- Babcock & Wilcox segment adjusted EBITDA

increased 23% to $19.3 million - Consolidated operating loss

improved by $42.0 million to a loss of $3.2 million - Company

generated consolidated adjusted EBITDA of $10.1 million

Babcock & Wilcox Enterprises, Inc. ("B&W Enterprises")

(NYSE: BW) announced today third quarter 2019 GAAP loss from

continuing operations improved by $47.2 million to a loss of $57.0

million compared to a loss of $104.1 million in third quarter 2018.

Adjusted EBITDA also improved by $36.8 million to a positive $10.1

million compared to negative $26.7 million in the prior year

period, resulting in the Company's second consecutive quarter of

profitability in 2019 on an adjusted EBITDA basis.

"Our performance in the third quarter of 2019 builds on last

quarter's improvements following our improved operational

performance and cost-saving efforts. Our consolidated business

continued to show increasing operating margins and for the second

consecutive quarter the Company was profitable on an adjusted

EBITDA basis. Our Babcock & Wilcox segment continued its solid

performance and across the Company we are showing steady progress

on our strategy to improve profitability by focusing on our core

strengths and reducing unnecessary G&A," said Kenneth Young,

B&W Enterprises Chief Executive Officer. "With our equitization

transactions completed in July, we are working to re-finance our

existing credit facility to support our growth. As 2019 draws to a

close, we are demonstrating the underlying core value of our

businesses to our customers and shareholders and laying the

foundation to leverage new opportunities on a worldwide basis."

"We're continuing to implement our cost-savings initiatives, for

$119 million in annualized savings," said Lou Salamone, B&W

Enterprises Chief Financial Officer. "Approximately $106 million of

these initiatives have now been implemented and we are aggressively

looking for further ways to streamline our operations while

maintaining our focus on our customers and quality. As we turn

toward 2020, we expect to see improvement each quarter as our

cost-savings measures continue to translate to bottom-line results.

We are also seeing our new opportunity pipeline increase for our

core technologies across the Babcock & Wilcox, Vølund and SPIG

segments globally. We are committed to our strategy, founded on our

world-class employees and technologies, and we are confident we are

accelerating toward an improved 2020."

Results of Operations

The Company's focus on core technologies and profitability, as

well as completion of the EPC loss contracts, were the primary

drivers, as expected, of a decline in revenue compared to the third

quarter of 2018. Consolidated revenues in third quarter 2019 were

$198.6 million, down 33% compared to third quarter 2018. The sales

of Palm Beach Resource Recovery Corporation ("PBRRC") in the third

quarter of 2018 and Loibl, a materials handling business in Germany

in the second quarter of 2019; and a lower level of activity on

SPIG legacy loss contracts and lower volume of new build cooling

system services in the SPIG segment following a change in strategy

to improve profitability, also drove the decline in revenue. The

GAAP operating loss in third quarter 2019 was $3.2 million,

inclusive of restructuring and settlement costs and advisory fees

of $7.0 million, compared to an operating loss of $45.1 million in

third quarter 2018. The improvement in operating losses was

primarily due to improved gross margins on construction projects in

the Babcock & Wilcox segment, a lower level of losses on the

six European EPC loss contracts and a change in strategy in the

SPIG segment to improve profitability by focusing on more selective

bidding in core geographies and products. Adjusted EBITDA improved

to a positive $10.1 million compared to negative $26.7 million in

third quarter 2018. All amounts referred to in this release are on

a continuing operations basis, unless otherwise noted.

Reconciliations of operating loss, the most directly comparable

GAAP measure, to adjusted EBITDA, as well as to adjusted gross

profit for the Company's segments, are provided in the exhibits to

this release.

Babcock & Wilcox segment revenues decreased 15.3% to

$161.8 million in the third quarter of 2019 compared to $191.1

million in the prior-year period, primarily attributable to lower

volume related to the periodic nature of large construction new

build projects. Adjusted EBITDA in third quarter 2019 increased 23%

to $19.3 million, compared to $15.6 million in last year's quarter,

primarily due to improved gross margins on construction projects,

as well as cost savings associated with cost reduction initiatives,

partially offset by the effects of lower volume and increases in

overhead being absorbed by the segment previously absorbed by other

segments; adjusted EBITDA margin was 11.9% compared to 8.2% in the

same period last year. Adjusted gross profit in the Babcock &

Wilcox segment in third quarter 2019 increased 19% to $41.0

million, compared to $34.3 million in the prior-year period,

primarily related to improved gross margins on construction

projects, which partially offset the gross profit effect of lower

volume as described above. Gross profit margin was 25.3%, compared

to 18.0% in the same period last year.

