Biotech Firm Moves to Revive Hong Kong IPO Market--Update

September 11 2019 - 8:54PM

Dow Jones News

By Joanne Chiu and Frances Yoon

A Chinese biotechnology company kicked off what would be Hong

Kong's first sizable listing after a summer of unrest and

stock-market weakness, on the same day the city's exchange-operator

made a surprise bid for its London rival.

The listing by Shanghai Henlius Biotech Inc., which could raise

up to $477 million, would reopen a market that has shrunk sharply

compared with 2018, with a couple of blockbuster deals falling

through. Trade tensions, China's economic slowdown and unrest in

the city have dented market sentiment, and share-trading has

declined year over year.

Companies raised $9.5 billion in IPOs this year through Sept.

11, roughly 40% of the total raised in the same period last year,

according to Dealogic.

In July, Anheuser-Busch InBev SA halted a unit's nearly $10

billion IPO, blaming market conditions, and in August people

familiar with the matter said Alibaba Group Holding Ltd. had

postponed plans for a multibillion-dollar listing in the city.

Late Wednesday, AB InBev said it was resuming its application to

list the Asian unit in Hong Kong, adding that any final decision

about taking the business public would "depend on a number of

factors and prevailing market conditions."

The Shanghai Henlius listing would represent about 12% of its

enlarged share base, and value the company at about $3 billion to

$3.5 billion, according to a term sheet seen by The Wall Street

Journal. The figures don't include an overallotment option to sell

more stock.

Other prospective issuers include consumer lender Home Credit

NV, which is looking to raise up to $1.5 billion and list by early

in the fourth quarter, and Chinese sportswear retailer Topsports

International Holdings Ltd., which aims to raise about $1

billion.

Sungho Im, chief executive at asset-management firm IM Capital

Partners Ltd., said investors' risk appetite is returning.

The city also is playing host to new bond sales. Volumes dipped

to $5.9 billion in August, but were still higher than the same

month a year earlier, and have since recovered to top $7 billion in

the first 11 days of this month, Dealogic says.

The figures cover Hong Kong-listed deals in dollars, yen, or

euros by bond issuers from Asian countries other than Japan.

Deals this week include $2.5 billion of green bonds from

Industrial and Commercial Bank of China's Hong Kong branch, and a

$600 million perpetual bond from Hong Kong insurer FWD Group. It

priced the deal to yield 6.375%, lower than initial guidance for a

yield of around 6.5%, implying solid demand.

In August, three Hong Kong-based bankers said investment

roadshows had been put off until September, including one for a

Chinese developer planning an inaugural dollar-bond sale. Some

bankers have been forced to cancel trips to meet clients or met

them in mainland China, while executives at some Chinese issuers

also delayed trips.

Citigroup's Asia co-head of debt syndicate, Rishi Jalan, said

bond deals this month had been oversubscribed. He said issuers had

to pay little or even negative new-issue premiums to borrow,

meaning some new securities offered lower yields than comparable

existing debt. "Most investors in Hong Kong are international

players who look at global rates and macroeconomic trends while

making investment decisions," Jalan said. "The recent events in

Hong Kong have not dampened investor sentiment in primary bond

markets."

Write to Joanne Chiu at joanne.chiu@wsj.com and Frances Yoon at

frances.yoon@wsj.com

(END) Dow Jones Newswires

September 11, 2019 20:39 ET (00:39 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

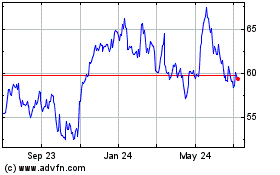

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

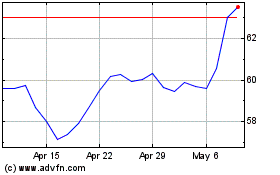

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Apr 2023 to Apr 2024