As filed with the Securities and Exchange Commission on April 30, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Babcock & Wilcox Enterprises, Inc.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

(State or other jurisdiction of

incorporation or organization)

|

3433

(Primary Standard Industrial Classification

Code Number)

|

47-2783641

(I.R.S. Employer

Identification Number)

|

20 South Van Buren Avenue

Barberton, Ohio 44203

(303) 753-4511

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Kenneth M. Young

Chief Executive Officer

Babcock & Wilcox Enterprises, Inc.

20 South Van Buren Avenue

Barberton, Ohio 44203

(303) 753-4511

(Name, address, including zip code, and telephone number, including area code, of agent for service)

|

|

|

|

|

|

|

|

With copies to:

|

|

|

J. André Hall

Senior Vice President, General Counsel

and Corporate Secretary

Babcock & Wilcox Enterprises, Inc.

20 South Van Buren Avenue

Barberton, Ohio 44203

(303) 753-4511

|

|

William Calvin Smith III

Zachary L. Cochran

King & Spalding LLP

1180 Peachtree Street, N.E.

Atlanta, Georgia 30309

(404) 572-4600

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

¨

|

Accelerated filer

x

|

Non-accelerated filer

¨

|

Smaller reporting company

¨

|

Emerging growth company

¨

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

¨

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

Title of each class of

securities to be registered

|

|

Proposed

maximum

aggregate

offering price(1)

|

Amount of

registration

fee

|

|

Common stock, par value $0.01 per share

|

|

$50,000,000.10(2)

|

$6,060.00

|

|

|

|

|

(1)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) of the Securities Act of 1933, as amended.

|

|

|

|

|

(2)

|

Represents the proposed maximum aggregate gross proceeds from the exercise of the maximum number of rights that may be issued.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities nor may offers to buy these securities be accepted until the Registration Statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated April 30, 2019

PRELIMINARY PROSPECTUS

Babcock & Wilcox Enterprises, Inc

.

Common Stock

Nontransferable Subscription Rights to Purchase up to 166,666,667 Shares of Common Stock at $0.30 per Share

We are distributing, at no charge, to the holders of our common stock as of 5:00 p.m., New York City time, on , 2019, which date and time we refer to as the 2019 rights offering record date, non-transferable subscription rights, which we refer to as rights, to purchase up to an aggregate of 166,666,667 newly-issued shares of our common stock. Each holder of our common stock as of the 2019 rights offering record date will receive one right for each share of common stock held as of the 2019 rights offering record date. Each right entitles the holder to purchase shares of our common stock at the subscription price of $0.30 per whole share of common stock, which we refer to as the subscription price. Rights may only be exercised in aggregate for whole numbers of shares of our common stock; no fractional shares of our common stock will be issued in this rights offering, which we refer to as the 2019 rights offering. Any fractional shares of our common stock created by the exercise of the rights will be rounded to the nearest whole share. Further, you will not be entitled to exercise an oversubscription privilege to purchase additional shares of common stock that may remain unsubscribed as a result of any unexercised rights in the 2019 rights offering.

If all conditions to the commencement of the 2019 rights offering are satisfied or waived by us in our sole discretion at 5:00 p.m., New York City time, on , 2019, which date and time we refer to as the rights distribution date, the 2019 rights offering will commence and you will receive one right for each share of common stock you held as of the 2019 rights offering record date.

The rights will expire at 5:00 p.m., New York City time, on , 2019, which date and time we refer to as the expiration date, unless extended as described herein. You may withdraw your exercise of any rights prior to the deadline for withdrawal, but not thereafter, subject to applicable law. The deadline for withdrawal is 5:00 p.m., New York City time, on , 2019, the business day prior to the expiration date. Rights that are not exercised prior to the expiration date will expire and have no value. There is no minimum number of shares of our common stock that we must sell in order to complete the 2019 rights offering.

We have entered into a backstop exchange agreement, which we refer to as the Backstop Exchange Agreement, with B. Riley FBR, Inc., which we refer to, together with its affiliates, as B. Riley. B. Riley is one of our significant stockholders and lenders and has agreed to purchase from us, at a price per share equal to the subscription price, all unsubscribed shares of common stock in the 2019 rights offering for cash or by exchanging an equal principal amount of Tranche A-2 or Tranche A-3 last-out term loans. B. Riley will also be entitled to exercise its own basic subscription privilege through the rights it receives pursuant to the 2019 rights offering. B. Riley will not receive any fee for acting as backstop for the 2019 rights offering, however, we have agreed to reimburse B. Riley for all reasonable out-of-pocket costs and expenses it incurs, including fees for its legal counsel. B. Riley’s commitment is subject to the satisfaction of certain conditions. See “The 2019 Rights Offering–Backstop Exchange Agreement.” B. Riley beneficially owned shares of our common stock, or approximately % of our outstanding shares of our common stock, as of the 2019 rights offering record date.

The 2019 rights offering is conditioned on, among other things, stockholder approval of the Equitization Transactions (as defined herein) at our 2019 annual meeting of stockholders. If stockholder approval is attained, each stockholder as of the 2019 rights offering record date is entitled to participate in the 2019 rights offering, regardless of whether or not they voted to approve the Equitization Transactions. See “The 2019 Rights Offering–Stockholder Approval.”

Neither we nor our Board of Directors, which we refer to as the Board of Directors, has made any recommendation as to whether you should exercise your rights, although our directors and executive officers may exercise their rights in their individual capacities. You are urged to carefully review the subscription materials we will provide and consult with your own legal and financial advisors when deciding whether or not to exercise your rights.

Our common stock is traded on the New York Stock Exchange, or NYSE, under the symbol “BW.” We do not expect to list the rights on the NYSE as the rights are non-transferable.

In reviewing this prospectus, you should carefully consider the matters described under the caption “Risk Factors” beginning on page

16

.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or has passed upon the adequacy or accuracy of this prospectus as truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2019.

TABLE OF CONTENTS

Unless otherwise indicated or unless the context requires otherwise, all references in this prospectus to “B&W,” the “Company,” “we,” “us,” “our,” or similar references, mean Babcock & Wilcox Enterprises, Inc.

We have not authorized any person to provide information other than that provided in this prospectus and the documents incorporated by reference. We do not take any responsibility for, or provide any assurance as to the reliability of, any information that others may give you. This prospectus may be used only for the purpose for which it has been published. You should assume that the information appearing in this prospectus is accurate only as of the date on its cover page and that any information previously filed with the Securities and Exchange Commission, or SEC, that is incorporated by reference is accurate only as of the date of the document incorporated by reference, in each case, regardless of the time of delivery of this prospectus or any exercise of the rights. Our business, financial condition, results of operations and prospects may have changed since those dates.

The distribution of this prospectus and the offer or sale of our common stock in some jurisdictions may be restricted by law. Persons outside of the United States who come into possession of this prospectus are required to inform themselves about and to observe any applicable restrictions. This prospectus may not be used for or in connection with an offer or solicitation by any person in any jurisdiction in which that offer or solicitation is not authorized or to any person to whom it is unlawful to make that offer or solicitation.

