|

KEY TERMS

|

|

Issuer:

|

Citigroup Global Markets Holdings Inc., a wholly owned subsidiary of Citigroup Inc.

|

|

Guarantee:

|

All payments due on the securities are fully and unconditionally guaranteed by Citigroup Inc.

|

|

Underlyings:

|

Underlying

|

Initial underlying value*

|

Buffer value**

|

|

|

Nasdaq-100 Index®

|

13,194.71

|

11,215.504

|

|

|

Russell 2000® Index

|

2,231.314

|

1,896.617

|

|

|

* For each underlying, its closing value on the pricing

date

** For each underlying, 85% of its initial underlying

value

|

|

Stated principal amount:

|

$1,000 per security

|

|

Pricing date:

|

February 23, 2021

|

|

Issue date:

|

February 26, 2021

|

|

Valuation dates:

|

February 24, 2022, February 23, 2023 and February 23, 2024 (the “final valuation date”), each subject to postponement if such date is not a scheduled trading day or certain market disruption events occur

|

|

Maturity date:

|

Unless earlier redeemed, February 28, 2024

|

|

Automatic early redemption:

|

If, on any valuation date prior to the final valuation date, the closing value of the worst performing underlying on that valuation date is greater than or equal to its initial underlying value, the securities will be automatically redeemed on the third business day immediately following that valuation date for an amount in cash per security equal to $1,000 plus the premium applicable to that valuation date. If the securities are automatically redeemed following any valuation date prior to the final valuation date, they will cease to be outstanding.

|

|

Payment at maturity:

|

If the securities are not automatically redeemed prior to maturity,

you will receive at maturity, for each security you then hold, an amount in cash equal to:

§

If the final underlying value of the worst performing underlying on the final valuation date is greater than its

initial underlying value: $1,000 + the return amount

§

If the final underlying value of the worst performing underlying on the final valuation date is less than or equal to

its initial underlying value but greater than or equal to its buffer value: $1,000

§

If the final underlying value of the worst performing underlying on the final valuation date is less than its buffer

value:

$1,000 + [$1,000 × (the underlying return of the worst performing underlying on the final valuation date + the buffer percentage)]

If the securities are not automatically redeemed prior to

maturity and the final underlying value of the worst performing underlying on the final valuation date is less than its buffer

value, you will lose 1% of the stated principal amount of your securities at maturity for every 1% by which that depreciation exceeds

the buffer percentage.

|

|

Buffer percentage:

|

15%

|

|

Listing:

|

The securities will not be listed on any securities exchange

|

|

CUSIP / ISIN:

|

17328YLM4 / US17328YLM48

|

|

Underwriter:

|

Citigroup Global Markets Inc. (“CGMI”), an affiliate of the issuer, acting as principal

|

|

Underwriting fee and issue price:

|

Issue price(1)

|

Underwriting fee(2)

|

Proceeds to issuer(3)

|

|

Per security:

|

$1,000

|

$36.00

|

$964.00

|

|

Total:

|

$1,226,000

|

$36,963.90

|

$1,189,036.10

|

|

|

|

|

|

|

(Key Terms continued on next page)

(1) On the date of this

pricing supplement, the estimated value of the securities is $948.50 per security, which is less than the issue price. The

estimated value of the securities is based on CGMI’s proprietary pricing models and our internal funding rate. It is not

an indication of actual profit to CGMI or other of our affiliates, nor is it an indication of the price, if any, at which CGMI

or any other person may be willing to buy the securities from you at any time after issuance. See “Valuation of the Securities”

in this pricing supplement.

(2) CGMI will receive an underwriting fee of up to $36.00 for

each security sold in this offering. The total underwriting fee and proceeds to issuer in the table above give effect to the actual

total underwriting fee. For more information on the distribution of the securities, see “Supplemental Plan of Distribution”

in this pricing supplement. In addition to the underwriting fee, CGMI and its affiliates may profit from hedging activity related

to this offering, even if the value of the securities declines. See “Use of Proceeds and Hedging” in the accompanying

prospectus.

(3) The per security proceeds to issuer indicated above represent

the minimum per security proceeds to issuer for any security, assuming the maximum per security underwriting fee. As noted above,

the underwriting fee is variable.

Investing in the securities

involves risks not associated with an investment in conventional debt securities. See “Summary Risk Factors” beginning

on page PS-7.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of the securities or determined that this pricing supplement and

the accompanying product supplement, underlying supplement, prospectus supplement and prospectus are truthful or complete. Any

representation to the contrary is a criminal offense. You

should read this pricing supplement together with the accompanying product

supplement, underlying supplement, prospectus supplement and prospectus,

which can be accessed via the hyperlinks below:

Product Supplement No. EA-02-08 dated February 15, 2019 Underlying Supplement No. 9 dated October 30, 2020

Prospectus Supplement and Prospectus each dated May 14, 2018

The securities are not bank deposits and

are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations

of, or guaranteed by, a bank.

|

Citigroup Global Markets Holdings Inc.

|

|

|

|

KEY TERMS (continued)

|

|

Premium:

|

The premium applicable to each valuation date prior to the final

valuation date is set forth below. The premium may be significantly less than the appreciation of any underlying from the pricing

date to the applicable valuation date.

·

February 24, 2022: 7.50% of the stated principal amount

·

February 23, 2023: 15.00% of the stated principal amount

|

|

Return amount:

|

$1,000 × the underlying return of the worst performing underlying on the final valuation date × the upside participation rate

|

|

Upside participation rate:

|

125%

|

|

Underlying return:

|

For each underlying on any valuation date, (i) its closing value on that valuation date minus its initial underlying value, divided by (ii) its initial underlying value

|

|

Worst performing underlying:

|

For any valuation date, the underlying with the lowest underlying return determined as of that valuation date

|

|

Final underlying value:

|

For each underlying, its closing value on the final valuation date

|

Additional Information

General. The terms of the securities are set forth in

the accompanying product supplement, prospectus supplement and prospectus, as supplemented by this pricing supplement. The accompanying

product supplement, prospectus supplement and prospectus contain important disclosures that are not repeated in this pricing supplement.

For example, the accompanying product supplement contains important information about how the closing value of each underlying

will be determined and about adjustments that may be made to the terms of the securities upon the occurrence of market disruption

events and other specified events with respect to each underlying. The accompanying underlying supplement contains information

about each underlying that is not repeated in this pricing supplement. It is important that you read the accompanying product supplement,

underlying supplement, prospectus supplement and prospectus together with this pricing supplement in deciding whether to invest

in the securities. Certain terms used but not defined in this pricing supplement are defined in the accompanying product supplement.