SPIG segment revenues decreased 70.4% as expected to

$10.3 million in the third quarter of 2019 compared to $34.8

million in third quarter 2018, mainly due to a lower volume of new

build cooling system projects as anticipated following the change

in strategy to more selectively bid and focus on core geographies

and products to improve profitability. Adjusted EBITDA improved by

$8.8 million to negative $2.4 million compared to negative $11.2

million in the same period last year, driven by the new strategy in

addition to the benefits of restructuring, SG&A cost savings

and operating cost reductions. Adjusted gross profit improved to

negative $1.0 million in third quarter 2019, compared to negative

$5.5 million in the prior-year period, primarily due to the effects

of the new strategy. SPIG's performance in the third quarter of

2018 was affected by increases in estimated costs to complete

remaining legacy new build cooling systems contracts; these

contracts that were sold under the previous strategy were mostly

complete as of December 31, 2018. At September 30, 2019, SPIG's

U.S. entity had one remaining significant loss contract, which was

97% complete at the end of the third quarter of 2019 and is

expected be fully complete in late-2019.

Vølund & Other Renewable segment revenues were $32.4

million for the third quarter of 2019, compared to $76.5 million in

third quarter 2018. As expected, third quarter revenues were lower

compared to the prior year quarter due to the completion of the EPC

loss contracts; the sales of PBRRC and Loibl, which had previously

generated annual revenues of approximately $60 million and $30

million, respectively; and a shift to a core technology business

model, partially offset by the startup of two operations and

maintenance contracts in the U.K. Adjusted EBITDA in the quarter

improved to negative $2.9 million compared to negative $25.7

million in the third quarter last year, primarily due to a lower

level of losses on the European EPC loss contracts. In the third

quarter of 2019, the segment recorded $0.7 million in net losses as

compared to $19.1 million of equivalent losses recorded in the

third quarter of 2018, inclusive of warranty expense. Beyond the

effect of the EPC loss contracts, third quarter 2019 adjusted

EBITDA included lower levels of direct overhead support, warranty

expense and lower SG&A, partially offset by the absence of

gross profit from PBRRC and Loibl due to their sales. The segment

adjusted gross profit improved $18.4 million to positive $1.3

million in third quarter 2019, compared to negative $17.1 million

reported in third quarter 2018.

European EPC Loss Projects

The Company is continuing to pursue cost recoveries under

various applicable insurance policies and from responsible

subcontractors for the European EPC loss contracts. As previously

disclosed, in June 2019, the Company agreed to a full settlement

related to a portion of the losses on the first project, under

which the insurer paid DKK 37 million ($5.6 million) in July 2019.

Also in June 2019, the Company agreed in principle to a settlement

agreement under one insurance policy to recover GBP 2.8 million

($3.5 million) of certain losses on the fifth project, which

payment was received in September 2019. The Company is continuing

to pursue other potential insurance recoveries and claims where

appropriate and available.

Financing, Liquidity and Balance Sheet

As previously disclosed, on April 5, 2019, the Company amended

its credit agreement to provide $150.0 million of Tranche A-3

last-out term loans from B. Riley as well as an uncommitted

incremental facility of up to $15.0 million, and entered into an

agreement with B. Riley and Vintage Capital Management, LLC to

effect a series of equitization transactions for a portion of the

last-out term loans, subject to, among other things, stockholder

approval. These transactions included a $50 million rights offering

at $0.30 per share ($3.00 per share after giving effect to the

reverse stock split); an exchange of all of the principal of

Tranche A-1 of the last-out term loan for common stock at $0.30 per

share; and the issuance of approximately 1.7 million warrants

(after giving effect to a one-for-ten reverse stock split), each to

purchase one share of common stock at $0.01 per share, to B. Riley

(or its designee) as further consideration under Tranche A-3 of the

last-out term loans.

These equitization transactions were completed on July 23, 2019.

On July 24, 2019, the Company effected a one-for-ten reverse stock

split that took effect immediately after completion of the

equitization transactions.

The rights offering resulted in the issuance of 13.9 million

common shares (after giving effect to the reverse stock split).

Gross proceeds from the rights offering were $41.8 million, of

which $10.3 million was used to fully repay Tranche A-2 of the

last-out term loans and the remaining $31.5 million was used to

reduce outstanding borrowings under Tranche A-3 of the last-out

term loans. Concurrently with the closing of the rights offering,

and in satisfaction of B. Riley's related backstop commitment, the

Company issued an aggregate of 2.7 million common shares (after

giving effect to the reverse stock split) in exchange for a portion

of the Tranche A-3 last-out term loans totaling $8.2 million. In

addition, all $38.2 million of outstanding principal of Tranche A-1

of the last-out term loans including accrued paid in kind interest

was exchanged for 12.7 million shares of common stock (after giving

effect to the reverse stock split).

