Current Report Filing (8-k)

February 22 2021 - 5:18PM

Edgar (US Regulatory)

0001574085false00015740852021-02-222021-02-220001574085us-gaap:CommonStockMember2021-02-222021-02-220001574085us-gaap:SeriesBPreferredStockMember2021-02-222021-02-220001574085us-gaap:SeriesDPreferredStockMember2021-02-222021-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): February 22, 2021

BRAEMAR HOTELS & RESORTS INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland

|

|

001-35972

|

|

46-2488594

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission File Number)

|

|

(IRS employer identification number)

|

|

|

|

|

|

|

|

14185 Dallas Parkway

|

|

|

|

|

|

Suite 1100

|

|

|

|

|

|

Dallas

|

|

|

|

|

|

Texas

|

|

|

|

75254

|

|

(Address of principal executive offices)

|

|

|

|

(Zip code)

|

Registrant’s telephone number, including area code: (972) 490-9600

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14-a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

BHR

|

|

New York Stock Exchange

|

|

Preferred Stock, Series B

|

|

BHR-PB

|

|

New York Stock Exchange

|

|

Preferred Stock, Series D

|

|

BHR-PD

|

|

New York Stock Exchange

|

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

On October 25, 2019, Braemar Hotels & Resorts Inc. (the “Company”) entered into a Second Amended and Restated Credit Agreement with Braemar Hospitality Limited Partnership, the Company’s operating partnership, Bank of America, N.A., as administrative agent, and the other financial institutions party thereto (the “Second Amended and Restated Credit Agreement”). On June 8, 2020, the Company entered into the First Amendment to Second Amended and Restated Credit Agreement (the “First Amendment,” and together with the Second Amended and Restated Credit Agreement, the “Credit Facility”). The material terms of the Credit Facility were summarized in the Company’s Current Reports on Form 8-K filed with the Securities and Exchange Commission on October 28, 2019 and June 11, 2020.

On February 22, 2021, the Company entered into the Second Amendment to Second Amended and Restated Credit Agreement (the “Second Amendment”). The Second Amendment waives certain covenants through the fourth quarter of 2021 and amends certain other terms, as described further below.

Pursuant to the terms of the Second Amendment, borrowings will bear interest at a rate of LIBOR plus 3.65% or Base Rate plus 2.65% until the Company provides a compliance certificate for the quarter ending March 31, 2022. After such date, the pricing will revert to the original terms of the Credit Facility.

The Second Amendment changes the terms of certain financial covenants that the Company was subject to under the Credit Facility. The requirement that the Consolidated Fixed Charge Coverage Ratio (as defined in the Credit Facility) be not less than 1.40 has been waived through December 31, 2021 (the “Covenant Waiver Period”). At the end of the Covenant Waiver Period, the Consolidated Fixed Charge Coverage Ratio becomes 1.0 for the first quarter of 2022, 1.10 for the second and third quarters of 2022, 1.20 for the fourth quarter of 2022, and then returns to 1.40 thereafter.

The Second Amendment permits funding of select renovation projects from existing furniture, fixtures and equipment (FF&E) reserves at the Ritz-Carlton Sarasota; Ritz-Carlton Lake Tahoe, Park Hyatt Beaver Creek, Hilton Torrey Pines, and Marriott Seattle, subject to a cap on amounts to be spent consistent with the forecasted spend information provided pursuant to the Second Amendment. The Credit Facility includes mandatory prepayments that require the Company to prepay and reduce the balance of the Credit Facility by an amount equal to 50% of net proceeds from any asset sales, equity offerings (including preferred equity offerings) or incurrence of indebtedness (including refinancings), except that the first $50 million of any common equity offering (including sales of shares of common stock under the Company’s “at-the-market” equity distribution program) is subject to a mandatory prepayment amount. The Second Amendment increases the mandatory prepayment amount from 25% of net proceeds to 35% of net proceeds.

The Second Amendment is filed with this Current Report on Form 8-K as Exhibit 10.1 and is incorporated herein by reference. This summary does not purport to be complete and is qualified in its entirety by reference to the actual amendment.

ITEM 2.03 CREATION OF A DIRECT FINANCIAL OBLIGATION UNDER AN OFF-BALANCE ARRANGEMENT OF A REGISTRANT.

The information in Item 1.01 is incorporated herein by reference.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

Exhibit

Number Exhibit Description

104 Cover Page Interactive Data File (formatted in Inline XBRL and contained in Exhibit 101).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 22, 2021

|

|

|

|

|

|

|

|

|

|

|

|

BRAEMAR HOTELS & RESORTS INC.

|

|

|

|

|

|

|

By:

|

/s/ ROBERT G. HAIMAN

|

|

|

|

Robert G. Haiman

|

|

|

|

Executive Vice President, General Counsel & Secretary

|

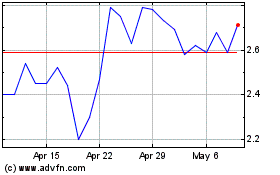

Braemar Hotels and Resorts (NYSE:BHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Braemar Hotels and Resorts (NYSE:BHR)

Historical Stock Chart

From Apr 2023 to Apr 2024