BlueLinx Holdings Inc. (NYSE:BXC), a leading distributor of

building and industrial products in the United States, today

reported financial results for the fiscal first quarter ended March

28, 2020, and provided a business update and review of current

market conditions related to the COVID-19 pandemic.

2020 First Quarter Financial Highlights

(all comparisons to prior year period unless otherwise

noted)

- Net sales of $662 million, compared to $639 million

- Gross margin increased to 14.1%, compared to 13.5%

- Net loss of $0.8 million, compared to a net loss of $6.7

million

- Adjusted EBITDA of $19.9 million, compared to $16.6

million

- Term loan reduction of $78 million since the fourth quarter

2019; most recent balance is $69 million

“Our first quarter results show the continuous

and sustained progress that began in the second half of 2019 and a

strong start to the year,” Mitch Lewis, President and Chief

Executive Officer, stated. “Net sales improved by approximately 9%

over the prior year when excluding the impact of our discontinued

siding line. We recorded both year over year and sequential

gross margin improvement, which combined with the improvement in

net sales, drove Adjusted EBITDA to $19.9 million compared to

$16.6 million last year, and $10.9 million in the fourth quarter of

2019.”

Mr. Lewis continued, “Our focus shifted towards

the end of the first quarter as we implemented numerous actions in

response to the COVID-19 pandemic including our highest priority of

ensuring a safe and healthy workplace environment for our

associates. We cannot predict how the business and social

restrictions stemming from the pandemic will ultimately impact the

U.S. housing industry and broader economy, however, we do know that

our business has weathered a wide range of economic cycles. We are

prepared to manage the challenges and opportunities that arise from

this trying time and are focused on efficiently supporting our

nation’s essential infrastructure needs in partnership with our

customers and suppliers.”

2020 First Quarter Financial Results

Review

The Company reported net sales of $662 million

for the first quarter of 2020, compared to $639 million for the

prior year period. Excluding $32 million from the prior year period

related to the discontinued siding line, net sales were up

approximately 9%. Net sales were driven by higher volumes,

and $2 million in commodity price inflation.

The Company recorded gross profit of $93 million

during the first quarter, compared to $86 million in the prior year

period, with a gross margin of 14.1% compared to 13.5% in the prior

year period. Gross margin improved in both structural and specialty

categories year-over-year.

The Company recorded a net loss of $0.8 million

for the first quarter, compared to a net loss of $6.7 million in

the prior year period. First quarter 2020 net loss includes

one-time charges for real estate financing obligation costs of $2

million, integration related charges of $1 million, share-based

compensation expense of $1 million, and $1 million for

restructuring charges. Net loss in the prior year period includes

integration related charges of $5 million, share-based compensation

expense of $1 million, and restructuring costs of $1 million.

Capital Structure and

Liquidity

During the quarter, the Company favorably

amended both its revolving credit facility and term loan facility

to enhance liquidity and provide financial flexibility. In

January, the Company amended its revolving credit facility to

better align advance rates with the seasonality of its

business. At the end of February, the Company amended its

term loan facility and it will no longer be subject to the

quarterly total net leverage ratio covenant when the principal

balance of the term loan is less than $45 million. The

Company further amended the term loan facility on April 1, 2020, to

provide greater financial flexibility by increasing the total net

leverage ratio covenants in the second and third quarters of 2020

to 8.75:1.00 from 6.50:1.00 and 6.00:1.00, respectively.

The enhancements that were made in the first

quarter to the Company’s capital structure contributed to its

strong liquidity position. The Company entered the second

quarter with excess availability and cash on hand of approximately

$97 million.

COVID-19 Operational

Response

“Our primary concern continues to be for the

safety and well-being of our employees, their families and

our communities,” said Mr. Lewis. The Company formed a

cross-functional COVID-19 Disaster Response Team in February and

implemented safety and hygiene protocols consistent with the

Centers for Disease Control and Prevention (“CDC”) and local

guidance. Those protocols continue to evolve in accordance

with CDC and local guidelines.

In early March, the Company implemented policies

and procedures to protect its associates, serve its customers, and

support its suppliers. The Company also moved quickly to

develop plans and take actions designed to give the Company

financial and operational flexibility during the periods impacted

by the pandemic. These actions are intended to reduce the

Company’s cost structure, strengthen its balance sheet, and

preserve and increase liquidity in response to the COVID-19

pandemic so far, and they include:

- Pausing virtually all new hiring

- Limiting all non-essential spending

- Substantially reducing headcount and variable operating expense

correlating to local market demand declines

- Furloughing approximately 15% of salaried workforce

- Reducing or eliminating executive and key management base

salaries for the next six months

- Enhancing working capital efficiency to optimize liquidity for

operations

Current Market Conditions

As of the date of this release, the Company’s

business has been designated as “essential” in all states in which

it operates, and the Company is continuing to operate and provide

service to customers and suppliers. The Company has not

experienced any significant supply chain disruptions as a result of

the COVID-19 pandemic, and the Company’s supply chain has remained

intact in all material respects.