After completion of the equitization transactions, Tranches A-1

and A-2 of the last-out term loans were fully extinguished, and the

balance on the Tranche A-3 last-out term loans was reduced to

$114.0 million inclusive of accrued paid in kind interest. In the

aggregate, $88.2 million of debt was converted to equity through

the equitization transactions. After giving effect to the reverse

stock split, the transactions resulted in the issuance of 29.4

million shares of additional common stock, for total outstanding

shares of 46.3 million. Further detail regarding the equitization

transactions and the reverse stock split can be found in the

Company's 10-Q.

At September 30, 2019, the Company had a cash and cash

equivalents balance of $32.1 million and borrowing availability of

$18.3 million. The Company's credit agreement requires it to

terminate its credit facility on or prior to March 15, 2020. The

Company has commenced the refinancing process and intends to

refinance the revolving credit facility as required.

Cost-Savings Measures Progressing

The Company continues to implement $119 million of annualized

cost-savings initiatives previously identified. Roughly 90% of the

aggregate $119 million in savings measures have been implemented to

date with the balance to be implemented in the fourth quarter of

2019 and into 2020. Cost savings have been identified across all

segments and at the Corporate level, and the implementation plan

and savings are progressing in line with expectations. The Company

continues to evaluate additional opportunities for cost savings and

continues to evaluate potential dispositions as appropriate.

NYSE Listing Standards

On November 27, 2018, the Company received notification from the

New York Stock Exchange (NYSE) that the Company had fallen below

its continued listing criteria based on the price of the Company's

common stock. The Company completed a one-for-ten reverse stock

split on July 24, 2019 to regain compliance. On September 4, 2019,

the Company received written notification from the NYSE that the

Company regained compliance after the Company’s average stock price

for the 30-trading-day period ended September 4, 2019 was above the

NYSE’s minimum listing criteria of $1.00. The Company, which

continued to trade on the NYSE after falling below the minimum

share price, is now in compliance with all NYSE listing

criteria.

Non-GAAP Financial Measures

The Company uses non-GAAP financial measures internally to

evaluate its performance and in making financial and operational

decisions. When viewed in conjunction with GAAP results and the

accompanying reconciliation, the Company believes that its

presentation of these measures provides investors with greater

transparency and a greater understanding of factors affecting our

financial condition and results of operations than GAAP measures

alone.

This release presents adjusted gross profit for each business

segment and adjusted EBITDA, which are non-GAAP financial measures.

Adjusted EBITDA on a consolidated basis is defined as the sum of

the adjusted EBITDA for each of the segments. At a segment level,

the adjusted EBITDA presented is consistent with the way the

Company's chief operating decision maker reviews the results of

operations and makes strategic decisions about the business and is

calculated as earnings before interest, tax, depreciation and

amortization adjusted for items such as gains or losses on asset

sales, mark to market ("MTM") pension adjustments, restructuring

and spin costs, impairments, losses on debt extinguishment, costs

related to financial consulting required under the U.S. Revolving

Credit Facility and other costs that may not be directly

controllable by segment management and are not allocated to the

segment. The Company presented consolidated Adjusted EBITDA because

it believes it is useful to investors to help facilitate

comparisons of the ongoing, operating performance before corporate

overhead and other expenses not attributable to the operating

performance of the Company's revenue generating segments.

This release also presents adjusted gross profit by segment. The

Company believes that adjusted gross profit by segment is useful to

investors to help facilitate comparisons of the ongoing, operating

performance of the segments by excluding expenses related to, among

other things, activities related to the spin-off, activities

related to various restructuring activities the Company has

undertaken, corporate overhead (such as SG&A expenses and

research and development costs) and certain non-cash expenses such

as intangible amortization and goodwill impairments that are not

allocated by segment. A reconciliation of operating loss, the most

directly comparable GAAP measure, to adjusted gross profit is

included in the table below.

Forward-Looking Statements

B&W Enterprises cautions that this release contains

forward-looking statements, including, without limitation,

statements relating to our strategic objectives; our business

execution model; management’s expectations regarding the industries

in which the Company operates; our guidance and forecasts; our

projected operating margin improvements, savings and restructuring

costs; our U.S. revolving credit facility; and project execution.