QUESTIONS AND ANSWERS RELATING TO THE 2019 RIGHTS OFFERING

The following are examples of what we anticipate will be common questions about the 2019 rights offering. The answers are based on selected information from this prospectus and the documents incorporated by reference herein. The following questions and answers do not contain all of the information that may be important to you and may not address all of the questions that you may have about the 2019 rights offering. This prospectus and the documents incorporated by reference herein contain more detailed descriptions of the terms and conditions of this rights offering and provide additional information about us and our business, including potential risks related to the 2019 rights offering, our common stock and our business.

Q: What is a rights offering?

|

|

|

|

A:

|

A rights offering is a distribution of subscription rights on a pro rata basis to stockholders of a company. We are distributing, at no charge, to the holders of our common stock as of the 2019 rights offering record date, non-transferable subscription rights to purchase up to an aggregate of 166,666,667 newly-issued shares of our common stock. Each holder of our common stock as of the 2019 rights offering record date will receive one right for each share of our common stock held as of the 2019 rights offering record date. Each right entitles the holder to purchase shares of our common stock from us at the subscription price of $0.30 per whole share of common stock.

|

|

|

|

|

A

.

|

Each right entitles its holder to purchase shares of our common stock from us at the subscription price of $0.30 per whole share of common stock. The subscription price for the rights is an approximately % discount to the trading day volume weighted average trading price of our common stock on , 2019.

|

|

|

|

|

Q.

|

What are the record and distribution dates for the 2019 rights offering?

|

|

|

|

|

A

.

|

Each holder of record of our common stock as of 5:00 p.m., New York City time, on , 2019, which we refer to as the 2019 rights offering record date, will receive rights on , 2019, the rights distribution date.

|

|

|

|

|

Q.

|

Are there other key dates relating to the 2019 rights offering?

|

|

|

|

|

A

.

|

Yes. Below is a list of the key dates for the 2019 rights offering of which you should be aware. With the exception of the 2019 rights offering record date and rights distribution date, the dates listed below are subject to change in the event we decide to extend the 2019 rights offering as discussed herein. For more information regarding these dates, we encourage you to review “The 2019 Rights Offering,” as that section of this prospectus describes other timing considerations of which you should be aware regarding the 2019 rights offering (including, for example, dates by which different forms of payment upon the exercise of rights are deemed received).

|

|

|

|

|

|

|

Date

|

Event / Action

|

|

5:00 p.m., New York City time, on , 2019

|

2019 rights offering record date.

|

|

5:00 p.m., New York City time, on , 2019

|

Rights distribution date; commencement of subscription period.

|

|

5:00 p.m., New York City time, on , 2019

|

Date by which the subscription agent must have received appropriate materials from holders of rights in order to withdraw any exercise of all or a portion of such holder’s rights.

|

|

5:00 p.m., New York City time, on , 2019

|

Expiration of the 2019 rights offering.

|

|

|

|

|

Q.

|

Why are you conducting the 2019 rights offering and how will you use the proceeds?

|

|

|

|

|

A

.

|

On April 5, 2019, we announced that we paid a combined £70 million (approximately $91.6 million at exchange rates at the time of announcement) to the customers on our two remaining European Vølund loss projects – referred to as the “second” and “fifth” projects in previous communications – in exchange for significantly limiting the Company’s obligations under these contracts, including a waiver of the customer’s rejection and termination rights on the fifth project. On April 5, 2019, we also announced that we had amended our U.S. credit agreement with our current lenders. The amendment provided an additional $150.0 million of financing from B. Riley through Tranche A-3 last-out term loans as well as an incremental uncommitted facility of up to $15.0 million to be provided by B. Riley or an assignee. The proceeds from the Tranche A-3 last-out term loans were used to pay the amounts due under these settlement agreements on our two remaining European Vølund loss projects and for working capital and general corporate purposes.

|

In connection with this amendment, we agreed to use our reasonable best efforts to effect a series of transactions intended to equitize a portion of the last-out term loans outstanding under our U.S. credit agreement. These transactions, which we refer to as the Equitization Transactions, are as follows:

|

|

|

|

•

|

a $50.0 million rights offering allowing our stockholders to subscribe for shares of our common stock at a price of $0.30 per share, the proceeds of which will be used to prepay a portion of the Tranche A-3 last-out term loans under our U.S. credit agreement;

|

|

|

|

|

•

|

the exchange of Tranche A-1 last-out term loans under our U.S. credit agreement for shares of our common stock at a price of $0.30 per share, which we refer to as the Tranche A-1 Debt Exchange; and

|

|

|

|

|

•

|

the issuance to B. Riley or its designees of an aggregate 16,666,667 warrants, each to purchase one share of our common stock at an exercise price of $0.01 per share, which we refer to as the Warrant Issuance.

|

The 2019 rights offering is intended to satisfy our obligation to effect the first of the Equitization Transactions, and, as a result, the proceeds from the 2019 rights offering will be used to repay a portion of our Tranche A-3 last-out term loans under the U.S. credit agreement.

|

|

|

|

Q.

|

How was the subscription price determined?

|

|

|

|

|

A

.

|

The subscription price was initially established at $0.30 per share of our common stock following negotiations with B. Riley, the backstop exchange party, as part of the negotiations regarding our commitment to seek to undertake the Equitization Transactions. The subscription price was not intended to bear any relationship to the historical price of our common stock or our past or future operations, cash flows, net income, current financial condition, the book value of our assets or any other established criteria for value. As a result, the subscription price should not be considered an indication of the actual value of our company or our common stock.

|

|

|

|

|

Q.

|

What do I have to do to receive rights?

|

|

|

|

|

A

.

|

Nothing. Holders of our common stock on the 2019 rights offering record date are not required to pay any cash, give up any shares of common stock or deliver any other consideration in order to receive the rights being distributed.

|

|

|

|

|

Q.

|

Will the 2019 rights offering include an oversubscription privilege?

|

|

|

|

|

A

.

|

No. You will not be entitled to exercise an oversubscription privilege to purchase any additional shares of our common stock that may remain unsubscribed as a result of any unexercised rights after the expiration of the 2019 rights offering. B. Riley, as the backstop exchange party, has agreed to purchase from us, at a price per share equal to the subscription price, all unsubscribed shares of common stock in the 2019 rights offering for cash or by exchanging an equal principal amount of Tranche A-2 or Tranche A-3 last-out term loans.

|

|

|

|

|

Q.

|

Will the Company issue fractional rights?

|

|

|

|

|

A

.

|

No. Holders of our common stock as of the 2019 rights offering record date will receive one right for each share of our common stock held as of the 2019 rights offering record date. We will not issue fractional rights or pay cash in lieu of fractional rights.

|

|

|

|

|

Q.

|

How will fractional shares of common stock be treated in the 2019 rights offering?

|

|

|

|

|

A

.

|

Each right entitles the holder to purchase shares of newly-issued common stock from us at the subscription price of $0.30 per whole share of common stock. However, we will not issue any fractional shares of common stock in the 2019 rights offering. You may only exercise your rights to purchase shares of our common stock in whole numbers. Any excess funds insufficient to purchase one whole share of our common stock will be returned to you by the subscription agent without penalty or interest.

