Current Report Filing (8-k)

December 23 2020 - 4:13PM

Edgar (US Regulatory)

0001689813FALSE00016898132020-12-232020-12-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 23, 2020

Biohaven Pharmaceutical Holding Company Ltd.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

British Virgin Islands

|

001-38080

|

Not applicable

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

c/o Biohaven Pharmaceuticals, Inc.

215 Church Street

New Haven, Connecticut 06510

(Address of principal executive offices, including zip code)

(203) 404-0410

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading symbol

|

Name of each exchange on which registered

|

|

Common Shares, no par value

|

BHVN

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01Other Events.

In order to provide added flexibility regarding potential future financing options, Biohaven Pharmaceutical Holding Company Ltd. (the “Company”) entered into an Equity Distribution Agreement (the “Equity Distribution Agreement”) on December 23, 2020, with Goldman Sachs & Co. LLC, Piper Sandler & Co., SVB Leerink LLC, Canaccord Genuity LLC, Mizuho Securities USA LLC, Wedbush Securities Inc., and William Blair & Company, L.L.C., as managers (each, a “Manager” and, collectively, the “Managers”), pursuant to which the Company may sell, from time to time, up to an aggregate offering price of $400.0 million of its common shares, without par value (the “Common Shares”), in an “at-the-market” equity offering program through the Managers. Sales of the Common Shares made pursuant to the Equity Distribution Agreement, if any, may be made by means of ordinary brokers’ transactions on the New York Stock Exchange or otherwise at market prices prevailing at the time of sale or negotiated transactions, or as otherwise agreed with the applicable Manager. Actual sales will depend on a variety of factors to be determined by the Company from time to time, including (among others) market conditions, the trading price of the Common Shares, capital needs and determinations by the Company of the appropriate sources of funding for the Company.

The Equity Distribution Agreement contains customary representations, warranties and agreements of the Company, conditions to closing, indemnification rights and obligations of the parties and termination provisions.

Any Common Shares sold will be offered and sold pursuant to an effective shelf registration statement (the “Registration Statement”) filed with the Securities and Exchange Commission on June 17, 2019 (File No. 333-232167), a base prospectus, dated June 17, 2019, included as part of the Registration Statement, and a prospectus supplement, dated December 23, 2020, filed with the Securities and Exchange Commission pursuant to Rule 424(b) under the Securities Act of 1933, as amended.

The foregoing description of the Equity Distribution Agreement is not complete and is qualified in its entirety by reference to the full text of the Equity Distribution Agreement, a copy of which is filed as Exhibit 1.1 to this Current Report on Form 8-K and is incorporated by reference into this Item 8.01. A copy of the opinion of Maples & Calder relating to the issuance of the Common Shares is filed as Exhibit 5.1 to this Current Report on Form 8-K. Exhibits 1.1, 5.1 and 23.1 hereto are hereby incorporated by reference into the Registration Statement.

This Current Report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to buy any securities, nor shall there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction.

Item 9.01Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Exhibit Description

|

|

|

|

Equity Distribution Agreement, dated as of December 23, 2020, by and between Biohaven Pharmaceutical Holding Company Ltd. and Goldman Sachs & Co. LLC, Piper Sandler & Co., SVB Leerink LLC, Canaccord Genuity LLC, Mizuho Securities USA LLC, Wedbush Securities Inc., and William Blair & Company, L.L.C.

|

|

|

|

|

|

|

|

|

|

104

|

|

The cover page of this Current Report on Form 8-K formatted as Inline XBRL.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 23, 2020

|

|

|

|

|

|

|

|

Biohaven Pharmaceutical Holding Company Ltd.

|

|

|

|

By:

|

/s/ Vlad Coric, M.D.

|

|

|

Vlad Coric, M.D.

|

|

|

Chief Executive Officer

|

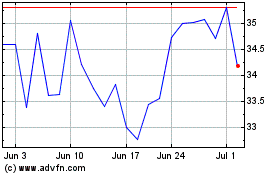

Biohaven (NYSE:BHVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

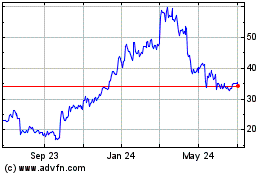

Biohaven (NYSE:BHVN)

Historical Stock Chart

From Apr 2023 to Apr 2024