Prospectus. The first sentence of “Description of

Debt Securities— Events of Default and Defaults” in the accompanying prospectus shall be amended to read in its entirety

as follows:

Events of default under the indenture are:

|

|

•

|

|

failure of Citigroup Global Markets Holdings or Citigroup to pay required interest on any debt security of such series for 30 days;

|

|

|

•

|

|

failure of Citigroup Global Markets Holdings or Citigroup to pay principal, other than a scheduled installment payment to a sinking fund, on any debt security of such series for 30 days;

|

|

|

•

|

|

failure of Citigroup Global Markets Holdings or Citigroup to make any required scheduled installment payment to a sinking fund for 30 days on debt securities of such series;

|

|

|

•

|

|

failure of Citigroup Global Markets Holdings to perform for 90 days after notice any other covenant in the indenture applicable to it other than a covenant included in the indenture solely for the benefit of a series of debt securities other than such series; and

|

|

|

•

|

|

certain events of bankruptcy or insolvency of Citigroup Global Markets Holdings, whether voluntary or not (Section 6.01).

|

|

Citigroup Global Markets Holdings Inc.

|

|

|

Payout Tables and Diagram

The table below illustrates how the amount payable per security

will be calculated if the closing value of the worst performing underlying on any valuation date prior to the final valuation date

is greater than or equal to its initial underlying value.

|

If the first valuation date on which the closing value of the worst performing underlying on that valuation date is greater than or equal to its initial underlying value is . . .

|

. . . then you will receive the following payment per $1,000 security upon automatic early redemption:

|

|

February 24, 2022

|

$1,000 + applicable premium = $1,000 + $75.00 = $1,075.00

|

|

February 23, 2023

|

$1,000 + applicable premium = $1,000 + $150.00 = $1,150.00

|

If, on any valuation date prior to the final valuation date,

the closing value of any underlying is greater than or equal to its initial underlying value, but the closing value of the other

underlying is less than its initial underlying value, you will not receive the premium indicated above following that valuation

date. In order to receive the premium indicated above, the closing value of each underlying on the applicable valuation

date must be greater than or equal to its initial underlying value.

The table below indicates what your payment at maturity would

be for various hypothetical underlying returns of the worst performing underlying on the final valuation date, assuming the securities

are not automatically redeemed prior to maturity. Your actual payment at maturity (if the securities are not earlier automatically

redeemed) will depend on the actual final underlying value of the worst performing underlying on the final valuation date.

|

Hypothetical Payment at Maturity(1)

|

|

Hypothetical Underlying Return of Worst Performing Underlying on the Final Valuation Date

|

Hypothetical Payment at Maturity per Security

|

|

100.00%

|

$2,250.00

|

|

75.00%

|

$1,937.50

|

|

50.00%

|

$1,625.00

|

|

25.00%

|

$1,312.50

|

|

10.00%

|

$1,125.00

|

|

0.00%

|

$1,000.00

|

|

-0.01%

|

$1,000.00

|

|

-10.00%

|

$1,000.00

|

|

-15.00%

|

$1,000.00

|

|

-15.01%

|

$999.90

|

|

-25.00%

|

$900.00

|

|

-50.00%

|

$650.00

|

|

-75.00%

|

$400.00

|

|

-100.00%

|

$150.00

|

(1) Assumes the securities are not automatically redeemed

prior to maturity. Each security has a stated principal amount of $1,000.00.

The diagram below illustrates the payment at maturity of the

securities, assuming the securities have not previously been automatically redeemed, for a range of hypothetical underlying returns

of the worst performing underlying on the final valuation date. Your payment at maturity (if the securities are not earlier automatically

redeemed) will be determined based solely on the performance of the worst performing underlying on the final valuation date.

Investors in the securities will not receive any dividends

with respect to the underlyings. The diagram and examples below do not show any effect of lost dividend yield over the term of

the securities. See “Summary Risk Factors—You will not receive dividends or have any other rights with respect

to the underlyings” below.

|

Citigroup Global Markets Holdings Inc.

|

|

|

|

Payment at Maturity

|

|

|

|

|

n The Securities

|

n The Worst Performing Underlying

|

|

Citigroup Global Markets Holdings Inc.

|

|

|

Hypothetical

Examples of the Payment at Maturity

The examples below illustrate how to determine the payment at

maturity on the securities, assuming the securities are not automatically redeemed prior to maturity. The examples are solely for

illustrative purposes, do not show all possible outcomes and are not a prediction of any payment that may be made on the securities.

The examples below are based on the following hypothetical values

and do not reflect the actual initial underlying values or buffer values of the underlyings. For the actual initial underlying

values and buffer values, see the cover page of this pricing supplement. We have used these hypothetical values, rather than the

actual values, to simplify the calculations and aid understanding of how the securities work. However, you should understand that

the actual payments on the securities will be calculated based on the actual initial underlying value and buffer value of each

underlying, and not the hypothetical values indicated below.

|

Underlying

|

Hypothetical initial underlying value

|

Hypothetical buffer value

|

|

Nasdaq-100 Index®

|

100

|

85 (85% of its hypothetical initial underlying value)

|

|

Russell 2000® Index

|

100

|

85 (85% of its hypothetical initial underlying value)

|

The examples below are intended to illustrate how, if the securities

are not automatically redeemed prior to maturity, your payment at maturity will depend on the final underlying value of the worst

performing underlying on the final valuation date. Your actual payment at maturity per security will depend on the actual final

underlying value of the worst performing underlying on the final valuation date.

Example 1—Upside

Scenario.

|

Underlying

|

Hypothetical final underlying value

|

Hypothetical underlying return

|

|

Nasdaq-100 Index®

|

110

|

10%

|

|

Russell 2000® Index

|

150

|

50%

|

Payment at maturity per

security = $1,000 + the return amount

= $1,000 + ($1,000 ×

the underlying return of the worst performing underlying on the final valuation date × the upside participation rate)

= $1,000 + ($1,000 ×

10% × 125%)

= $1,000 + $125

= $1,125

In this example, the Nasdaq-100

Index® has the lowest underlying return and is, therefore, the worst performing

underlying on the final valuation date. Because the final underlying value of the worst performing underlying on the final valuation

date is greater than its initial underlying value, your total return at maturity would equal the underlying return of the worst

performing underlying on the final valuation date multiplied by the upside participation rate.

