Statement of Changes in Beneficial Ownership (4)

July 02 2020 - 7:17PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Batcheler Colleen |

2. Issuer Name and Ticker or Trading Symbol

CONAGRA BRANDS INC.

[

CAG

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

EVP Gen Counsel & Corp Secty |

|

(Last)

(First)

(Middle)

C/O CONAGRA BRANDS, INC., 222 W. MERCHANDISE MART PLAZA, STE 1300 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

7/1/2020 |

|

(Street)

CHICAGO, IL 60654

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 7/1/2020 | | M(1) | | 111062 | A | $27.46 | 280935 | D | |

| Common Stock | 7/1/2020 | | S(1) | | 111062 (2) | D | $36.003 (3) | 169873 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Employee Stock Option (right to buy) | $27.46 (4) | 7/1/2020 | | M | | | 111062 (4) | (5) | 7/14/2023 | Common Stock | 111062 | $0.00 | 76545 | D | |

| Explanation of Responses: |

| (1) | This exercise of stock options reported in this Form 4 relates to the Reporting Person's acquisition and sale of shares, as part of the process of

exercising stock options that were scheduled to expire in July 2023. The exercise and sale were affected pursuant to a Rule 10b5-1 trading plan

adopted by the Reporting Person during an open trading window. |

| (2) | All of the shares being sold were acquired by the Reporting Person within the past two business days upon the exercise of stock options. |

| (3) | Price reflects the weighted average purchase price for multiple transactions ranging from $36.44 to $36.05 per share, inclusive. The Reporting Person undertakes to provide, upon request by the Commission Staff, the Issuer or a security holder of the Issuer, full information regarding the number of shares purchased at each separate price. |

| (4) | Reflects an antidilution adjustment to the number of options (originally granted on July 15, 2013 and expiring July 14, 2023, for 139,632 shares at an exercise price of $36.89 per share) held by the Reporting Person and the exercise price for such options, which antidilution adjustment was made prior to the exercise date in connection with the spinoff of Lamb Weston Holdings, Inc. from the Issuer on November 9, 2016 (the "Spinoff"). The total number of options held by the Reporting Person immediately prior to the Spinoff was 139,632. |

| (5) | Options become exercisable as to 40% on July 15, 2014, 30% on July 15, 2015, and 30% on July 15, 2016. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Batcheler Colleen

C/O CONAGRA BRANDS, INC.

222 W. MERCHANDISE MART PLAZA, STE 1300

CHICAGO, IL 60654 |

|

| EVP Gen Counsel & Corp Secty |

|

Signatures

|

| /s/ Uche Ndumele, Attorney-in-fact | | 7/2/2020 |

| **Signature of Reporting Person | Date |

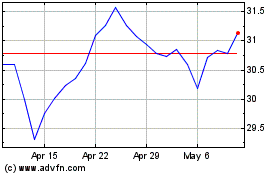

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Apr 2023 to Apr 2024