CBL Properties Provides Update on Sears and Anchor Redevelopment Program

October 16 2018 - 6:30PM

Business Wire

CBL Properties (NYSE: CBL) today provided an update on its

redevelopment efforts related to Sears stores in its portfolio.

“We have been preparing for an eventual Sears bankruptcy since

2013, when we purchased two Sears locations and transformed them

into dining, retail and entertainment destinations,” said Stephen

Lebovitz, chief executive officer. “The Sears stores in our markets

are well-located with excellent visibility, access and

infrastructure. As a result, we have been able to attract high

quality replacement users and new concepts that had not previously

considered a mall environment. Additionally, we are able to pursue

a number of non-traditional uses through partnerships. These other

developers, be it multi-family, hotel or other use, recognize the

immense value of these locations and are coming to us to take

advantage of the great real estate that’s becoming available.”

Yesterday Sears announced anticipated store closures as part of

its Chapter 11 bankruptcy filing. CBL stores on the closure list

include Hamilton Place in Chattanooga, TN; Jefferson Mall in

Louisville, KY; Cross Creek Mall in Fayetteville, NC; Imperial

Valley in El Centro, CA (location owned by a third party); Honey

Creek Mall in Terre Haute, IN; and Governor’s Square Mall in

Clarksville, TN (property owned in a 50/50 joint venture).

CBL proactively purchased the Sears locations at Hamilton Place,

Jefferson Mall and Cross Creek in 2017 and has redevelopment plans

in process for all three locations. In anticipation of a bankruptcy

or additional closures by Sears, CBL has been actively marketing

locations to replacement users. CBL has leases executed,

out-for-signature or under negotiation for a majority of the

locations leased by Sears in its portfolio. Additionally, CBL is

pursuing opportunities to utilize ground leases, outparcel land

sales and joint ventures to enhance returns while limiting the

required investment and will also use construction loans for select

projects to reduce the equity commitment.

Over the last three years, more than 35 redevelopment projects

have been completed or are underway in the CBL portfolio, including

nearly two dozen anchor store redevelopments, furthering the

Company’s vision of creating a portfolio of diverse suburban town

centers. Current projects include:

- Brookfield Square, Brookfield, WI –

former Sears is being transformed into an entertainment and dining

destination with Marcus Theaters, Whirlyball entertainment center,

a fitness operator and restaurants. A portion of the site was sold

for development of a hotel and conference center.

- Jefferson Mall, Louisville, KY – Round

1 will open in a former Macy’s location later this year.

- York Galleria, York, PA – Earlier this

year, Marshalls joined H&M & Gold’s Gym in the former

JCPenney location.

- Eastland Mall, Forsyth, IL – H&M,

Outback and Planet Fitness are opening in the former JCPenney

location.

Through these redevelopment efforts as well as dispositions of

select assets, CBL has reduced its exposure to Sears and other

underperforming anchors significantly. At year-end 2015, CBL had 53

Sears operating in its portfolio. With the planned closures

announced yesterday, by year-end 2018 CBL anticipates 21 operating

Sears stores in its core portfolio, including five locations leased

by Sears and 16 owned by Sears or third parties.

About CBL Properties

Headquartered in Chattanooga, TN, CBL Properties owns and

manages a national portfolio of market-dominant properties located

in dynamic and growing communities. CBL’s portfolio is comprised of

114 properties totaling 71.9 million square feet across 26 states,

including 73 high-quality enclosed, outlet and open-air retail

centers and 12 properties managed for third parties. CBL

continuously strengthens its company and portfolio through active

management, aggressive leasing and profitable reinvestment in its

properties. For more information visit cblproperties.com.

Information included herein contains

"forward-looking statements" within the meaning of the federal

securities laws. Such statements are inherently subject to risks

and uncertainties, many of which cannot be predicted with accuracy

and some of which might not even be anticipated. Future events and

actual events, financial and otherwise, may differ materially from

the events and results discussed in the forward-looking statements.

The reader is directed to the Company’s various filings with the

Securities and Exchange Commission, including without limitation

the Company’s Annual Report on Form 10-K and the "Management’s

Discussion and Analysis of Financial Condition and Results of

Operations" included therein, for a discussion of such risks and

uncertainties.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181016006109/en/

CBL PropertiesInvestor Contact:Katie Reinsmidt,

423-490-8301Executive Vice President & Chief Investment

OfficerKatie.Reinsmidt@cblproperties.comorMedia Contact:Stacey

Keating, 423-490-8361Director of Public Relations & Corporate

CommunicationsStacey.Keating@cblproperties.com

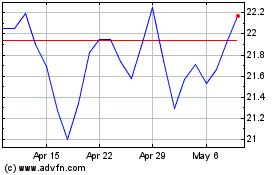

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

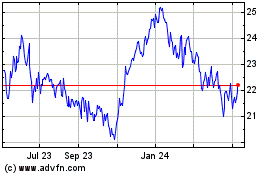

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Apr 2023 to Apr 2024