Brookfield Business Partners L.P. (NYSE: BBU) (TSX: BBU.UN)

(“Brookfield Business Partners”) announced today financial results

for the quarter ended September 30, 2020.

“The resilience of our overall business served

us well over the last few months with virtually all our operations

recovered from the economic shutdown," said Cyrus Madon, CEO of

Brookfield Business Partners. “During the quarter we progressed

several initiatives to build value in our business and we remain

well positioned to generate strong growth of intrinsic value per

unit."

| |

. |

Three Months Ended September

30, |

|

Nine Months Ended September

30, |

| US$

millions (except per unit amounts), unaudited |

|

2020 |

|

|

|

2019 |

|

|

2020 |

|

|

|

2019 |

|

|

Net income (loss) attributable to unitholders1 |

|

$ |

(19 |

) |

|

|

$ |

24 |

|

|

$ |

(254 |

) |

|

|

$ |

193 |

|

| Net income (loss) per limited

partnership unit2 |

|

$ |

(0.12 |

) |

|

|

$ |

0.16 |

|

|

$ |

(1.69 |

) |

|

|

$ |

1.41 |

|

| |

|

|

|

|

|

|

|

|

| Company EBITDA1,3 |

|

$ |

381 |

|

|

|

$ |

368 |

|

|

$ |

961 |

|

|

|

$ |

871 |

|

| |

|

|

|

|

|

|

|

|

| Company FFO1,4 |

|

$ |

208 |

|

|

|

$ |

219 |

|

|

$ |

575 |

|

|

|

$ |

859 |

|

| Company FFO per unit2 |

|

$ |

1.39 |

|

|

|

$ |

1.46 |

|

|

$ |

3.83 |

|

|

|

$ |

6.31 |

|

| Company FFO, excluding gain

(loss) on acquisitions/ dispositions1,4 |

|

$ |

208 |

|

|

|

$ |

213 |

|

|

$ |

533 |

|

|

|

$ |

556 |

|

| Company

FFO, excluding gain (loss) on acquisitions/ dispositions per

unit2 |

|

$ |

1.39 |

|

|

|

$ |

1.41 |

|

|

$ |

3.55 |

|

|

|

$ |

4.09 |

|

Brookfield Business Partners generated Company

EBITDA of $381 million for the three months ended

September 30, 2020 compared to $368 million for the three

months ended September 30, 2019 reflecting increased EBITDA in

our Business Services segment, partially offset by reduced

contribution from our Industrials segment. For the three months

ended September 30, 2020 Company FFO was $208 million ($1.39

per unit) compared to $213 million ($1.41 per unit) in the prior

year on a comparable basis excluding the one-time benefit of a gain

on the sale of industrial operations at BRK Ambiental within our

Industrials segment last year.

Net loss attributable to unitholders for the

three months ended September 30, 2020 was $19

million (loss of $0.12 per unit) compared to net income of $24

million ($0.16 per unit) in the prior year. Net loss in the current

period includes provisions recorded during the quarter, partially

offset by mark-to-market gains on financial assets, including

public securities.

Operational Update

The following table presents Company EBITDA by

segment:

| |

|

Three Months Ended September

30, |

|

Nine Months Ended September

30, |

| US$

millions, unaudited |

|

2020 |

|

|

|

2019 |

|

|

2020 |

|

|

|

2019 |

|

|

Business Services |

|

$ |

96 |

|

|

|

$ |

64 |

|

|

$ |

179 |

|

|

|

$ |

170 |

|

| Infrastructure Services |

|

142 |

|

|

|

139 |

|

|

446 |

|

|

|

362 |

|

| Industrials |

|

166 |

|

|

|

189 |

|

|

409 |

|

|

|

404 |

|

|

Corporate and Other |

|

(23 |

) |

|

|

(24 |

) |

|

(73 |

) |

|

|

(65 |

) |

|

Company EBITDA1,3 |

|

$ |

381 |

|

|

|

$ |

368 |

|

|

$ |

961 |

|

|

|

$ |

871 |

|

Our Business Services segment

generated Company EBITDA of $96 million during the three months

ended September 30, 2020, compared with $64 million in the

same period in 2019. Results benefited from contributions by our

mortgage insurance business which we acquired in 2019, partially

offset by the impact of the economic shutdown on our fuel

distribution and gaming operations.