Example 2—Par Scenario.

|

Underlying

|

Hypothetical final underlying value

|

Hypothetical underlying return

|

|

Nasdaq-100 Index®

|

110

|

10%

|

|

Russell 2000® Index

|

95

|

-5%

|

In this example, the Russell 2000® Index has the

lowest underlying return and is, therefore, the worst performing underlying on the final valuation date. Because the final underlying

value of the worst performing underlying on the final valuation date is less than its initial underlying value but greater than

its buffer value, you would be repaid the stated principal amount of $1,000 per security at maturity but would not receive any

positive return on your investment.

|

Citigroup Global Markets Holdings Inc.

|

|

|

Example 3—Downside Scenario.

|

Underlying

|

Hypothetical final underlying value

|

Hypothetical underlying return

|

|

Nasdaq-100 Index®

|

30

|

-70%

|

|

Russell 2000® Index

|

80

|

-20%

|

In this example, the Nasdaq-100 Index® has the

lowest underlying return and is, therefore, the worst performing underlying on the final valuation date. Because the final underlying

value of the worst performing underlying on the final valuation date is less than its buffer value, you would receive a payment

at maturity per security that is less than the stated principal amount, calculated as follows:

Payment at maturity per security = $1,000 + [$1,000 × (the

underlying return of the worst performing underlying on the final valuation date + the buffer percentage)]

= $1,000 + [$1,000 × (-70% + 15%)]

= $1,000 + [$1,000 × -55%]

= $1,000 + -$550

= $450

In this example, because the final underlying value of the worst

performing underlying on the final valuation date is less than its buffer value, you would lose a portion of your investment in

the securities. Your payment at maturity would reflect a loss of 1% of the stated principal amount of your securities for every

1% by which the depreciation of the worst performing underlying on the final valuation date has exceeded the buffer percentage.

|

Citigroup Global Markets Holdings Inc.

|

|

|

Summary Risk Factors

An investment in the securities is significantly riskier than

an investment in conventional debt securities. The securities are subject to all of the risks associated with an investment in

our conventional debt securities (guaranteed by Citigroup Inc.), including the risk that we and Citigroup Inc. may default on our

obligations under the securities, and are also subject to risks associated with each underlying. Accordingly, the securities are

suitable only for investors who are capable of understanding the complexities and risks of the securities. You should consult your

own financial, tax and legal advisors as to the risks of an investment in the securities and the suitability of the securities

in light of your particular circumstances.

The following is a summary of certain key risk factors for investors

in the securities. You should read this summary together with the more detailed description of risks relating to an investment

in the securities contained in the section “Risk Factors Relating to the Securities” beginning on page EA-7 in the

accompanying product supplement. You should also carefully read the risk factors included in the accompanying prospectus supplement

and in the documents incorporated by reference in the accompanying prospectus, including Citigroup Inc.’s most recent Annual

Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q, which describe risks relating to the business of Citigroup

Inc. more generally.

|

|

§

|

You may lose a significant portion of your investment. Unlike conventional debt securities, the securities do not provide

for the repayment of the stated principal amount at maturity in all circumstances. If the securities are not automatically redeemed

prior to maturity, your payment at maturity will depend on the final underlying value of the worst performing underlying on the

final valuation date. If the final underlying value of the worst performing underlying on the final valuation date is less than

its buffer value, which means that the worst performing underlying on the final valuation

date has depreciated from its initial underlying value by more than the buffer percentage, you

will lose 1% of the stated principal amount of your securities for every 1% by which that depreciation exceeds the buffer percentage.

|

§

The securities do not pay interest. You should not invest in the securities if you seek current income during the

term of the securities.

|

|

§

|

The securities are subject to heightened risk because they have multiple underlyings. The securities are more risky

than similar investments that may be available with only one underlying. With multiple underlyings, there is a greater chance that

any one underlying will perform poorly, adversely affecting your return on the securities.

|

|

|

§

|

The securities are subject to the risks of each of the underlyings and will be negatively affected if any one underlying

performs poorly. You are subject to risks associated with each of the underlyings. If any one underlying performs poorly, you

will be negatively affected. The securities are not linked to a basket composed of the underlyings, where the blended performance

of the underlyings would be better than the performance of the worst performing underlying alone. Instead, you are subject to the

full risks of whichever of the underlyings is the worst performing underlying.

|

|

|

§

|

You will not benefit in any way from the performance of any better performing underlying. The return on the securities

depends solely on the performance of the worst performing underlying, and you will not benefit in any way from the performance

of any better performing underlying.

|

|

|

§

|

You will be subject to risks relating to the relationship between the underlyings. It is preferable from your perspective

for the underlyings to be correlated with each other, in the sense that they tend to increase or decrease at similar times and

by similar magnitudes. By investing in the securities, you assume the risk that the underlyings will not exhibit this relationship.

The less correlated the underlyings, the more likely it is that any one of the underlyings will perform poorly over the term of

the securities. All that is necessary for the securities to perform poorly is for one of the underlyings to perform poorly. It

is impossible to predict what the relationship between the underlyings will be over the term of the securities. The underlyings

differ in significant ways and, therefore, may not be correlated with each other.

|

|

|

§

|

The securities may be automatically redeemed prior to maturity, limiting the term of the securities. If the closing

value of the worst performing underlying on any valuation date (other than the final valuation date) is greater than or equal to

its initial underlying value, the securities will be automatically redeemed. If the securities are automatically redeemed following

any valuation date (other than the final valuation date), they will cease to be outstanding. Moreover, you may not be able to reinvest

your funds in another investment that provides a similar yield with a similar level of risk.

|

|

|

§

|

You will not receive dividends or have any other rights with respect to the underlyings. You will not receive any dividends

with respect to the underlyings. This lost dividend yield may be significant over the term of the securities. The payment scenarios

described in this pricing supplement do not show any effect of such lost dividend yield over the term of the securities. In addition,

you will not have voting rights or any other rights with respect to the underlyings or the stocks included in the underlyings.

|

|

|

§

|

The performance of the securities will depend on the closing values of the underlyings solely on the valuation dates, which

makes the securities particularly sensitive to volatility in the closing values of the underlyings on or near the valuation dates.

