Table of Contents

As filed with the Securities and Exchange Commission on May 20, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Boston Scientific Corporation

(Exact name of Registrant as specified in its charter)

|

|

|

|

Delaware

(State or other jurisdiction of incorporation or organization)

|

|

04-2695240

(I.R.S. Employer Identification No.)

|

300 Boston Scientific Way

Marlborough, Massachusetts 01752-1234

Telephone: (508) 683-4000

(Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices)

Desiree Ralls-Morrison, Esq.

Senior Vice President, General Counsel and Corporate Secretary

Boston Scientific Corporation

300 Boston Scientific Way

Marlborough, Massachusetts 01752-1234

Telephone: (508) 683-4000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Richard B. Alsop, Esq.

Shearman & Sterling LLP

599 Lexington Avenue

New York, New York 10022-6069

Telephone: (212) 848-4000

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this

registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box. o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing

with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ý

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an

emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act:

|

|

|

|

|

|

|

|

|

Large accelerated filer ý

|

|

Accelerated filer o

|

|

Non-accelerated filer o

|

|

Smaller reporting company o

Emerging growth company o

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to be Registered

|

|

Amount to be

Registered(1)

|

|

Proposed Maximum

Offering Price Per

Unit(1)

|

|

Proposed Maximum

Aggregate Offering

Price(1)

|

|

Amount of

Registration Fee(1)(2)

|

|

|

|

Common stock, par value $0.01 per share

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock, par value $0.01 per share

|

|

|

|

|

|

|

|

|

|

|

-

(1)

-

An

indeterminate amount of the securities of each identified class is being registered as may from time to time be offered hereunder at indeterminate prices,

including an indeterminate number of shares of common stock, par value $0.01 per share, of the Registrant that may be issued upon conversion, exchange, exercise or settlement of, or as dividends on,

the preferred stock, par value $0.01 per share, of the Registrant offered or sold hereunder. Additionally, under Rule 416 under the Securities Act of 1933, as amended (the "Securities Act"),

the number of securities registered hereby includes an indeterminate number of such securities that may be issued in connection with stock splits, stock dividends, anti-dilution provisions of any of

the securities, or similar transactions. Separate consideration may or may not be received for securities that are issued upon conversion, exchange, exercise or settlement of, or as dividends on,

other securities offered hereby. The proposed maximum offering price per security will be determined from time to time by the Registrant in connection with, and at the time of, offering by the

Registrant of the securities registered hereby.

-

(2)

-

In

accordance with Rules 456(b) and 457(r) under the Securities Act, the Registrant is deferring payment of all registration fees and will pay the

registration fees subsequently in advance or on a "pay-as-you-go" basis.

Table of Contents

PROSPECTUS

Common Stock

Preferred Stock

The

securities covered by this prospectus may be sold from time to time by Boston Scientific Corporation (the "Company") in one or more offerings, including an indeterminate number of

common stock, par value $0.01 per share, of the Company that may be issued upon conversion, exchange or settlement of, or as dividends on, preferred stock, par value $0.01 per share, of the Company

offered or sold hereunder.

When

we offer securities, we will provide you with a prospectus supplement describing the specific terms of the specific issue of securities, including the offering price of the

securities. You should carefully read this prospectus and the prospectus supplement relating to the specific issue of securities, as well as the documents incorporated by reference herein or therein,

before you decide to invest in any of these securities. This prospectus may not be used to offer or sell any securities unless accompanied by a prospectus supplement.

Our

common stock is traded on the New York Stock Exchange ("NYSE") under the symbol "BSX." On May 19, 2020, the closing price of our common stock on the NYSE was $35.43 per share.

Investing in our securities involves risks. See "Forward-Looking Statements" on page 3 and the risks described in the "Risk Factors" on

page 4 of this prospectus, the "Risk Factors" section of our periodic reports that we file with the Securities and Exchange Commission and any applicable prospectus supplement before investing

in any of our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or

adequacy of this prospectus. Any representation to the contrary is a criminal offense.

We

may offer and sell securities to or through underwriters, dealers or agents as designated from time to time, or directly to one or more other purchasers or through a combination of

such methods. See "Plan of Distribution." If any underwriters, dealers or agents are involved in the sale of any of the securities, their names, and any applicable purchase price, fee, commission or

discount arrangements between or among them, will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement.

The

date of this prospectus is May 20, 2020.

Table of Contents

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the "SEC") using the "shelf"

registration process. Under this shelf process, we may sell the securities described in this prospectus in one or more offerings. This prospectus provides you with a general description of the

securities we may offer. Each time we sell securities, we will provide a prospectus supplement, which may be in the form of a term sheet, or other offering material that will contain specific

information about the terms of that offering and the specific terms of the securities. The prospectus supplement may also add to, update or change information contained in this prospectus and,

accordingly, to the extent inconsistent, information in this prospectus is superseded by the information in the prospectus supplement. You should read both this prospectus and any accompanying

prospectus supplement together with additional information described under the heading "Where You Can Find More Information" before making an investment decision.