During April, many of the Company’s markets have

experienced negative sales volume impacts when compared to the

prior year. Certain select markets that have stronger

shelter-in-place and related restrictions have experienced more

significant impacts. Those impacts have been somewhat offset by

increases in sales volume in areas where the pandemic has not had

as significant of an impact. As a result, overall April daily

sales were down approximately 11% over the prior year period. The

Company has also experienced below average gross margin in April,

primarily related to the degradation in market pricing for

structural products in connection with the COVID-19 pandemic. The

structural products market began to stabilize in late April,

although the Company cannot predict whether this stabilization will

continue.

Despite the decline in sales volume, the

platform for long-term growth that the Company built through the

latter half of 2019 into the start of 2020 has remained intact and

should continue to provide a solid foundation for execution as and

when the pandemic subsides.

2020 First Quarter Conference Call with

Accompanying Slide Presentation

BlueLinx will host a conference call on May 6,

2020, at 10:00 a.m. Eastern Time, accompanied by a supporting slide

presentation.

Participants can access the live conference call

via telephone at (877) 873-5864, using Conference ID # 7594658.

Investors will also be able to access an archived audio recording

of the conference call for one week following the live call by

dialing (404) 537 3406, Conference ID # 7594658.

Investors can also listen to the live audio of

the conference call and view the accompanying slide presentation by

visiting the BlueLinx website, www.BlueLinxCo.com, and selecting

the conference link on the Investor Relations page. After the

conference call has concluded, an archived recording will be

available on the BlueLinx website.

Use of Non-GAAP Measures

The Company reports its financial results in

accordance with GAAP. The Company also believes that presentation

of certain non-GAAP measures may be useful to investors and may

provide a more complete understanding of the factors and

trends affecting the business than using reported GAAP results

alone. Any non-GAAP measures used herein are reconciled to their

most directly comparable GAAP measures herein or in the financial

tables accompanying this news release. The Company cautions that

non-GAAP measures should be considered in addition to, but not as a

substitute for, the Company’s reported GAAP results.

Adjusted EBITDA

We define Adjusted EBITDA as an amount equal to

net income plus interest expense and all interest expense related

items, income taxes, depreciation and amortization, and further

adjusted for certain non-cash items and other special items,

including compensation expense from share-based compensation,

one-time charges associated with the legal and professional fees

and integration costs related to the Cedar Creek acquisition, and

gains on sales of properties including amortization of deferred

gains.

We present Adjusted EBITDA because it is a

primary measure used by management to evaluate operating

performance and, we believe, helps to enhance investors’ overall

understanding of the financial performance and cash flows of our

business. We believe Adjusted EBITDA is helpful in highlighting

operating trends. We also believe that Adjusted EBITDA is

frequently used by securities analysts, investors and other

interested parties in their evaluation of companies, many of which

present an Adjusted EBITDA measure when reporting their results.

However, Adjusted EBITDA is not a presentation made in accordance

with GAAP, and is not intended to present a superior measure of our

financial condition from those measures determined under GAAP.

Adjusted EBITDA, as used herein, is not necessarily comparable to

other similarly titled captions of other companies due to

differences in methods of calculation. This non-GAAP measure

is reconciled in the “Reconciliation of Non-GAAP Measurements”

table later in this release.

About BlueLinx Holdings

Inc.BlueLinx (NYSE: BXC) is a leading wholesale

distributor of building and industrial products in the United

States with over 50,000 branded and private-label SKUs, and a broad

distribution footprint servicing 40 states. BlueLinx has a

differentiated distribution platform, value-driven business model

and extensive cache of products across the building products

industry. Headquartered in Marietta, Georgia, BlueLinx has over

2,200 associates and distributes its comprehensive range of

structural and specialty products to approximately 15,000 national,

regional, and local dealers, as well as specialty distributors,

national home centers, industrial, and manufactured housing

customers. BlueLinx encourages investors to visit its website,

www.BlueLinxCo.com, which is updated regularly with financial and

other important information about BlueLinx.

Contacts:Investors:Kelly C.

