UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

September 9, 2019

| BIGLARI HOLDINGS INC. |

| (Exact Name of Registrant as Specified in Its Charter) |

| |

|

|

| INDIANA |

001-38477 |

82-3784946 |

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

| |

|

|

17802

IH 10 West, Suite 400, San Antonio, Texas

|

78257 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s Telephone Number, Including

Area Code: (210) 344-3400

| |

| (Former Name or Former Address, If Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

☐ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

| Class A common stock |

BH.A

|

New York Stock Exchange |

Class B common stock

|

BH |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if

the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

On September 12, 2019, Biglari

Holdings Inc. (the “Company”) filed a Current Report on Form 8-K (the “Original Report”) reporting

that, on September 9, 2019, a wholly-owned subsidiary of the Company, Southern Oil Company,

acquired all of the membership interests in Upstream Exploration Holdings LLC for an adjusted purchase price of $51,505,254

in cash. Upon completion of the transaction, Upstream Exploration Holdings LLC was converted to a corporation named Southern

Oil of Louisiana Inc. (“Southern Oil”). The Company is filing this Amendment No. 1 on Form 8-K/A (this

“Amendment”) to amend the Original Report to include certain financial statements of Southern Oil and certain pro

forma financial information of the Company, as required by Item 9.01(a) and Item 9.01(b), respectively, of Form 8-K.

Except as described in this Explanatory

Note, this Amendment does not amend or otherwise update the Original Report. Therefore, this Amendment should be read in conjunction

with the Original Report.

| Item 9.01. | Financial Statements and Exhibits. |

| (a) | Financial Statements of Businesses Acquired. |

Southern Oil’s

audited financial statements as of and for the year ended December 31, 2018, and the accompanying notes thereto, and unaudited financial statements as of and for the

six months ended June 30, 2019 are attached as Exhibits 99.1 and 99.2, respectively, to this

Amendment and are incorporated herein by reference.

| (b) | Pro Forma Financial Information. |

The Company’s

unaudited pro forma consolidated statements of earnings for the year ended December 31, 2018 and the six months ended June 30,

2019, and the accompanying notes thereto, are attached as Exhibit 99.3 to this Amendment and are incorporated herein by reference.

A consolidated

balance sheet as of September 30, 2019, including the assets and liabilities of Southern Oil, is included in the Company’s

Quarterly Report on Form 10-Q for the quarter ended September 30, 2019 filed with the Securities and Exchange Commission

on November 1, 2019.

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report on Form 8-K/A to be signed

on its behalf by the undersigned hereunto duly authorized.

