Current Report Filing (8-k)

February 03 2020 - 7:00AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 31, 2020

BlueLinx Holdings Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-32383

|

|

77-062735

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

1950 Spectrum Circle, Marietta, Georgia

|

|

30067

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code (770) 953-7000

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

o

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

o

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

|

|

|

o

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

BXC

|

New York Stock Exchange

|

Item 1.01 Entry into a Material Definitive Agreement.

On January 31, 2020, BlueLinx Holdings Inc. (the “Company”) amended its existing revolving credit facility (the “Revolving Credit Facility”) by entering into that certain Amendment No. 1 to Amended and Restated Credit Agreement (the “Amendment”), by and among the Company, certain of the Company’s subsidiaries, as borrowers or guarantors thereunder, Wells Fargo Bank, National Association, a national banking association, in its capacity as administrative agent, and certain other financial institutions party thereto.

Pursuant to the Amendment, (i) the “Seasonal Period” was modified to run from November 15, 2019, through July 15, 2020, for the calendar year 2019, and to run from December 15 of each calendar year through April 15 of each immediately succeeding calendar year for the calendar year 2020 and thereafter, and (ii) the measurement period in the definition of “Cash Dominion Event” was extended from three consecutive business days to five consecutive business days.

The foregoing description of the material terms of the Amendment is qualified in its entirety by reference to the Amendment, which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ending March 28, 2020.

Item 7.01 Regulation FD Disclosure.

On February 3, 2020, the Company issued a press release announcing the transactions described in Items 1.01 and 8.01 of this Current Report. A copy of the press release is furnished as Exhibit 99.1 to this Current Report and is incorporated herein by reference.

Item 8.01 Other Events.

On January 31, 2020, the Company, through certain of its subsidiaries, completed sale‑leaseback transactions (the “Sale-Leaseback Transactions”) with affiliates of AIC Ventures L.P. (collectively, the “Buyer”) with respect to the Company’s warehouse facilities located in Charlotte, North Carolina; Memphis, Tennessee; Independence, Kentucky (Cincinnati); Tallmadge, Ohio (Akron); Portland, Maine; Denville, New Jersey; Yaphank, New York (Long Island); Pensacola, Florida; and San Antonio, Texas, for aggregate net proceeds of approximately $34.1 million. Net proceeds of the Sale-Leaseback Transactions were used to repay indebtedness under the Company’s term loan facility.

The Sale-Leaseback Transactions were completed pursuant to deeds and other customary real estate transaction closing documents between certain subsidiaries of the Company and the Buyer. Upon completion of the Sale-Leaseback Transactions, a subsidiary of the Company entered into long-term leases on the properties for fifteen-year initial terms with multiple five-year renewal options. The leases provide for, among other things, customary security deposits in an aggregate amount of approximately $1.0 million, which will be reduced if the Company satisfies certain financial milestones.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

The following exhibits are attached with this Current Report on Form 8-K:

|

|

|

|

Exhibit No.

|

Exhibit Description

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

BlueLinx Holdings Inc.

Dated: February 3, 2020 By: /s/ Justin B. Heineman

Justin B. Heineman

Vice President, General Counsel & Corporate Secretary

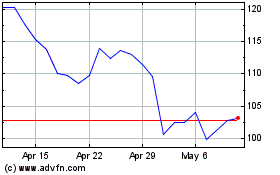

BlueLinx (NYSE:BXC)

Historical Stock Chart

From Mar 2024 to Apr 2024

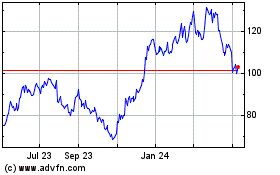

BlueLinx (NYSE:BXC)

Historical Stock Chart

From Apr 2023 to Apr 2024