Janzen, SVP, CFO & TreasurerBlueLinx Holdings Inc.(770)

953-7000

Mary Moll, Investor Relations(866)

671-5138investor@bluelinxco.com

Forward-looking StatementsThis

press release contains forward-looking statements. Forward-looking

statements include, without limitation, any statement that

predicts, forecasts, indicates or implies future results,

performance, liquidity levels or achievements, and may contain the

words “believe,” “anticipate,” “expect,” “estimate,” “intend,”

“project,” “plan,” “will be,” “will likely continue,” “will likely

result” or words or phrases of similar meaning. The forward-looking

statements in this press release include statements about the

COVID-19 pandemic and our response thereto, including statements

around the impact of the pandemic on the U.S. housing industry and

broader economy, our preparations to manage the pandemic, our areas

of focus during the pandemic, and our related protocols, policies,

procedures, plans, and actions and their potential effects on our

cost structure, balance sheet, and liquidity; the long-term effects

and benefits of amendments to our revolving credit facility and

term loan facility, including with respect to liquidity, financial

flexibility, and our leverage covenants; the structural products

market and its stability; and our platform for long-term growth and

its ability to support execution as and when the pandemic

subsides.

Forward-looking statements in this press release

are based on estimates and assumptions made by our management that,

although believed by us to be reasonable, are inherently uncertain.

Forward-looking statements involve risks and uncertainties that may

cause our business, strategy, or actual results to differ

materially from the forward-looking statements. These risks and

uncertainties include those listed under the heading “Risk Factors”

in Item 1A of our Annual Report on Form 10-K for the year ended

December 29, 2018, and those discussed in our Quarterly Reports on

Form 10-Q and in our periodic reports filed with the SEC from time

to time. We operate in a changing environment in which new risks

can emerge from time to time. It is not possible for management to

predict all of these risks, nor can it assess the extent to which

any factor, or a combination of factors, may cause our business,

strategy, or actual results to differ materially from those

contained in forward-looking statements. Factors that may cause

these differences include, among other things: the COVID-19

pandemic and other contagious illness outbreaks and their potential

effects on our industry, suppliers and supply chain, and customers,

and our business, results of operations, cash flows, financial

condition, and future prospects; our ability to integrate and

realize anticipated synergies from acquisitions; loss of material

customers, suppliers, or product lines in connection with

acquisitions; operational disruption in connection with the

integration of acquisitions; our indebtedness and its related

limitations; sufficiency of cash flows and capital resources; our

ability to monetize real estate assets; fluctuations in commodity

prices; adverse housing market conditions; disintermediation by

customers and suppliers; changes in prices, supply and/or demand

for our products; inventory management; competitive industry

pressures; industry consolidation; product shortages; loss of and

dependence on key suppliers and manufacturers; import taxes and

costs, including new or increased tariffs, anti-dumping duties,

countervailing duties, or similar duties; our ability to

successfully implement our strategic initiatives; fluctuations in

operating results; sale-leaseback transactions and their effects;

real estate leases; changes in interest rates; exposure to product

liability claims; our ability to complete offerings under our shelf

registration statement on favorable terms, or at all; changes in

our product mix; petroleum prices; information technology security

and business interruption risks; litigation and legal proceedings;

natural disasters and unexpected events; activities of activist

stockholders; labor and union matters; limits on net operating loss

carryovers; pension plan assumptions and liabilities; risks related

to our internal controls; retention of associates and key

personnel; federal, state, local and other regulations, including

environmental laws and regulations; and changes in accounting

principles. Given these risks and uncertainties, we caution you not

to place undue reliance on forward-looking statements. We expressly

disclaim any obligation to update or revise any forward-looking

statement as a result of new information, future events or

otherwise, except as required by law.