|

|

|

|

|

Q.

|

When will the 2019 rights offering commence and when will it expire?

|

|

|

|

|

A

.

|

The 2019 rights offering will commence on , 2019 and will expire at the expiration date of 5:00 p.m., New York City time, on , 2019, which is the 20th calendar day following the commencement of the 2019 rights offering, unless we extend such date or time as described herein. We may extend the expiration date for any reason and for any length of time at our discretion. However, we do not intend to extend the expiration date for more than 20 calendar days past the original 20 calendar day period. Notwithstanding the foregoing, we will extend the duration of the 2019 rights offering as required by applicable law.

|

The Backstop Exchange Agreement does not prevent us from cancelling, terminating, amending or extending the 2019 rights offering prior to the commencement of the offering. However, once the 2019 rights offering has commenced, any such cancellation, termination, amendment or extension will require the prior consent of B. Riley (except for an extension of the subscription period by not more than 10 days), unless the Backstop Exchange Agreement is terminated.

|

|

|

|

Q.

|

Who is the backstop exchange party in the 2019 rights offering?

|

|

|

|

|

A

.

|

B. Riley, one of our significant stockholders and lenders, will serve as a backstop exchange party in the 2019 rights offering. B. Riley beneficially owned shares of our common stock, or approximately % of our outstanding common stock, as of the 2019 rights offering record date.

|

|

|

|

|

Q.

|

How does the backstop exchange commitment work?

|

|

|

|

|

A

.

|

Pursuant to the Backstop Exchange Agreement, B. Riley has agreed to purchase from us, at a price per share equal to the subscription price, all unsubscribed shares of common stock in the 2019 rights offering for cash or by exchanging an equal principal amount of Tranche A-2 or Tranche A-3 last-out term loans. B. Riley will also be entitled to exercise its own basic subscription privilege through the rights it receives.

|

B. Riley’s obligations under the Backstop Exchange Agreement are subject to various terms and conditions. See “The 2019 Rights Offering

–

Backstop Exchange Agreement” for additional information.

|

|

|

|

Q.

|

Why is there a backstop exchange party?

|

|

|

|

|

A

.

|

As described above, we are conducting the 2019 rights offering as part of the overall set of Equitization Transactions intended to equitize a portion of our last-out term loans under our U.S. credit agreement. As part of our agreement to use our reasonable best efforts to seek to effect the Equitization Transactions, B. Riley agreed to use its reasonable best efforts to act as a backstop for the rights offering contemplated as part of the Equitization Transactions. B. Riley’s commitment to act as the backstop exchange party for the 2019 rights offering is intended to satisfy this obligation.

|

|

|

|

|

Q.

|

Is the backstop exchange party receiving a fee for providing the backstop exchange commitment?

|

|

|

|

|

A

.

|

No. B. Riley will not receive any fee for acting as backstop for the 2019 rights offering. However, we have agreed to reimburse B. Riley for all reasonable out-of-pocket costs and expenses it incurs, including fees for its legal counsel.

|

|

|

|

|

Q.

|

When do the obligations of the backstop exchange party expire?

|

|

|

|

|

A

.

|

Unless extended by us, the backstop exchange commitment will expire if the 2019 rights offering has not been concluded prior to the Additional Term Loan Prepayment Transaction Deadline (as defined under “The 2019 Rights Offering

–

Termination”).

|

|

|

|

|

Q.

|

Are there any conditions on the backstop exchange party’s obligations to purchase any unsubscribed shares of common stock?

|

|

|

|

|

A

.

|

Yes. Our obligations and the obligations of B. Riley to consummate the transactions contemplated by the Backstop Exchange Agreement are subject to the satisfaction of various conditions described in “The 2019 Rights Offering

–

Backstop Exchange Agreement.” B. Riley’s obligations as backstop exchange party are not, however, subject to the absence of a material adverse change in our business, financial condition or results of operations or a material deterioration in the financial markets.

|

|

|

|

|

Q.

|

Can you change or terminate the 2019 rights offering?

|

|

|

|

|

A

.

|

We reserve the right to amend, extend, terminate or cancel the 2019 rights offering on or prior to the expiration date for any reason in our sole discretion. We may cancel the 2019 rights offering if at any time before completion of the 2019 rights offering there is any judgment, order, decree, injunction, statute, law or regulation entered, enacted, amended or held to be applicable to the 2019 rights offering that in our sole judgment would or might make the 2019 rights offering or its completion, whether in whole or in part, illegal or otherwise restrict or prohibit completion of the 2019 rights offering. If we cancel the 2019 rights offering, in whole or in part, all affected rights will expire without value, and all subscription payments received by the subscription agent will be returned, without interest or penalty, as soon as practicable.

|

|

|

|

|

Q.

|

If you terminate the 2019 rights offering, will my subscription payment be refunded to me?

|

|

|

|

|

A

.

|

Yes. If we terminate the 2019 rights offering, the subscription agent will return promptly all subscription payments received by it. We will not pay interest on, or deduct any amounts from, subscription payments if we terminate the 2019 rights offering.

|

|

|

|

|

Q.

|

How many shares of common stock do you expect to be outstanding following the 2019 rights offering and the other Equitization Transactions?

|

|

|

|

|

A

.

|

Assuming the 2019 rights offering is fully subscribed, and without giving effect to any anti-dilution adjustments associated with outstanding equity awards and based on 168,867,532 shares of our common stock outstanding as of April 25, 2019, we estimate that we would have approximately 459.3 million shares of common stock outstanding immediately following the completion of the Equitization Transactions. This does not include 16,666,667 shares of common stock subject to issuance pursuant to the warrants issued in the Warrant Issuance or shares of common stock reserved for issuance under the Babcock & Wilcox Enterprises, Inc. Amended and Restated 2015 Long-Term Incentive Plan, which we refer to as the 2015 LTIP. The actual number of shares of common stock issued in the Equitization Transactions may be higher than the amount indicated, however, due to, among other things, the accumulation of paid-in-kind interest on the outstanding Tranche A-1 last-out term loans under our U.S. credit agreement through the completion of the Tranche A-1 Debt Exchange.

|

|

|

|

|

Q.

|

How might the 2019 rights offering affect the trading price of the common stock?

|

|

|

|

|

A

.

|

We cannot assure you as to how the 2019 rights offering will impact the trading price of our common stock. Historically, due to the inclusion of a discounted subscription price and the resulting dilution, rights

|

offerings have adversely impacted the trading price of the underlying stock, especially during the period that the rights offerings remain open.

|

|

|

|

Q.

|

How do I exercise my rights?

|

|

|

|

|

A

.

|

Subscription materials, including rights certificates, will be made available to holders upon the commencement of the 2019 rights offering. Each holder who wishes to exercise its rights should properly complete and sign the applicable rights certificate and deliver the rights certificate together with payment of the subscription price for each share of our common stock subscribed for to the subscription agent before the expiration date. We recommend that any holder of rights who uses the United States mail to effect delivery to the subscription agent use insured, registered mail with return receipt requested. We will not pay interest on subscription payments. We have provided more detailed instructions on how to exercise the rights under “The 2019 Rights Offering