The

prospectus supplement will describe: the terms of the securities offered, any initial public offering price, the price paid to us for the securities, the net proceeds to us, the

manner of distribution and any underwriting compensation and the other specific material terms related to the offering of the securities. For more detail about the terms of the securities, you should

read the exhibits filed with or incorporated by reference in our registration statement of which this prospectus forms a part.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All

of the summaries are qualified in their entirety by the actual documents. Copies of the documents referred to herein have been filed, or will be filed or incorporated by reference as exhibits to the

registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under "Where You Can Find More Information."

Because

we are a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933, as amended (the "Securities Act"), we may offer additional securities by filing

an automatically effective post-effective amendment to this registration statement with the SEC at the time of the offering.

We

have not authorized any person to provide you with any information or to make any representation other than as contained in this prospectus or in any prospectus supplement and the

information incorporated by reference herein and therein. We do not take any responsibility for, and can provide no assurance as to the reliability of, any information that others may provide you. The

information appearing or incorporated by reference in this prospectus and any accompanying prospectus supplement is accurate only as of the date of this prospectus or any accompanying prospectus

supplement or the date of the document in which incorporated information appears. Our business, financial condition, results of operations and prospects may have changed since those dates.

Unless

otherwise indicated or unless the context otherwise requires, all references in this prospectus to "Boston Scientific," the "Company," "we," "us," and "our" refer to Boston

Scientific Corporation and our consolidated subsidiaries.

1

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and, in accordance

therewith, we file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available on the SEC's website at http://www.sec.gov. You can also find

information about us by visiting our website at www.bostonscientific.com. We have included our website address as an inactive textual reference only. Information on, or accessible through, our website

is not incorporated by reference into this registration statement or prospectus or any accompanying prospectus supplement.

Incorporation by Reference

This prospectus is part of a registration statement on Form S-3 that we filed with the SEC. We are "incorporating by reference" specific

documents that we file with the SEC, which means that we can disclose important information to you by referring you to those documents that are considered part of this prospectus. Information that we

file subsequently with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below, and any documents that we file with the SEC under

Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, after the date of this prospectus until the offering of all of the securities covered by a particular prospectus supplement has been

terminated or completed (excluding any portions of such documents that have been "furnished" but not "filed" for purposes of the Exchange Act):

-

•

-

our Annual Report on Form 10-K

for the fiscal year ended December 31, 2019, filed on February 25, 2020 ("2019 Form 10-K");

-

•

-

our Quarterly Report on

Form 10-Q for the fiscal quarter ended March 31, 2020, filed on May 6, 2020 ("Q1 2020 Form 10-Q");

-

•

-

our Current Reports on Form 8-K filed on

February 5, 2020,

February 27, 2020,

April 2, 2020 (Item 5.02 only),

April 10, 2020,

April 21, 2020,

May 12, 2020,

May 15, 2020 and

May 18, 2020; and

-

•

-

portions of our Proxy Statement on

Schedule 14A, filed on March 25, 2020, that are incorporated by reference into Part III of our 2019 Form 10-K.

You

may also request a copy of these filings (other than certain exhibits), at no cost, by writing or telephoning our investor relations department at the following address:

Boston

Scientific Corporation

300 Boston Scientific Way

Marlborough, Massachusetts 01752-1234

Attention: Investor Relations

Telephone: (508) 683-5565

Email: BSXInvestorRelations@bsci.com

Any

statement contained herein or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus

to the extent that a statement contained herein, in any other subsequently filed document that also is or is deemed to be incorporated by reference herein or in any accompanying prospectus supplement,

modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified and superseded, to constitute a part of this prospectus.

Any

statement made in this prospectus concerning the contents of any contract, agreement or other document is only a summary of the actual contract, agreement or other document. If we

have filed or incorporated by reference any contract, agreement or other document as an exhibit to the registration statement, you should read the exhibit for a more complete understanding of the

document or matter involved. Each statement regarding a contract, agreement or other document is qualified by reference to the actual document.

2

Table of Contents

FORWARD-LOOKING STATEMENTS

This prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein or therein contain or incorporate by

reference statements that may constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking

statements may be identified by words like "anticipate," "expect," "project," "believe," "plan," "estimate," "intend," "aiming" and similar words. These forward-looking statements are based on our

beliefs, assumptions and estimates using information available to us at the time and are not intended to be guarantees of future events or performance. If our underlying assumptions turn out to be

incorrect, or if certain risks or uncertainties materialize, actual results could vary materially from the expectations and projections expressed or implied by our forward-looking statements. As a

result, investors are cautioned not to place undue reliance on any of our forward-looking statements.

