Current Report Filing (8-k)

October 13 2021 - 6:01AM

Edgar (US Regulatory)

0000863436false00008634362021-10-122021-10-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

Date of Report (Date of earliest event reported): October 12, 2021

|

BENCHMARK ELECTRONICS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Texas

|

001-10560

|

74-2211011

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

56 South Rockford Drive

|

|

|

Tempe, Arizona

|

|

85281

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

|

|

Registrant’s Telephone Number, Including Area Code: (623) 300-7000

|

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.10 per share

|

|

BHE

|

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On October 12, 2021, Benchmark Electronics, Inc. (NYSE: BHE) announced the appointment of Ramesh Gopalakrishnan as an independent director to the Board of Directors of the Company effective October 11, 2021. In the press release, the Company also announced the resignation of Bruce Carlson, who has served as a board member since 2017, effective October 11, 2021. Mr. Carlson’s resignation was delivered pursuant to the retirement provisions of the Company’s Corporate Governance Guidelines and was occasioned by him attaining the age of 72. His resignation was not the result of any disagreement with management or the Board.

Mr. Gopalakrishnan is the Chief Operating Officer, Wind, of TPI Composites, Inc. (NASDAQ: TPIC), a global manufacturer of utility-scale wind turbine blades. Prior to joining TPI Composites, Inc. in September 2016, Mr. Gopalakrishnan was with Senvion GmbH, where he served as the Executive Vice President of Manufacturing from May 2015 to August 2016 and Senior Vice President, Global Blades, from February 2013 to April 2015. Mr. Gopalakrishnan also served as the Chief Operating Officer of Suzlon Energy Composites from February 2011 to January 2013. Prior to joining Suzlon Energy Composites, Mr. Gopalakrishnan held leadership roles in supply chain and strategy at Halliburton (2006-2010)(NYSE: HAL). Before his time at Halliburton, Mr. Gopalakrishnan held several leadership roles in operations, engineering, and advanced technology at General Electric (1996-2006)(NYSE: GE) and Siemens (1993-1996)(FRA: SIE).

He holds a bachelors of science in mechanical engineering from the Indian Institute of Technology Bombay, and a masters of science and a doctorate in mechanical engineering from State University of New York at Stony Brook.

For his service as a member of the Board, Mr. Gopalakrishnan will receive the same compensation as other non-employee directors under the Company’s current non-employee director compensation program described in the Company’s definitive proxy statement filed with the U.S. Securities and Exchange Commission on April 1, 2021. During 2021, our non-employee directors will receive: (a) an annual retainer of $60,000, (b) $1,500 for each Board or committee meeting attended and (c) an annual restricted stock unit (“RSU”) with a grant-date fair market value of $150,000. Mr. Gopalakrishnan’s annual retainer and initial RSU grant will be prorated from the date he begins serving on the Board, and the prorated RSU grant is scheduled to vest May 12, 2022.

Item 8.01 Other Events.

On October 12, 2021, the Company issued a press release relating to the matters described under Item 5.02. The press release is incorporated herein by reference to Exhibit 99.1 filed herewith.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

BENCHMARK ELECTRONICS, INC.

|

|

|

|

|

|

|

Date:

|

October 12, 2021

|

By:

|

/s/ Stephen J. Beaver

|

|

|

|

|

Stephen J. Beaver, Esq.

Senior Vice President, General Counsel and Chief Legal Officer

|

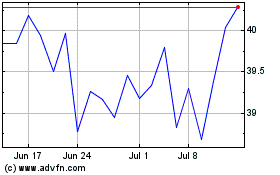

Benchmark Electronics (NYSE:BHE)

Historical Stock Chart

From Mar 2024 to Apr 2024

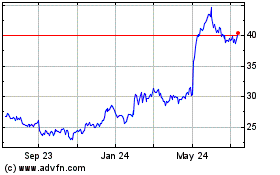

Benchmark Electronics (NYSE:BHE)

Historical Stock Chart

From Apr 2023 to Apr 2024