UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

Commission File Number

001-36876

(Check One)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

Form 10-K

|

¨

|

Form 20-F

|

¨

|

Form 11-K

|

¨

|

Form 10-Q

|

¨

|

Form N-SAR

|

¨

|

Form N-CSR

|

For the period ended

December 31, 2018

|

|

|

|

|

|

|

|

|

¨

|

Transition Report on Form 10-K

|

|

¨

|

Transition Report on Form 10-Q

|

|

¨

|

Transition Report on Form 20-F

|

|

¨

|

Transition Report on Form N-SAR

|

|

¨

|

Transition Report on Form 11-K

|

|

|

|

For the Transition Period Ended: ________________________________

|

|

|

|

|

Read Instruction (on back page) Before Preparing Form. Please print or type.

|

|

Nothing in the form shall be construed to imply that the Commission has verified any information contained herein.

|

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

_____________________________________________________________________________________________________

PART I - REGISTRANT INFORMATION

BABCOCK & WILCOX ENTERPRISES, INC.

Full Name of Registrant

Former Name if Applicable

20 SOUTH VAN BUREN AVENUE

Address of Principal Executive Office

(Street and Number)

BARBERTON, OHIO 44203

City, State and Zip Code

PART II

RULE 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate.)

|

|

|

|

|

|

|

|

(a)

|

The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

|

|

|

|

x

|

(b)

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

|

|

|

|

(c)

|

The accountant's statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

|

|

|

|

PART III - NARRATIVE

State below in reasonable detail the reasons why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-SAR, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

Babcock & Wilcox Enterprises, Inc. (the “Company”) has been delayed in the filing of its Form 10-K for the year ended December 31, 2018 (the “2018 Annual Report”). This delay relates to active settlement negotiations for the Company’s final two renewable energy loss contracts. The proposed settlements of these two contracts are subsequent events that could materially affect the Company’s estimates as of December 31, 2018. As a result, the accounting effect of these negotiations could not be reflected in the Company’s consolidated financial statements as of and for the year ended December 31, 2018, and the Company is currently unable to file the 2018 Annual Report. The Company anticipates that it will be able to file its complete Annual Report on Form 10-K on or before April 2, 2019.

PART IV - OTHER INFORMATION

(1) Name and telephone number of person to contact in regard to this notification

|

|

|

|

|

|

|

|

|

Louis Salamone

|

|

330

|

|

753-4511

|

|

(Name)

|

|

(Area Code)

|

|

(Telephone Number)

|

(2) Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If the answer is no, identify report(s).

(3) Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portions thereof?

If so: attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

As discussed above, the Company is in the process of preparing and finalizing its consolidated financial statements as of and for the year ended December 31, 2018 and, therefore, cannot provide significant quantitative estimates of its results of operations for such period. The Company recorded higher operating losses in 2018 than in 2017. The most significant driver of the Company’s operating losses was the charges for its six European Renewable loss contracts, which were also higher in 2018 than 2017, inclusive of warranty expense, from changes in the estimated revenues and costs to complete these contracts. As of March 18, 2019, four of the six Renewable loss contracts had been turned over to the customer, with only punchlist or agreed remediation items remaining, many of which are expected to be performed during the customers’ scheduled maintenance outages. This applies to the first, third, fourth and sixth contracts, as previously disclosed. The customers for the second and fifth contracts are related parties, and the Company is in active settlement discussions to pay a sum to both to waive the rejection and termination rights under the fifth contract as well as limit the Company’s remaining performance obligations on both contracts.

The Company’s Industrial segment losses were higher in 2018 than in 2017 primarily driven by increases in estimated costs to complete new build cooling systems contracts sold under a previous strategy and lower volumes of aftermarket cooling system services. The Company’s Industrial segment’s 2018 results also include bad debt expense of $9.3 million and legal expenses related to legacy litigation. The Industrial segment previously included the Company’s former MEGTEC and Universal businesses that were sold on October 5, 2018. Beginning with the second quarter of 2018, the MEGTEC and Universal businesses were presented as discontinued operations because the disposal represents a strategic shift that had a major effect on the Company’s operations.

The Company’s Power segment generated lower income in 2018 than 2017. The Company anticipated the decline in the global new build market for coal-fired power generation and from lower demand for retrofit projects resulting from previously enacted Coal Combustion Residue regulations in the U.S. and took proactive restructuring actions in the segment largely to maintain the gross profit percentage and continue to generate strong earnings and cash flow from the segment.