–

Exercising Your Rights,” in the rights certificates themselves and in the document entitled “Instructions for Use of Babcock & Wilcox Enterprises, Inc. Rights Certificates” that accompanies this prospectus.

|

|

|

|

|

Q.

|

How may I pay the subscription price?

|

|

|

|

|

A

.

|

Your cash payment of the subscription price must be made by either check or bank draft drawn upon a U.S. bank payable to the subscription agent, which is . Payments should be made payable to “ .” Please see “The 2019 Rights Offering

–

Delivery of Subscription Materials and Payment.”

|

|

|

|

|

Q.

|

What should I do if I want to participate in the 2019 rights offering but my shares of common stock will be held in the name of my broker or a custodian bank on the 2019 rights offering record date?

|

|

|

|

|

A

.

|

We will ask brokers, dealers and nominees holding shares of common stock on behalf of other persons to notify these persons of the 2019 rights offering. Any beneficial owner wishing to exercise its rights will need to have its broker, dealer or nominee act on its behalf. Each beneficial owner should complete and return to its broker, dealer or nominee the form entitled “Beneficial Owner Election Form.” This form will be available with the other subscription materials from brokers, dealers and nominees holding our common stock on behalf of other persons on the 2019 rights offering record date.

|

|

|

|

|

Q.

|

Will I receive subscription materials by mail if my address is outside the United States?

|

|

|

|

|

A

.

|

No. We will not mail rights certificates to any person with an address outside the United States. Instead, the subscription agent will hold rights certificates for the account of all foreign holders. To exercise those rights, each such holder must notify the subscription agent on or before 11:00 a.m., New York City time, on the fifth business day before the expiration date, and establish to the satisfaction of the subscription agent that it is permitted to exercise its rights under applicable law.

|

|

|

|

|

Q.

|

Will I receive rights for shares I own through the Company’s 401(k) plan, non-qualified defined contribution retirement plan or Supplemental Executive Retirement Plan?

|

|

|

|

|

A

.

|

No. Certain retirement plans, like our 401(k) plan, non-qualified defined contribution retirement plan or Supplemental Executive Retirement Plan, which we collectively refer to as the Benefit Plans, are not permitted to acquire, hold or dispose of rights unless the U.S. Department of Labor issues a prohibited transaction exemption. We have determined that it would not be prudent or cost-effective to request an exemption to permit the Benefit Plans to acquire and hold rights that the Benefit Plans would be unable to exercise. Accordingly, the Benefit Plans have been excluded from receiving any rights under the 2019 rights offering.

|

|

|

|

|

Q.

|

Will I be charged any fees if I exercise my rights?

|

|

|

|

|

A

.

|

We will not charge a fee to holders for exercising their rights. However, any holder exercising its rights through a broker, dealer or nominee will be responsible for any fees charged by its broker, dealer or nominee.

|

|

|

|

|

Q.

|

May I transfer my rights if I do not want to purchase any shares?

|

|

|

|

|

A

.

|

No. The rights are non-transferable.

|

|

|

|

|

Q.

|

Am I required to exercise the rights I receive in the 2019 rights offering?

|

|

|

|

|

A

.

|

No. However, we intend to issue an aggregate 166,666,667 shares of our common stock through the 2019 rights offering and the backstop exchange commitment. If a stockholder does not exercise its rights in the 2019 rights offering in full, its percentage ownership will be materially diluted after the 2019 rights offering. Further, because we will issue additional shares of our common stock in the other Equitization Transactions and our stockholders (other than B. Riley and Vintage Capital Management, LLC, which we refer to as Vintage) will not be given the opportunity to participate in those issuances, our stockholders (other than B. Riley and Vintage) will see their percentage ownership materially diluted following the other Equitization Transactions regardless of whether they exercise their rights to participate in the 2019 rights offering.

|

|

|

|

|

Q.

|

If I exercise rights in the 2019 rights offering, may I withdraw the exercise?

|

|

|

|

|

A

.

|

Yes. Once you have exercised your rights, you may withdraw your exercise at any time prior to the deadline for withdrawal, but not thereafter, by following the procedures described under “The 2019 Rights Offering

–

Withdrawal of Exercise of Rights,” subject to applicable law. The deadline for withdrawal is 5:00 p.m., New York City time, on the business day prior to the expiration date. Unless the 2019 rights offering is extended, the deadline for withdrawal will be 5:00 p.m., New York City time, on. , 2019.

|

|

|

|

|

Q.

|

Will I be charged any fees if I withdraw my rights?

|

|

|

|

|

A

.

|

We will not charge a fee to holders for withdrawing their rights. However, any holder withdrawing its rights through a broker, dealer or nominee will be responsible for any fees charged by its broker, dealer or nominee.

|

|

|

|

|

Q.

|

If I exercise my rights, when will I receive the shares for which I have subscribed?

|

|

|

|

|

A

.

|

We will issue the shares of common stock for which subscriptions have been properly delivered to the subscription agent prior to the expiration date, as soon as practicable following the expiration date. We will not be able to calculate the number of shares of common stock to be issued to each exercising holder of rights until the expiration date, which is the latest time by which rights certificates may be delivered to the subscription agent.

|

|

|

|

|

Q.

|

Are there any risks in exercising my rights?

|

|

|

|

|

A

.

|

Yes. The exercise of your rights involves risks. Exercising your rights means buying additional shares of our common stock and should be considered as carefully as you would consider any other equity investment. You should carefully read the section entitled “Risk Factors” beginning on page

16

of this prospectus and all other information included or incorporated by reference in this prospectus in its entirety before you decide whether to exercise your rights.

|

|

|

|

|

Q.

|

Has the Company or the Board of Directors made a recommendation as to whether I should exercise my rights or how I should pay my subscription price?

|

|

|

|

|

A

.

|

No. Neither we nor the Board of Directors have made any recommendation as to whether you should exercise your rights. You should decide whether to subscribe for common stock or simply take no action with respect to your rights, based on your own assessment of your best interests. However, if you do not exercise your rights, you will lose any value inherent in the rights and your percentage ownership interest in us will be diluted. As of the date of this prospectus, none of our directors or executive officers has definitively indicated an intention with respect to participation in the 2019 rights offering. Some of our executive officers and directors may exercise some or all of their rights.

|

|

|

|

|

Q.

|

What are the U.S. federal income tax consequences of the receipt and exercise of the rights?

|

|

|

|

|

A

.

|

We have received an opinion of counsel to the effect that, among other things, for U.S. federal income tax purposes, (i) no gain or loss should be recognized by us as a result of the distribution of rights and (ii) no gain or loss should be recognized by, and no amount should be included in the income of, holders of our common stock upon the receipt of rights. Stockholders who receive rights should not recognize taxable income, gain or loss in connection with the exercise of such rights pursuant to the 2019 rights offering. For a more complete summary of the material U.S. federal income tax consequences of the receipt and exercise of rights to our stockholders, please see “Material U.S. Federal Income Tax Consequences.”

|

|

|

|

|

Q.

|

Does the 2019 rights offering require a vote of the Company’s stockholders?

|

|

|

|

|

A

.