These forward-looking statements are based on management’s current

expectations and involve a number of risks and uncertainties,

including, among other things, our ability to continue as a going

concern; our recognition of any asset impairments as a result of

any decline in the value of our assets or our efforts to dispose of

any assets in the future; our ability to obtain and maintain

sufficient financing to provide liquidity to meet our business

objectives, surety bonds, letters of credit and similar financing;

our ability to satisfy the liquidity and other requirements under

our revolving credit facility as recently amended; our ability to

refinance said facility in a timely manner, if at all; our ability

to obtain waivers of required pension contributions; the highly

competitive nature of our businesses; general economic and business

conditions, including changes in interest rates and currency

exchange rates; general developments in the industries in which the

Company is involved; cancellations of and adjustments to backlog

and the resulting impact from using backlog as an indicator of

future earnings; our ability to perform contracts on time and on

budget, in accordance with the schedules and terms established by

the applicable contracts with customers; failure by third-party

subcontractors, joint venture partners or suppliers to perform

their obligations on time and as specified; our ability to

successfully resolve claims by vendors for goods and services

provided and claims by customers for items under warranty; our

ability to realize anticipated savings and operational benefits

from our restructuring plans, and other cost-savings initiatives;

our ability to successfully address productivity and schedule

issues in our Vølund and Other Renewable segment, including the

ability to complete our European EPC projects within the expected

time frame and the estimated costs; our ability to successfully

partner with third parties to win and execute renewable contracts;

changes in our effective tax rate and tax positions; our ability to

maintain operational support for our information systems against

service outages and data corruption, as well as protection against

cyber-based network security breaches and theft of data; our

ability to protect our intellectual property and renew licenses to

use intellectual property of third parties; our use of the

percentage-of-completion method of accounting; our ability to

successfully manage research and development projects and costs,

including our efforts to successfully develop and commercialize new

technologies and products; the operating risks normally incident to

our lines of business, including professional liability, product

liability, warranty and other claims against us; changes in, or our

failure or inability to comply with, laws and government

regulations; actual or anticipated changes in governmental

regulation, including trade and tariff policies; difficulties the

Company may encounter in obtaining regulatory or other necessary

permits or approvals; changes in, and liabilities relating to,

existing or future environmental regulatory matters; changes in

actuarial assumptions and market fluctuations that affect our net

pension liabilities and income; potential violations of the Foreign

Corrupt Practices Act; our ability to successfully compete with

current and future competitors; the loss of key personnel and the

continued availability of qualified personnel; our ability to

negotiate and maintain good relationships with labor unions;

changes in pension and medical expenses associated with our

retirement benefit programs; social, political, competitive and

economic situations in foreign countries where the Company does

business or seek new business; the possibilities of war, other

armed conflicts or terrorist attacks; the willingness of customers

and suppliers to continue to do business with us on reasonable

terms and conditions; and our ability to successfully consummate

strategic alternatives for non-core assets, if the Company

determines to pursue them. If one or more of these risks or other

risks materialize, actual results may vary materially from those

expressed. For a more complete discussion of these and other risk

factors, see B&W Enterprise’s filings with the Securities and

Exchange Commission, including our most recent annual report on

Form 10-K. B&W Enterprises cautions not to place undue reliance

on these forward-looking statements, which speak only as of the

date of this release, and undertakes no obligation to update or

revise any forward-looking statement, except to the extent required

by applicable law.

About B&W Enterprises

Headquartered in Barberton, Ohio, Babcock & Wilcox

Enterprises is a global leader in energy and environmental

technologies and services for the power and industrial markets.

Follow us on Twitter @BabcockWilcox and learn more at

www.babcock.com.

Exhibit 1

Babcock & Wilcox Enterprises,

Inc.

Condensed Consolidated Statements of

Operations(1)

(In millions, except per share

amounts)

Three months ended September

30,

Nine months ended September

30,

2019

2018

2019

2018

Revenues

$

198.6

$

295.0

$

678.7

$

839.5

Costs and expenses:

Cost of operations

158.3

284.5

563.2

894.2

Selling, general and administrative

expenses

36.0

45.0

120.4

151.5

Goodwill impairment

—

—

—

37.5

Advisory fees and settlement costs

4.5

7.2

22.9

15.5

Restructuring activities and spin-off

transaction costs

2.6

2.9

9.6

13.6

Research and development costs

0.8

0.5

2.3

2.9

(Gain) loss on asset disposals, net

(0.3

)

—

(0.2

)

1.4

Total costs and expenses

201.8

340.1

718.1

1,116.6

Equity in income and impairment of

investees

—

—

—

(11.8

)

Operating loss

(3.2

)

(45.1

)

(39.4

)

(288.9

)

Other (expense) income:

Interest expense

(29.5

)

(10.4

)

(67.4

)

(35.7

)

Interest income

0.1

0.2

0.9

0.4

Loss on debt extinguishment

—

—

(4.0

)

(49.2

)

Gain (loss) on sale of business

—

39.7

(3.6

)