BLUELINX HOLDINGS

INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

| |

Three Months Ended |

| |

March 28,2020 |

|

March 30,2019 |

| |

(In thousands, except per share data) |

|

Net sales |

$ |

662,070 |

|

|

$ |

638,701 |

|

| Cost of sales |

568,861 |

|

|

552,656 |

|

| Gross profit |

93,209 |

|

|

86,045 |

|

| Gross margin |

14.1 |

% |

|

13.5 |

% |

| Operating expenses: |

|

|

|

|

Selling, general, and administrative |

77,769 |

|

|

74,410 |

|

|

Gains from sales of property |

(525 |

) |

|

— |

|

|

Depreciation and amortization |

7,635 |

|

|

7,328 |

|

|

Total operating expenses |

84,879 |

|

|

81,738 |

|

| Operating income |

8,330 |

|

|

4,307 |

|

| Non-operating expenses

(income): |

|

|

|

|

Interest expense, net |

14,380 |

|

|

13,401 |

|

|

Other (income) expense, net |

(237 |

) |

|

150 |

|

| Loss before benefit from

income taxes |

(5,813 |

) |

|

(9,244 |

) |

| Benefit from income taxes |

(5,026 |

) |

|

(2,525 |

) |

| Net loss |

$ |

(787 |

) |

|

$ |

(6,719 |

) |

| |

|

|

|

| Basic loss per share |

$ |

(0.08 |

) |

|

$ |

(0.72 |

) |

| Diluted loss per share |

$ |

(0.08 |

) |

|

$ |

(0.72 |

) |

| |

|

|

|

|

|

|

|

BLUELINX HOLDINGS

INC.CONDENSED CONSOLIDATED BALANCE

SHEETS

| |

March 28,2020 |

|

December 28,2019 |

| |

(In thousands, except share data) |

|

ASSETS |

| Current assets: |

|

|

|

|

Cash |

$ |

12,558 |

|

|

$ |

11,643 |

|

|

Receivables, less allowances of $3,875 and $3,236,

respectively |

247,940 |

|

|

192,872 |

|

|

Inventories, net |

378,634 |

|

|

345,806 |

|

|

Other current assets |

26,437 |

|

|

27,718 |

|

| Total current assets |

665,569 |

|

|

578,039 |

|

| Property and equipment, at

cost |

308,288 |

|

|

308,067 |

|

|

Accumulated depreciation |

(117,036 |

) |

|

(112,299 |

) |

| Property and equipment,

net |

191,252 |

|

|

195,768 |

|

| Operating lease right-of-use

assets |

52,502 |

|

|

54,408 |

|

| Goodwill |

47,772 |

|

|

47,772 |

|

| Intangible assets, net |

24,414 |

|

|

26,384 |

|

| Deferred tax assets |

59,308 |

|

|

53,993 |

|

| Other non-current assets |

20,404 |

|

|

15,061 |

|

| Total assets |

$ |

1,061,221 |

|

|

$ |

971,425 |

|

|

LIABILITIES AND STOCKHOLDERS' DEFICIT |

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

162,398 |

|

|

$ |

132,348 |

|

|

Accrued compensation |

8,216 |

|

|

7,639 |

|

|

Current maturities of long-term debt, net of discount and debt

issuance costs of $74 and $74, respectively |

2,176 |

|

|

2,176 |

|

|

Finance leases - short-term |

5,924 |

|

|

6,385 |

|

|

Real estate deferred gains - short-term |

3,935 |

|

|

3,935 |

|

|

Operating lease liabilities - short-term |

7,016 |

|

|

7,317 |

|

| Other current liabilities |

9,903 |

|

|

11,323 |

|

| Total current liabilities |

199,568 |

|

|

171,123 |

|

|

Non-current liabilities: |

|

|

|

|

Long-term debt, net of discount and debt issuance costs of

$11,861 and $12,481, respectively |

444,937 |

|

|

458,439 |

|

|

Real estate financing obligation |

123,765 |

|

|

44,914 |

|

|

Finance leases - long-term |

145,427 |

|

|

146,611 |

|

|

Real estate deferred gains - long-term |

80,935 |

|

|

81,886 |

|

|

Operating lease liabilities - long-term |

45,571 |

|

|

47,091 |

|

|

Pension benefit obligation |

22,596 |

|

|

23,420 |

|

|

Other non-current liabilities |

24,106 |

|

|

24,024 |

|

| Total liabilities |

1,086,905 |

|

|

997,508 |

|

| Commitments and

Contingencies |

|

|

|

|

STOCKHOLDERS' DEFICIT: |

|

Common Stock, $0.01 par value, 20,000,000 shares authorized,

9,366,641 and 9,365,768 outstanding on March 28, 2020 and December

28, 2019, respectively |

94 |

|

|

94 |

|

|

Additional paid-in capital |

261,980 |

|

|

260,974 |

|

|

Accumulated other comprehensive loss |

(34,383 |

) |

|

(34,563 |

) |

|

Accumulated stockholders’ deficit |

(253,375 |

) |

|

(252,588 |

) |

| Total stockholders’