|

Yes. The 2019 rights offering is conditioned upon, among other things, receipt of stockholder approval of (i) an amendment to our restated certificate of incorporation to increase the authorized number of shares of common stock that we may permissibly issue from 200,000,000 to 500,000,000, (ii) the Equitization Transactions, including the acquisition of additional shares of stock by B. Riley and Vintage as part of the Backstop Exchange Agreement, the Tranche A-1 Debt Exchange and the issuance and exercise of warrants in the Warrant Issuance, and (iii) an amendment to our restated certificate of incorporation to renounce any interest or expectancy in, or in being offered an opportunity to participate in, any business opportunity that is presented to B. Riley, Vintage, or their respective directors, officers, shareholders, or employees. We intend to seek stockholder approval of these matters at our 2019 annual meeting of stockholders.

|

As part of our 2019 annual meeting of stockholders, we are also seeking approval for, among other things, a reverse stock split to be completed following the Equitization Transactions.

|

|

|

|

Q.

|

What should I do if I have other questions?

|

|

|

|

|

A

.

|

If you have questions or need assistance, please contact , the information agent for the 2019 rights offering, at , or email at .

|

PROSPECTUS SUMMARY

The following summary provides an overview of certain information contained elsewhere or incorporated by reference in this prospectus. This summary may not contain all the information that is important to you or that you should consider before deciding to invest in our common stock. You should carefully read this prospectus and the registration statement of which it is a part, as well as documents incorporated by reference, in their entirety before deciding to invest in our common stock, including the information discussed under “Risk Factors” in this prospectus and under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as the information presented in our consolidated financial statements and related notes, included in our Annual Report on Form 10-K for the year ended December 31, 2018, which is incorporated by reference in this prospectus. Certain statements contained in this summary are forward-looking statements that involve risk and uncertainty. Our actual results may differ significantly for future periods. See “Cautionary Note Regarding Forward-Looking Statements.”

Our Company

We are a leading technology-based provider of advanced fossil and renewable power generation and environmental equipment that includes a broad suite of boiler products, environmental systems, and services for power and industrial uses. We specialize in technology and engineering for power generation and various other industries, including the procurement, erection and specialty manufacturing of related equipment, and services, including:

|

|

|

|

•

|

high-pressure equipment for energy conversion, such as boilers fueled by coal, oil, bitumen, natural gas, and renewables including municipal solid waste and biomass fuels;

|

|

|

|

|

•

|

environmental control systems for both power generation and industrial applications to incinerate, filter, capture, recover and/or purify air, liquid and vapor-phase effluents from a variety of power generation and specialty manufacturing processes;

|

|

|

|

|

•

|

aftermarket support for the global installed base of operating plants with a wide variety of products and technical services including replacement parts, retrofit and upgrade capabilities, field engineering, construction, inspection, operations and maintenance, condition assessment and other technical support;

|

|

|

|

|

•

|

custom-engineered comprehensive dry and wet cooling solutions;

|

|

|

|

|

•

|

gas turbine inlet and exhaust systems, custom silencers, filters and custom enclosures; and

|

|

|

|

|

•

|

engineered-to-order services, products and systems for energy conversion worldwide and related auxiliary equipment, such as burners, pulverizers, soot blowers and ash and material handling systems.

|

Our overall activity depends significantly on the capital expenditures and operations and maintenance expenditures of global electric power generating companies, other steam-using industries and industrial facilities with environmental compliance and noise abatement needs. Several factors influence these expenditures, including:

|

|

|

|

•

|

prices for electricity, along with the cost of production and distribution including the cost of fuel within the United States or internationally;

|

|

|

|

|

•

|

demand for electricity and other end products of steam-generating facilities;

|

|

|

|

|

•

|

requirements for environmental and noise abatement improvements;

|

|

|

|

|

•

|

expectation of future requirements to further limit or reduce greenhouse gas and other emissions in the United States and internationally;

|

|

|

|

|

•

|

environmental policies which include waste-to-energy or biomass as options to meet legislative requirements and clean energy portfolio standards;

|

|

|

|

|

•

|

level of capacity utilization at operating power plants and other industrial uses of steam production;

|

|

|

|

|

•

|

requirements for maintenance and upkeep at operating power plants to combat the accumulated effects of usage;

|

|

|

|

|

•

|

overall strength of the industrial industry; and

|

|

|

|

|

•

|

ability of electric power generating companies and other steam users to raise capital.

|

Customer demand is heavily affected by the variations in our customers' business cycles and by the overall economies and energy, environmental and noise abatement needs of the countries in which they operate.

Recent Strategic Business and Financing Developments

On April 5, 2019, we announced that we paid a combined £70 million (approximately $91.6 million at exchange rates at the time of announcement) to the customers on our two remaining European Vølund loss projects – referred to as the “second” and “fifth” projects in previous communications – in exchange for significantly limiting our obligations under these contracts, including a waiver of the customer’s rejection and termination rights on the fifth project. We agreed to provide construction services on the fifth project to complete key systems of the plant, not to exceed a minimal cost to complete. The settlement also eliminates all historical claims and remaining liquidated damages. Upon completion of these activities in accordance with the settlement, we will have no further obligation related to the fifth project other than customary warranty of core products. For the second project, the settlement clearly defines and limits the remaining performance obligations and settles prior claims. We expect to turn over the second project in May 2019 and will then assume the plant’s operations and maintenance under a separate contract.

We also entered into a settlement in connection with an additional European waste-to-energy EPC contract for which notice to proceed was not given and the contract was not started. The settlement limits our obligations to core scope activities and eliminates risk related to us acting as the prime EPC should the project move forward.

On April 5, 2019, we also announced that we had taken action to strengthen our financial position. This included securing additional financing and amending our U.S. credit agreement with our current lenders. The amendment provided for an additional $150.0 million of financing from B. Riley through Tranche A-3 last-out term loans as well as an incremental uncommitted facility of up to $15.0 million to be provided by B. Riley or an assignee. The proceeds from the Tranche A-3 last-out term loans were used to pay the amounts due under the settlement agreements described above and for working capital and general corporate purposes. The amendment also, among other things, modified various covenants in our U.S. credit agreement going forward to provide us with additional operational flexibility and created an event of default if we fail to terminate the existing revolving credit facility under the U.S. credit agreement on or before March 15, 2020. In connection with the amendment, we entered into a letter agreement with B. Riley and Vintage pursuant to which we committed to use our reasonable best efforts to effect the following Equitization Transactions:

|

|

|

|

•

|

a $50.0 million rights offering allowing our stockholders to subscribe for shares of our common stock at a price of $0.30 per share, the proceeds of which will be used to prepay a portion of the Tranche A-3 last-out term loans under our U.S. credit agreement;

|

|

|

|

|

•

|

the exchange of Tranche A-1 last-out term loans under our U.S. credit agreement for shares of our common stock at a price of $0.30 per share; and

|

|

|

|

|

•

|

the issuance to B. Riley or its designees of an aggregate 16,666,667 warrants, each to purchase one share of our common stock at an exercise price of $0.01 per share.

|

In order to complete the Equitization Transactions and certain other planned transactions, we also committed to seek stockholder approval of, among other actions, (i) an amendment to our restated certificate of incorporation to increase the authorized number of shares of common stock that we may permissibly issue from 200,000,000 to 500,000,000, (ii) the Equitization Transactions, including the acquisition of additional shares of stock by B. Riley and Vintage as part of the Backstop Exchange Agreement, the Tranche A-1 Debt Exchange and the issuance and

exercise of warrants in the Warrant Issuance, (iii) an amendment to our restated certificate of incorporation to waive our expectation of certain corporate opportunities presented to B. Riley or Vintage and (iv) a reverse stock split to be completed following the Equitization Transactions.