39.7

Benefit plans, net

3.6

10.8

9.1

24.8

Foreign exchange

(26.7

)

(4.9

)

(27.4

)

(22.7

)

Other – net

(0.3

)

0.0

0.2

0.2

Total other (expense) income

(52.8

)

35.3

(92.2

)

(42.4

)

Loss before income tax expense

(55.9

)

(9.9

)

(131.6

)

(331.4

)

Income tax expense

1.0

94.3

3.6

99.3

Loss from continuing operations

(57.0

)

(104.1

)

(135.2

)

(430.7

)

(Loss) income from discontinued

operations, net of tax

—

(1.4

)

0.7

(60.9

)

Net loss

(57.0

)

(105.6

)

(134.5

)

(491.5

)

Net income (loss) attributable to

noncontrolling interest

—

(0.1

)

0.1

(0.4

)

Net loss attributable to

stockholders

$

(57.0

)

$

(105.7

)

$

(134.4

)

$

(491.9

)

Basic and diluted loss per common

share:

Continuing operations

$

(1.39

)

$

(5.68

)

$

(5.21

)

$

(35.02

)

Discontinued operations

—

(0.08

)

0.03

(4.95

)

Basic and diluted loss per common

share

$

(1.39

)

$

(5.76

)

$

(5.18

)

$

(39.97

)

Shares used in the computation of earnings

per share:

Basic and Diluted(2)

40.9

18.3

26.0

12.3

(1) Figures may not be clerically accurate

due to rounding.

(2) Basic and diluted shares reflect the

bonus element for the 2019 Rights Offering on July 23, 2019 as

described in Note 2, in the Company's 10-Q and the one-for-ten

reverse stock split on July 24, 2019 as described in Note 1, in the

Company's 10-Q.

Exhibit 2

Babcock & Wilcox Enterprises,

Inc.

Condensed Consolidated Balance

Sheets(2)

(In millions, except per share amount)

September 30, 2019

December 31, 2018

Cash and cash equivalents

$

32.1

$

43.2

Restricted cash and cash equivalents

11.3

17.1

Accounts receivable – trade, net

182.7

197.2

Accounts receivable – other

20.6

44.7

Contracts in progress

118.4

144.7

Inventories

64.5

61.3

Other current assets

65.3

41.4

Total current assets

495.0

549.6

Net property, plant and equipment

74.3

90.9

Goodwill

47.0

47.1

Intangible assets

26.4

30.8

Right-of-use assets

13.1

—

Other assets

16.8

27.1

Total assets

$

672.6

$

745.5

Revolving credit facilities

191.7

145.5

Last out term loans

101.9

30.6

Accounts payable

125.6

199.9

Accrued employee benefits

25.1

19.3

Advance billings on contracts

81.0

149.4

Accrued warranty expense

35.6

45.1

Lease liabilities

4.3

—

Other accrued liabilities

90.5

122.1

Total current liabilities

655.6

712.0

Pension and other accumulated

postretirement benefit liabilities

271.9

281.6

Noncurrent lease liabilities

8.7

—

Other noncurrent liabilities

26.5

29.2

Total liabilities

962.7

1,022.8

Commitments and contingencies

Stockholders' deficit:

Common stock, par value $0.01 per share,

authorized 500,000 shares at September 30, 2019 and 200,000 shares

at December 31, 2018, respectively; issued and outstanding 46,341

and 16,879 shares at September 30, 2019 and December 31, 2018,

respectively (1)

4.7

1.7

Capital in excess of par value

1,142.2

1,047.1

Treasury stock at cost, 599 and 587 shares

at September 30, 2019 and December 31, 2018, respectively (1)

(105.6

)

(105.6

)

Accumulated deficit

(1,352.3

)

(1,217.9

)

Accumulated other comprehensive income

(loss)

12.7

(11.4

)

Stockholders' deficit attributable to

shareholders

(298.3

)

(286.1

)

Noncontrolling interest

8.2

8.8

Total stockholders' deficit

(290.1

)

(277.3

)

Total liabilities and stockholders'

deficit

$

672.6

$

745.5

(1) Issued and outstanding common shares

and treasury stock shares reflect the one-for-ten reverse stock

split on July 24, 2019 as described in Note 1 in the Company's

10-Q.

(2) Figures may not be clerically accurate

due to rounding.

Exhibit 3

Babcock & Wilcox Enterprises,

Inc.