Whether the securities will be automatically redeemed prior to maturity will depend on the closing values of the underlyings solely

on the valuation dates (other than the final valuation date), regardless of the closing values of the underlyings on other days

during the term of the securities. If the securities are not automatically redeemed prior to maturity, what you receive at maturity

will depend solely on the final underlying value of the worst performing underlying on the final valuation date, and not on

|

|

Citigroup Global Markets Holdings Inc.

|

|

|

any other day during the term of the securities. Because

the performance of the securities depends on the closing values of the underlyings on a limited number of dates, the securities

will be particularly sensitive to volatility in the closing values of the underlyings on or near the valuation dates. You should

understand that the closing value of each underlying has historically been highly volatile.

|

|

§

|

The securities are subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. If we default

on our obligations under the securities and Citigroup Inc. defaults on its guarantee obligations, you may not receive anything

owed to you under the securities.

|

|

|

§

|

The securities will not be listed on any securities exchange and you may not be able to sell them prior to maturity. The

securities will not be listed on any securities exchange. Therefore, there may be little or no secondary market for the securities.

CGMI currently intends to make a secondary market in relation to the securities and to provide an indicative bid price for the

securities on a daily basis. Any indicative bid price for the securities provided by CGMI will be determined in CGMI’s sole

discretion, taking into account prevailing market conditions and other relevant factors, and will not be a representation by CGMI

that the securities can be sold at that price, or at all. CGMI may suspend or terminate making a market and providing indicative

bid prices without notice, at any time and for any reason. If CGMI suspends or terminates making a market, there may be no secondary

market at all for the securities because it is likely that CGMI will be the only broker-dealer that is willing to buy your securities

prior to maturity. Accordingly, an investor must be prepared to hold the securities until maturity.

|

|

|

§

|

The estimated value of the securities on the pricing date, based on CGMI’s proprietary pricing models and our internal

funding rate, is less than the issue price. The difference is attributable to certain costs associated with selling, structuring

and hedging the securities that are included in the issue price. These costs include (i) any selling concessions or other fees

paid in connection with the offering of the securities, (ii) hedging and other costs incurred by us and our affiliates in connection

with the offering of the securities and (iii) the expected profit (which may be more or less than actual profit) to CGMI or other

of our affiliates in connection with hedging our obligations under the securities. These costs adversely affect the economic terms

of the securities because, if they were lower, the economic terms of the securities would be more favorable to you. The economic

terms of the securities are also likely to be adversely affected by the use of our internal funding rate, rather than our secondary

market rate, to price the securities. See “The estimated value of the securities would be lower if it were calculated based

on our secondary market rate” below.

|

|

|

§

|

The estimated value of the securities was determined for us by our affiliate using proprietary pricing models. CGMI

derived the estimated value disclosed on the cover page of this pricing supplement from its proprietary pricing models. In doing

so, it may have made discretionary judgments about the inputs to its models, such as the volatility of and correlation between

the underlyings, dividend yields on the underlyings and interest rates. CGMI’s views on these inputs may differ from your

or others’ views, and as an underwriter in this offering, CGMI’s interests may conflict with yours. Both the models

and the inputs to the models may prove to be wrong and therefore not an accurate reflection of the value of the securities. Moreover,

the estimated value of the securities set forth on the cover page of this pricing supplement may differ from the value that we

or our affiliates may determine for the securities for other purposes, including for accounting purposes. You should not invest

in the securities because of the estimated value of the securities. Instead, you should be willing to hold the securities to maturity

irrespective of the initial estimated value.

|

|

|

§

|

The estimated value of the securities would be lower if it were calculated based on our secondary

market rate. The estimated value of the securities included in this pricing supplement is calculated based on our internal

funding rate, which is the rate at which we are willing to borrow funds through the issuance of the securities. Our internal funding

rate is generally lower than our secondary market rate, which is the rate that CGMI will use in determining the value of the securities

for purposes of any purchases of the securities from you in the secondary market. If the estimated value included in this pricing

supplement were based on our secondary market rate, rather than our internal funding rate, it would likely be lower. We determine

our internal funding rate based on factors such as the costs associated with the securities, which are generally higher than the

costs associated with conventional debt securities, and our liquidity needs and preferences. Our internal funding rate is not an

interest rate that is payable on the securities.

|

Because there is not an active market for traded instruments

referencing our outstanding debt obligations, CGMI determines our secondary market rate based on the market price of traded instruments

referencing the debt obligations of Citigroup Inc., our parent company and the guarantor of all payments due on the securities,

but subject to adjustments that CGMI makes in its sole discretion. As a result, our secondary market rate is not a market-determined

measure of our creditworthiness, but rather reflects the market’s perception of our parent company’s creditworthiness

as adjusted for discretionary factors such as CGMI’s preferences with respect to purchasing the securities prior to maturity.

|

|

§

|

The estimated value of the securities is not an indication of the price, if any, at which CGMI or any other person may be

willing to buy the securities from you in the secondary market. Any such secondary market price will fluctuate over the term

of the securities based on the market and other factors described in the next risk factor. Moreover, unlike the estimated value

included in this pricing supplement, any value of the securities determined for purposes of a secondary market transaction will

be based on our secondary market rate, which will likely result in a lower value for the securities than if our internal funding

rate were used. In addition, any secondary market price for the securities will be reduced by a bid-ask spread, which may vary

depending on the aggregate stated principal amount of the securities to be purchased in the secondary market transaction, and the

expected cost

|

|

Citigroup Global Markets Holdings Inc.

|

|

|

of unwinding related

hedging transactions. As a result, it is likely that any secondary market price for the securities will be less than the issue

price.

|

|

§

|

The value of the securities prior to maturity will

fluctuate based on many unpredictable factors. The value of your securities prior to maturity will fluctuate based on the

closing values of the underlyings, the volatility of the closing values of the underlyings, the correlation between the underlyings,

dividend yields on the underlyings, interest rates generally, the time remaining to maturity and our and Citigroup Inc.’s

creditworthiness, as reflected in our secondary market rate, among other factors described under “Risk Factors Relating

to the Securities—Risk Factors Relating to All Securities—The value of your securities prior to maturity will fluctuate

based on many unpredictable factors” in the accompanying product supplement. Changes in the closing values of the underlyings

may not result in a comparable change in the value of your securities. You should understand that the value of your securities

at any time prior to maturity may be significantly less than the issue price.

