Current Report Filing (8-k)

March 18 2019 - 6:13AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 15, 2019

|

|

|

|

|

BABCOCK & WILCOX ENTERPRISES, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

DELAWARE

|

001-36876

|

47-2783641

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

20 SOUTH VAN BUREN AVENUE

BARBERTON, OHIO

|

44203

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

(330) 753-4511

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On March 15, 2019, Babcock & Wilcox Enterprises, Inc. (“we”, “our” or the "Company") entered into a limited waiver (the “Limited Waiver”) to our existing credit agreement (as amended, the “Credit Agreement”) with Bank of America, N.A., as administrative agent and lender, and the other lenders party thereto. The Limited Waiver waives our compliance with covenants in the Credit Agreement (1) requiring that we maintain a minimum liquidity amount of $40.0 million as a condition to borrowing both at the time of any credit extension request and on the proposed date of the credit extension (as defined in the Credit Agreement), provided that we must maintain a minimum liquidity amount of $35.0 million as a condition to borrowing both at the time of any credit extension request and on the proposed date of the credit extension, (2) requiring that we maintain the specified consolidated interest coverage and senior leverage coverage ratios contained in the Credit Agreement, (3) specifying certain contract completion milestones that we are required to meet in connection with one renewable energy project, (4) limiting the amount of certain net losses permitted in connection with renewable energy projects, (5) requiring our independent registered public accounting firm certify our consolidated financial statements without a going concern qualification and (6) requiring the delivery of certain compliance certificates. The Limited Waiver also waives certain events of default related to development projects in our Renewables segment. The Limited Waiver will terminate at 5:00 p.m., New York City time, on March 25, 2019 unless earlier terminated upon the occurrence of, among other things, an event of default under the Credit Agreement, our payment of certain fees in connection with one renewable energy project or our failure to maintain a minimum liquidity amount of $35.0 million as a condition to borrowing both at the time of any credit extension request and on the proposed date of the credit extension.

Certain of the lenders, as well as certain of their respective affiliates, have performed and may in the future perform for the Company and its subsidiaries, various commercial banking, investment banking, lending, underwriting, trust services, financial advisory and other financial services, for which they have received and may in the future receive customary fees and expenses.

|

|

|

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information described in Item 1.01 above relating to the Limited Waiver is incorporated herein by reference into this Item 2.03.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

BABCOCK & WILCOX ENTERPRISES, INC.

|

|

|

|

|

|

|

|

|

|

|

|

March 15, 2019

|

By:

|

/s/ J. André Hall

|

|

|

|

|

J. André Hall

|

|

|

|

|

Senior Vice President, General Counsel and Corporate Secretary

|

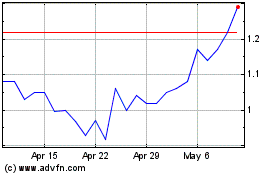

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Mar 2024 to Apr 2024

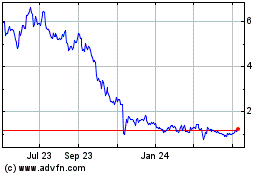

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Apr 2023 to Apr 2024