Pulmonx Corp. Sets IPO at 6.67 Million Shares; Sees Pricing at $14-$16 Each

September 24 2020 - 7:08AM

Dow Jones News

By Colin Kellaher

Pulmonx Corp. on Thursday said it expects to sell 6.67 million

shares at between $14 and $16 each in its initial public

offering.

At the $15 midpoint of that range, the Redwood City, Calif.,

medical-technology company said it expects net proceeds of about

$88 million, or roughly $102 million if the underwriters exercise

an option to buy an additional one million shares.

Pulmonx, which provides a minimally invasive treatment for

patients with severe emphysema, said it will use the proceeds to

hire additional sales and marketing personnel and to fund product

development and research-and-development activities.

Boston Scientific Corp. currently owns a 30.1% stake in Pulmonx,

which has applied to list its shares on the Nasdaq Global Select

Market under the symbol LUNG.

In a filing with the U.S. Securities and Exchange Commission,

Pulmonx said it would have about 31.7 million shares outstanding

after the IPO, assuming exercise of the overallotment option, for a

valuation of about $476 million at the $15-a-share midpoint.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

September 24, 2020 06:53 ET (10:53 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

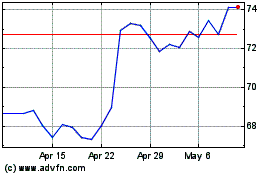

Boston Scientific (NYSE:BSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

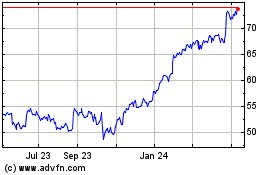

Boston Scientific (NYSE:BSX)

Historical Stock Chart

From Apr 2023 to Apr 2024