The

forward-looking statements in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein or therein are based on certain risks and

uncertainties, including the risk factors described in Part I, Item 1A. under the heading "Risk Factors" in our 2019 Form 10-K and in Part II, Item 1A. under the

heading "Risk Factors" in our Q1 2020 Form 10-Q and in connection with forward-looking statements throughout our 2019 Form 10-K and Q1 2020 Form 10-Q, as well as in any other

document we may file with the SEC that is incorporated by reference herein, and the specific risk factors discussed in this prospectus and in any accompanying prospectus supplement which could cause

actual results to vary materially from the expectations and projections expressed or implied by our forward-looking statements. These risks and uncertainties, in some cases, have affected and in the

future could affect our ability to implement our business strategy and may cause actual results to differ materially from those contemplated by the forward-looking statements. Risks and

uncertainties that may cause such differences include, among other things: future economic, political, competitive, reimbursement and regulatory conditions, new product introductions and the market

acceptance of those products, markets for our products, expected pricing environment, expected procedural volumes, the closing and integration of acquisitions, clinical trial results, demographic

trends, intellectual property rights, litigation, financial market conditions, the execution and effect of our restructuring program, the execution and effect of our business strategy, including our

cost-savings and growth initiatives and future business decisions made by us and our competitors. New risks and uncertainties may arise from time to time and are difficult to predict, including those

that have emerged or have increased in significance or likelihood as a result of the COVID-19 pandemic. All of these factors are difficult or impossible to predict accurately and many of them are

beyond our control. We caution investors to consider carefully these factors. We disclaim any intention or obligation to publicly update or revise any forward-looking statement to reflect any change

in our expectations or in events, conditions, or circumstances on which those expectations may be based, or that may affect the likelihood that actual results will differ from those contained in the

forward-looking statements. This cautionary statement is applicable to all forward-looking statements contained in this prospectus.

For

further discussion of these risks and uncertainties and other risk factors, see Part I, Item 1A. in our 2019 Form 10-K, under the heading "Risk Factors,"

Part II, Item 1A. under the heading "Risk Factors" in our Q1 2020 Form 10-Q and under the heading "Risk Factors" herein and in any accompanying prospectus supplement and in any

other document we may file with the SEC that is incorporated by reference herein and therein.

3

Table of Contents

RISK FACTORS

Our

business is subject to significant risks. You should carefully consider the risks and uncertainties set forth in Part I, Item 1A. under the heading "Risk Factors"

included in our 2019 Form 10-K and Part II, Item 1A. under the heading "Risk Factors" in our Q1 2020 Form 10-Q, which are incorporated by reference in this prospectus.

Additional risk factors that you should carefully consider also may be included in a prospectus supplement relating to an offering of our securities as well as the other documents filed with the SEC

that are incorporated by reference herein or therein.

The

risks and uncertainties described in any accompanying prospectus supplement as well as the documents incorporated by reference herein or therein are not the only ones facing us.

Additional risks and uncertainties that we do not presently know about or that we currently believe are not material may also adversely affect our business. If any of the risks and uncertainties

described in this prospectus, any accompanying prospectus supplement or the documents incorporated by reference herein or therein actually occur, our business, financial condition, results of

operations and prospects could be adversely affected in a material way. The occurrence of any of these risks may cause you to lose all or part of your investment in the offered securities.

4

Table of Contents

BOSTON SCIENTIFIC CORPORATION

Our Company

Boston Scientific Corporation is a global developer, manufacturer and marketer of medical devices that are used in a broad range of

interventional medical specialties. Our mission is to transform lives through innovative medical solutions that improve the health of patients around the world. As a medical technology leader for

nearly 40 years, we advance science for life by providing a broad range of high performance solutions to address unmet patient needs and reduce the cost of healthcare.

Our

history began in the late 1960s when our co-founder, John Abele, acquired an equity interest in Medi-tech, Inc., a research and development company focused on developing

alternatives to surgery. In 1969, Medi-tech introduced a family of steerable catheters used in some of the world's first less-invasive procedures. In 1979, John Abele joined with Pete Nicholas to form

Boston Scientific Corporation, which indirectly acquired Medi-tech. This acquisition began a period of active and focused new product development, innovation, market development and organizational

growth. Since then, we have advanced the practice of less-invasive medicine by helping physicians and other medical professionals diagnose and treat a wide range of diseases and medical conditions,

and improve patients' quality of life by providing alternatives to surgery and other medical procedures that are typically traumatic to the body.

Our

net sales have increased substantially since our formation. Our growth has been fueled in part by strategic acquisitions designed to improve our ability to take advantage of growth

opportunities in the medical device industry and to build depth of portfolio within our core businesses. These strategic acquisitions have helped us to add promising new technologies to our pipeline

and to offer one of the broadest product portfolios in the world for use in less-invasive procedures in our core areas of Medical Surgical (MedSurg), Rhythm and Neuro, and Cardiovascular. We believe

that the depth and breadth of our product portfolio has also enabled us to compete more effectively in the current healthcare environment that seeks to improve outcomes and lower costs. Our strategy

of category leadership also enables us to compete in a changing healthcare landscape and position our products with providers and payers, while also expanding internationally and managing the

complexities of the global healthcare market.