Condensed Consolidated Statements of

Cash Flows(1)

(In millions)

Nine months ended September

30,

2019

2018

Cash flows from operating activities:

Net loss

$

(134.5

)

$

(491.5

)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Depreciation and amortization of

long-lived assets

19.1

24.5

Amortization of deferred financing costs,

debt discount and payment-in-kind interest

42.2

10.1

Non-cash operating lease cost

4.1

—

Loss (gain) on sale of business

3.6

(39.7

)

Loss on debt extinguishment

4.0

49.2

Goodwill impairment of discontinued

operations

—

72.3

Goodwill impairment

—

37.5

Income from equity method investees

—

(6.6

)

Other-than-temporary impairment of equity

method investment in TBWES

—

18.4

(Gains) losses on asset disposals and

impairments

(0.2

)

1.9

Reserve for claims receivable

—

15.5

(Benefit from) provision for deferred

income taxes, including valuation allowances

(0.7

)

97.7

Mark to market losses (gains) and prior

service cost amortization for pension plans

(0.1

)

(6.6

)

Stock-based compensation, net of

associated income taxes

1.8

2.0

Changes in assets and liabilities:

Accounts receivable

41.3

45.4

Contracts in progress and advance billings

on contracts

(45.0

)

(41.2

)

Inventories

(6.6

)

5.2

Income taxes

1.6

(6.9

)

Accounts payable

(71.3

)

(12.3

)

Accrued and other current liabilities

(21.1

)

28.8

Accrued contract loss

(49.8

)

1.4

Pension liabilities, accrued

postretirement benefits and employee benefits

(5.8

)

(29.3

)

Other, net

16.2

10.7

Net cash used in operating

activities

(201.1

)

(213.5

)

Cash flows from investing activities:

Purchase of property, plant and

equipment

(1.6

)

(5.0

)

Proceeds from sale of business

7.4

43.9

Proceeds from sale of equity method

investments in joint venture

—

28.8

Purchases of available-for-sale

securities

(3.5

)

(17.8

)

Sales and maturities of available-for-sale

securities

5.1

18.2

Other, net

(0.4

)

(0.4

)

Net cash from investing

activities

7.1

67.7

Exhibit 3

Babcock & Wilcox Enterprises,

Inc.

Condensed Consolidated Statements of

Cash Flows(1)

(In millions)

Nine months ended September

30,

2019

2018

Cash flows from financing activities:

Borrowings under our U.S. revolving credit

facility

251.9

446.4

Repayments of our U.S. revolving credit

facility

(205.1

)

(350.1

)

Repayments of our second lien term loan

facility

—

(212.6

)

Borrowings under Last Out Term Loan

Tranche A-1

—

20.0

Borrowings under Last Out Term Loan

Tranche A-2

10.0

—

Repayments under Last Out Term Loan

Tranche A-2

(10.3

)

—

Borrowings under Last Out Term Loan

Tranche A-3

141.4

—

Repayments under Last Out Term Loan

Tranche A-3

(31.5

)

—

Repayments under our foreign revolving

credit facilities

(0.6

)

(5.6

)

Shares of our common stock returned to

treasury stock

—

(0.8

)

Proceeds from rights offering

40.4

247.1

Costs related to rights offering

(0.7

)

(3.3

)

Debt issuance costs

(15.5

)

(8.1

)

Issuance of common stock

1.4

1.2

Other, net

(0.3

)

—

Net cash from financing

activities

181.0

134.3

Effects of exchange rate changes on

cash

(4.0

)

(1.4

)

Net decrease in cash, cash equivalents

and restricted cash

(16.9

)

(12.8

)

Less net increase in cash and cash

equivalents of discontinued operations

—

4.7

Net decrease in cash, cash equivalents

and restricted cash of continuing operations

(16.9

)

(17.5

)

Cash, cash equivalents and restricted cash

of continuing operations, beginning of period

60.3

69.7

Cash, cash equivalents and restricted

cash of continuing operations, end of period

$

43.3

$

52.2

(1) Figures may not be clerically accurate

due to rounding.

Exhibit 4

Babcock & Wilcox Enterprises,

Inc.

Segment Information(1)

(In millions)

SEGMENT RESULTS

Three months ended September

30,

Nine months ended September

30,

2019

2018

2019

2018

REVENUES:

Babcock & Wilcox segment

$

161.8

$

191.1

$

551.3

$

547.9

Vølund & Other Renewable segment

32.4

76.5

95.6

191.4

SPIG segment

10.3

34.8

62.0

117.6

Eliminations

(5.8

)

(7.4

)

(30.3

)

(17.5

)

$

198.6

$

295.0

$

678.7

$

839.5

ADJUSTED EBITDA:

Babcock & Wilcox segment

$

19.3

$

15.6

$

47.5

$

30.8

Vølund & Other Renewable segment

(2.9

)

(25.7

)

(12.4

)

(165.9

)

SPIG segment

(2.4

)

(11.2

)

