Mondelez Is Stung by Coronavirus Lockdowns in Emerging Markets--Update

July 28 2020 - 7:13PM

Dow Jones News

By Annie Gasparro

Mondelez International Inc. said tough lockdowns to fight the

coronavirus in emerging markets hurt sales of its cookies and other

snacks in the second quarter.

Comparable sales for the maker of Oreo cookies, Toblerone

chocolate and Ritz crackers rose 11% in North America, but in Latin

America, where coronavirus cases have multiplied rapidly, sales by

that metric fell 11%. In its Asia, Middle East and Africa division,

where some countries have imposed stricter social distancing

regulations than in North America, comparable sales decreased 3%,

the company said Tuesday.

Mondelez Chief Executive Dirk Van de Put said the company's

emerging markets business improved in June and July as store

closures eased and more consumers were able to access its snacks.

"The majority of these markets are on better footing," he said.

Mondelez said it expects an increase in snacking in North

America to continue while sales in India, China and other emerging

markets return to growth, leading to stronger revenue in the second

half of the year. Still, executives cautioned that Latin American

demand lags and that the global business environment remains

volatile and susceptible to a second wave of coronavirus

lockdowns.

"We are now clearly talking about this change to our lives

continuing well into 2021," Mr. Van de Put said.

Food companies in the U.S. have been inundated with orders from

grocery stores since the pandemic exploded in March. In a country

where a lot of people are staying home and can afford to stock up

on food, the coronavirus has buoyed sales for the food

industry.

But Mondelez has benefited less than its U.S.-centric rivals

such as Campbell Soup Co. and Conagra Brands Inc.

Mondelez has also spent more to boost production to meet the

unprecedented demand in regions such as North America. The company

said Covid-19-related costs, higher prices for raw materials and

unfavorable exchange rates contributed to a lower profit margin in

the latest period.

Mondelez said it is removing 25% of the varieties to simplify

its supply chain and innovation process and reduce inventories. The

cost-saving move will also help meet higher demand for core

products such as Oreos.

In the latest quarter, Mondelez said it gained market share in

many segments, such as cookies in the U.S. and China, and chocolate

in India and the U.K.

Mr. Van de Put said he is spending more on brands to leverage

momentum gained during the pandemic. The company is also investing

in e-commerce, and figuring out how to best handle pricing and

sizes of snacks to weather the recession.

Mondelez's total revenue fell 2.5% from last year's second

quarter to $5.9 billion, in line with analysts' estimate, according

to FactSet. Adjusted profit of 63 cents a share marked a 16%

increase from the prior year excluding currency fluctuations and

topped analysts' projection of 56 cents a share.

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

July 28, 2020 18:58 ET (22:58 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

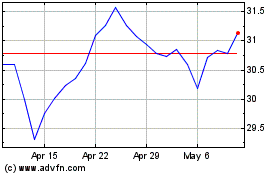

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Apr 2023 to Apr 2024