Our

principal executive offices are located at 300 Boston Scientific Way, Marlborough, Massachusetts 01752-1234. Our telephone number is (508) 683-4000. Our website is located at

www.bostonscientific.com. We have included our website address as an inactive textual reference only. Information contained on, or accessible through, our website is not incorporated in this

prospectus, or any accompanying prospectus supplement or any document incorporated by reference herein or therein.

USE OF PROCEEDS

Unless otherwise indicated in a prospectus supplement, we intend to use the net proceeds from the sale of our securities for general corporate

purposes, which may include, without limitation, repurchases or redemptions of our outstanding debt securities or other reductions of our outstanding borrowings, repurchases of our outstanding equity

securities, working capital, business acquisitions, investments or other strategic alliances, payment of contingent consideration, investments in or loans to subsidiaries, capital expenditures or for

such other purposes as may be specified in the applicable prospectus supplement relating to such offering.

5

Table of Contents

DESCRIPTION OF CAPITAL STOCK

The following description summarizes the general terms and provisions of our common stock and preferred stock, certain provisions of the

Delaware General Corporation Law ("DGCL"), and provisions of our Third Restated Certificate of Incorporation ("Charter") and Amended and Restated By-Laws ("by-laws"). We have filed

copies of our Charter and by-laws as exhibits to the registration statement of which this prospectus forms a part.

In

this section, "we," "us," or "our" refers to Boston Scientific Corporation, excluding its subsidiaries, unless otherwise expressly stated or the context otherwise requires.

Description of Common Stock

The following description of the terms of the common stock sets forth certain general provisions of the common stock as contained in our Charter

and by-laws and is qualified in its entirety by reference to Delaware law and our Charter and by-laws in their entirety.

General

We are currently authorized to issue up to 2,000,000,000 shares of common stock, par value $0.01 per share. As of March 31, 2020, there

were 1,646,877,242 shares of our common stock outstanding. All outstanding shares of our common stock are fully paid and nonassessable. Our common stock is listed on the NYSE under the symbol "BSX."

Holders

of our common stock have no preemptive, subscription, redemption or conversion rights and the common stock is not subject to redemption. The rights, preferences and privileges of

holders of common stock are subject to, and may be adversely affected by, the rights of holders of any series of preferred stock, whether currently outstanding or designated and issued in the future.

Dividends

Subject to the preferences of holders of preferred stock, if any, holders of common stock are entitled to dividends and other distributions

when, as and if declared by our board of directors out of funds legally available therefor and shall share equally on a per share basis in all such dividends and other distributions.

Voting Rights

Except as otherwise provided by law or by the designation of the preferences, limitations and relative rights of any series of preferred stock,

the voting power with respect to us is held by holders of our common stock. Each holder of common stock is entitled to one vote for each share held.

Liquidation and Dissolution

Except as otherwise provided by the certificate of designation and limitations and relative rights of any series of preferred stock, in the

event of any of our liquidation, dissolution, or winding up, whether voluntary or involuntary, after payment of all our liabilities and obligations and after payment has been made to holders of each

series of preferred stock of the full amount to which they are entitled, holders of shares of common stock will be entitled to share, ratably according to the number of shares of common stock held by

them, in all remaining assets available for distribution to holders of the common stock.

6

Table of Contents

Description of Preferred Stock

We are currently authorized to issue up to 50,000,000 shares of preferred stock, par value $0.01 per share. As of March 31, 2020, there

were no shares of our preferred stock outstanding. Pursuant to the provisions of our Charter, our board of directors is authorized, without stockholder approval and subject to limitations set forth in

our Charter and prescribed by Delaware law, to issue preferred stock in one or more series by resolution adopted by the Board. By filing a certificate of designation pursuant to Delaware law setting

forth such resolution or resolutions and providing for the issuance of such series, our board of directors is authorized to establish from time to time the number of shares to be included in each

series and to fix the designation, powers, preferences and relative, participating, optional or other rights, if any, of the shares of each series and any of its qualifications, limitations or

restrictions, in each case without further vote or action by our stockholder. Without limiting the generality of the foregoing, the resolutions providing for issuance of any series of preferred stock

may provide that such series shall be superior to, rank equally with or be junior to any other series of preferred stock to the extent permitted by law and the terms of any other series of preferred

stock. Shares of preferred stock may be convertible into shares of our common stock and any dividends payable on shares of preferred stock may be payable in cash or shares of our common stock at our

election. The issuance of preferred stock could, among other things, have the effect of delaying, deferring or preventing a change in control of our company and might adversely affect the market price

of our common stock and the voting and other rights of the holders of our common stock.

