Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

April 03 2019 - 4:00PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-228614

ACCELERATED RETURN NOTES

®

(ARNs

®

)

|

|

Accelerated Return Notes

®

Linked to the Common Stock of Apple Inc.

|

This graph reflects the hypothetical return on the notes, based on the mid-point of the range(s) set forth in the table to the left. This graph has been prepared for

purposes of illustration only.

|

|

Issuer

|

The Bank of Nova Scotia (“BNS”)

|

|

Principal Amount

|

$10.00 per unit

|

|

Term

|

Approximately 14 months

|

|

Market Measure

|

Common Stock of Apple Inc. (the “Underlying Company”) (NASDAQ symbol: AAPL).

|

|

Payout Profile at

Maturity

|

·

3-to-1

upside exposure to increases in the Underlying Stock, subject to the Capped Value

·

1-to-1 downside exposure to decreases in the Underlying Stock, with up to 100.00% of your investment at risk

|

|

Capped Value

|

[$12.00 to $12.40] per unit, a [20% to 24%] return over the principal amount, to be determined on the pricing date.

|

|

Investment

Considerations

|

This investment is designed for investors who anticipate that the Underlying Stock will increase moderately over the term of the notes, and are willing to

accept a capped return, take full downside risk and forgo interim interest payments.

|

|

Preliminary

Offering Documents

|

|

|

Exchange Listing

|

No

|

You should read the relevant Preliminary Offering Documents before you invest.

Click on the Preliminary Offering Documents hyperlink above or call your Financial Advisor for a hard copy.

Risk Factors

Please see the Preliminary Offering Documents for a description of certain risks related to this investment, including, but not limited to, the following:

|

·

|

Depending on the performance of the Underlying Stock as measured shortly before the maturity date, your investment may result in a loss; there is no

guaranteed return of principal.

|

|

·

|

Payments on the notes are subject to the credit risk of BNS, and actual or perceived changes in the creditworthiness of BNS are expected to affect the

value of the notes. If BNS becomes insolvent or is unable to pay its obligations, you may lose your entire investment.

|

|

·

|

Your investment return is limited to the return represented by the Capped Value and may be less than a comparable investment directly in the Underlying

Stock.

|

|

·

|

The initial estimated value of the notes on the pricing date will be less than their public offering price.

|

|

·

|

If you attempt to sell the notes prior to maturity, their market value may be lower than both the public offering price and the initial estimated value of

the notes on the pricing date.

|

|

·

|

You will have no rights of a holder of the Underlying Stock, and you will not be entitled to receive any shares of the Underlying Stock or dividends or

other distributions by the Underlying Company.

|

|

·

|

The issuer, MLPF&S and their respective affiliates do not control the Underlying Company and have not verified any disclosure made by the Underlying

Company. The Underlying Company will not have any obligations relating to the notes.

|

|

·

|

The Redemption Amount will not be adjusted for all corporate events that could affect the Underlying Stock.

|

Final terms will be set on the pricing date within the given range for the specified Market-Linked Investment. Please see the Preliminary Offering Documents for complete

product disclosure, including related risks and tax disclosure.

The Bank of Nova Scotia (“BNS”) has filed a registration statement (which includes a prospectus) with the U.S. Securities and Exchange Commission (SEC)

for the notes that are described in this Guidebook. Before you invest, you should carefully read the prospectus in that registration statement and other documents that BNS has filed with the SEC for more complete information about BNS and any

offering described in this Guidebook. You may obtain these documents without cost by visiting EDGAR on the SEC Website at www.sec.gov. BNS's Central Index Key, or CIK, on the SEC website is 9631. Alternatively, Merrill Lynch will arrange to send

you the prospectus and other documents relating to any offering described in this document if you so request by calling toll-free 1-800-294-1322. BNS faces risks that are specific to its business, and we encourage you to carefully consider these

risks before making an investment in its securities

.

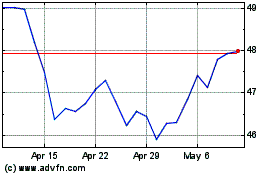

Bank Nova Scotia Halifax (NYSE:BNS)

Historical Stock Chart

From Mar 2024 to Apr 2024

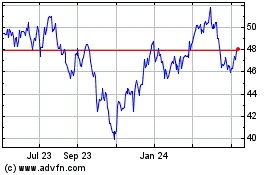

Bank Nova Scotia Halifax (NYSE:BNS)

Historical Stock Chart

From Apr 2023 to Apr 2024