Through the Company’s restructuring efforts, it made significant strides to make its cost structure more variable and to reduce costs. The Company has identified additional initiatives that are underway as of the date of this filing that are expected to further reduce costs, and it expects to continue to explore other cost saving initiatives to improve cash generation and to evaluate additional non-core asset sales to reduce its debt.

Year-over-year comparisons of the Company’s results from continuing operations were also affected by:

|

|

|

|

•

|

$39.8 million pre-tax gain in 2018 for the sale of PBRRC, a subsidiary that held two operations and maintenance contracts for waste-to-energy facilities in West Palm Beach, Florida. Prior to the divestiture, PBRRC generated annual

|

revenues of approximately $60 million in the Renewable segment. The Company received cash proceeds of $38.9 million, net of certain working capital adjustments and $4.9 million deposited in escrow.

|

|

|

|

•

|

$49.2 million debt extinguishment loss from early repayment of the Second Lien Term Loan Facility on May 4, 2018 with $214.9 million of the proceeds from a Rights Offering that was completed on April 30, 2018. Through the Rights Offering, the Company raised $248.4 million of gross proceeds and issued 124.3 million shares of common stock.

|

|

|

|

|

•

|

$99.6 million of non-cash income tax charges in 2018 to increase the valuation allowance against the Company’s remaining net deferred tax assets. In 2017, $62.4 million of deferred tax expense was recorded primarily from the revaluation of its deferred tax balances.

|

|

|

|

|

•

|

$(67.5) million and $8.7 million of actuarially determined mark-to-market (losses) gains on the Company’s pension and other postretirement benefits in 2018 and 2017, respectively.

|

|

|

|

|

•

|

$40.0 million and $86.9 million of goodwill and other intangible impairments in 2018 and 2017, respectively. The 2018 impairment charges were to fully impair goodwill related to the SPIG reporting unit and to impair other intangibles related to SPIG geographies that will be exited. The 2017 impairment charges fully impaired the goodwill of the Renewable reporting unit and $36.9 million related to the SPIG reporting unit.

|

|

|

|

|

•

|

$17.8 million and $2.7 million of financial advisory services in 2018 and 2017, respectively, which are required under the U.S. Revolving Credit Facility.

|

•

$16.8 million and $15.0 million of restructuring and spin-off costs were recognized in 2018 and 2017, respectively.

|

|

|

|

•

|

$6.5 million of gain on the sale of the Company’s interest in Babcock & Wilcox Beijing Company, Ltd., an equity method investment in China, that was recognized in the first quarter of 2018. The sale was completed in early 2018 with proceeds, net of withholding tax, of $19.8 million.

|

|

|

|

|

•

|

$18.4 million and $18.2 million of other-than-temporary impairment of the Company’s interest in Thermax Babcock & Wilcox Energy Solutions Private Limited, an equity method investment in India, in the first quarter of 2018 and the second quarter of 2017, respectively, based on an agreement to sell, preceded by a change in strategy. The Company completed the sale in July 2018, which generated $15.0 million for the sale and settlement of contractual claims.

|

|

|

|

|

•

|

$2.9 million of accelerated depreciation expense in the second half of 2018 for fixed assets affected by the announcement in September 2018 that the Company would be consolidating office space and relocating its global headquarters to Akron, Ohio from Charlotte, North Carolina in mid-2019.

|

|

|

|

|

•

|

$1.5 million to dispose and write off unused IT equipment and cancel in-process IT projects in the second quarter of 2018.

|

•

$1.5 million of acquisition and integration costs in 2017 related to the acquisition of its SPIG business.

|

|

|

|

•

|

$77.8 million of impairment and loss on sale of the Company’s former MEGTEC and Universal businesses in October 2018, which remains subject to adjustment. The loss is included in Loss from discontinued operations, net of tax.

|

In an effort to address our liquidity needs from the accrued losses on the six European Vølund loss contracts, we have:

•

raised gross proceeds of $248.4 million on April 30, 2018 through the Rights Offering;