| November 25, 2019 |

BIGLARI HOLDINGS INC. |

| |

|

| |

|

| |

|

| |

|

| |

By: |

/s/ Bruce Lewis |

| |

|

Name: |

Bruce Lewis |

| |

|

Title: |

Controller |

Exhibit 99.2

| SOUTHERN OIL |

| BALANCE SHEET |

| (in thousands) |

| | |

June 30,

2019 |

| | |

(Unaudited) |

| Assets | |

|

| Current assets: | |

| | |

| Cash and cash equivalents | |

$ | 29,185 | |

| Receivables | |

| 7,536 | |

| Prepaid assets | |

| 1,257 | |

| Other current assets | |

| 636 | |

| Total current assets | |

| 38,614 | |

| Oil and gas properties, net | |

| 71,861 | |

| Other property and equipment, net | |

| 189 | |

| Other assets | |

| 50 | |

| Total assets | |

$ | 110,714 | |

| | |

| | |

| Liabilities and members’ equity | |

| | |

| Liabilities | |

| | |

| Current liabilities: | |

| | |

| Accounts payable and accrued expenses | |

$ | 7,344 | |

| Asset retirement obligation - current portion | |

| 1,420 | |

| Total current liabilities | |

| 8,764 | |

| Asset retirement obligation - long-term portion | |

| 9,840 | |

| Deferred taxes | |

| 5,867 | |

| Other liabilities | |

| 81 | |

| Total liabilities | |

| 24,552 | |

| Members’ equity | |

| 86,162 | |

| Total liabilities and members’ equity | |

$ | 110,714 | |

| SOUTHERN OIL |

| STATEMENT OF EARNINGS AND MEMBERS’ EQUITY |

| (in thousands) |

| | |

First Six Months

2019 |

| | |

(Unaudited) |

| Revenues | |

|

| Oil and gas | |

$ | 39,927 | |

| Cost and expenses | |

| | |

| Oil and gas production costs | |

| 9,822 | |

| Selling, general and administrative | |

| 3,051 | |

| Depreciation, depletion and amortization | |

| 9,804 | |

| | |

| 22,677 | |

| Other income (expenses) | |

| | |

| Interest expense | |

| (9 | ) |

| Earnings before income taxes | |

| 17,241 | |

| Income tax expense | |

| 4,215 | |

| Net earnings | |

$ | 13,026 | |

| | |

| | |

| Members’ equity - beginning | |

| 73,136 | |

| Contributions | |

| - | |

| Members’ equity - ending | |

$ | 86,162 | |

| SOUTHERN OIL |

| STATEMENT OF CASH FLOWS |

| (in thousands) |

| | |

First Six Months |

| | |

2019 |

| | |

(Unaudited) |

| Operating activities | |

| | |

| Net earnings | |

$ | 13,026 | |

| Adjustments to reconcile net earnings to operating cash flows: | |

| | |

| Depreciation, depletion and amortization | |

| 9,804 | |

| Provision for deferred income taxes | |

| 1,002 | |

| Mark to market of hedge position | |

| 1,003 | |

| Non-cash expenses | |

| 238 | |

| Changes in receivables and inventories | |

| (734 | ) |

| Changes in other assets | |

| (824 | ) |

| Changes in accounts payable and accrued expenses | |

| 211 | |

| Net cash provided by operating activities | |

| 23,726 | |

| Investing activities | |

| | |

| Capital expenditures | |

| (5,084 | ) |

| Net cash (used in) investing

activities | |

| (5,084 | ) |

| Decrease in cash, cash equivalents and restricted cash | |

| 18,642 | |

| Cash, cash equivalents and restricted cash at beginning of year | |

| 10,593 | |

| Cash, cash equivalents and restricted cash at end of second quarter | |

$ | 29,235 | |

Exhibit 99.3

UNAUDITED PRO FORMA

COMBINED FINANCIAL STATEMENTS

The following unaudited pro forma combined

financial statements give effect to the Company’s acquisition of Southern Oil on September 9, 2019 and include adjustments

for certain reclassifications to conform historical financial statement presentation of the Company and Southern Oil.

The following unaudited pro forma combined

financial statements and related notes are based on and should be read in conjunction with (i) the historical unaudited consolidated

financial statements of the Company for the six months ended June 30, 2019 and the related notes included in the Company’s

Quarterly Report on Form 10-Q for the quarter ended June 30, 2019, (ii) the historical unaudited consolidated financial

statements of Southern Oil for the six months ended June 30, 2019, which financial statements are filed as Exhibit 99.2 to this

Current Report on Form 8-K/A, (iii) the historical audited consolidated financial statements of the Company for the year ended

December 31, 2018 and the related notes included in the Company’s Annual Report on Form 10-K for the year ended December

31, 2018, and (iv) the historical audited consolidated financial statements of Southern Oil and the related notes for the year

ended December 31, 2018, which financial statements are filed as Exhibit 99.1 to this Current Report on Form 8-K/A.

The unaudited pro forma combined statements

of earnings for the six months ended June 30, 2019 and the year ended December 31, 2018 give effect to the acquisition as if it

had been completed on January 1, 2018. A consolidated balance sheet as of September 30, 2019, including the assets and

liabilities of Southern Oil, is included in the Company’s Quarterly Report on Form 10-Q for the quarter ended September

30, 2019 filed with the Securities and Exchange Commission on November 1, 2019.

The adjustments to the historical financial

statements are based upon currently available information and certain estimates and assumptions. Actual effects of this transaction

will differ from the pro forma adjustments. The unaudited pro forma combined financial statements are not necessarily indicative

of the results that would have occurred if the transaction had been completed on the dates indicated or what could be achieved

in the future. No adjustments have been made to our historical financial statements to reflect other events subsequent to the periods

shown by such financial statements. As no intangibles were identified in the preliminary purchase price allocation, any adjustments

to fair value were allocated to oil and gas reserves.

| BIGLARI HOLDINGS INC. |

| UNAUDITED COMBINED STATEMENT OF EARNINGS |

| YEAR ENDED DECEMBER 31, 2018 |

| (in thousands) |

| |

| | |

Biglari

Holdings | |

Southern Oil | |

Pro Forma

Adjustments | |

Notes | |

Pro Forma

Combined |

| Revenues | |

| |

| |

| |

| |

|

| Restaurant operations | |

$ | 775,690 | | |

$ | — | | |

$ | — | | |

| | | |

$ | 775,690 | |

| Insurance premiums and other | |

| 27,628 | | |

| — | | |

| — | | |

| | | |

| 27,628 | |

| Oil and gas | |

| — | | |

| 48,189 | | |

| 1,872 | | |

| A | | |

| 50,061 | |

| Media and licensing | |

| 6,576 | | |

| — | | |

| — | | |

| | | |

| 6,576 | |

| | |

| 809,894 | | |

| 48,189 | | |

| 1,872 | | |

| | | |

| 859,955 | |

| Cost and expenses | |

| | | |

| | | |

| | | |

| | | |

| | |

| Restaurant cost of sales | |

| 636,456 | | |

| — | | |

| — | | |

| | | |

| 636,456 | |

| Insurance losses and underwriting expenses | |

| 20,831 | | |

| — | | |

| — | | |

| | | |

| 20,831 | |

| Oil and gas production costs | |

| — | | |

| 15,377 | | |

| (1,653 | ) | |

| B | | |

| 13,724 | |

| Media and licensing costs | |

| 4,152 | | |

| — | | |

| — | | |

| | | |

| 4,152 | |

| Selling, general and administrative | |

| 127,232 | | |

| 6,836 | | |

| — | | |

| | | |

| 134,068 | |

| Impairments | |

| 5,677 | | |

| — | | |

| — | | |

| | | |

| 5,677 | |

| Depreciation, depletion and amortization | |

| 19,318 | | |

| 9,942 | | |

| — | | |

| | | |

| 29,260 | |

| | |

| 813,666 | | |

| 32,155 | | |

| (1,653 | ) | |

| | | |

| 844,168 | |

| Other income (expenses) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (11,677 | ) | |