As contemplated by the letter agreement, on April 30, 2019 we entered into an investor rights agreement with B. Riley and Vintage, which we refer to as the Investor Rights Agreement, providing each of them with certain governance rights, including (i) the right for B. Riley and Vintage to each nominate up to three individuals to serve on the Board of Directors, subject to certain continued lending and equity ownership thresholds, and (ii) pre-emptive rights permitting B. Riley to participate in future issuances of our equity securities. The rights provided to B. Riley and Vintage as part of the Investor Rights Agreement will remain in full force and effect regardless of whether we are able to complete all or any part of the Equitization Transactions. For additional detail on the Investor Rights Agreement, see “The Equitization Transactions

–

Investor Rights Agreement.”

In connection with the letter agreement, we also committed, subject to stockholder approval and in consultation with B. Riley and Vintage, to establish an equity pool of 16,666,666 shares of our common stock for issuance for long-term incentive planning, upon such terms (including any vesting period or performance targets), in such amounts and forms of awards as the Compensation Committee of the Board of Directors determines. We are seeking stockholder approval to amend and restate the 2015 LTIP to authorize the issuance of additional shares of our common stock in order to satisfy this obligation.

The 2019 Rights Offering

The Offer

We are distributing, at no charge, to the holders of our common stock as of the 2019 rights offering record date of 5:00 p.m., New York City time, on , 2019, non-transferable rights to purchase up to an aggregate of 166,666,667 newly-issued shares of our common stock. Each holder of our common stock as of the 2019 rights offering record date will receive one right for each share of common stock held as of the 2019 rights offering record date. Each right entitles the holder to purchase shares of our common stock at the subscription price of $0.30 per whole share of common stock. The gross proceeds from the 2019 rights offering will be approximately $50 million after giving effect to the backstop exchange commitment.

Rights may be exercised at any time during the subscription period, which commences on , 2019, and ends at 5:00 p.m., Eastern Time, on , 2019, the expiration date, unless extended by us. The subscription period may be extended as described in this prospectus. Following commencement of the 2019 rights offering, we may not amend the terms of the 2019 rights offering without the consent of B. Riley; however, we may extend the subscription period for up to 10 days without the prior written consent of B. Riley.

Rights may only be exercised in aggregate for whole numbers of shares of our common stock; no fractional shares of our common stock will be issued in the 2019 rights offering. Any fractional shares of our common stock created by the exercise of the rights will be rounded to the nearest whole share. Further, you will not be entitled to exercise an oversubscription privilege to purchase additional shares of common stock that may remain unsubscribed as a result of any unexercised rights in the 2019 rights offering.

If the 2019 rights offering is terminated, all rights will expire without value and we will promptly arrange for the refund, without interest, of all funds received from holders of rights. All monies received by the subscription agent in connection with the 2019 rights offering will be held by the subscription agent, on our behalf, in a segregated interest-bearing account at a negotiated rate. All such interest shall be payable to us even if we determine to terminate the 2019 rights offering and return your subscription payment.

Purpose of the 2019 Rights Offering

As discussed in greater detail elsewhere in this prospectus, in April 5, 2019, we announced that we paid a combined £70 million (approximately $91.6 million at exchange rates at the time of announcement) to the customers on our two remaining European Vølund loss projects – referred to as the “second” and “fifth” projects in previous

communications – in exchange for significantly limiting the Company’s obligations under these contracts, including a waiver of the customer’s rejection and termination rights on the fifth project. On April 5, 2019, we also announced that we had amended our U.S. credit agreement with our current lenders. The amendment provided an additional $150.0 million of financing from B. Riley through Tranche A-3 last-out term loans as well as an incremental uncommitted facility of up to $15.0 million to be provided by B. Riley or an assignee. The proceeds from the Tranche A-3 last-out term loans were used to pay the amounts due under these settlement agreements on our two remaining European Vølund loss projects and for working capital and general corporate purposes.

In connection with this amendment, we agreed to use our reasonable best efforts to effect a series of transactions intended to equitize a portion of the last-out term loans outstanding under our U.S. credit agreement through the Equitization Transactions. The 2019 rights offering is intended to satisfy our obligation to effect the first of the Equitization Transactions, and, as a result, the proceeds from the 2019 rights offering will be used to repay a portion of our Tranche A-3 last-out term loans under the U.S. credit agreement.

Backstop Exchange Agreement

On April 30, 2019, we entered into the Backstop Exchange Agreement with B. Riley. Pursuant to the Backstop Exchange Agreement, B. Riley has agreed to purchase from us, at a price per share equal to the subscription price, all unsubscribed shares of common stock in the 2019 rights offering for cash or by exchanging an equal principal amount of Tranche A-2 or Tranche A-3 last-out term loans. B. Riley’s purchase of shares of our common stock pursuant to the Backstop Exchange Agreement will be completed in a transaction exempt from the registration requirements of the Securities Act of 1933, as amended, which we refer to as the Securities Act. B. Riley will not receive any fee for acting as backstop for the 2019 rights offering, however, we have agreed to reimburse B. Riley for all reasonable out-of-pocket costs and expenses it incurs, including fees for its legal counsel.

Our obligations and the obligations of B. Riley to consummate the transactions contemplated by the Backstop Exchange Agreement are subject to the satisfaction of each of the following conditions (which may be waived in whole or in part by either party with respect to itself in its sole discretion), which we refer to as the joint conditions:

|

|

|

|

(i)

|

the registration statement relating to the 2019 rights offering shall have been declared effective by the SEC and shall continue to be effective and no stop order shall have been entered by the SEC with respect thereto;

|

|

|

|

|

(ii)

|

the 2019 rights offering shall have been conducted in accordance with the Backstop Exchange Agreement in all material respects without the waiver of any condition thereto;

|

|

|

|

|

(iii)

|

all material governmental and third-party notifications, filings, consents, waivers, and approvals required for the consummation of the transactions contemplated by the Backstop Exchange Agreement, including the 2019 rights offering, shall have been made or received;

|

|

|

|

|

(iv)

|

no action shall have been taken, no statute, rule, regulation, or order shall have been enacted, adopted, or issued by any federal, state, or foreign governmental or regulatory authority, and no judgment, injunction, decree, or order of any federal, state or foreign court shall have been issued that, in each case, prohibits the implementation of the 2019 rights offering and the issuance and sale of our common stock in the 2019 rights offering or materially impairs the benefit of implementation thereof, and no action or proceeding by or before any federal, state, or foreign governmental or regulatory authority shall be pending or, to the knowledge of the parties, threatened wherein an adverse judgment, decree, or order would be reasonably likely to result in the prohibition of or material impairment of the benefits of the implementation of the 2019 rights offering and the issuance and sale of our common stock in the 2019 rights offering;

|

|

|

|

|

(v)

|

we shall have received requisite stockholder approval of each of (i) the receipt of stockholder approval of a proposal to approve the Equitization Transactions, (ii) the receipt of stockholder approval of a proposal to increase authorized shares, and (iii) the receipt of stockholder approval of a proposal to renounce certain corporate opportunities (the “Equitization Proposals”); and

|

|

|

|

|

(vi)

|

the shares of our common stock to be issued in the 2019 rights offering shall have been approved for listing on the NYSE, subject to official notice of issuance; provided, however, that this condition will not apply in the event our common stock ceases to be listed and traded on the NYSE on or prior to the closing.

|

If required, the Company and B. Riley will file a Premerger Notification and Report Form under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, with the Federal Trade Commission and the Antitrust Division of the U.S. Department of Justice in connection with B. Riley's acquisition of common stock in the Equitization Transactions.

