Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

April 09 2021 - 6:05AM

Edgar (US Regulatory)

Registration No. 333-237342

Filed Pursuant to Rule 433

Dated April 8, 2021

Member

FINRA, SIPC NOT FDIC INSURED / NOT BANK GUARANTEED / MAY LOSE VALUE Continued on next page

Overview The MicroSectors™ Gold Miners Exchange Traded Notes (ETNs) are linked to the

performance of the S-Network MicroSectors™ Gold Miners Index. Each ETN offers investors

a return based on changes in the level of the S-Network MicroSectors™ Gold Miners Index,

compounded daily, before taking into account fees. Each ETN has a specified leverage factor

that is reset daily. This fact sheet relates to two separate ETN offerings. Each ETN seeks

a return on the underlying index for a single day. The ETNs are not “buy and hold”

investments and should not be expected to provide its respective return of the underlying

index’s cumulative return for periods greater than a day. The S-Network MicroSectors™

Gold Miners Index The S-Network MicroSectors™ Gold Miners Index (“MINERS”)

tracks the performance of two of the largest gold mining exchange traded funds, the VanEck

Vectors® Gold Miners ETF (the “GDX”) and the VanEck Vectors® Junior Gold

Miners ETF (the “GDXJ”). The index’s underlying composition is market capitalization

weighted across both ETFs. More information about the index can be found here https://snetworkglobalindexes.com/indexes/s-network-microsectors-indexes.

Q1 2021 Daily Returns (1/4/2021 to 3/31/2021) The following graph illustrates, for the indicted

period, the daily changes in the closing level of the index, and the resulting changes in

closing daily closing indicative value of each ETN. Past performance is no indication of

future results as to the index, or any ETN. Ticker Exchange Traded Note GDXU MicroSectors™

Gold Miners 3X Leveraged ETN GDXD MicroSectors™ Gold Miners -3X Inverse Leveraged ETN

ETN Details GDXD GDXU Intraday Indicative Value GDXDIV GDXUIV CUSIP 063679658 063679641 ISIN

US0636796411 US0636796585 Daily Investor Fee¹ 0.95% per annum, accrued on a daily basis

0.95% per annum, accrued on a daily basis Daily Financing/Interest Rate2 US Federal Funds

Effective Rate minus the Spread of 2% per annum, accrued on a daily basis* Federal Reserve

Bank Prime Loan Rate plus the Financing Spread of 2.25% per annum, accrued on a daily basis**

Leverage Factor -3X +3X Leverage Reset Frequency Daily Daily Exchange NYSE Arca NYSE Arca

Issuer Bank of Montreal Bank of Montreal Initial Trade Date 12/2/2020 12/2/2020 Maturity

Date 6/30/2040 6/30/2040 Gold Miners Leveraged & Inverse Leveraged Exchange Traded Notes

Index Constituents Ticker Name Weight GDX VanEck Vectors® Gold Miners ETF 72.59% GDXJ

VanEck Vectors® Junior Gold Miners ETF 27.41% As of 3/22/2021. Index weightings and constituents

are subject to change. -25% -20% -15% -10% -5% 0% 5% 10% 25% 20% 15% MicroSectors™

Gold Miners -3X Inverse Leveraged ETN MicroSectors™ Gold Miners 3X Leveraged ETN S-Network

MicroSectors™ Gold Miners Total Return Index January 2021 February 2021 March 2021

Source: Bloomberg L.P. 1 The Daily Investor Fee is a per annum number that accrues on a daily

basis. 2 The Daily Financing & Interest Rates are per annum numbers that accrue on a

daily basis. The Daily Financing Rate applies to GDXU, and the Daily Interest Rate applies

to GDXD. * The Spread will initially be 2%, but may be increased to up to 4% at our option.

** The Financing Spread will initially be 2.25%, but may be increased to up to 5% at our

option. Member FINRA, SIPC NOT FDIC INSURED / NOT BANK GUARANTEED / MAY LOSE VALUE Bank of

Montreal, the issuer of the ETNs (“Bank of Montreal” or the “Issuer”),

has filed a registration statement (including a pricing supplement, a product supplement,

a prospectus supplement and prospectus with the Securities and Exchange Commission (the “SEC”)

for each of the offerings to which this document relates. Please read those documents and

the other documents relating to these offerings that Bank of Montreal has filed with the

SEC for more complete information about Bank of Montreal and these offerings. These documents

may be obtained without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively,

Bank of Montreal, any agent or any dealer participating in these offerings will arrange to

send the applicable pricing supplement, prospectus supplement and prospectus if so requested

by calling toll-free at 1-877-369-5412. The ETNs are senior, unsecured debt obligations of

Bank of Montreal and are subject to Bank of Montreal’s credit risk. Investment suitability

must be determined individually for each investor, and the ETNs may not be suitable for all

investors. This information is not intended to provide and should not be relied upon as providing

accounting, legal, regulatory or tax advice. Investors should consult with their own financial

advisors as to these matters. The leveraged and leveraged inverse ETNs are intended to be

daily trading tools for sophisticated investors to manage daily trading risks as part of

an overall diversified portfolio. They are designed to achieve their stated investment objectives

on a daily basis. You should proceed with extreme caution in considering an investment in

the ETNs. The ETNs do not guarantee the return of your investment. If the Closing Indicative