Certain Provisions of Delaware Law, the Charter and the By-laws

Business Combinations with Interested Stockholders. We are subject to the provisions of the DGCL. Section 203 of the DGCL

prohibits a publicly

held Delaware corporation from engaging in a "business combination" with an "interested stockholder" for a period of three years after the date of the transaction in which the person became an

interested stockholder, unless the business combination is approved in a prescribed manner. A "business combination" includes mergers, consolidations, assets sales, and other transactions resulting in

a financial benefit to the interested stockholder. Subject to certain exceptions, an "interested stockholder" is a person who, together with affiliates owns, or within three years did own, 15% or more

of the corporation's voting stock.

Liability of Directors and Officers. As permitted by the DGCL, our Charter provides that our directors

will not be personally liable to us or our stockholders for monetary damages for breach of fiduciary duty as a director, except in certain circumstances involving wrongful acts, such as the breach of

a director's duty of loyalty, acts or omissions which involve intentional misconduct or a knowing violation of law or for any transaction from which the director derives an improper personal benefit.

Our directors are also subject to liability under Section 174 of the DGCL, which makes directors personally liable for unlawful dividends or unlawful stock repurchases or redemptions if the

unlawful conduct is willful or results from negligence.

Under

our Charter and by-laws (and in accordance with Section 145 of the DGCL), we will indemnify to the fullest extent permitted by the DGCL any person who was or is a party or

is threatened to be made a party to any threatened, pending or completed action, suit or proceeding. These include civil, criminal, administrative, investigative or other proceedings by reason of the

fact that the person is or was one of our directors, officers or employees, or is or was serving in that capacity or as an agent at our request for another entity. Our indemnity covers expenses,

judgments, fines and amounts paid or to be paid in settlement actually and reasonably incurred in connection with the defense or settlement of an action, suit or proceeding if the person acted in good

faith and in a manner the person reasonably believed to be in or not opposed to our best interest and, with respect to any criminal action or proceeding, had no reasonable cause to believe that their

conduct was unlawful. We will indemnify a person in a derivative action under the same conditions, except that no indemnification is permitted without judicial approval if the person is adjudged to be

liable to us in

7

Table of Contents

performance

of his or her duty. Derivative actions are actions by us or in our right to procure a judgment in our favor. Our agents may be similarly indemnified at the discretion of our board of

directors. In addition, we have entered into indemnification agreements with each of our directors and executive officers. These agreements provide rights of indemnification substantially similar to

and, in certain respects, broader than those provided by the Charter and by-laws.

Election of Directors; Removal; Vacancies. Our Charter and by-laws provide that the directors shall be elected at each annual meeting

or at any

special meeting the notice of which specified the election of directors as an item of business for such meeting. Our by-laws provide that each nominee for director shall be elected to the board of

directors by the affirmative vote of the majority of votes cast, in person or by proxy, by the holders of shares entitled to vote at a meeting at which a quorum is present; provided, however, that if

the number of nominees exceeds the number of directors to be elected at any such meeting, the directors shall be elected by a plurality of the votes cast, in person or by proxy. Our Charter provides

that vacancies on the board of directors may only be filled by a majority of the board of directors then in office and further provides that directors may only be removed by the affirmative vote of

holders of at least 80% of the voting power of all the then outstanding shares of stock entitled to vote generally in the election of directors. The provisions of our Charter and by-laws that govern

the number, election, and terms of the board of directors may not be amended without the

affirmative vote of at least 80% of the voting power of all the then outstanding shares of stock entitled to vote generally in the election of directors.

Meetings of Stockholders. Our Charter provides that stockholder action can only be taken at an annual or special meeting of stockholders

and that the

business permitted to be conducted at any special meeting of stockholders is limited to the business brought before the meeting by the Chairman of the board of directors or our President or at the

request of a majority of the members of the board of directors. Our Charter and by-laws provide that special meetings of stockholders can be called only by the Chairman of the board of directors, the

Chief Executive Officer (or if there is no Chief Executive Officer, the President), or pursuant to a resolution approved by a majority of the total number of directors which we would have if there

were no vacancies on the board of directors. Stockholders are not permitted to call a special meeting or to require that the board of directors call a special meeting of stockholders.

Advance Notice Requirements for Stockholder Proposals and Director Nominees. Our by-laws provide that stockholders seeking to make

nominations of

candidates for election as directors, or to bring other business before an annual or special meeting of the stockholders, must provide timely notice of their intent in writing. To be timely, a

stockholder's notice must be delivered to and received at our principal executive offices not less than 120 days prior to the anniversary date that our proxy statement was released to

shareholders in connection with the previous year's annual meeting. However, in the event that the date of the annual meeting is more than 30 days before or after the first anniversary date of

the preceding year's annual meeting, or in the event of a special meeting of stockholders called for the purpose of electing directors, then the deadline is a reasonable time before the we begin to

print and mail our proxy materials. Our by-laws also specify certain requirements as to the form and content of a stockholder's notice. These provisions may restrict the ability of our stockholders to

bring business before our annual meeting of stockholders or to make nominations for directors at our annual meeting or any special meeting of stockholders.