In addition to the joint conditions, our obligation to issue and sell to B. Riley shares of our common stock under the Backstop Exchange Agreement is subject to the satisfaction of each of the following conditions (which may be waived in whole or in part by us in our sole discretion):

|

|

|

|

(i)

|

the representations and warranties of B. Riley made in the Backstop Exchange Agreement shall be true and correct in all material respects; and

|

|

|

|

|

(ii)

|

B. Riley has performed and complied in all material respects with all covenants and agreements contained in the Backstop Exchange Agreement.

|

In addition to the joint conditions, B. Riley’s obligation to purchase shares of our common stock under the Backstop Exchange Agreement is subject to the satisfaction of each of the following conditions (which may be waived in whole or in part by B. Riley in its sole discretion):

|

|

|

|

(i)

|

our representations and warranties made in the Backstop Exchange Agreement shall be true and correct in all material respects; and

|

|

|

|

|

(ii)

|

we have performed and complied in all material respects with all covenants and agreements contained in the Backstop Exchange Agreement.

|

In addition to the foregoing, our obligation to commence and consummate the 2019 rights offering under the Backstop Exchange Agreement is subject to conditions set forth in "The 2019 Rights Offering

–

Backstop Exchange Agreement

–

Conditions to the Backstop Exchange Commitment."

See “The Rights Offering

–

Backstop Exchange Agreement” for additional information.

Use of Proceeds

We expect to use the proceeds from the 2019 rights offering to partially repay the indebtedness outstanding and our other obligations under the Tranche A-3 last-out term loans under our U.S. credit agreement. See “Use of Proceeds.”

Subscription and Information Agent

will act as the information agent in connection with the 2019 rights offering. You may contact the information agent with questions at . will act as the subscription agent in connection with the 2019 rights offering. You may contact the subscription agent with questions at .

Exchange of Tranche A-1 Last-Out Term Loans

Concurrent with the closing of the 2019 rights offering, we expect to complete a debt-for-equity exchange with the holders of all outstanding Tranche A-1 last-out term loans under the U.S. credit agreement, pursuant to which we will exchange shares of our common stock at the subscription price of $0.30 per share for an equal aggregate principal amount of Tranche A-1 last-out term loans under the U.S. credit agreement.

As of December 31, 2018, all outstanding Tranche A-1 last-out term loans under the U.S. credit agreement were held by Vintage. Subject to certain limited exceptions, Vintage may transfer part or all of the Tranche A-1 last-out term loans prior to the completion of the Tranche A-1 Debt Exchange, including to B. Riley. Approval of this proposal

would include the approval of any shares of our common stock issued to Vintage or B. Riley, as applicable, in connection with the Tranche A-1 Debt Exchange. All shares of our common stock issued pursuant to the Tranche A-1 Debt Exchange will be issued in a transaction exempt from registration under the Securities Act, and we will not have any obligation to issue shares of our common stock to any person in the absence of such an exemption from registration.

The completion of the Tranche A-1 Debt Exchange will be conditioned on, among other things, the closing of the 2019 rights offering.

Based on approximately $37.1 million aggregate principal amount of Tranche A-1 last-out term loans under the U.S. credit agreement outstanding as of April 4, 2019, if the Tranche A-1 Debt Exchange is completed, we would issue an aggregate of approximately 123.7 million shares of our common stock to holders of the Tranche A-1 last-out term loans. The actual number of shares of our common stock that we issue in the Tranche A-1 Debt Exchange will likely be greater than this amount because the Tranche A-1 last-out term loans accrue interest through the date of the exchange at a fixed rate per annum of 7.5% payable in cash and 8% payable in kind.

Issuance of the Warrants

Concurrently with the Tranche A-1 Debt Exchange, we intend to issue to B. Riley, or such other persons as B. Riley directs, an aggregate of 16,666,667 warrants, each exercisable for one right to purchase one share of our common stock at a purchase price of $0.01 per share. These warrants, and the shares of our common stock issuable upon exercise, will be issued in transactions exempt from registration under the Securities Act. For more information, see “The Equitization Transactions

–

Issuance of the Warrant.”

The 2019 Annual Meeting of Stockholders

Our 2019 annual meeting of stockholders is scheduled to take place on , 2019. At the 2019 annual meeting of stockholders, we will ask our stockholders to approve, among other proposals, the following proposals for general improvements in our corporate governance framework and proposals necessary for the conduct of the Equitization Transactions:

|

|

|

|

•

|

an amendment to our restated certificate of incorporation to increase the authorized number of shares of our common stock from 200,000,000 to 500,000,000 shares;

|

|

|

|

|

•

|

an amendment to our restated certificate of incorporation to declassify the Board of Directors;

|

|

|

|

|

•

|

amendments to our restated certificate of incorporation to remove provisions that require the affirmative vote of holders of at least 80% of the voting power to approve certain amendments to our restated certificate of incorporation and our bylaws, and replace this requirement with a majority vote requirement;

|

|

|

|

|

•

|

approval of the Equitization Transactions;

|

|

|

|

|

•

|

an amendment to our restated certificate of incorporation to renounce any interest or expectancy of the Company in, or in being offered an opportunity to participate in, any business opportunity that is presented to B. Riley, Vintage or their respective directors, officers, shareholders, or employees; and

|

|

|

|

|

•

|

an amendment to our restated certificate of incorporation to effect a reverse stock split of our common stock.

|

The 2019 rights offering is conditioned on, among other things, stockholder approval of the proposals regarding the increase in the authorized number of shares of our common stock, the Equitization Transactions and the renunciation of business opportunities at our 2019 annual meeting of stockholders.

Dilutive Effects of the Equitization Transactions

If the Equitization Transactions are consummated, we will issue approximately 290.4 million shares of common stock. Based on the number of shares of common stock outstanding as of April 25, 2019, the shares issued in the Equitization Transactions will represent approximately 63% of the total shares of common stock outstanding following the Equitization Transactions. This excludes the 16,666,667 shares of common stock subject to issuance pursuant to the exercise of warrants issued in the Equitization Transactions as well shares of common stock reserved for issuance under the 2015 LTIP. The actual number of shares of common stock issued in the Equitization Transactions may be higher than the amount indicated, however, due to, among other things, the accumulation of paid-in-kind interest on the outstanding Tranche A-1 last-out term loans under our U.S. credit agreement through the completion of the Tranche A-1 Debt Exchange.

