Current Report Filing (8-k)

January 08 2021 - 6:02AM

Edgar (US Regulatory)

0001689813FALSE00016898132021-01-012021-01-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 1, 2021

Biohaven Pharmaceutical Holding Company Ltd.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

British Virgin Islands

|

001-38080

|

Not applicable

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

c/o Biohaven Pharmaceuticals, Inc.

215 Church Street

New Haven, Connecticut 06510

(Address of principal executive offices, including zip code)

(203) 404-0410

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading symbol

|

Name of each exchange on which registered

|

|

Common Shares, no par value

|

BHVN

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On January 1, 2021, Biohaven Pharmaceutical Holding Company Ltd. (the “Company”) and its subsidiaries Biohaven Therapeutics Ltd. (“Therapeutics”) and Kleo Acquisition, Inc. (“Merger Sub”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Kleo Pharmaceuticals, Inc. (“Kleo”) and Shareholder Representative Services LLC, which contemplates Merger Sub, subject to the terms and conditions set forth in the Merger Agreement, merging with and into Kleo, with Kleo surviving the merger as a wholly-owned subsidiary of the Company. The merger closed on January 4, 2021.

In the merger, each share of Kleo common stock issued and outstanding immediately prior to the effective time of the merger was converted into the right to receive (i) approximately 0.007 of a common share of the Company, rounded up to the nearest whole share, (ii) one contingent value right, as further described below, and (iii) certain other amounts to extent released from escrows established to provide for indemnification claims.

The merger values Kleo at approximately $20 million, exclusive of the value of the contingent value rights, and the Merger Agreement provides for approximately $1 million of holdbacks to provide for indemnification claims. Prior to the consummation of the merger, the Company owned approximately 42% of the outstanding shares of Kleo through its subsidiary Therapeutics, resulting in an aggregate maximum of 116,007 common shares of the Company being issued to Kleo stockholders in the merger, assuming each Kleo stockholder is an accredited investor entitled under the Merger Agreement to receive common shares of the Company.

In the merger, each share of Kleo common stock received one contingent value right, representing the right to receive $1.00 in cash if certain specified Kleo biopharmaceutical products or product candidates receive the approval of the U.S. Food and Drug Administration prior to the expiration of 30 months following the effective time of the merger. The maximum amount payable pursuant to the contingent value rights is approximately $17.3 million.

The Merger Agreement contains various representations and warranties, covenants, indemnification obligations and other provisions customary for transactions of this nature. Kleo’s employees, other than its President and CFO, will be retained as part of the merger.

Pursuant to the Merger Agreement, the Company has agreed to prepare and file a registration statement permitting Kleo stockholders to offer and sell the common shares of the Company issued in the merger.

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of the Merger Agreement, which is filed as Exhibit 1.1 hereto.

Item 8.01 Other Events.

Pursuant to the terms and subject to the conditions of the Merger Agreement, stockholders of Kleo receive up to approximately 116,007 common shares of the Company as merger consideration. Those common shares were issued without registration under the Securities Act of 1933 in reliance on the private offering exemption provided by Section 4(a)(2) thereof. The securities will bear a legend restricting their further transfer or sale until they have been registered under the Securities Act of 1933 or an exemption from registration thereunder is available.

On January 7, 2021, the Company issued a press release announcing the acquisition of Kleo. A copy of the press release is attached as Exhibit 99.1 hereto and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Exhibit Description

|

|

1.1

|

|

|

|

99.1

|

|

|

|

104

|

|

The cover page of this Current Report on Form 8-K formatted as Inline XBRL.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 7, 2021

|

|

|

|

|

|

|

|

Biohaven Pharmaceutical Holding Company Ltd.

|

|

|

|

By:

|

/s/ Vlad Coric, M.D.

|

|

|

Vlad Coric, M.D.

|

|

|

Chief Executive Officer

|

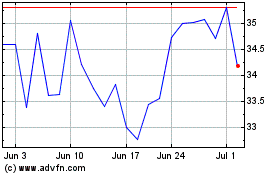

Biohaven (NYSE:BHVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

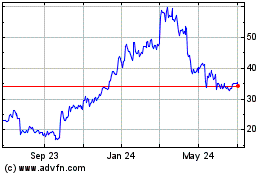

Biohaven (NYSE:BHVN)

Historical Stock Chart

From Apr 2023 to Apr 2024