(1.8

)

(24.6

)

Corporate

(3.1

)

(5.0

)

(17.0

)

(20.8

)

Research and development costs

(0.8

)

(0.5

)

(2.3

)

(2.9

)

$

10.1

$

(26.7

)

$

14.0

$

(183.5

)

AMORTIZATION EXPENSE:

Babcock & Wilcox segment

$

0.2

$

0.2

$

0.5

$

0.5

Vølund & Other Renewable segment

0.1

0.2

0.4

0.6

SPIG segment

0.7

1.0

2.4

4.2

$

1.0

$

1.3

$

3.3

$

5.4

DEPRECIATION EXPENSE:

Babcock & Wilcox segment

$

3.4

$

4.1

$

12.6

$

10.5

Vølund & Other Renewable segment

0.5

0.9

1.9

2.8

SPIG segment

0.4

0.5

1.4

1.4

Corporate

—

0.3

—

0.9

$

4.3

$

5.8

$

15.8

$

15.6

BOOKINGS:

Babcock & Wilcox segment

$

84

$

131

$

411

$

535

Vølund & Other Renewable segment

(2)(3)

(1

)

(440

)

(60

)

(417

)

SPIG segment

8

5

38

51

Other/Eliminations

(5

)

0

(20

)

(2

)

$

86

(304

)

$

369

$

167

As of September 30,

BACKLOG:

2019

2018

Babcock & Wilcox segment

$

245

$

440

Vølund & Other Renewable segment

(4)

172

400

SPIG segment

63

109

Other/Eliminations

(7

)

(28

)

$

473

$

921

(1) Figures may not be clerically accurate

due to rounding.

(2) Vølund & Other Renewable bookings

includes the revaluation of backlog denominated in currency other

than U.S. dollars. The foreign exchange impact on Vølund &

Other Renewable bookings in the three months ended September 30,

2019 and 2018 was $(6.9) million and $0.8 million, respectively,

and the foreign exchange impact on Vølund & Other Renewable

bookings in the nine months ended September 30, 2019 and 2018 was

$(7.4) million and $(11.5) million, respectively.

(3) In the three and nine months ended

September 30, 2019, Vølund & Other Renewable includes

debookings of $19 million related to the sale of Loibl and $72

million related to a 15-year operations and maintenance contract

previously expected to follow completion of the fifth European

Vølund EPC loss contract, which was canceled following the

settlement agreement. In the three months ended September 30, 2018,

Vølund & Other Renewable includes a reduction of approximately

$467 million from the sale of PBRRC.

(4) Vølund & Other Renewable backlog

at September 30, 2019, includes $139.5 million related to long-term

operation and maintenance contracts for renewable energy plants,

with remaining durations extending until 2034. Generally, such

contracts have a duration of 10-20 years and include options to

extend.

Exhibit 5

Babcock & Wilcox Enterprises,

Inc.

Reconciliation of Adjusted

EBITDA(2)

(In millions)

Three months ended September

30,

Nine months ended September

30,

2019

2018

2019

2018

Adjusted EBITDA (1)

Babcock & Wilcox segment(2)

$

19.3

$

15.6

$

47.5

$

30.8

Vølund & Other Renewable segment

(2.9

)

(25.7

)

(12.4

)

(165.9

)

SPIG segment

(2.4

)

(11.2

)

(1.8

)

(24.6

)

Corporate(3)

(3.1

)

(5.0

)

(17.0

)

(20.8

)

Research and development costs

(0.8

)

(0.5

)

(2.3

)

(2.9

)

10.1

(26.7

)

14.0

(183.5

)

Restructuring activities and spin-off

transaction costs

(2.6

)

(2.9

)

(9.6

)

(13.6

)

Financial advisory services

(1.2

)

(7.2

)

(8.4

)

(15.5

)

Settlement cost to exit Vølund

contract(4)

—

—

(6.6

)

—

Advisory fees for settlement costs and

liquidity planning

(2.8

)

—

(7.4

)

—

Litigation settlement

(0.5

)

—

(0.5

)

—

Stock compensation

(1.3

)

(1.3

)

(2.1

)

(4.5

)

Goodwill impairment

—

—

—

(37.5

)

Impairment of equity method investment in

TBWES

—

—

—

(18.4

)

Gain on sale of equity method investment

in BWBC

—

—

—

6.5

Depreciation & amortization

(5.3

)

(7.1

)

(19.1

)

(21.0

)

Gain (loss) on asset disposals, net

0.3

—

0.2

(1.5

)

Operating loss

(3.2

)

(45.1

)

(39.4

)

(288.9

)

Interest expense, net

(29.4

)

(10.2

)

(66.6

)

(35.3

)