Proxy Access. Our by-laws permit an eligible stockholder or group of stockholders to include up to a specified number of director

nominees in our

proxy materials for an annual meeting of stockholders. To qualify, the stockholders (or group of up to twenty stockholders) must have continuously owned for at least three years 3% or more of our

outstanding shares of common stock. The maximum number of stockholder nominees permitted under the proxy access provisions of our

8

Table of Contents

by-laws

is the greater of (i) two or (ii) 20% of the total number of our directors in office as of the last day on which notice of a nomination may be delivered.

Notice

of a nomination under our proxy access by-law provisions must generally be submitted to our principal executive offices not less than 120 days nor more than 150 days

prior to the first anniversary of the date that we first mailed our proxy statement to stockholders for the immediately preceding annual meeting of stockholders. The notice must contain certain

information specified in our by-laws.

Stock Repurchases; Change of Control. Our Charter prohibits us, with certain exceptions, from purchasing any shares of our stock from

any person,

entity or group that beneficially owns 5% or more of our voting stock at an above-market price, unless a majority of our disinterested stockholders approve the transaction. In addition, our Charter

empowers the board of directors, when considering a tender offer or merger or acquisition proposal, to take into account factors in addition to potential economic benefits to stockholders and to

consider constituencies other than stockholders.

Amendment of Charter and By-Laws. The DGCL provides generally that the vote of a majority of shares entitled to vote is required to act

on most

matters and to amend a corporation's certificate of incorporation. Our Charter and by-laws contain provisions requiring the affirmative vote of the holders of at least 80% of the voting stock, voting

together as a single class, to amend certain provisions of the Charter and our by-laws, including certain of the foregoing provisions. Such a supermajority vote would be in addition to any separate

class vote that might in the future be required with respect to shares of preferred stock then outstanding.

Miscellaneous. The foregoing and other provisions of Delaware law and the Charter and our by-laws could make it more difficult to

acquire us by means

of a tender offer, a proxy contest or otherwise. These provisions may have the effect of delaying, deferring or preventing a change in control of our company, may discourage bids for the common stock

at a premium over the market price of the common stock and may adversely affect the market price of the common stock.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Computershare Inc.

9

Table of Contents

PLAN OF DISTRIBUTION

We may sell our securities in any one or more of the following ways: (i) through agents; (ii) to or through underwriters;

(iii) through dealers; (iv) directly by us to a limited number of purchasers or to a single purchaser; or (v) through a combination of any of these methods of sale. The applicable

prospectus supplement will contain the terms of the transaction, name or names of any underwriters, dealers, agents and the respective amounts of securities underwritten or purchased by them, the

initial public offering price of the securities, and the applicable agent's commission, dealer's purchase price or underwriter's discount. Any dealers and agents, in addition to any underwriter,

participating in the distribution of the securities may be deemed to be underwriters within the meaning of the Securities Act, and compensation received by them on resale of the securities may be

deemed to be underwriting discounts.

Any

initial offering price, dealer purchase price, discount or commission, and concessions allowed or reallowed or paid to dealers may be changed from time to time.

Offers

to purchase securities may be solicited directly by us or by agents designated by us from time to time. Any such agent may be deemed to be an underwriter, as that term is defined

in the Securities Act, of the securities so offered and sold.

If

underwriters are utilized in the sale of any securities in respect of which this prospectus is being delivered, such securities will be acquired by the underwriters for their own

account and may be resold from time to time in one or more transactions, including negotiated transactions, at fixed public offering prices or at varying prices determined by the underwriters at the

time of sale. Securities may be offered to the public either through underwriting syndicates represented by managing underwriters or directly by one or more underwriters. If any underwriter or

underwriters are utilized in the sale of securities, unless otherwise indicated in the applicable prospectus supplement, the obligations of the underwriters are subject to certain conditions precedent

and that the underwriters will be obligated to purchase all such securities if any are purchased.

If

a dealer is utilized in the sale of the securities in respect of which this prospectus is delivered, we will sell such securities as principal. The dealer may then resell such

securities to the public at varying prices to be determined by such dealer at the time of resale. Any such dealer may be deemed to be an underwriter, as such term is defined in the Securities Act, of

the securities so offered and sold.

Offers

to purchase securities may be solicited directly by us and the sale thereof may be made by us directly to institutional investors or others, who may be deemed to be underwriters

within the meaning of the Securities Act with respect to any resale thereof.

If

so indicated in the applicable prospectus supplement, we may authorize agents and underwriters to solicit offers by certain institutions to purchase securities from us at the public

offering price set forth in the applicable prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery on the date or dates stated in the applicable prospectus

supplement. Such delayed delivery contracts will be subject only to those conditions set forth in the applicable prospectus supplement.

Securities

may also be offered and sold, if so indicated in the applicable prospectus supplement, in connection with a remarketing upon their purchase, in accordance with a redemption or

repayment pursuant to their terms, or otherwise, by one or more firms, which we refer to herein as the "remarketing firms," acting as principals for their own accounts or as our agents, as applicable.