|

|

|

§

|

Immediately following issuance, any secondary market

bid price provided by CGMI, and the value that will be indicated on any brokerage account statements prepared by CGMI or its affiliates,

will reflect a temporary upward adjustment. The amount of this temporary upward adjustment will steadily decline to zero over

the temporary adjustment period. See “Valuation of the Securities” in this pricing supplement.

|

|

|

§

|

The Russell 2000® Index is subject

to risks associated with small capitalization stocks. The stocks that constitute the Russell 2000® Index are

issued by companies with relatively small market capitalization. The stock prices of smaller companies may be more volatile than

stock prices of large capitalization companies. These companies tend to be less well-established than large market capitalization

companies. Small capitalization companies may be less able to withstand adverse economic, market, trade and competitive conditions

relative to larger companies. Small capitalization companies are less likely to pay dividends on their stocks, and the presence

of a dividend payment could be a factor that limits downward stock price pressure under adverse market conditions.

|

|

|

§

|

Our offering of the securities is not a recommendation

of any underlying. The fact that we are offering the securities does not mean that we believe that investing in an instrument

linked to the underlyings is likely to achieve favorable returns. In fact, as we are part of a global financial institution, our

affiliates may have positions (including short positions) in the underlyings or in instruments related to the underlyings, and

may publish research or express opinions, that in each case are inconsistent with an investment linked to the underlyings. These

and other activities of our affiliates may affect the closing values of the underlyings in a way that negatively affects the value

of and your return on the securities.

|

|

|

§

|

The closing value of an underlying may be adversely

affected by our or our affiliates’ hedging and other trading activities. We expect to hedge our obligations under the

securities through CGMI or other of our affiliates, who may take positions in the underlyings or in financial instruments related

to the underlyings and may adjust such positions during the term of the securities. Our affiliates also take positions in the

underlyings or in financial instruments related to the underlyings on a regular basis (taking long or short positions or both),

for their accounts, for other accounts under their management or to facilitate transactions on behalf of customers. These activities

could affect the closing values of the underlyings in a way that negatively affects the value of and your return on the securities.

They could also result in substantial returns for us or our affiliates while the value of the securities declines.

|

|

|

§

|

We and our affiliates may have economic interests

that are adverse to yours as a result of our affiliates’ business activities. Our affiliates engage in business activities

with a wide range of companies. These activities include extending loans, making and facilitating investments, underwriting securities

offerings and providing advisory services. These activities could involve or affect the underlyings in a way that negatively affects

the value of and your return on the securities. They could also result in substantial returns for us or our affiliates while the

value of the securities declines. In addition, in the course of this business, we or our affiliates may acquire non-public information,

which will not be disclosed to you.

|

|

|

§

|

The calculation agent, which is an affiliate of ours,

will make important determinations with respect to the securities. If certain events occur during the term of the securities,

such as market disruption events and other events with respect to an underlying, CGMI, as calculation agent, will be required

to make discretionary judgments that could significantly affect your return on the securities. In making these judgments, the

calculation agent’s interests as an affiliate of ours could be adverse to your interests as a holder of the securities.

See “Risk Factors Relating to the Securities—Risk Factors Relating to All Securities—The calculation agent,

which is an affiliate of ours, will make important determinations with respect to the securities” in the accompanying product

supplement.

|

|

|

§

|

Changes that affect the underlyings may affect the

value of your securities. The sponsors of the underlyings may at any time make methodological changes or other changes in

the manner in which they operate that could affect the values of the underlyings. We are not affiliated with any such underlying

sponsor and, accordingly, we have no control over any changes any such sponsor may make. Such changes could adversely affect the

performance of the underlyings and the value of and your return on the securities.

|

|

|

§

|

The U.S. federal tax consequences of an investment

in the securities are unclear. There is no direct legal authority

regarding the proper U.S. federal tax treatment of the securities, and we do not plan to request a ruling from the Internal Revenue

Service (the “IRS”). Consequently, significant aspects of the tax treatment of the securities are uncertain, and the

IRS or a court might not agree with the treatment of the securities as prepaid forward contracts. If the IRS were successful in

asserting an alternative treatment of the securities, the tax consequences of the ownership and disposition of the securities

might be materially and

|

|

Citigroup Global Markets Holdings Inc.

|

|

|

adversely affected. Moreover, future legislation,

Treasury regulations or IRS guidance could adversely affect the U.S. federal tax treatment of the securities, possibly retroactively.

If you are a non-U.S. investor, you should review

the discussion of withholding tax issues in “United States Federal Tax Considerations—Non-U.S. Holders” below.

You should read carefully the

discussion under “United States Federal Tax Considerations” and “Risk Factors Relating to the Securities”

in the accompanying product supplement and “United States Federal Tax Considerations” in this pricing supplement. You

should also consult your tax adviser regarding the U.S. federal tax consequences of an investment in the securities, as well as

tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction.

|

Citigroup Global Markets Holdings Inc.

|

|

|

Information About the Nasdaq-100 Index®

The Nasdaq-100 Index®

is a modified market capitalization-weighted index of stocks of the 100 largest non-financial companies listed on the Nasdaq Stock

Market. All stocks included in the Nasdaq-100 Index® are traded on a major U.S. exchange. The Nasdaq-100 Index®

was developed by the Nasdaq Stock Market, Inc. and is calculated, maintained and published by Nasdaq, Inc.

Please refer to the section

“Equity Index Descriptions—The Nasdaq-100 Index®” in the accompanying underlying supplement for

additional information.

We have derived all information

regarding the Nasdaq-100 Index® from publicly available information and have not independently verified any information

regarding the Nasdaq-100 Index®. This pricing supplement relates only to the securities and not to the Nasdaq-100

Index®. We make no representation as to the performance of the Nasdaq-100 Index® over the term of

the securities.

The securities represent

obligations of Citigroup Global Markets Holdings Inc. (guaranteed by Citigroup Inc.) only. The sponsor of the Nasdaq-100 Index®

is not involved in any way in this offering and has no obligation relating to the securities or to holders of the securities.

Historical Information

The closing value of the Nasdaq-100 Index® on

February 23, 2021 was 13,194.71.

The graph below shows the closing value of the Nasdaq-100 Index®

for each day such value was available from January 3, 2011 to February 23, 2021. We obtained the closing values from Bloomberg

L.P., without independent verification. You should not take historical closing values as an indication of future performance.