Loss on debt extinguishment

—

—

(4.0

)

(49.2

)

Gain (loss) on sale of business

—

39.7

(3.6

)

39.7

Net pension benefit before MTM

3.6

6.6

10.4

20.1

MTM (loss) gain from benefit plans

—

4.2

(1.3

)

4.7

Foreign exchange

(26.7

)

(4.9

)

(27.4

)

(22.7

)

Other – net

(0.3

)

—

0.2

0.2

Loss before income tax expense

$

(55.9

)

$

(9.9

)

$

(131.6

)

$

(331.4

)

(1) Adjusted EBITDA for the three and nine

months ended September 30, 2018 excludes stock compensation that

was previously included in segment results and totals $0.3 million

and $1.3 million, respectively in the Babcock & Wilcox segment,

$0.1 million and $0.3 million, respectively in the Vølund &

Other Renewable segment, $0.0 million and $0.1 million,

respectively in the SPIG segment, and $0.9 million and $2.8

million, respectively in Corporate. Beginning in the third quarter

of 2019, stock compensation is no longer allocated to the segments,

and prior periods have been adjusted to be presented on a

comparable basis.

(2) The Babcock & Wilcox segment

adjusted EBITDA for the three and nine months ended September 30,

2018 excludes $6.6 million and $20.1 million, respectively, of net

benefit from pension and other postretirement benefit plans,

excluding MTM adjustments, that were previously included in the

segment results. Beginning in 2019, net pension benefits are no

longer allocated to the segments, and prior periods have been

adjusted to be presented on a comparable basis.

(3) Allocations are excluded from

discontinued operations. Accordingly, allocations previously

absorbed by the MEGTEC and Universal businesses in the SPIG segment

have been included with other unallocated costs in Corporate, and

total $2.9 million and $8.6 million in the three months and nine

months ended September 30, 2018, respectively.

(4) In March 2019, we entered into a

settlement in connection with an additional European

waste-to-energy EPC contract, for which notice to proceed was not

given and the contract was not started. The settlement eliminates

our obligations and our risk related to acting as the prime EPC

should the project move forward.

(5) Figures may not be clerically accurate

due to rounding.

Exhibit 6

Babcock & Wilcox Enterprises,

Inc.

Reconciliation of Adjusted Gross Profit

(Loss)(2)

(In millions)

Three months ended September

30,

Nine months ended September

30,

2019

2018

2019

2018

Adjusted gross profit (loss)(1)

Operating loss

$

(3.2

)

$

(45.1

)

$

(39.4

)

$

(288.9

)

Selling, general and administrative

("SG&A") expenses

35.8

44.9

120.0

151.0

Advisory fees and settlement costs

4.5

7.2

22.9

15.5

Intangible amortization expense

1.0

1.3

3.3

5.4

Goodwill impairment

—

—

—

37.5

Restructuring activities and spin-off

transaction costs

2.6

2.9

9.6

13.6

Research and development costs

0.8

0.5

2.3

2.9

(Gain) loss on asset disposals, net

(0.3

)

—

(0.2

)

1.4

Equity in income and impairment of

investees

—

—

—

11.8

Adjusted gross profit (loss)

41.2

11.7

118.4

(49.9

)

Adjusted gross profit by segment is as

follows:

Three months ended September

30,

Nine months ended September

30,

2019

2018

2019

2018

Adjusted gross profit (loss)(1)

Babcock & Wilcox segment

41.0

34.3

109.9

95.2

Vølund & Other Renewable segment

1.3

(17.1

)

3.5

(136.9

)

SPIG segment

(1.0

)

(5.5

)

5.1

(8.2

)

Adjusted gross profit (loss)

41.2

11.7

118.4

(49.9

)

(1) Intangible amortization is not

allocated to the segments' adjusted gross profit, but depreciation

is allocated to the segments' adjusted gross profit.

(2) Figures may not be clerically accurate

due to rounding

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191107005325/en/

Investor Contact: Megan Wilson Vice President, Corporate

Development & Investor Relations Babcock & Wilcox

Enterprises 704.625.4944 | investors@babcock.com

Media Contact: Ryan Cornell Public Relations Babcock

& Wilcox Enterprises 330.860.1345 | rscornell@babcock.com

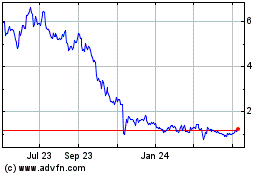

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Mar 2024 to Apr 2024

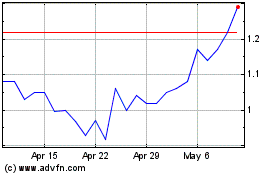

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Apr 2023 to Apr 2024