Any remarketing firm will be identified and the terms of its agreement, if any, with us and its compensation will be described in the applicable prospectus supplement. Remarketing firms may be deemed

to be underwriters, as that term is defined in the Securities Act, in connection with the securities remarketed thereby.

10

Table of Contents

Agents,

underwriters and dealers may be entitled under relevant agreements with us to indemnification by us against certain liabilities, including liabilities under the Securities Act,

or to contribution with respect to payments which such agents, underwriters and dealers may be required to make in respect thereof. The terms and conditions of any indemnification or contribution will

be described in the applicable prospectus supplement.

We

may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions. If the applicable

prospectus supplement indicates, in connection with those derivatives, the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in short

sale transactions. If so, the third party may use securities pledged by us or borrowed from us or others to settle those sales or to close out any related open borrowings of stock, and may use

securities received from us in settlement of those derivatives to close out any related open borrowings of stock. The third party in such sale transactions may be deemed to be an underwriter and will

be identified in the applicable prospectus supplement (or a post-effective amendment).

We

may elect to list any series of securities on an exchange, but, unless otherwise specified in the applicable prospectus supplement, we shall not be obligated to do so. No assurance

can be given as to the liquidity of the trading market for any of the securities.

Agents,

underwriters and dealers may engage in transactions with, or perform services for, us and our respective subsidiaries in the ordinary course of business.

Any

underwriter may engage in overallotment, stabilizing transactions, short covering transactions and penalty bids in accordance with Regulation M under the Exchange Act.

Overallotment involves sales in excess of the offering size which creates a short position. Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing bids do

not exceed a specified maximum. Short covering transactions involve purchases of the securities in the open market after the distribution is completed to cover short positions. Penalty bids permit the

underwriters to reclaim a selling concession from a dealer when the securities originally sold by the dealer are purchased in a covering transaction to cover short positions. Those activities may

cause the price of the securities to be higher than it would otherwise be. If commenced, the underwriters may discontinue any of the activities at any time.

The

place and time of delivery for securities will be set forth in the prospectus supplement for such securities.

11

Table of Contents

LEGAL MATTERS

The validity of the securities offered hereby will be passed upon for us by Shearman & Sterling LLP, New York, New York. Certain

legal matters with respect to the offered securities will be passed upon for any underwriters, dealers or agents by counsel identified in the related prospectus supplement

EXPERTS

The consolidated financial statements of Boston Scientific Corporation appearing in Boston Scientific Corporation's

Annual Report (Form 10-K) for the year ended December 31, 2019

(including the schedule appearing therein), and the effectiveness of Boston Scientific Corporation's internal control over financial reporting as of December 31, 2019 have been audited by

Ernst & Young LLP, independent registered public accounting firm, as set forth in their reports thereon, included therein, and incorporated herein by reference. Such consolidated

financial statements are incorporated herein by reference in reliance upon such reports given on the authority of such firm as experts in accounting and auditing.

12

Table of Contents

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item. 14. Other Expenses of Issuance and Distribution.

The following table sets forth the costs and expenses payable by the Registrant in connection with the sale of the securities being registered

hereby.

|

|

|

|

|

|

|

|

Amount

|

|

|

SEC registration fee

|

|

|

(1)

|

|

|

Printing expenses

|

|

|

(1)

|

|

|

Legal fees and expenses

|

|

|

(1)

|

|

|

Accounting fees and expenses

|

|

|

(1)

|

|

|

Transfer Agent and Registrar fees

|

|

|

(1)

|

|

|

Stock exchange listing fees

|

|

|

(1)

|

|

|

Miscellaneous

|

|

|

(1)

|

|

|

|

|

|

|

|

|

Total

|

|

|

(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

(1)

-

These

fees are based in part on the number of issuances and amount of securities offered and accordingly cannot be estimated at this time

Item 15. Indemnification of Directors and Officers.

Under our Third Restated Certificate of Incorporation and our amended and restated by-laws (and in accordance with Section 145 of the

DGCL), we will indemnify to the fullest extent permitted by the DGCL any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or

proceeding, including civil, criminal, administrative, investigative or other proceedings, by reason of the fact that the person is or was a director, officer or employee of the Company, or is or was

serving in that capacity or as an agent at the request of the Company for another entity.

Our

indemnity covers expenses, judgments, fines and amounts paid or to be paid in settlement actually and reasonably incurred in connection with the defense or settlement of an action,

suit or proceeding if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to our best interest and, with respect to any criminal action or proceeding,

had no reasonable cause to believe that his or her conduct was unlawful. We will indemnify a person in a derivative action under the same conditions, except that no indemnification is permitted

without judicial approval if the person is adjudged to be liable to us in performance of his or her duty. Derivative actions are actions by us or in our right to procure a judgment in our favor. Our

agents may be similarly indemnified at the discretion of our board of directors.