•

repaid on May 4, 2018 the Second Lien Term Loan Facility that had been in default beginning March 1, 2018;

|

|

|

|

•

|

completed the sale of the MEGTEC and Universal businesses on October 5, 2018, for $130 million, subject to adjustment, resulting in receipt of $112.0 million in cash, net of $22.5 million in cash sold with the businesses, and $7.7 million that was deposited in escrow pending final settlement of working capital and other customary matters;

|

|

|

|

|

•

|

completed the sale of Palm Beach Resource Recovery Corporation, a subsidiary that held two operations and maintenance contracts for waste-to-energy facilities in West Palm Beach, Florida, on September 17, 2018 for $45 million subject to adjustment, resulting in receipt of $38.9 million in cash and $4.9 million, which was deposited in escrow pending final settlement of working capital and other customary matters;

|

|

|

|

|

•

|

sold equity method investments in Babcock & Wilcox Beijing Company, Ltd., a joint venture in China, and TBWES, a joint venture in India, and settled related contractual claims, resulting in proceeds of $21.1 million in the second quarter of 2018 and $15.0 million in the third quarter of 2018, respectively;

|

|

|

|

|

•

|

sold another non-core business for $5.1 million in the first quarter of 2018;

|

|

|

|

|

•

|

initiated restructuring actions and other additional cost reductions beginning in the second quarter of 2018 that are designed to save approximately $84 million annually;

|

|

|

|

|

•

|

received $30 million in net proceeds from the Last Out Term Loan, from B. Riley FBR, Inc., a related party, in September and October 2018 (the Last Out Term Loan was assigned to Vintage Capital Management LLC, another related party, on November 19, 2018); and

|

|

|

|

|

•

|

entered into several waivers and amendments to avoid default under the U.S. Revolving Credit Facility. Under the most recent limited waiver, which was entered into on March 15, 2019 and is expected to expire at 5:00 p.m., New York City time, on March 25, 2019, the Company’s lenders agreed to waive compliance with the following covenants: (1) that the Company maintain a minimum liquidity amount of $40.0 million as a condition to borrowing both at the time of any credit extension request and on the proposed date of the credit extension (as defined in the Amended Credit Agreement), provided that the Company must maintain a minimum liquidity amount of $35.0 million as a condition to borrowing both at the time of any credit extension request and on the proposed date of the credit extension, (2) that the Company maintain the specified consolidated interest coverage and senior leverage coverage ratios contained in the U.S. Revolving Credit Facility, (3) that certain contract completion milestones be met in connection with one renewable energy project, (4) that net losses in connection with certain renewable energy projects not exceed a designated cap, (5) that the Company’s independent registered public accounting firm certify its consolidated financial statements without a going concern qualification and (6) that certain compliance certificates be delivered to the lenders. The Limited Waiver also waives certain events of default related to development projects in the Renewable segment.

|

FORWARD LOOKING STATEMENTS

This Form 12b-25 contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. You should not place undue reliance on these statements. Statements that include the words "expect," "intend," "plan," "believe," "project," "forecast," "estimate," "may," "should," "anticipate" and similar statements of a future or forward-looking nature identify forward-looking statements. These forward-looking statements address matters that involve risks and uncertainties and include statements regarding the expected settlement of the Company’s final two renewable energy project contracts. There are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. Differences between actual results and any future performance suggested in our forward-looking statements could result from a variety of factors, including the following: the Company’s ability to continue as a going concern; the Company’s ability to obtain and maintain sufficient financing to provide liquidity to meet its business objectives, surety bonds, letters of credit and similar financing; and the Company’s ability to satisfy the liquidity and other requirements under U.S. revolving credit facility as recently amended, including its ability to receive concessions from customers on its Vølund loss contracts and the other risks discussed in the Company’s filings with the Securities and Exchange Commission, including its most recent annual report on Form 10-K and subsequent quarterly reports on Form 10-Q. These factors are not necessarily all the factors that could affect us. The Company assumes no obligation to revise or update any forward-looking statement included in this Form 12b-25 for any reason, except as required by law.

BABCOCK & WILCOX ENTERPRISES, INC.

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

Date: March 18, 2019

|

By:

/s/ Louis Salamone

|

|

|

Name: Louis Salamone

|

|

|

Title: Chief Financial Officer

|

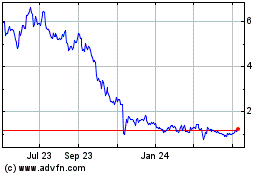

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Mar 2024 to Apr 2024

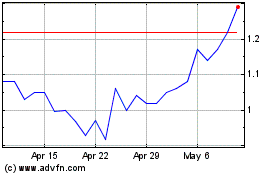

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Apr 2023 to Apr 2024