Nasdaq-100 Index® – Historical Closing Values

January 3, 2011 to February 23, 2021

|

|

|

Citigroup Global Markets Holdings Inc.

|

|

|

Information About the Russell 2000®

Index

The Russell 2000® Index is designed to track the

performance of the small capitalization segment of the U.S. equity market. All stocks included in the Russell 2000®

Index are traded on a major U.S. exchange. It is calculated and maintained by FTSE Russell.

Please refer to the section “Equity Index Descriptions—The

Russell Indices—The Russell 2000® Index” in the accompanying underlying supplement for additional information.

We have derived all information regarding the Russell 2000®

Index from publicly available information and have not independently verified any information regarding the Russell 2000®

Index. This pricing supplement relates only to the securities and not to the Russell 2000® Index. We make no representation

as to the performance of the Russell 2000® Index over the term of the securities.

The securities represent obligations of Citigroup Global Markets

Holdings Inc. (guaranteed by Citigroup Inc.) only. The sponsor of the Russell 2000® Index is not involved in any

way in this offering and has no obligation relating to the securities or to holders of the securities.

Historical Information

The closing value of the Russell 2000® Index on

February 23, 2021 was 2,231.314.

The graph below shows the closing value of the Russell 2000®

Index for each day such value was available from January 3, 2011 to February 23, 2021. We obtained the closing values from Bloomberg

L.P., without independent verification. You should not take historical closing values as an indication of future performance.

Russell 2000® Index – Historical Closing Values

January 3, 2011 to February 23, 2021

|

|

|

Citigroup Global Markets Holdings Inc.

|

|

|

United States Federal Tax Considerations

You should read carefully the discussion under “United

States Federal Tax Considerations” and “Risk Factors Relating to the Securities” in the accompanying product

supplement and “Summary Risk Factors” in this pricing supplement.

In the opinion of our counsel, Davis Polk & Wardwell LLP,

which is based on current market conditions, a security should be treated as a prepaid forward contract for U.S. federal income

tax purposes. By purchasing a security, you agree (in the absence of an administrative determination or judicial ruling to the

contrary) to this treatment. There is uncertainty regarding this treatment, and the IRS or a court might not agree with it.

Assuming this treatment of the securities is respected and subject

to the discussion in “United States Federal Tax Considerations” in the accompanying product supplement, the following

U.S. federal income tax consequences should result under current law:

|

|

·

|

You should not recognize taxable income over the term of the securities prior to maturity, other than pursuant to a sale or

exchange.

|

|

|

·

|

Upon a sale or exchange of a security (including retirement at maturity), you should recognize capital gain or loss equal to

the difference between the amount realized and your tax basis in the security. Such gain or loss should be long-term capital gain

or loss if you held the security for more than one year.

|

We do not plan to request a ruling from the IRS regarding the

treatment of the securities. An alternative characterization of the securities could materially and adversely affect the tax consequences

of ownership and disposition of the securities, including the timing and character of income recognized. In addition, the U.S.

Treasury Department and the IRS have requested comments on various issues regarding the U.S. federal income tax treatment of “prepaid

forward contracts” and similar financial instruments and have indicated that such transactions may be the subject of future

regulations or other guidance. Furthermore, members of Congress have proposed legislative changes to the tax treatment of derivative

contracts. Any legislation, Treasury regulations or other guidance promulgated after consideration of these issues could materially

and adversely affect the tax consequences of an investment in the securities, possibly with retroactive effect. You should consult

your tax adviser regarding possible alternative tax treatments of the securities and potential changes in applicable law.

Non-U.S. Holders. Subject to the discussions below and

in “United States Federal Tax Considerations” in the accompanying product supplement, if you are a Non-U.S. Holder

(as defined in the accompanying product supplement) of the securities, you generally should not be subject to U.S. federal withholding

or income tax in respect of any amount paid to you with respect to the securities, provided that (i) income in respect of the securities

is not effectively connected with your conduct of a trade or business in the United States, and (ii) you comply with the applicable

certification requirements.

As discussed under “United States Federal Tax Considerations—Tax

Consequences to Non-U.S. Holders” in the accompanying product supplement, Section 871(m) of the Code and Treasury regulations

promulgated thereunder (“Section 871(m)”) generally impose a 30% withholding tax on dividend equivalents paid or deemed

paid to Non-U.S. Holders with respect to certain financial instruments linked to U.S. equities (“U.S. Underlying Equities”)

or indices that include U.S. Underlying Equities. Section 871(m) generally applies to instruments that substantially replicate

the economic performance of one or more U.S. Underlying Equities, as determined based on tests set forth in the applicable Treasury

regulations. However, the regulations, as modified by an IRS notice, exempt financial instruments issued prior to January 1, 2023

that do not have a “delta” of one. Based on the terms of the securities and representations provided by us, our counsel

is of the opinion that the securities should not be treated as transactions that have a “delta” of one within the meaning

of the regulations with respect to any U.S. Underlying Equity and, therefore, should not be subject to withholding tax under Section

871(m).

A determination that the securities are not subject to Section

871(m) is not binding on the IRS, and the IRS may disagree with this treatment. Moreover, Section 871(m) is complex and its application

may depend on your particular circumstances, including your other transactions. You should consult your tax adviser regarding the

potential application of Section 871(m) to the securities.

If withholding tax applies to the securities, we will not be

required to pay any additional amounts with respect to amounts withheld.

You should read the section entitled “United States

Federal Tax Considerations” in the accompanying product supplement. The preceding discussion, when read in combination with

that section, constitutes the full opinion of Davis Polk & Wardwell LLP regarding the material U.S. federal tax consequences

of owning and disposing of the securities.

You should also consult your tax adviser regarding all aspects

of the U.S. federal income and estate tax consequences of an investment in the securities and any tax consequences arising under

the laws of any state, local or non-U.S. taxing jurisdiction.

|

Citigroup Global Markets Holdings Inc.

|

|

|

Supplemental Plan of Distribution

CGMI, an affiliate of Citigroup Global Markets Holdings Inc.

and the underwriter of the sale of the securities, is acting as principal and will receive an underwriting fee of up to $36.00

for each security sold in this offering. The actual underwriting fee will be equal to the selling concession provided to selected

dealers, as described in this paragraph. From this underwriting fee, CGMI will pay selected dealers not affiliated with CGMI a

variable selling concession of up to $36.00 for each security they sell. For the avoidance

of doubt, any fees or selling concessions described in this pricing supplement will not be rebated if the securities are automatically

redeemed prior to maturity.