In

addition, we have indemnification agreements in place with our directors and certain officers, including all executive officers, which set forth the details of our indemnification

obligations to such persons, including mechanics of the payment of expenses and obligations of the parties in the event of a change of control.

All

of our directors and officers are covered by an insurance policy that we maintain against specified liabilities for actions taken in their capacities as such, including liabilities

under the Securities Act.

II-1

Table of Contents

Item 16. Exhibits.

-

*

-

To

be filed as an exhibit to a Current Report on Form 8-K to be filed by the Company in connection with a specific offering.

-

+

-

Incorporated

by reference.

Item 17. Undertakings.

(a) The

undersigned Registrant hereby undertakes:

(1) To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) to

include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) to

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof)

which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of

securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may

be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) under the Securities Act if, in the aggregate, the changes in volume and price represent no more than a 20%

change in the maximum aggregate offering price set forth in the "Calculation of Registration Fee" table in the effective registration statement; and

(iii) to

include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such

information in the registration statement;

provided,

however, that paragraphs (1)(i), (1)(ii) and (1)(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in

II-2

Table of Contents

reports

filed with or furnished to the SEC by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement,

or is contained in a form of prospectus filed pursuant to Rule 424(b) under the Securities Act that is part of the registration statement.

(2) That,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That,

for the purpose of determining liability under the Securities Act to any purchaser:

(i) Each

prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus

was deemed part of and included in the registration statement; and

(ii) Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating

to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act shall be deemed to be

part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in

the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a

new effective date of the registration statement relating to the securities in the registration statement to which the prospectus relates, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof; provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a

document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of

sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document

immediately prior to such effective date.

(5) That,

for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned

registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities

to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be

considered to offer or sell such securities to such purchaser:

(i) Any

preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The

portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided

by or on behalf of the undersigned registrant; and

II-3

Table of Contents

(b) The

undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant's annual report

pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and where applicable, each filing of an employee benefit plan's annual report pursuant to Section 15(d) of the

Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such

securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to

the foregoing provisions, or otherwise, the Registrant has been advised that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is,

therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or

controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being

registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such

indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

II-4

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, Boston Scientific Corporation certifies that it has reasonable grounds to believe

that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the

City of Marlborough, Commonwealth of Massachusetts, on the 20th day of May, 2020.

|

|

|

|

|

|

|

|

|

Boston Scientific Corporation

|

|

|

By:

|

|

/s/ DANIEL J. BRENNAN

Daniel J. Brennan

Executive Vice President and

Chief Financial Officer

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Michael F. Mahoney, Daniel J.

Brennan, Desiree Ralls-Morrison and Vance R. Brown, and each of them, his or her true and lawful attorney-in-fact and agent, severally, with full power of substitution and resubstitution, for him or

her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this registration statement, with all exhibits thereto,

and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power of authority to do and perform

each and every act and thing requisite or necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, thereby ratifying and

confirming all that said attorneys-in-fact and agents, or their substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities indicated on the 20th day of

May, 2020.

|

|

|

|

|

Name and Signature

|

|

Title

|

|

|

|

/s/ DANIEL J. BRENNAN

Daniel J. Brennan

|

|

Executive Vice President and Chief Financial Officer

|

/s/ NELDA J. CONNORS

Nelda J. Connors

|

|

Director

|

/s/ CHARLES J. DOCKENDORFF

Charles J. Dockendorff

|

|

Director

|

/s/ YOSHIAKI FUJIMORI

Yoshiaki Fujimori

|

|

Director

|

II-5

Table of Contents

|

|

|

|

|

Name and Signature

|

|

Title

|

|

|

|

/s/ DONNA A. JAMES

Donna A. James

|

|

Director

|

/s/ EDWARD J. LUDWIG

Edward J. Ludwig

|

|

Director

|

/s/ STEPHEN P. MACMILLAN

Stephen P. MacMillan

|

|

Director

|

/s/ MICHAEL F. MAHONEY

Michael F. Mahoney

|

|

Director, Chairman of the Board President and Chief Executive Officer

|

/s/ JONATHAN R. MONSON

Jonathan R. Monson

|

|

Vice President, Global Controller and Chief Accounting Officer

|

/s/ DAVID J. ROUX

David J. Roux

|

|

Director

|

/s/ JOHN E. SUNUNU

John E. Sununu

|

|

Director

|

/s/ ELLEN M. ZANE

Ellen M. Zane

|

|

Director

|

II-6

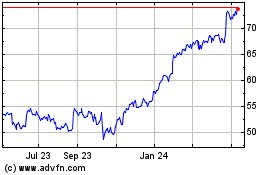

Boston Scientific (NYSE:BSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

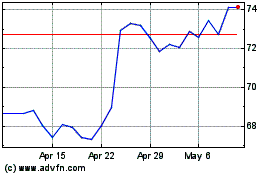

Boston Scientific (NYSE:BSX)

Historical Stock Chart

From Apr 2023 to Apr 2024