By David Benoit

On the first Friday night in November, bank investor Ben

Mackovak sat outside his Cleveland home smoking a cigar,

contemplating the ruin in his portfolio.

It had been a brutal year and he'd just taken another beating.

The day after the U.S. election, the Nasdaq Bank Index he uses as a

benchmark suffered its worst underperformance against the S&P

500 since 1987. Mr. Mackovak no longer saw a path to the higher

interest rates that banks need to make more money in the coming

years.

"It was a gut punch," he said.

Come Monday night, Mr. Mackovak, co-founder of the $270 million

fund Strategic Value Bank Partners, believed the industry was

saved. Pfizer Inc. was making progress on a Covid-19 vaccine. The

Nasdaq Bank Index had its best day since 1984. Mr. Mackovak, not a

regular smoker, took out another cigar -- this time a Cuban.

"It's very unusual to have two paradigm shifts in six days," he

said.

The year 2020 will go down as one of the most volatile -- and

likely one of the worst -- for bank stocks on record.

More broadly, the stock market is soaring even as the economy

continues to stumble amid the pandemic. The Dow Jones Industrial

Average is nearing the symbolic 30000 threshold, and the S&P

500 hit new records this month. Giant technology companies like

Facebook Inc. and Amazon.com Inc., which have benefited from

stay-at-home directives, have fueled the market's rise. The lesser

performance by banks, viewed as closely tied to the fortunes of

consumers and businesses, highlights the disparity between a

rallying market and a troubled economy.

The past few weeks in particular sent bank investors whipsawing.

The day after the election was among the worst days ever for bank

stocks when compared with the S&P 500. Three sessions later,

news broke that a vaccine developed by Pfizer and BioNTech SE

proved better than expected at protecting people from Covid-19, and

banks had one of their best days.

Investors, for their part, can't quite decide what to think.

They increased their allocation to banks by more than for any other

sector this month, according to a Bank of America Corp. survey. At

the same time, betting against banks remained the second-most

popular trade in the survey.

Bank investors admit it has been a bad year, with clients

pulling money and some funds closing. Even Warren Buffett's

Berkshire Hathaway Inc. has sold down its holdings of JPMorgan

Chase & Co. and Wells Fargo & Co.

The index for the biggest banks, the KBW Nasdaq Bank Index, is

down 22% for the year. It remains on pace to underperform the

S&P 500 by more than any year on records going back to

1993.

When the economy started recovering this summer and other

industries rallied, banks stayed beaten down. There are concerns

that people will stop paying loans en masse as the pandemic

stretches on. The Federal Reserve plans to keep interest rates low,

which hurts margins. Loan growth is expected to be anemic.

There were a few bright spots in October. Trading revenue

powered profits at Wall Street heavy hitters Goldman Sachs Group

Inc. and Morgan Stanley. JPMorgan, Citigroup Inc. and others slowed

their stockpiling for bad loans. Smaller banks started buying back

stock again. There were even some deals announced. Many investors

bet that Democrats would sweep the results on Election Day and pass

a big stimulus package, providing another reason to bet on

banks.

Then, on Nov. 3, the nation voted.

After polls closed, it was apparent a Blue Wave wouldn't

materialize to easily push through new stimulus. Wall Street

quickly unwound those trades.

On Wednesday, Nov. 4, the big bank index fell 5% while the

S&P 500 rose 2.2%, the banks' worst comparative performance in

more than a decade. The KBW Nasdaq Regional Banking Index slumped

7.4%, its worst day ever compared with the broader benchmark.

The mood shifted dramatically the morning of Monday, Nov. 9, on

the Pfizer news. The market jumped. Banks soared. The KBW big bank

index rose 13.5%. The regional bank index jumped 16%, marking its

best-ever performance against the S&P 500.

Now the prevailing hope wasn't that a stimulus would prop up the

economy temporarily, but that the pandemic would end.

For Anton Schutz, portfolio manager of the RMB Mendon Financial

Services Fund, the year has been a struggle to keep clients and get

new ones.

But like many bank investors, he is feeling some measure of

relief thanks to the vaccine news and is betting his portfolio will

recover next year. He doesn't believe credit losses will be as bad

as first feared, which could turn the billions of dollars the banks

have put aside for potentially bad loans into 2021 profits.

He had been telling potential investors that a vaccine would

send the industry soaring, but some were reticent until after the

recent rally.

"You can sit there and say 'I told you so,'" he said, "but it

doesn't feel so good."

Write to David Benoit at david.benoit@wsj.com

(END) Dow Jones Newswires

November 22, 2020 05:44 ET (10:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

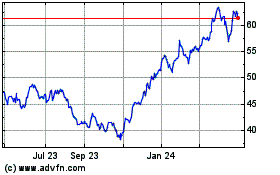

Citigroup (NYSE:C)

Historical Stock Chart

From Mar 2024 to Apr 2024

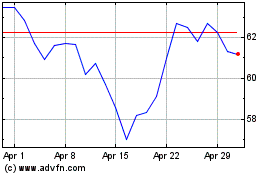

Citigroup (NYSE:C)

Historical Stock Chart

From Apr 2023 to Apr 2024