Current Report Filing (8-k)

February 26 2020 - 4:32PM

Edgar (US Regulatory)

PEABODY ENERGY CORP false 0001064728 0001064728 2020-02-20 2020-02-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 20, 2020

PEABODY ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-16463

|

|

13-4004153

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

701 Market Street, St. Louis, Missouri

|

|

63101-1826

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (314) 342-3400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.01 per share

|

|

BTU

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On February 20, 2020, and effective on such date, the Board of Directors (the “Board”) of Peabody Energy Corporation (the “Company”) (i) voted to increase the size of the Board from 10 directors to 12 directors, creating a total of three vacancies, and (ii) appointed David Miller, Samantha Algaze, and Darren Yeates (the “New Directors”) to serve as directors of the Company to fill the resulting vacancies, with terms expiring at the Company’s 2020 Annual Meeting of Stockholders (the “2020 Annual Meeting”). Mr. Miller will serve as a member of the Board’s Executive Committee and Compensation Committee. Ms. Algaze will serve as a member of the Board’s Nominating and Corporate Governance Committee. Mr. Yeates will serve as a member of the Board’s Health, Safety, Security and Environmental Committee and Audit Committee.

The New Directors were appointed to serve as directors of the Company pursuant to and as contemplated by the Agreement, dated as of February 4, 2020, by and among the Company, Elliott Investment Management L.P., Elliott Associates, L.P. and Elliott International, L.P. (the “Agreement”), which was previously filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on February 5, 2020 (the “Prior Form 8-K”). Other than as described in the Prior Form 8-K and the Agreement, there are no arrangements or understandings between any of the New Directors and any other persons pursuant to which any of the New Directors were named a director of the Company. None of the New Directors have any direct or indirect material interest in any transaction or proposed transaction required to be reported under Item 404(a) of Regulation S-K.

Each of the New Directors will participate in the Company’s non-employee director compensation program, which is described on pages 25 through 27 of the Company’s proxy statement for its 2019 Annual Meeting of Stockholders, filed with the SEC on March 27, 2019. In connection with their appointments to the Board, each of the New Directors received a prorated grant of deferred stock units (“DSUs”), awarded on February 20, 2020. The number of DSUs granted to each of the New Directors was determined by dividing $35,000 by $10.00 per share (rounding down to the nearest whole DSU). The DSUs granted to the New Directors generally vest monthly over a three-month period beginning on March 8, 2020. However, the underlying shares generally are not distributed until the earlier of (1) three years after the grant date and (2) the director’s separation from service, subject to any deferral election under the terms of the deferred stock unit agreement. A copy of the form of deferred stock unit agreement will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019. In addition, the Company will enter into its standard director indemnification agreement with each of the New Directors.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

PEABODY ENERGY CORPORATION

|

|

|

|

|

|

|

|

|

|

February 26, 2020

|

|

|

|

By:

|

|

/s/ A. Verona Dorch

|

|

|

|

|

|

Name:

|

|

A. Verona Dorch

|

|

|

|

|

|

Title:

|

|

Chief Legal Officer

|

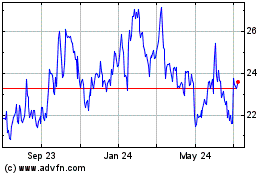

Peabody Energy (NYSE:BTU)

Historical Stock Chart

From Mar 2024 to Apr 2024

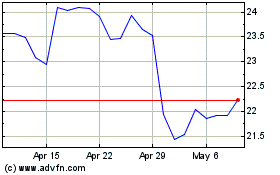

Peabody Energy (NYSE:BTU)

Historical Stock Chart

From Apr 2023 to Apr 2024