Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

June 30 2020 - 6:31AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

|

|

☐

|

Preliminary Proxy Statement

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

☐

|

Definitive Additional Materials

|

|

|

☒

|

Soliciting Material Under Rule 14a-12

|

|

BARNES & NOBLE EDUCATION, INC.

|

|

(Name of Registrant as Specified in Its Charter)

|

|

|

|

OUTERBRIDGE CAPITAL MANAGEMENT, LLC

OUTERBRIDGE MASTER FUND LP

OUTERBRIDGE GP, LLC

OUTERBRIDGE PARTNERS, LP

OUTERBRIDGE FUND LTD.

RORY WALLACE

MIKE ALFRED

DAVID KIM

ZACHARY LEVENICK

LOWELL ROBINSON

|

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee paid previously with preliminary materials:

|

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

Outerbridge Capital

Management, LLC, together with the other participants named herein (collectively, “Outerbridge”), intends to file a

preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission (“SEC”) to

be used to solicit votes for the election of its slate of highly-qualified director nominees at the 2020 annual meeting of stockholders

of Barnes & Noble Education, Inc., a Delaware corporation (the “Company”).

On June 29, 2020,

Outerbridge filed its Amendment No. 2 to the Schedule 13D with respect to the Company announcing its nomination of a slate of highly-qualified

director nominees for election at the 2020 annual meeting of stockholders, a copy of which is attached hereto as Exhibit 1 and

is incorporated herein by reference.

CERTAIN INFORMATION CONCERNING THE

PARTICIPANTS

OUTERBRIDGE STRONGLY ADVISES ALL STOCKHOLDERS

OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION,

THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the proxy solicitation

are anticipated to be Outerbridge Capital Management, LLC (“Outerbridge Capital”), Outerbridge Master Fund LP (“Outerbridge

Master”), Outerbridge GP, LLC (“Outerbridge GP”), Outerbridge Partners, LP (“Outerbridge Partners”),

Outerbridge Fund Ltd. (“Outerbridge Fund”), Rory Wallace, Mike Alfred, David Kim, Zachary Levenick and Lowell Robinson.

As of the date hereof, Outerbridge

Master beneficially owns directly 6,499,621 shares of Common Stock, par value $0.01 per share, of the Company (the “Common

Stock”). As of the date hereof, Outerbridge Capital, as the investment manager to Outerbridge Master, Outerbridge Partners,

and Outerbridge Fund, may be deemed the beneficial owner of the 6,499,621 shares of Common Stock owned by Outerbridge Master.

Outerbridge GP, as the general partner of Outerbridge Master and Outerbridge Partners, may be deemed the beneficial owner of the

6,499,621 shares of Common Stock owned by Outerbridge Master. Outerbridge Partners, a feeder fund of Outerbridge Master, may be

deemed the beneficial owner of the 6,499,621 shares of Common Stock owned by Outerbridge Master. Outerbridge Fund, as a feeder

fund of Outerbridge Master, may be deemed the beneficial owner of the 6,499,621 shares of Common Stock owned by Outerbridge Master.

Mr. Wallace, as the managing member of each of Outerbridge Capital and Outerbridge GP, may be deemed the beneficial owner of the

6,499,621 shares of Common Stock owned by Outerbridge Master. As of the date hereof, Mr. Alfred directly beneficially owns 10,000

shares of Common Stock. As of the date hereof, Mr. Levenick directly beneficially owns 5,500 shares of Common Stock, including

3,500 shares of Common Stock underlying certain call options. As of the date hereof, Messrs. Kim and Robinson do not own any shares

of Common Stock.

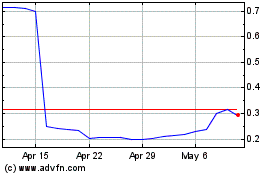

Barnes and Noble Education (NYSE:BNED)

Historical Stock Chart

From Mar 2024 to Apr 2024

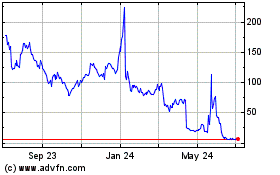

Barnes and Noble Education (NYSE:BNED)

Historical Stock Chart

From Apr 2023 to Apr 2024