See “Plan of Distribution; Conflicts of Interest”

in the accompanying product supplement and “Plan of Distribution” in each of the accompanying prospectus supplement

and prospectus for additional information.

Valuation of the Securities

CGMI calculated the estimated value of the securities set forth

on the cover page of this pricing supplement based on proprietary pricing models. CGMI’s proprietary pricing models generated

an estimated value for the securities by estimating the value of a hypothetical package of financial instruments that would replicate

the payout on the securities, which consists of a fixed-income bond (the “bond component”) and one or more derivative

instruments underlying the economic terms of the securities (the “derivative component”). CGMI calculated the estimated

value of the bond component using a discount rate based on our internal funding rate. CGMI calculated the estimated value of the

derivative component based on a proprietary derivative-pricing model, which generated a theoretical price for the instruments that

constitute the derivative component based on various inputs, including the factors described under “Summary Risk Factors—The

value of the securities prior to maturity will fluctuate based on many unpredictable factors” in this pricing supplement,

but not including our or Citigroup Inc.’s creditworthiness. These inputs may be market-observable or may be based on assumptions

made by CGMI in its discretionary judgment.

For a period of approximately three months following issuance

of the securities, the price, if any, at which CGMI would be willing to buy the securities from investors, and the value that will

be indicated for the securities on any brokerage account statements prepared by CGMI or its affiliates (which value CGMI may also

publish through one or more financial information vendors), will reflect a temporary upward adjustment from the price or value

that would otherwise be determined. This temporary upward adjustment represents a portion of the hedging profit expected to be

realized by CGMI or its affiliates over the term of the securities. The amount of this temporary upward adjustment will decline

to zero on a straight-line basis over the three-month temporary adjustment period. However, CGMI is not obligated to buy the securities

from investors at any time. See “Summary Risk Factors—The securities will not be listed on any securities exchange

and you may not be able to sell them prior to maturity.”

Certain

Selling Restrictions

Hong

Kong Special Administrative Region

The contents of this pricing supplement and the accompanying

product supplement, underlying supplement, prospectus supplement and prospectus have not been reviewed by any regulatory authority

in the Hong Kong Special Administrative Region of the People’s Republic of China (“Hong Kong”). Investors are

advised to exercise caution in relation to the offer. If investors are in any doubt about any of the contents of this pricing supplement

and the accompanying product supplement, underlying supplement, prospectus supplement and prospectus, they should obtain independent

professional advice.

The securities have not been offered or sold and will not be

offered or sold in Hong Kong by means of any document, other than

|

|

(i)

|

to persons whose ordinary business is to buy or sell shares or debentures (whether as principal or agent); or

|

|

|

(ii)

|

to “professional investors” as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong (the “Securities

and Futures Ordinance”) and any rules made under that Ordinance; or

|

|

|

(iii)

|

in other circumstances which do not result in the document being a “prospectus” as defined in the Companies Ordinance

(Cap. 32) of Hong Kong or which do not constitute an offer to the public within the meaning of that Ordinance; and

|

There is no advertisement, invitation or document relating to

the securities which is directed at, or the contents of which are likely to be accessed or read by, the public of Hong Kong (except

if permitted to do so under the securities laws of Hong Kong) other than with respect to securities which are or are intended to

be disposed of only to persons outside Hong Kong or only to “professional investors” as defined in the Securities and

Futures Ordinance and any rules made under that Ordinance.

Non-insured Product: These securities are not insured by any

governmental agency. These securities are not bank deposits and are not covered by the Hong Kong Deposit Protection Scheme.

|

Citigroup Global Markets Holdings Inc.

|

|

|

Singapore

This pricing supplement and the accompanying product supplement,

underlying supplement, prospectus supplement and prospectus have not been registered as a prospectus with the Monetary Authority

of Singapore, and the securities will be offered pursuant to exemptions under the Securities and Futures Act, Chapter 289 of Singapore

(the “Securities and Futures Act”). Accordingly, the securities may not be offered or sold or made the subject of an

invitation for subscription or purchase nor may this pricing supplement or any other document or material in connection with the

offer or sale or invitation for subscription or purchase of any securities be circulated or distributed, whether directly or indirectly,

to any person in Singapore other than (a) to an institutional investor pursuant to Section 274 of the Securities and Futures Act,

(b) to a relevant person under Section 275(1) of the Securities and Futures Act or to any person pursuant to Section 275(1A) of

the Securities and Futures Act and in accordance with the conditions specified in Section 275 of the Securities and Futures Act,

or (c) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the Securities and Futures

Act. Where the securities are subscribed or purchased under Section 275 of the Securities and Futures Act by a relevant person

which is:

|

|

(a)

|

a corporation (which is not an accredited investor (as defined in Section 4A of the Securities and Futures Act)) the sole business

of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited

investor; or

|

|

|

(b)

|

a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary is

an individual who is an accredited investor, securities (as defined in Section 239(1) of the Securities and Futures Act) of that

corporation or the beneficiaries’ rights and interests (howsoever described) in that trust shall not be transferable for

6 months after that corporation or that trust has acquired the relevant securities pursuant to an offer under Section 275 of the

Securities and Futures Act except:

|

|

|

(i)

|

to an institutional investor or to a relevant person defined in Section 275(2) of the Securities and Futures Act or to any

person arising from an offer referred to in Section 275(1A) or Section 276(4)(i)(B) of the Securities and Futures Act; or

|

|

|

(ii)

|

where no consideration is or will be given for the transfer; or

|

|

|

(iii)

|

where the transfer is by operation of law; or

|

|

|

(iv)

|

pursuant to Section 276(7) of the Securities and Futures Act; or

|

|

|

(v)

|

as specified in Regulation 32 of the Securities and Futures (Offers of Investments) (Shares and Debentures) Regulations 2005

of Singapore.

|

Any securities referred to herein may not be registered with

any regulator, regulatory body or similar organization or institution in any jurisdiction.

The securities are Specified Investment Products (as defined

in the Notice on Recommendations on Investment Products and Notice on the Sale of Investment Product issued by the Monetary Authority

of Singapore on 28 July 2011) that is neither listed nor quoted on a securities market or a futures market.

