By Nina Trentmann and Jennifer Maloney

Felipe Dutra, Anheuser-Busch InBev SA's departing finance chief,

said he is leaving the world's biggest brewer to seek a new

challenge after 15 years in the role.

"It's been a long journey," Mr. Dutra said in a brief interview

Thursday. "I want to do something else in life now." He didn't

elaborate.

The company also declined to provide more details on the reason

behind the departure, which was announced Wednesday. But two people

familiar with the matter said Mr. Dutra left the company because he

mismanaged the initial public offering of the company's Asian

business. The unit went public in September, after AB InBev called

off an earlier IPO attempt, citing market conditions.

Mr. Dutra misjudged investor appetite for the listing, one of

the people said.

Mr. Dutra said Thursday that the Asia IPO was "a very successful

transaction from all standards."

Leuven, Belgium-based AB InBev said Wednesday that Mr. Dutra

would step down after the company's annual meeting on April 29. He

will be succeeded by Fernando Tennenbaum, the company's vice

president of finance for South America.

Mr. Dutra, 54 years old, said he thinks AB InBev is in good

shape and that his priority now is to manage the transition to Mr.

Tennenbaum. Mr. Dutra will remain with the company -- the maker of

beers such as Budweiser, Stella Artois and Beck's -- for several

months after the handover, according to AB InBev.

Mr. Dutra has been AB InBev's CFO since January 2005, and in

2014 added the title of chief technology officer to his role. He

played a key role in building the company by striking deals to

integrate assets including Interbrew, Anheuser-Busch International,

Modelo and SABMiller, according to analysts at Jefferies Financial

Group.

"After closing all these actions -- for example, the integration

of SABMiller, deleveraging -- it is a chapter that I am closing,"

Mr. Dutra said. He added that his long tenure had caused him to

grow comfortable in his job as finance and technology chief.

Mr. Dutra's departure is part of a wider management shake-up at

AB InBev that includes the appointment of David Almeida as the

company's chief strategy and technology officer and Nelson Jamel as

chief people officer. The moves come less than a year into the

tenure of Chairman Marty Barrington, who was appointed in March

2019.

"As we move people out of their comfort zone," Mr. Dutra said,

"I am moving out of my comfort zone."

Little is expected to change in AB InBev's strategy when Mr.

Tennenbaum takes over, and the market might welcome a fresh pair of

eyes, analysts at Citigroup Inc. said.

Mr. Tennenbaum, who serves as chief financial and investor

relations officer at AB InBev's Brazilian subsidiary, Ambev, is

known for his more granular guidance. "A similar approach at the AB

InBev group level would be well-received by investors," the

Citigroup analysts said.

Lucas Lira, global vice president of finance and mergers and

acquisitions at AB InBev, will succeed Mr. Tennenbaum as Ambev's

CFO.

AB InBev had $104.5 billion in debt at the end of September,

according to S&P Global Market Intelligence. Mr. Tennenbaum is

expected to continue Mr. Dutra's efforts to reduce the company's

debt pile while focusing on organic growth, analysts at ING Groep

NV said.

"Fernando's mandate will be to ensure AB InBev continues to

invest behind the organic growth of the business while deleveraging

toward the optimal capital structure," Carlos Brito, AB InBev's

chief executive, said in a release.

The company in its latest quarter struggled with declining beer

volumes in the U.S., its biggest market, as consumers move away

from mainstream lagers such as Budweiser and Bud Light in favor of

craft beers and other types of drinks.

Sales in China, Brazil and South Korea were also lower, and

higher commodity prices and foreign-exchange losses also hurt

earnings.

The company's American depositary receipts, which have declined

about 7% this year, were trading at $76.67 recently, unchanged from

Wednesday's close.

Saabira Chaudhuri, Mengqi Sun,

Adria Calatayud

and

Lorena Ruibal

contributed to this article.

Write to Nina Trentmann at Nina.Trentmann@wsj.com and Jennifer

Maloney at jennifer.maloney@wsj.com

(END) Dow Jones Newswires

February 06, 2020 18:49 ET (23:49 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

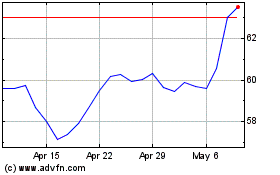

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

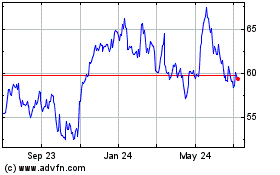

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Apr 2023 to Apr 2024