| (11 | ) | |

| — | | |

| | | |

| (11,688 | ) |

| Interest on obligations under leases | |

| (8,207 | ) | |

| — | | |

| — | | |

| | | |

| (8,207 | ) |

| Unrealized gains on commodity derivative instruments | |

| — | | |

| 1,872 | | |

| (1,872 | ) | |

| A | | |

| — | |

| Other income | |

| — | | |

| 2,853 | | |

| (2,853 | ) | |

| B | | |

| — | |

| Investment partnership gains | |

| 40,411 | | |

| — | | |

| — | | |

| | | |

| 40,411 | |

| Total other income (expenses) | |

| 20,527 | | |

| 4,714 | | |

| (4,725 | ) | |

| | | |

| 20,516 | |

| Earnings (loss) before income taxes | |

| 16,755 | | |

| 20,748 | | |

| (1,200 | ) | |

| | | |

| 36,303 | |

| Income tax expense (benefit) | |

| (2,637 | ) | |

| 5,331 | | |

| (312 | ) | |

| | | |

| 2,382 | |

| Net earnings (loss) | |

$ | 19,392 | | |

$ | 15,417 | | |

$ | (888 | ) | |

| | | |

$ | 33,921 | |

Adjustment Note A – Unrealized gains on commodity derivative

instruments of $1,872 were reclassified to revenue to conform with Biglari Holdings Inc.’s reporting.

Adjustment Note B – A non-recurring intercompany management

fee of $1,200 reported in other income was eliminated from the combined financial statements. Property tax and other refunds of

$1,653 were reclassified to oil and gas production costs to conform with Biglari Holdings Inc.’s reporting.

| BIGLARI HOLDINGS INC. |

| UNAUDITED COMBINED STATEMENT OF EARNINGS |

| FIRST SIX MONTHS ENDED JUNE 30, 2019 |

| (in thousands) |

| |

| | |

Biglari

Holdings | |

Southern Oil | |

Pro Forma

Combined |

| Revenues | |

| |

| |

|

| Restaurant operations | |

$ | 333,836 | | |

$ | — | | |

$ | 333,836 | |

| Insurance premiums and other | |

| 14,624 | | |

| — | | |

| 14,624 | |

| Oil and gas | |

| — | | |

| 39,927 | | |

| 39,927 | |

| Media and licensing | |

| 1,742 | | |

| — | | |

| 1,742 | |

| | |

| 350,202 | | |

| 39,927 | | |

| 390,129 | |

| Cost and expenses | |

| | | |

| | | |

| | |

| Restaurant cost of sales | |

| 284,199 | | |

| — | | |

| 284,199 | |

| Insurance losses and underwriting expenses | |

| 11,158 | | |

| — | | |

| 11,158 | |

| Oil and gas production costs | |

| — | | |

| 9,822 | | |

| 9,822 | |

| Media and licensing costs | |

| 1,589 | | |

| — | | |

| 1,589 | |

| Selling, general and administrative | |

| 58,941 | | |

| 3,051 | | |

| 61,992 | |

| Impairments | |

| 2,338 | | |

| — | | |

| 2,338 | |

| Depreciation, depletion and amortization | |

| 10,677 | | |

| 9,804 | | |

| 20,481 | |

| | |

| 368,902 | | |

| 22,677 | | |

| 391,579 | |

| Other income (expenses) | |

| | | |

| | | |

| | |

| Interest expense | |

| (6,208 | ) | |

| (9 | ) | |

| (6,217 | ) |

| Interest on finance leases and obligations | |

| (4,012 | ) | |

| — | | |

| (4,012 | ) |

| Investment partnership gains | |

| 68,352 | | |

| — | | |

| 68,352 | |

| Total other income (expenses) | |

| 58,132 | | |

| (9 | ) | |

| 58,123 | |

| Earnings before income taxes | |

| 39,432 | | |

| 17,241 | | |

| 56,673 | |

| Income tax expense | |

| 7,640 | | |

| 4,215 | | |

| 11,855 | |

| Net earnings | |

$ | 31,792 | | |

$ | 13,026 | | |

$ | 44,818 | |

This regulatory filing also includes additional resources:

ex991to8ka07428007_11252019.pdf

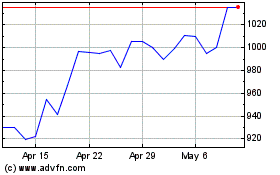

Biglari (NYSE:BH.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

Biglari (NYSE:BH.A)

Historical Stock Chart

From Apr 2023 to Apr 2024