If a stockholder does not exercise any rights in the 2019 rights offering, the number of shares of our common stock that such stockholder owns will not change. However, we intend to issue an aggregate 166,666,667 shares of our common stock through the 2019 rights offering and the backstop exchange commitment. If a stockholder does not exercise its rights in the 2019 rights offering in full, its percentage ownership will be materially diluted after the 2019 rights offering. Further, because we will issue additional shares of our common stock in the other Equitization Transactions and our stockholders (other than B. Riley and Vintage) will not be given the opportunity to participate in those issuances, our stockholders (other than B. Riley and Vintage) will see their percentage ownership materially diluted following the other Equitization Transactions regardless of whether they exercise their rights to participate in the 2019 rights offering.

For additional information on the possible dilutive effects of the Equitization Transactions, see “The 2019 Rights Offering

–

Dilutive Effects of the Equitization Transactions.”

Interests of Our Officers, Directors and Principal Stockholders in the Equitization Transactions

B. Riley and Vintage are each significant stockholders of, and lenders to, the Company. A total of five of our seven directors on the Board of Directors have been designated by either Vintage or B. Riley pursuant to the Investor Rights Agreement. In addition, we are party to a consulting agreement with B. Riley for the services of our Chief Executive Officer. We have also entered into or will enter into various agreements with each of B. Riley and Vintage to implement the Equitization Transactions. These various agreements and relationships may result in B. Riley and Vintage, and any associated directors and officers of the Company, having interests that may be different from those of our stockholders generally.

In addition, a change in control under certain of our employee compensation plans and awards and management severance agreements would require the accelerated vesting of all outstanding and unvested equity awards. If a change in control were to occur following the completion of the Equitization Transactions, certain members of management would be entitled to cash-based severance payments, health and welfare benefits, and bonus payments if such members of senior management are terminated without cause or for good reason (each as defined in the applicable employee compensation plans and awards and management severance agreements) within 24 months following the change in control.

Risk Factors

You should carefully read and consider the risk factors contained in our Annual Report on Form 10-K for the year ended December 31, 2018, and in the “Risk Factors” section beginning on page

16

of this prospectus, together with all of the other information included in or incorporated by reference into this prospectus, before you decide to exercise your subscription rights to purchase shares of our common stock.

Corporate Information

Our principal executive offices are located at 20 South Van Buren Avenue, Barberton, Ohio 44203. Our telephone number is (330) 753-4511. Our website is http://www.babcock.com. The information contained on or accessible

through our website is not part of this prospectus, other than the documents that we file with the SEC that are explicitly incorporated by reference into this prospectus.

Additional Information

For additional information regarding our business, financial condition and results of operations as well as other important information about us, please see our filings with the SEC incorporated by reference in this prospectus. For instructions on how to find copies of these documents, see “Where You Can Find More Information.”

RISK FACTORS

An investment in our common stock involves risk. You should consider carefully the risks described below, along with the information discussed under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2018, which is incorporated by reference into this prospectus, together with all the other information included in this prospectus and in the documents we have incorporated by reference. The occurrence of any of the events described could have a material adverse effect on our business, financial condition, results of operations, cash flows, prospects or the value of our common stock. These risks are not the only ones that we face. Additional risks not currently known to us or that we currently deem immaterial also may impair our business. See “Where You Can Find More Information.”

Risks Related to Our Business

You should read and consider risk factors specific to our business before making an investment decision. Those risks are described in the section entitled “Risk Factors

–

Risks Relating to Our Industry and Our Business” in our Annual Report on Form 10-K for the year ended December 31, 2018. Please be aware that additional risks and uncertainties not currently known to us or that we currently deem to be immaterial could also materially and adversely affect our business, results of operations, financial condition, cash flows, prospects or the value of our common stock.

Risk Factors Relating to the 2019 Rights Offering

We reserve the right to cancel, terminate, amend, or extend the 2019 rights offering at any time prior to the expiration date. If we cancel the 2019 rights offering, neither we nor the subscription agent will have any obligation to you, except to return your subscription payments.

We reserve the right to amend, extend, terminate or cancel the 2019 rights offering on or prior to the expiration date for any reason in our sole discretion. In addition, we may cancel the 2019 rights offering if at any time before completion of the 2019 rights offering there is any judgment, order, decree, injunction, statute, law or regulation entered, enacted, amended or held to be applicable to the 2019 rights offering that in our sole judgment would or might make the 2019 rights offering or its completion, whether in whole or in part, illegal or otherwise restrict or prohibit completion of the 2019 rights offering. If we cancel the 2019 rights offering, in whole or in part, all affected rights will expire without value, and all subscription payments received by the subscription agent will be returned, without interest or penalty, as soon as practicable, and we will promptly arrange for the refund, without interest, of all funds received from holders of rights. All monies received by the subscription agent in connection with the 2019 rights offering will be held by the subscription agent, on our behalf, in a segregated interest bearing account at a negotiated rate. All such interest shall be payable to us even if we determine to terminate the 2019 rights offering and return your subscription payment.

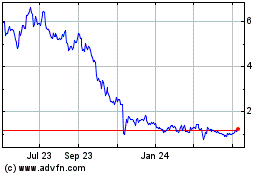

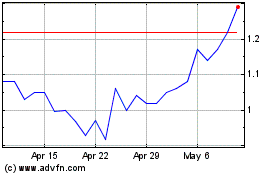

We are currently out of compliance with the NYSE’s minimum share price requirement and are at risk of the NYSE delisting shares of our common stock, which would have an adverse impact on the trading volume, liquidity and market price of shares of our common stock.

On November 27, 2018, we received written notification from the NYSE that we were not in compliance with an NYSE continued listing standard in Rule 802.01C of the NYSE Listed Company Manual because the average closing price of shares of our common stock fell below $1.00 over a period of 30 consecutive trading days. We informed the NYSE that we intend to seek to cure the price condition by executing our strategic plan, which is expected to result in improved operational and financial performance that we expect will ultimately lead to a recovery of the price of shares of our common stock. We can regain compliance with the minimum per share average closing price standard at any time during the six-month cure period if, on the last trading day of any calendar month during the cure period, we have (i) a closing share price of at least $1.00 and (ii) an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of that month. We informed the NYSE that we are also prepared to consider a reverse stock split to cure the deficiency, should such action be necessary, subject to approval of our stockholders, at our next annual meeting. Shares of our common stock could also be delisted if our average market capitalization over a consecutive 30 trading-day period is less than $15.0 million, in which case we would not have an opportunity to cure the deficiency, shares of our common stock would be suspended from trading on the NYSE immediately, and the NYSE would begin the process to delist shares of our common stock, subject to our right to appeal under NYSE rules. We

cannot assure you that any appeal we undertake in these or other circumstances will be successful. While we are considering various options, it may take a significant effort to cure this deficiency and regain compliance with this continued listing standard, and there can be no assurance that we will be able to cure this deficiency or if we will cease to comply with another NYSE continued listing standard.