0.05

Straight-line rental income

$

984

$

(1,108

)

$

3,286

$

(5,031

)

Straight-line rental income per share

$

—

$

(0.01

)

$

0.02

$

(0.03

)

Gains on outparcel sales, net of taxes

$

3,021

$

1,679

$

5,915

$

13,138

Gains on outparcel sales, net of taxes per

share

$

0.02

$

0.01

$

0.03

$

0.07

Net amortization of acquired above- and

below-market leases

$

930

$

662

$

2,962

$

1,644

Net amortization of acquired above- and

below-market leases per share

$

—

$

—

$

0.01

$

0.01

Net amortization of debt premiums and

discounts

$

334

$

316

$

1,316

$

1,043

Net amortization of debt premiums and

discounts per share

$

—

$

—

$

0.01

$

0.01

Income tax benefit (provision)

$

(32

)

$

(295

)

$

(2,654

)

$

1,551

Income tax benefit (provision) per

share

$

—

$

—

$

(0.01

)

$

0.01

Gain on extinguishment of debt

$

—

$

—

$

71,722

$

—

Gain on extinguishment of debt per

share

$

—

$

—

$

0.36

$

—

Non-cash default interest expense

$

(1,146

)

$

(1,669

)

$

(1,688

)

$

(5,285

)

Non-cash default interest expense per

share

$

(0.01

)

$

(0.01

)

$

(0.01

)

$

(0.03

)

Abandoned projects expense

$

(50

)

$

(410

)

$

(91

)

$

(787

)

Abandoned projects expense per share

$

—

$

—

$

—

$

—

Interest capitalized

$

692

$

919

$

2,661

$

3,655

Interest capitalized per share

$

—

$

—

$

0.01

$

0.02

Litigation settlement, net of taxes

$

3,708

$

—

$

(61,271

)

$

—

Litigation settlement, net of taxes per

share

$

0.02

$

—

$

(0.31

)

$

—

As of December 31,

2019

2018

Straight-line rent receivable

$

46,973

$

55,902

Same-center Net Operating Income (Dollars in

thousands)

Three Months Ended

December 31,

Year Ended

December 31,

2019

2018

2019

2018

Net income (loss)

$

65,064

$

(65,621

)

$

(103,467

)

$

(99,229

)

Adjustments:

Depreciation and amortization

59,308

68,140

257,746

285,401

Depreciation and amortization from

unconsolidated affiliates

12,835

10,681

49,434

41,858

Noncontrolling interests' share of

depreciation and amortization in other consolidated

subsidiaries

(1,355

)

(2,177

)

(8,191

)

(8,601

)

Interest expense

49,266

56,874

206,261

220,038

Interest expense from unconsolidated

affiliates

7,204

6,754

27,046

25,603

Noncontrolling interests' share of

interest expense in other consolidated subsidiaries

(1,112

)

(1,837

)

(6,156

)

(7,749

)

Abandoned projects expense

50

410

91

787

Gain on sales of real estate assets

(2,463

)

(2,616

)

(16,274

)

(19,001

)

Gain on sales of real estate assets of

unconsolidated affiliates

—

(1,043

)

(627

)

(1,607

)

Gain on investments/deconsolidation

(84,356

)

—

(95,530

)

—

Gain on extinguishment of debt

—

—

(71,722

)

—

Loss on impairment

37,400

89,885

239,521

174,529

Litigation settlement

(3,708

)

—

61,754

—

Income tax (benefit) provision

32

295

2,654

(1,551

)

Lease termination fees

(856

)

(317

)

(3,794

)

(10,105

)

Straight-line rent and above- and

below-market lease amortization

(1,914

)

446

(6,248

)

3,387

Net (income) loss attributable to

noncontrolling interests in other consolidated subsidiaries

(108

)

604

(739

)

973

General and administrative expenses

15,280

13,661

64,181

61,506

Management fees and non-property level

revenues

(3,171

)

(4,501

)

(12,202

)

(14,143

)

Operating Partnership's share of

property NOI

147,396

169,638

583,738

652,096

Non-comparable NOI

(3,786

)

(11,681

)

(21,648

)

(51,131

)

Total same-center NOI (1)

$

143,610

$

157,957

$

562,090

$

600,965

Total same-center NOI percentage

change

(9.1

)%

(6.5

)%

Same-center Net Operating Income (Continued)

Three Months Ended

December 31,

Year Ended

December 31,

2019

2018

2019

2018

Malls

$

129,386

$

143,502

$

504,789

$

544,829

Associated centers

8,110

8,286

32,720

32,380

Community centers

5,057

5,013

20,273

19,624

Offices and other

1,057

1,156

4,308

4,132

Total same-center NOI (1)

$

143,610

$

157,957

$

562,090

$

600,965

Percentage Change:

Malls

(9.8

)%

(7.3

)%

Associated centers

(2.1

)%

1.1

%

Community centers

0.9

%

3.3

%

Offices and other

(8.6

)%

4.3

%

Total same-center NOI (1)

(9.1

)%

(6.5

)%

(1) CBL defines NOI as property operating

revenues (rental revenues, tenant reimbursements and other income),

less property operating expenses (property operating, real estate

taxes and maintenance and repairs). Same-center NOI excludes lease

termination income, straight-line rent adjustments, amortization of

above and below market lease intangibles and write-offs of landlord

inducement assets. We include a property in our same-center pool

when we own all or a portion of the property as of December 31,

2019, and we owned it and it was in operation for both the entire

preceding calendar year and the current year-to-date reporting

period ending December 31, 2019. New properties are excluded from

same-center NOI, until they meet these criteria. Properties

excluded from the same-center pool that would otherwise meet these

criteria are properties which are under major redevelopment or

being considered for repositioning, where we intend to renegotiate

the terms of the debt secured by the related property or return the

property to the lender.

