AB InBev Sales Drained as Virus Closes Bars, Eateries -- WSJ

May 08 2020 - 3:02AM

Dow Jones News

By Saabira Chaudhuri

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 8, 2020).

A coronavirus-fueled shutdown of bars, nightclubs and other

drinking venues around the world hammered sales for Anheuser-Busch

InBev SA in the first quarter, a trend the Budweiser brewer warned

would get much worse before it gets better.

AB InBev, the world's largest brewer, reported sharply lower

volumes for the quarter as sales in China were badly hit by the

coronavirus pandemic, starting in late January when parts of the

country went into lockdown. Since then, the U.S., Brazil and many

other major beer markets have gone into lockdown, too, as the virus

spread. AB InBev said it expects the impact from this on its

second-quarter results to be "materially worse" than its first.

It said it was seeing signs of recovery in Asia, which is

emerging from the worst of the pandemic, and sales in the U.S. held

up. Still, indications of a tough three months ahead were already

showing in April numbers. The brewer's global volumes dropped by

32% in April, a far steeper decline than the 9.3% drop it reported

for the first quarter, which ended March 31. It didn't issue

financial guidance for the rest of the year.

The company, which makes one out of every four beers sold

globally, said the decline in China is slowing. Volumes in April

were down just 17% from the previous April. That compares with a

first-quarter decline of 46.5% from the year-earlier quarter. It

also reported higher sales in the quarter in the U.S., where

consumers have been buying far more booze to drink at home,

offsetting a slump from sales at bars and other out-of-home

channels.

Buoyed by those two key markets, AB InBev shares rose 1.4% in

European trading.

The U.S. has been a relative bright spot for global brewers,

with 80% of industry sales on average made through grocery and

liquor stores rather than the other out-of-home channels. Recent

data from research firm Nielsen showed alcohol sales in stores

outstripping growth in overall consumer-goods products.

By contrast, in countries like Colombia and Brazil, AB InBev

relies on bars, clubs and restaurants for more than 50% of its

volumes.

Overall for the quarter, the brewer swung to a loss of $2.25

billion compared with a profit of $3.57 billion a year earlier.

Results were dragged lower by a large mark-to-market loss tied to

the hedging of its share-based employee payment programsas the

company's share price tumbled in the quarter. That was almost

double the mark-to-market gain it saw a year earlier.

Revenue fell 5.8% on an organic basis to $11 billion, lower than

the 5.4% drop analysts had expected.

In the U.S., AB InBev said net sales grew 1.9% but its brands'

overall market share dropped by 50 basis points in the quarter.

While hard seltzer sales have surged, AB InBev's stable of brands

including Bud Light Seltzer, is smaller and launched later than

rival brands.

The results come after rival Molson Coors Brewing Co. last week

reported net sales dropped 8.7% for the quarter and warned that the

uplift from grocery and liquor stores wouldn't be enough to offset

the slump at bars and restaurants, dragging on sales through at

least the end of the year.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

May 08, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

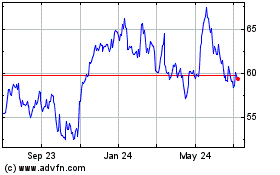

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

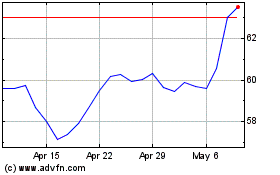

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Apr 2023 to Apr 2024