Why the S&P 500 Index Is Poised to Move Lower This Week?

May 22 2022 - 3:59PM

Finscreener.org

Technology stocks are

experiencing a sell-off similar to the dot-com bubble. Last week,

the Nasdaq Composite Index fell close to 4% marking the seventh

straight week of decline. It was the longest losing streak for the

index in the last 21 years.

The

triple whammy of

inflation, geopolitical tensions,

and higher interest rates continue to weigh heavily on investor

sentiment. Add the impact of lockdowns in China as well as rising

commodity prices and it seems like a recipe for disaster. We can

understand why several economists are forecasting a global

recession by the end of 2022.

The Federal Reserve will continue

to raise interest rates to combat inflation. So, higher costs of

capital coupled with lower consumer spending will impact the bottom

line of corporates in 2022.

The Nasdaq index is down almost

30% below compared to record highs while the S&P 500 index

briefly entered bear market territory on Friday, indicating a

decline of 20% from all-time highs.

Will the S&P 500 decline in the upcoming

week?

A key catalyst for the equity

markets this week will be the quarterly results of retailers such

as Costco (NASDAQ:

COST) and Best Buy

(NYSE: BBY).

Additionally, personal consumption expenditures or PCE data which

includes data on income, inflation, and spending will also be

released in the upcoming week.

Last week less than impressive

results by Target and Walmart drove equity indices significantly

lower on fears of lower consumer spending and falling profit

margins.

So, is the equity market

bottoming out or will there be more pain for investors going

forward? In the last three markets where there was no recession,

the S&P 500 declined by 21.3% on average. However, in the

case of a recession, the average decline for the stock market stood

at 47.9%.

A weak macroeconomy also impacted

networking giant Cisco (NASDAQ:

CSCO) as the company

projected a revenue decline in the current quarter. Cisco stock

fell 13% after it reported its quarterly results last week after it

explained the guidance reflects the decision to cease operations in

Belarus and Russia, in addition to supply chain disruptions arising

from lockdowns imposed in several Chinese provinces.

Cisco stated, “Given this

uncertainty, we are being practical about the current environment

and erring on the side of caution in terms of our outlook, taking

it one quarter at a time.”

What next for investors?

In addition to PCE data,

investors will be closely watching the new home sales data for

April as well as indicators for durable goods consumption both of

which might show an improvement.

It makes sense for investors to

focus on companies that are defensive in nature and that enjoy a

certain amount of pricing power in the current investing

environment which is volatile and uncertain. Further, over the

near-term, projected earnings growth, depressed multiple, and high

short interest ratios are likely to impact stock prices.

In addition, investors can also

look to buy value stocks that are trading at a discount to benefit

from market-beating returns.

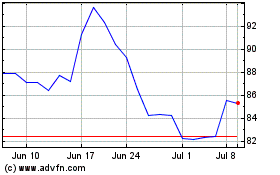

Best Buy (NYSE:BBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

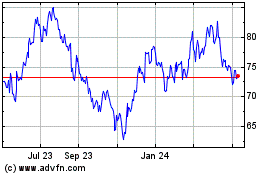

Best Buy (NYSE:BBY)

Historical Stock Chart

From Apr 2023 to Apr 2024