Alphabet, Campbell, Expedia: Stocks That Defined the Week

December 06 2019 - 6:01PM

Dow Jones News

By Francesca Fontana

FedEx Corp.

It is crunchtime for FedEx, United Parcel Service Inc. and

Amazon.com Inc., which have to figure out how to deliver millions

more orders this holiday season in fewer days. The window between

Thanksgiving and Christmas is almost a week shorter than last year.

FedEx's load will be lightened somewhat now that it no longer has

to carry Amazon's packages. The two cut ties in the U.S. earlier

this year, freeing up space for other shippers that FedEx is

courting. FedEx shares fell 1.3% Monday.

Alphabet Inc.

Larry Page and Sergey Brin said it is time to play the role of

"proud parents" at the internet giant they built, offering "advice

and love but not daily nagging." The co-founders made their comment

in a letter Tuesday announcing their decision to step down from

day-to-day management of Alphabet, the parent company of Google.

Messrs. Page and Brin, who had been chief executive and president,

respectively, surrendered immediate control to a company veteran

and Google CEO Sundar Pichai. Mr. Pichai will now have to navigate

global regulatory threats as well as employee discontent. Messrs.

Page and Brin remain on Alphabet's board and will still together

control a majority of voting power over company decisions under

Alphabet's dual-class share structure. Alphabet shares jumped 2% on

Wednesday.

Campbell Soup Co.

Soup sales have cooled for Campbell Soup. The food maker said

Wednesday that it sold fewer of its namesake products in the U.S.

in the latest quarter, wiping out gains from its growing snacks

division. Campbell said that retailers put off shipments of

Thanksgiving soups since the holiday came later this year. However,

Campbell has also lost space for some of its soups on store shelves

after years of sales declines. The company has been pushing to

expand its snacks business after a jump-start from its 2018

acquisition of Snyder's Lance pretzels and nuts. Campbell shares

fell 1.7% Thursday.

Expedia Group Inc.

Two top executives at Expedia packed their bags. Chief Executive

Mark Okerstrom and Chief Financial Officer Alan Pickerill have

resigned after clashing with Chairman Barry Diller and the board

over the online-travel company's direction, the company said

Wednesday. The executives stepped down immediately from their

roles, at the behest of the board, Expedia said. Mr. Diller and

Vice Chairman Peter Kern will manage day-to-day operations while

the board overhauls the leadership of the Bellevue, Wash., company.

Expedia's chief strategy officer, Eric Hart, will serve as acting

CFO. Expedia shares gained 6.2% Wednesday.

Sage Therapeutics Inc.

Sage Therapeutics Inc.'s share price was cut in half Thursday,

falling 60% and erasing more than $4 billion in market value after

the firm's treatment for depression failed in a late-stage trial.

The biopharmaceutical company said its Phase 3 study of the

Sage-217 treatment in adults with major depressive disorder didn't

meet its primary endpoint of a statistically significant

improvement in a scale that tracks 17 parameters, including anxiety

and paranoia, at day 15. The study is the first time Sage-217 "has

missed on a major depression trial and thus, a major surprise to

investors," SVB Leerink analysts said in a note to clients.

Slack Technologies Inc.

Investors messaged Slack Technologies Inc. the equivalent of a

smiley-face emoji after the chat app company said it added more

large corporate users for its workplace-collaboration software in

the last quarter. Shares gained 5.2% following the announcement

Thursday. Investors' concerns about competition have weighed on

Slack's shares in recent weeks as the company has been engaged in

heated competition for customers with Microsoft Corp. Slack said a

number of big companies have embraced its messaging platform and

many of those already use its rivals' software for other purposes.

Microsoft's competing messaging product, called Teams, is free to

its Office 365 subscribers. Slack raised its full-year outlook and

said it has more than 50 customers that each generate $1 million or

more in annual revenue.

BlackRock Inc.

A potential heir to the top job at the world's largest money

manager has been ousted for failing to disclose a relationship with

a colleague. The firm on Thursday said in an internal memo that

Mark Wiseman, a top lieutenant to Chief Executive Laurence Fink,

was departing the company for violating policies. BlackRock

requires employees to disclose any relationships -- whether they

are with direct subordinates or with other colleagues -- to the

company. Mr. Wiseman is married to Marcia Moffat, a BlackRock

executive who heads the firm's Canada business. Mr. Wiseman joined

BlackRock in 2016 from Canada's public pension world. Shares rose

1.4% Thursday.

Write to Francesca Fontana at francesca.fontana@wsj.com

(END) Dow Jones Newswires

December 06, 2019 17:46 ET (22:46 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

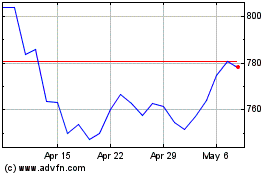

BlackRock (NYSE:BLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

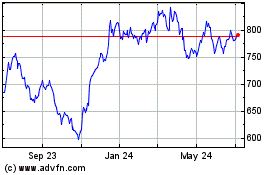

BlackRock (NYSE:BLK)

Historical Stock Chart

From Apr 2023 to Apr 2024