deficit |

(25,684 |

) |

|

(26,083 |

) |

| Total liabilities and

stockholders’ deficit |

$ |

1,061,221 |

|

|

$ |

971,425 |

|

| |

|

|

|

|

|

|

|

BLUELINX HOLDINGS

INC.CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS

| |

Three Months EndedMarch 28, 2020 |

|

Three Months EndedMarch 30, 2019 |

| |

(In thousands) |

| Cash flows from

operating activities: |

|

|

|

|

Net loss |

$ |

(787 |

) |

|

$ |

(6,719 |

) |

| Adjustments to reconcile net

loss to cash used in operations: |

|

|

|

|

Benefit from income taxes |

(5,026 |

) |

|

(2,525 |

) |

|

Depreciation and amortization |

7,635 |

|

|

7,328 |

|

|

Amortization of debt issuance costs |

956 |

|

|

455 |

|

|

Gains from sales of property |

(525 |

) |

|

— |

|

|

Share-based compensation |

1,004 |

|

|

706 |

|

|

Amortization of deferred gain |

(984 |

) |

|

(951 |

) |

| Changes in operating assets

and liabilities: |

|

|

|

|

Accounts receivable |

(55,068 |

) |

|

(37,908 |

) |

|

Inventories |

(32,828 |

) |

|

(45,479 |

) |

|

Accounts payable |

30,050 |

|

|

26,004 |

|

|

Prepaid and other current assets |

(3,006 |

) |

|

(423 |

) |

|

Other assets and liabilities |

(608 |

) |

|

1,191 |

|

| Net cash used in operating

activities |

(59,187 |

) |

|

(58,321 |

) |

| Cash flows from

investing activities: |

|

|

|

| Acquisition of business, net

of cash acquired |

— |

|

|

6,009 |

|

| Proceeds from sale of

assets |

44 |

|

|

143 |

|

| Property and equipment

investments |

(1,245 |

) |

|

(1,223 |

) |

| Net cash (used in) provided by

investing activities |

(1,201 |

) |

|

4,929 |

|

| Cash flows from

financing activities: |

|

|

|

| Borrowings on revolving credit

facilities |

204,196 |

|

|

197,114 |

|

| Repayments on revolving credit

facilities |

(149,079 |

) |

|

(136,892 |

) |

| Repayments on term loan |

(69,238 |

) |

|

(900 |

) |

| Principal payments on real

estate financing obligations |

(340 |

) |

|

— |

|

| Proceeds from real estate

financing obligations |

78,329 |

|

|

— |

|

| Debt financing costs |

(336 |

) |

|

— |

|

| Repurchase of shares to

satisfy employee tax withholdings |

(7 |

) |

|

— |

|

| Principal payments on finance

lease obligations |

(2,222 |

) |

|

(2,187 |

) |

| Net cash provided by financing

activities |

61,303 |

|

|

57,135 |

|

| |

|

|

|

| Net change in cash |

915 |

|

|

3,743 |

|

| Cash, beginning of period |

11,643 |

|

|

8,939 |

|

| Cash, end of period |

$ |

12,558 |

|

|

$ |

12,682 |

|

| |

|

|

|

|

|

|

|

BLUELINX HOLDINGS

INC.RECONCILIATION OF NON-GAAP

MEASUREMENTS(Unaudited)

The following schedule reconciles net loss to

Adjusted EBITDA:

| |

Quarter Ended |

| |

March 28,2020 |

|

March 30,2019 |

| |

(In thousands) |

|

Net loss |

$ |

(787 |

) |

|

$ |

(6,719 |

) |

| Adjustments: |

|

|

|

|

Depreciation and amortization |

7,635 |

|

|

7,328 |

|

|

Interest expense |

14,380 |

|

|

13,401 |

|

|

Benefit from income taxes |

(5,026 |

) |

|

(2,525 |

) |

|

Gain from sales of property |

(525 |

) |

|

— |

|

|

Amortization of deferred gain |

(984 |

) |

|

(951 |

) |

|

Share-based compensation expense |

1,004 |

|

|

706 |

|

|

Real estate financing obligation costs |

1,793 |

|

|

— |

|

|

Merger and acquisition costs (1) |

1,070 |

|

|

4,597 |

|

|

Restructuring, severance, and legal |

1,309 |

|

|

764 |

|

| Adjusted EBITDA |

$ |

19,869 |

|

|

$ |

16,601 |

|

(1) Reflects primarily legal, professional and

other integration costs related to the Cedar Creek acquisition

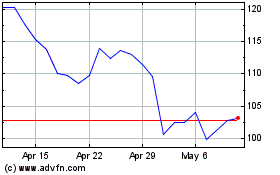

BlueLinx (NYSE:BXC)

Historical Stock Chart

From Mar 2024 to Apr 2024

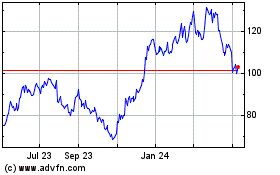

BlueLinx (NYSE:BXC)

Historical Stock Chart

From Apr 2023 to Apr 2024