Company's Share of Consolidated and Unconsolidated Debt

(Dollars in thousands)

As of December 31,

2019

Fixed Rate

Variable

Rate

Total per

Debt

Schedule

Unamortized

Deferred

Financing

Costs

Total

Consolidated debt

$

2,695,888

$

847,275

$

3,543,163

$

(16,148

)

$

3,527,015

Noncontrolling interests' share of

consolidated debt

(30,658

)

—

(30,658

)

318

(30,340

)

Company's share of unconsolidated

affiliates' debt

633,243

104,408

737,651

(2,851

)

734,800

Company's share of consolidated and

unconsolidated debt

$

3,298,473

$

951,683

$

4,250,156

$

(18,681

)

$

4,231,475

Weighted-average interest rate

5.10

%

4.00

%

4.85

%

As of December 31,

2018

Fixed Rate

Variable

Rate

Total per

Debt

Schedule

Unamortized

Deferred

Financing

Costs

Total

Consolidated debt

$

3,147,108

$

955,751

$

4,102,859

(1

)

$

(15,963

)

$

4,086,896

Noncontrolling interests' share of

consolidated debt

(94,361

)

—

(94,361

)

804

(93,557

)

Company's share of unconsolidated

affiliates' debt

550,673

99,904

650,577

(2,687

)

647,890

Company's share of consolidated and

unconsolidated debt

$

3,603,420

$

1,055,655

$

4,659,075

$

(17,846

)

$

4,641,229

Weighted-average interest rate

5.16

%

4.28

%

4.96

%

(1) Includes $43,716 of debt related to

Cary Town Center that is classified in liabilities related to

assets held for sale in the consolidated balance sheet as of

December 31, 2018. The mall was sold in January 2019.

Total Market Capitalization as of December 31,

2019 (In thousands, except stock price)

Shares

Outstanding

Stock

Price (1)

Common stock and operating partnership

units

200,189

$

1.05

7.375% Series D Cumulative Redeemable

Preferred Stock

1,815

250.00

6.625% Series E Cumulative Redeemable

Preferred Stock

690

250.00

(1) Stock price for common stock and

Operating Partnership units equals the closing price of the common

stock on December 31, 2019. The stock prices for the preferred

stocks represent the liquidation preference of each respective

series.

Reconciliation of Shares and Operating Partnership Units

Outstanding (In thousands)

Three Months Ended

December 31,

Year Ended

December 31,

Basic

Diluted

Basic

Diluted

2019:

Weighted-average shares - EPS

173,578

173,578

173,445

173,445

Weighted-average Operating Partnership

units

26,623

26,623

26,724

26,724

Weighted-average shares - FFO

200,201

200,201

200,169

200,169

2018:

Weighted-average shares - EPS

172,665

172,665

172,486

172,486

Weighted-average Operating Partnership

units

26,765

26,765

27,094

27,094

Weighted-average shares – FFO

199,430

199,430

199,580

199,580

Consolidated Balance Sheets (Unaudited; in thousands,

except share data)

As of December 31,

2019

2018

ASSETS

Real estate assets:

Land

$

730,218

$

793,944

Buildings and improvements

5,630,795

6,414,886

6,361,013

7,208,830

Accumulated depreciation

(2,349,404

)

(2,493,082

)

4,011,609

4,715,748

Held for sale

—

30,971

Developments in progress

49,207

38,807

Net investment in real estate assets

4,060,816

4,785,526

Cash and cash equivalents

32,816

25,138

Receivables:

Tenant, net of allowance for doubtful

accounts of $2,337 in 2018

74,718

77,788

Other, net of allowance for doubtful

accounts of $838 in 2018

10,793

7,511

Mortgage and other notes receivable

4,662

7,672

Investments in unconsolidated

affiliates

326,526

283,553

Intangible lease assets and other

assets

129,973

153,665

$

4,640,304

$

5,340,853

LIABILITIES, REDEEMABLE NONCONTROLLING

INTERESTS AND EQUITY

Mortgage and other indebtedness, net

$

3,527,015

$

4,043,180

Accounts payable and accrued

liabilities

221,010

218,217

Liabilities related to assets held for

sale

—

43,716

Total liabilities

3,748,025

4,305,113

Commitments and contingencies

Redeemable noncontrolling interests

2,381

3,575

Shareholders' equity:

Preferred stock, $.01 par value,

15,000,000 shares authorized:

7.375% Series D Cumulative Redeemable

Preferred Stock, 1,815,000 shares outstanding

18

18

6.625% Series E Cumulative Redeemable

Preferred Stock, 690,000 shares outstanding

7

7

Common stock, $.01 par value, 350,000,000

shares authorized, 174,115,111 and 172,656,458 issued and

outstanding in 2019 and 2018, respectively

1,741

1,727

Additional paid-in capital

1,965,897

1,968,280

Dividends in excess of cumulative

earnings

(1,136,874

)

(1,005,895

)

Total shareholders' equity

830,789

964,137

Noncontrolling interests

59,109

68,028

Total equity

889,898

1,032,165

$

4,640,304

$

5,340,853

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200206005952/en/

Katie Reinsmidt, Executive Vice President - Chief Investment

Officer, 423.490.8301, katie.reinsmidt@cblproperties.com

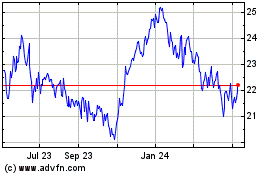

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

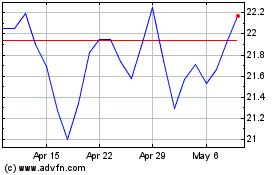

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Apr 2023 to Apr 2024