Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

July 11 2019 - 4:59PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-231135

Prospectus Supplement No. 1

(to Prospectus dated June 28, 2019)

Babcock & Wilcox Enterprises, Inc

.

Common Stock

Nontransferable Subscription Rights to Purchase up to 166,666,667 Shares of Common Stock at $0.30 per Share

This prospectus supplement no. 1 supplements the prospectus dated June 28, 2019 relating to the distribution to the holders of our common stock as of 5:00 p.m., New York City time, on June 27, 2019 of non-transferable subscription rights to purchase up to an aggregate of 166,666,667 newly-issued shares of our common stock.

On July 11, 2019, we issued a press release announcing a one-for-ten reverse stock split of the outstanding and treasury shares of our common stock. We are filing this prospectus supplement to update and supplement the information included or incorporated by reference in the prospectus dated June 28, 2019 with the information contained in the press release, which is attached to and a part of this prospectus supplement.

This prospectus supplement should be read in conjunction with the prospectus dated June 28, 2019 and may not be delivered or utilized without the prospectus. To the extent there is a discrepancy between the information contained in this prospectus supplement and the information in the prospectus, the information contained herein supersedes and replaces such conflicting information.

Neither we nor our Board of Directors has made any recommendation as to whether you should exercise your rights, although our directors and executive officers may exercise their rights in their individual capacities. You are urged to carefully review the subscription materials we will provide and consult with your own legal and financial advisors when deciding whether or not to exercise your rights.

In reviewing this prospectus supplement, you should carefully consider the matters described under the caption “Risk Factors” beginning on page 17 of the prospectus dated June 28, 2019.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or has passed upon the adequacy or accuracy of this prospectus as truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is July 11, 2019.

Babcock & Wilcox Announces One-for-Ten Reverse Stock Split

(BARBERTON, Ohio – July 11, 2019) – Babcock & Wilcox Enterprises, Inc. ("B&W" or the “Company”) (NYSE: BW) announced today that its board of directors approved a one-for-ten reverse stock split of the outstanding and treasury shares of the Company’s common stock. The reverse stock split was previously approved by a majority of the Company’s stockholders at the Company’s annual meeting of stockholders held on June 14, 2019.

The reverse stock split, which is expected to become effective after the market closes on July 23, 2019, will follow the completion of the previously announced rights offering. Once effective, every 10 shares of the Company’s outstanding and treasury common stock will automatically be converted into one share of common stock. No fractional shares will be issued if, as a result of the reverse stock split, a stockholder would otherwise become entitled to a fractional share. Instead, stockholders who would otherwise hold fractional shares will be entitled to cash payments (without interest) in respect of such fractional shares. The reverse stock split will not impact any stockholder’s percentage ownership of the Company, subject to the treatment of fractional shares. Following the reverse stock split, the number of outstanding and treasury shares of the Company’s common stock will be reduced by a factor of 10.

“This reverse stock split is another key step in B&W’s turnaround efforts and reflects the importance we place in remaining a listed company on the New York Stock Exchange,” said Kenneth Young, B&W Chief Executive Officer. “We look forward to providing more information about our continuing progress when we release the company’s second quarter 2019 financial results.”

The Company’s common stock is expected to begin trading on the New York Stock Exchange (“NYSE”) on a split-adjusted basis when the market opens on July 24, 2019 under a new CUSIP number, 05614L209. The trading symbol for the Company’s common stock will remain “BW.”

The reverse stock split will increase the market price per share of the Company’s common stock to allow the Company to regain compliance with the NYSE’s continued listing standards relating to minimum price per share.

Computershare Trust Company, N.A., the Company’s transfer agent, will act as the exchange agent for the reverse stock split. Additional information regarding the reverse stock split can be found in the Company’s Definitive Proxy Statement filed with the Securities and Exchange Commission on May 13, 2019.

About B&W

Headquartered in Barberton, Ohio, Babcock & Wilcox is a global leader in energy and environmental technologies and services for the power and industrial markets. Follow us on Twitter @BabcockWilcox and learn more at www.babcock.com.

Forward-Looking Statements

B&W cautions that this release contains forward-looking statements, including, without limitation, statements relating to the effectiveness of the reverse stock split and the Company’s ability to regain compliance with NYSE continued listing requirements. These forward-looking statements are based on management’s current expectations and involve a number of risks and uncertainties, including, among other things, the completion and settlement of the Company’s current rights offering and the other equitization transaction described in the Company’s Definitive Proxy Statement filed with the Securities and Exchange Commission on May 13, 2019; potential volatility in the price of the Company’s common stock following the reverse stock split; the Company’s ability to attain the necessary stock price levels to regain compliance with the NYSE continued listing standards or, if achieved, to continue to satisfy the NYSE’s qualitative and quantitative continued listing standards in the future; and a determination by the Company’s board of directors not to implement or to abandon the proposed reverse stock split in its discretion. If one or more of these risks or other risks materialize, actual results may vary materially from those expressed. For a more complete discussion of these and other risk factors that may impact the forward-looking statements contained in this release, see B&W’s filings with the Securities and Exchange Commission, including B&W’s most recent annual report on Form 10-K and quarterly report on Form 10-Q. B&W cautions not to place undue reliance on these forward-looking statements, which speak only as of the date of this release, and undertakes no obligation to update or revise any forward-looking statement, except to the extent required by applicable law.

# # #

Investor Contact: Media Contact:

Megan Wilson Ryan Cornell

|

|

|

|

Vice President, Corporate Development & Investor Relations

|

Public Relations

|

Babcock & Wilcox Babcock & Wilcox

704.625.4944 | investors@babcock.com 330.860.1345 | rscornell@babcock.com

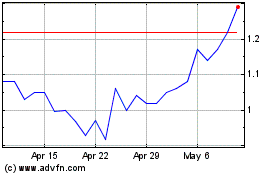

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Mar 2024 to Apr 2024

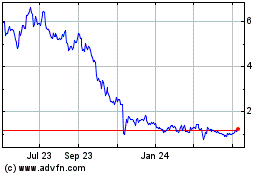

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Apr 2023 to Apr 2024