Non-insured Product: These securities are not insured by any

governmental agency. These securities are not bank deposits. These securities are not insured products subject to the provisions

of the Deposit Insurance and Policy Owners’ Protection Schemes Act 2011 of Singapore and are not eligible for deposit insurance

coverage under the Deposit Insurance Scheme.

Validity

of the Securities

In the opinion of Davis

Polk & Wardwell LLP, as special products counsel to Citigroup Global Markets Holdings Inc., when the securities offered by

this pricing supplement have been executed and issued by Citigroup Global Markets Holdings Inc. and authenticated by the trustee

pursuant to the indenture, and delivered against payment therefor, such securities and the related guarantee of Citigroup Inc.

will be valid and binding obligations of Citigroup Global Markets Holdings Inc. and Citigroup Inc., respectively, enforceable in

accordance with their respective terms, subject to applicable bankruptcy, insolvency and similar laws affecting creditors’

rights generally, concepts of reasonableness and equitable principles of general applicability (including, without limitation,

concepts of good faith, fair dealing and the lack of bad faith), provided that such counsel expresses no opinion as to the effect

of fraudulent conveyance, fraudulent transfer or similar provision of applicable law on the conclusions expressed above. This opinion

is given as of the date of this pricing supplement and is limited to the laws of the State of New York, except that such counsel

expresses no opinion as to the application of state securities or Blue Sky laws to the securities.

In giving this opinion,

Davis Polk & Wardwell LLP has assumed the legal conclusions expressed in the opinions set forth below of Scott L. Flood, General

Counsel and Secretary of Citigroup Global Markets Holdings Inc., and Barbara Politi, Assistant General Counsel—Capital Markets

of Citigroup Inc. In addition, this opinion is subject to the assumptions set forth in the letter of Davis Polk & Wardwell

LLP dated May 17, 2018, which has been filed as an exhibit to a Current Report on Form 8-K filed by Citigroup Inc. on May 17, 2018,

that the indenture has been duly authorized, executed and delivered by, and is a valid, binding and enforceable agreement of, the

trustee and that none of the terms of the securities nor the issuance and delivery of the securities and the related guarantee,

nor the

|

Citigroup Global Markets Holdings Inc.

|

|

|

compliance by Citigroup Global Markets Holdings Inc. and Citigroup

Inc. with the terms of the securities and the related guarantee respectively, will result in a violation of any provision of any

instrument or agreement then binding upon Citigroup Global Markets Holdings Inc. or Citigroup Inc., as applicable, or any restriction

imposed by any court or governmental body having jurisdiction over Citigroup Global Markets Holdings Inc. or Citigroup Inc., as

applicable.

In the opinion of Scott

L. Flood, Secretary and General Counsel of Citigroup Global Markets Holdings Inc., (i) the terms of the securities offered by this

pricing supplement have been duly established under the indenture and the Board of Directors (or a duly authorized committee thereof)

of Citigroup Global Markets Holdings Inc. has duly authorized the issuance and sale of such securities and such authorization has

not been modified or rescinded; (ii) Citigroup Global Markets Holdings Inc. is validly existing and in good standing under the

laws of the State of New York; (iii) the indenture has been duly authorized, executed and delivered by Citigroup Global Markets

Holdings Inc.; and (iv) the execution and delivery of such indenture and of the securities offered by this pricing supplement by

Citigroup Global Markets Holdings Inc., and the performance by Citigroup Global Markets Holdings Inc. of its obligations thereunder,

are within its corporate powers and do not contravene its certificate of incorporation or bylaws or other constitutive documents.

This opinion is given as of the date of this pricing supplement and is limited to the laws of the State of New York.

Scott L. Flood, or other

internal attorneys with whom he has consulted, has examined and is familiar with originals, or copies certified or otherwise identified

to his satisfaction, of such corporate records of Citigroup Global Markets Holdings Inc., certificates or documents as he has deemed

appropriate as a basis for the opinions expressed above. In such examination, he or such persons has assumed the legal capacity

of all natural persons, the genuineness of all signatures (other than those of officers of Citigroup Global Markets Holdings Inc.),

the authenticity of all documents submitted to him or such persons as originals, the conformity to original documents of all documents

submitted to him or such persons as certified or photostatic copies and the authenticity of the originals of such copies.

In the opinion of Barbara

Politi, Assistant General Counsel—Capital Markets of Citigroup Inc., (i) the Board of Directors (or a duly authorized committee

thereof) of Citigroup Inc. has duly authorized the guarantee of such securities by Citigroup Inc. and such authorization has not

been modified or rescinded; (ii) Citigroup Inc. is validly existing and in good standing under the laws of the State of Delaware;

(iii) the indenture has been duly authorized, executed and delivered by Citigroup Inc.; and (iv) the execution and delivery of

such indenture, and the performance by Citigroup Inc. of its obligations thereunder, are within its corporate powers and do not

contravene its certificate of incorporation or bylaws or other constitutive documents. This opinion is given as of the date of

this pricing supplement and is limited to the General Corporation Law of the State of Delaware.

Barbara Politi, or other

internal attorneys with whom she has consulted, has examined and is familiar with originals, or copies certified or otherwise identified

to her satisfaction, of such corporate records of Citigroup Inc., certificates or documents as she has deemed appropriate as a

basis for the opinions expressed above. In such examination, she or such persons has assumed the legal capacity of all natural

persons, the genuineness of all signatures (other than those of officers of Citigroup Inc.), the authenticity of all documents

submitted to her or such persons as originals, the conformity to original documents of all documents submitted to her or such persons

as certified or photostatic copies and the authenticity of the originals of such copies.

Contact

Clients may contact their local brokerage representative. Third-party

distributors may contact Citi Structured Investment Sales at (212) 723-7005.

© 2021 Citigroup Global Markets Inc. All rights

reserved. Citi and Citi and Arc Design are trademarks and service marks of Citigroup Inc. or its affiliates and are used and registered

throughout the world.

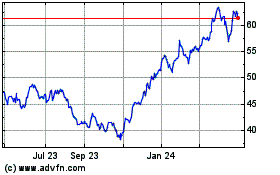

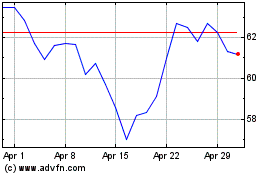

Citigroup (NYSE:C)

Historical Stock Chart

From Mar 2024 to Apr 2024

Citigroup (NYSE:C)

Historical Stock Chart

From Apr 2023 to Apr 2024