Definitive Materials Filed by Investment Companies. (497)

November 27 2019 - 4:08PM

Edgar (US Regulatory)

Filed Pursuant to Rule 497(e)

Registration File No.: 333-233028

BLACKROCK SCIENCE AND TECHNOLOGY TRUST

Supplement dated November 27, 2019 to the Prospectus Supplement

dated September 30, 2019 and to the Prospectus and

Statement of Additional Information (“SAI”), each dated September 26, 2019

This supplement amends certain information in the Prospectus Supplement, dated September 30, 2019, and in the Prospectus and SAI, each dated

September 26, 2019, of BlackRock Science and Technology Trust (the “Trust”). Unless otherwise indicated, all other information included in the Prospectus Supplement, Prospectus and SAI that is not inconsistent with the information set

forth in this supplement remains unchanged. Capitalized terms not otherwise defined in this supplement have the same meanings as in the Prospectus Supplement, Prospectus and SAI, as applicable.

Effective December 1, 2019, the following changes are made to the Prospectus Supplement, Prospectus and SAI, as applicable:

In the section of the Prospectus Supplement entitled “Summary of Trust Expenses,” footnote 6 to the fee table is deleted in its entirety and

replaced with the following:

|

(6)

|

The Trust and the Advisor have entered into a fee waiver agreement (the “Fee Waiver Agreement”),

pursuant to which the Advisor has contractually agreed to waive the management fee with respect to any portion of the Trust’s assets attributable to investments in any equity and fixed-income mutual funds and exchange-traded funds managed by

the Advisor or its affiliates that have a contractual fee, through June 30, 2021. In addition, pursuant to the Fee Waiver Agreement, the Advisor has contractually agreed to waive its management fees by the amount of investment advisory fees the

Trust pays to the Advisor indirectly through its investment in money market funds managed by the Advisor or its affiliates, through June 30, 2021. The Fee Waiver Agreement may be terminated at any time, without the payment of any penalty, only

by the Trust (upon the vote of a majority of the Trustees who are not “interested persons” (as defined in the Investment Company Act) of the Trust or a majority of the outstanding voting securities of the Trust), upon 90 days’ written

notice by the Trust to the Advisor.

|

In the section of the Prospectus entitled “Summary of Trust Expenses,” footnote 5 to

the fee table is deleted in its entirety and replaced with the following:

|

(5)

|

The Trust and the Advisor have entered into a fee waiver agreement (the “Fee Waiver Agreement”),

pursuant to which the Advisor has contractually agreed to waive the management fee with respect to any portion of the Trust’s assets attributable to investments in any equity and fixed-income mutual funds and ETFs managed by the Advisor or its

affiliates that have a contractual fee, through June 30, 2021. In addition, pursuant to the Fee Waiver Agreement, the Advisor has contractually agreed to waive its management fees by the amount of investment advisory fees the Trust pays to the

Advisor indirectly through its investment in money market funds managed by the Advisor or its affiliates, through June 30, 2021. The Fee Waiver Agreement may be terminated at any time, without the payment of any penalty, only by the Trust (upon

the vote of a majority of the Trustees who are not “interested persons” (as defined in the Investment Company Act) of the Trust (the “Independent Trustees”) or a majority of the outstanding voting securities of the Trust), upon

90 days’ written notice by the Trust to the Advisor.

|

The last paragraph of the

sub-section of the Prospectus entitled “Management of the Trust – Investment Management Agreement” is deleted in its entirety and replaced with the following:

The Trust and the Advisor have entered into the Fee Waiver Agreement, pursuant to which the Advisor has contractually agreed to waive the management fee with

respect to any portion of the Trust’s assets attributable to

investments in any equity and fixed-income mutual funds and ETFs managed by the Advisor or its affiliates that have a contractual fee, through June 30, 2021. In addition, effective

December 1, 2019, pursuant to the Fee Waiver Agreement, the Advisor has contractually agreed to waive its management fees by the amount of investment advisory fees the Trust pays to the Advisor indirectly through its investment in money market

funds advised by the Advisor or its affiliates, through June 30, 2021. The Fee Waiver Agreement may be continued from year to year thereafter, provided that such continuance is specifically approved by the Advisor and the Trust (including by a

majority of the Trust’s Independent Trustees). Neither the Advisor nor the Trust is obligated to extend the Fee Waiver Agreement. The Fee Waiver Agreement may be terminated at any time, without the payment of any penalty, only by the Trust

(upon the vote of a majority of the Independent Trustees or a majority of the outstanding voting securities of the Trust), upon 90 days’ written notice by the Trust to the Advisor.

The fourth paragraph of the sub-section of the SAI entitled “Management of the Trust – Investment

Management Agreement” is deleted in its entirety and replaced with the following:

The Trust and the Advisor have entered into a fee waiver

agreement (the “Fee Waiver Agreement”), pursuant to which the Advisor has contractually agreed to waive the management fee with respect to any portion of the Trust’s assets attributable to investments in any equity and fixed-income

mutual funds and ETFs managed by the Advisor or its affiliates that have a contractual fee, through June 30, 2021. In addition, effective December 1, 2019, pursuant to the Fee Waiver Agreement, the Advisor has contractually agreed to waive

its management fees by the amount of investment advisory fees the Trust pays to the Advisor indirectly through its investment in money market funds advised by the Advisor or its affiliates, through June 30, 2021. The Fee Waiver Agreement may be

continued from year to year thereafter, provided that such continuance is specifically approved by the Advisor and the Trust (including by a majority of the Trustees who are not “interested persons” (as defined in the Investment Company

Act) (the “Independent Trustees”)). Neither the Advisor nor the Trust is obligated to extend the Fee Waiver Agreement. The Fee Waiver Agreement may be terminated at any time, without the payment of any penalty, only by the Trust (upon the

vote of a majority of the Independent Trustees or a majority of the outstanding voting securities of the Trust), upon 90 days’ written notice by the Trust to the Advisor. Prior to December 1, 2019, such agreement to waive a portion of the

Trust’s management fee in connection with the Trust’s investment in affiliated money market funds was voluntary.

In the sub-section of the SAI entitled “Management of the Trust – Investment Management Agreement,” footnote 1 to the table is deleted in its entirety.

Investors should retain this supplement for future reference.

- 2 -

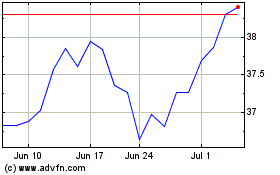

BlackRock Science and Te... (NYSE:BST)

Historical Stock Chart

From Mar 2024 to Apr 2024

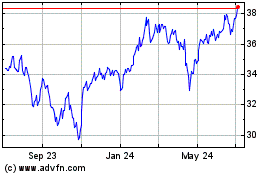

BlackRock Science and Te... (NYSE:BST)

Historical Stock Chart

From Apr 2023 to Apr 2024