Cadence Bancorporation Receives Regulatory Approval for Merger with State Bank Financial Corp. & Share Repurchase Program

December 07 2018 - 5:37PM

Business Wire

Cadence Bancorporation (NYSE: CADE) (“Cadence”) today announced

that it has received regulatory approval from the Federal Reserve

to complete its pending stock-for-stock transaction with State Bank

Financial Corporation (“State Bank”), which will create a combined

organization with $17 billion in assets, $13 billion in loans, $14

billion in deposits and approximately 98 branches serving Texas,

Georgia, Florida, Alabama, Tennessee and Mississippi, based on the

companies’ balance sheets as of September 30, 2018. Cadence has now

received all regulatory approvals required to consummate the

proposed transaction.

“We are very pleased to announce that we have completed the last

approval necessary to close the State Bank merger, and we plan to

close the transaction on December 31,” said Paul B. Murphy, Jr.,

Chairman and CEO of Cadence Bancorporation. “It is with great

enthusiasm that I welcome the State Bank bankers to the Cadence

team. I am confident that our combination will be a major

success.”

In addition, the Federal Reserve approved Cadence’s previously

announced share repurchase program under which Cadence may

repurchase up to $50 million of its shares of common stock.

The merger is expected to be completed on December 31, 2018,

subject to the satisfaction of customary closing conditions.

About Cadence Bancorporation

Cadence Bancorporation (NYSE:CADE), headquartered in Houston,

Texas, is a regional bank holding company with $11.8 billion in

assets. Through its affiliates, Cadence operates 66 locations in

Alabama, Florida, Mississippi, Tennessee and Texas, and provides

corporations, middle-market companies, small businesses and

consumers with a full range of innovative banking and financial

solutions. Services and products include commercial and business

banking, treasury management, specialized lending, commercial real

estate, foreign exchange, wealth management, investment and trust

services, financial planning, retirement plan management, personal

insurance, consumer banking, consumer loans, mortgages, home equity

lines and loans, and credit cards. Clients have access to

leading-edge online and mobile solutions, interactive teller

machines, and 56,000 ATMs. The Cadence team of 1,200 associates is

committed to exceeding customer expectations and helping their

clients succeed financially. Cadence Bank, N.A. and Linscomb &

Williams are subsidiaries of Cadence Bancorporation.

Cautionary Statement Regarding Forward-Looking

Information

This communication contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements reflect our current views

with respect to, among other things, future events and our results

of operations, financial condition and financial performance. These

statements are often, but not always, made through the use of words

or phrases such as “may,” “should,” “could,” “predict,”

“potential,” “believe,” “will likely result,” “expect,” “continue,”

“will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,”

“projection,” “would” and “outlook,” or the negative version of

those words or other comparable words of a future or

forward-looking nature. These forward-looking statements are not

historical facts, and are based on current expectations, estimates

and projections about our industry, management’s beliefs and

certain assumptions made by management, many of which, by their

nature, are inherently uncertain and beyond our control.

Accordingly, we caution you that any such forward-looking

statements are not guarantees of future performance and are subject

to risks, assumptions and uncertainties that are difficult to

predict. Although we believe that the expectations reflected in

these forward-looking statements are reasonable as of the date

made, actual results may prove to be materially different from the

results expressed or implied by the forward-looking statements.

Such factors include, without limitation, the “Risk Factors”

referenced in our Registration Statement on Form S-3 filed with the

Securities and Exchange Commission (the “SEC”) on May 21, 2018, and

our Registration Statement on Form S-4 filed with the SEC on July

20, 2018, other risks and uncertainties listed from time to time in

our reports and documents filed with the SEC, including our Annual

Reports on Form 10-K and Quarterly Reports on Form 10-Q, and the

following factors: the occurrence of any event, change or other

circumstances that could give rise to the right of Cadence or State

Bank to terminate the definitive merger agreement between Cadence

and State Bank, including the fact that the price of Cadence common

stock is currently below the thresholds that, if Cadence common

stock were to trade at or below those thresholds for the 20 full

trading days prior December 22, 2018, the board of directors of

State Bank would be entitled to terminate the merger agreement, and

there is no assurance that Cadence’s stock price will not continue

to be below such thresholds; the possibility that the anticipated

benefits of the merger with State Bank are not realized when

expected or at all, including as a result of the impact of, or

problems arising from, the integration of the two companies or as a

result of the strength of the economy and competitive factors in

the areas where Cadence and State Bank do business; the possibility

that the transaction may be more expensive to complete than

anticipated, including as a result of unexpected factors or events;

diversion of management’s attention from ongoing business

operations and opportunities; potential adverse reactions or

changes to business or employee relationships, including those

resulting from the announcement or completion of the transaction.

Cadence can give no assurance that any goal or plan or expectation

set forth in forward-looking statements can be achieved and readers

are cautioned not to place undue reliance on such statements. The

forward-looking statements are made as of the date of this

communication, and Cadence does not intend, and assumes no

obligation, to update any forward-looking statement to reflect

events or circumstances after the date on which the statement is

made or to reflect the occurrence of unanticipated events or

circumstances, except as required by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181207005569/en/

Media contact:Danielle

Kernell713-871-4051danielle.kernell@cadencebank.com

Investor relations contact:Valerie Toalson713-871-4103 or

800-698-7878vtoalson@cadencebancorporation.com

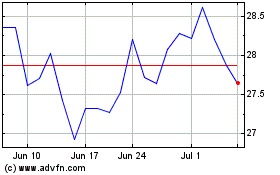

Cadence Bank (NYSE:CADE)

Historical Stock Chart

From Mar 2024 to Apr 2024

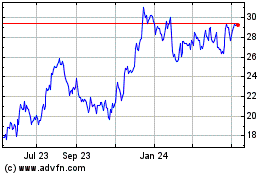

Cadence Bank (NYSE:CADE)

Historical Stock Chart

From Apr 2023 to Apr 2024