Note Value or the Intraday Indicative Value for the ETNs is equal to or less than $0 at any

time during an Exchange Business Day (as described in the applicable pricing supplement),

you will lose all of your investment in the ETNs. Even if the Index level has increased or

decreased, as applicable, from the Initial Index Level, you may receive less than the principal

amount of your ETNs upon a call, redemption, at maturity, or if you sell your ETNs, as described

more in the applicable pricing supplement. Leverage increases the sensitivity of your ETNs

to changes in the level of the Index. The ETNs are not suitable for investors with longer-term

investment objectives. In particular, the ETNs should be purchased only by sophisticated

investors who do not intend to hold the ETNs as a buy and hold investment, who are willing

to actively and continuously monitor their investment and who understand the consequences

of investing in and of seeking daily resetting investment results, which are leveraged as

to these ETNs. Due to the effect of compounding, if the Indicative Note Value changes, any

subsequent adverse change of the Index level will result in a larger dollar reduction from

the Indicative Note Value than if the Indicative Note Value remained constant. The ETNs are

subject to intraday purchase risk. The Indicative Note Value is reset daily, and the leverage

or exposure of the ETNs during any given Exchange Business Day may be greater than or less

than the amount indicated by the name of the ETN. The ETNs are subject to a call right, which

may adversely affect the value of, or your ability to sell, your ETNs. The ETNs do not pay

any interest, and you will not have any ownership rights in the Index constituents. The Index

level used to calculate any payment on the ETNs may be different from the Index level at

other times during the term of the ETNs. There are restrictions on your ability to request

a redemption of the ETNs, and you will not know the amount due upon redemption at the time

you elect to request that the ETNs be redeemed. The Issuer may sell additional ETNs, but

is under no obligation to do so. Market disruptions may adversely affect your return. Significant

aspects of the tax treatment of the ETNs are uncertain. The Intraday Indicative Value and

the Indicative Note Value are not the same as the closing price or any other trading price

of the ETNs in the secondary market. There is no assurance that your ETNs will be listed

or continue to be listed on a securities exchange, and they may not have an active trading

market. The value of the ETNs in the secondary market may be influenced by many unpredictable

factors. The Issuer or its affiliates may have economic interests that are adverse to those

of the holders of the ETNs as a result of its business, hedging and trading activities, or

as Calculation Agent of the ETNs (as defined in the applicable pricing supplement), and may

have published research, expressed opinions or provided recommendations that are inconsistent

with investing in or holding the ETNs, and may do so in the future. The Index has limited

actual historical information. The Index Sponsor or the Index Calculation Agent (as defined

in the applicable pricing supplement) may adjust the Index in a way that may affect its level,

and may, in its sole discretion, discontinue the public disclosure of the intraday Index

value and the level of the Index. The Index lacks diversification and is vulnerable to fluctuations

in the precious metal mining industry. Please see the “Risk Factors” section

in the applicable pricing supplement. We urge you to consult your investment, legal, tax,

accounting and other advisers before you invest in the ETNs. MicroSectors™ and REX™

are registered trademarks of REX Shares, LLC (“REX”). The trademarks have been

licensed for use for certain purposes by Bank of Montreal. The ETNs are not sponsored or

sold by REX or any of its affiliates or third-party licensors (collectively, “REX Index

Parties”). REX Index Parties make no representation or warranty, express or implied,

to the owners of the ETNs or any member of the public regarding the advisability of investing

in securities generally or in the ETNs particularly or the ability of the Index to track

general market performance. REX Index Parties’ only relationship to Bank of Montreal

with respect to the Index is the licensing of the Index and certain trademarks, service marks

and/or trade names of REX Index Parties. REX Index Parties are not responsible for and have

not participated in the determination of the prices, and amount of the ETNs or the timing

of the issuance or sale of the ETNs or in the determination or calculation of the equation

by which the ETNs are to be converted into cash. REX Index Parties have no obligation or

liability in connection with the administration, marketing or trading of the ETNs. Inclusion

of a security within an index is not a recommendation by REX Index Parties to buy, sell,

or hold such security, nor is it considered to be investment advice. S-Network Global Indexes,

Inc. (“S-Network”) is the licensor of the S-Network MicroSectors™ Gold

Miners Index. The ETNs are not sponsored, endorsed, sold or promoted by S-Network, or its

third-party licensors, in any way and makes no express or implied representation, guarantee

or assurance with regard to: (a) the advisability in investing in the ETNs; (b) the quality,

accuracy and/or completeness of the Index; and/or (c) the results obtained or to be obtained

by any person or entity from the use of the Index. S-Network does not guarantee the accuracy

and/or the completeness of the Index and shall not have any liability for any errors or omissions

with respect thereto. Notwithstanding S-Network’s obligations to its licensees, S-Network

reserves the right to change the methods of calculation or publication of the Index, and

S-Network shall not be liable for any miscalculation of or any incorrect, delayed or interrupted

publication with respect to the Index. S-Network shall not be liable for any damages, including,

without limitation, any loss of profits or business, or any special, incidental, punitive,

indirect or consequential damages suffered or incurred as a result of the use (or inability

to use) of the Index. Call Us 203-557-6201 Email Us info@rexshares.com Visit Us www.microsectors.com

Gold Miners Leveraged & Inverse Leveraged Exchange Traded Notes

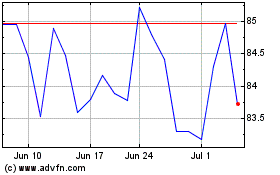

Bank of Montreal (NYSE:BMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank of Montreal (NYSE:BMO)

Historical Stock Chart

From Apr 2023 to Apr 2024