Our Infrastructure Services

segment generated Company EBITDA of $142 million during the three

months ended September 30, 2020, compared to $139 million in

the same period in 2019. Results benefited from the contribution of

BrandSafway which we acquired in January 2020, offset by reduced

contribution from Westinghouse compared to the prior year. Third

quarter 2019 contribution from Westinghouse benefited from higher

than normal margins in its new plant business as a result of a

one-time reversal of reserves.

Our Industrials segment

generated Company EBITDA of $166 million during the three months

ended September 30, 2020 compared to $189 million in the same

period in 2019. Increased contribution from Clarios compared to the

prior year was more than offset by decreased contribution from

GrafTech due to lower sales volumes and price. Prior year results

also included contribution from our palladium producer which was

sold in 2019.

The following table presents Company FFO by

segment:

| |

|

Three Months Ended September

30, |

|

Nine Months Ended September

30, |

| US$

millions (except per unit amounts), unaudited |

|

2020 |

|

|

|

2019 |

|

|

|

2020 |

|

|

2019 |

|

|

Business Services |

|

$ |

62 |

|

|

|

$ |

31 |

|

|

|

$ |

143 |

|

|

$ |

405 |

|

| Infrastructure Services |

|

78 |

|

|

|

95 |

|

|

|

269 |

|

|

251 |

|

| Industrials |

|

86 |

|

|

|

103 |

|

|

|

205 |

|

|

230 |

|

|

Corporate and Other |

|

(18 |

) |

|

|

(10 |

) |

|

|

(42 |

) |

|

(27 |

) |

|

Company FFO1,4 |

|

$ |

208 |

|

|

|

$ |

219 |

|

|

|

$ |

575 |

|

|

$ |

859 |

|

| Gain

(loss) on acquisitions/dispositions, net |

|

— |

|

|

|

6 |

|

|

|

42 |

|

|

303 |

|

| Company

FFO, excluding gain (loss) on

acquisitions/ dispositions1,4 |

|

208 |

|

|

|

213 |

|

|

|

533 |

|

|

556 |

|

| Company

FFO, excluding gain (loss) on acquisitions/ dispositions per

unit2 |

|

$ |

1.39 |

|

|

|

$ |

1.41 |

|

|

|

$ |

3.55 |

|

|

$ |

4.09 |

|

Company FFO for the three months ended

September 30, 2020 decreased to $208 million from $219

million in the same period in 2019. The decrease was a result of

reduced contribution from certain of our operations within our

Infrastructure Services and Industrials segments, partially offset

by incremental contributions from recent acquisitions. Company FFO

for the third quarter 2019 included an after-tax gain of $6 million

recognized on sale of industrial assets at BRK Ambiental.

Liquidity

We ended the quarter with approximately $2.2

billion of liquidity at the corporate level including $348 million

of cash and liquid securities and $1.9 billion of undrawn credit

facilities.

Strategic Initiatives

- Sagen (formerly Genworth MI Canada) Subsequent

to the end of the quarter, together with institutional partners, we

reached a definitive agreement to acquire the 43% publicly held

common shares in Sagen for an equity purchase price of

approximately $1.2 billion. Brookfield Business Partners expects to

fund approximately $460 million of the transaction which will

increase our ownership interest in Sagen to approximately 40%. The

transaction is subject to customary approvals and is expected to

close in the first half of 2021.

- Unit Repurchase ProgramFor the three and nine

months ended September 30, 2020 we repurchased 416,935 and

977,426 of BBU units, respectively, under our normal course issuer

bid (NCIB).

Distribution

The Board of Directors has declared a quarterly

distribution in the amount of $0.0625 per unit, payable on December

31, 2020 to unitholders of record as at the close of business on

November 30, 2020.

Additional Information

The Board has reviewed and approved this news

release, including the summarized unaudited consolidated financial

statements contained herein.

Brookfield Business Partners’ Letter to

Unitholders and the Supplemental Information are available at

https://bbu.brookfield.com/reports-and-filings.

Notes:

- Attributable to limited partnership unitholders, general

partnership unitholders, special limited partnership unitholders

and redemption-exchange unitholders.

- Average number of partnership units outstanding on a fully

diluted time weighted average basis, assuming the exchange of

redemption exchange units held by Brookfield Asset Management for

limited partnership units, for the three and nine months ended

September 30, 2020 was 150 million and 150.2 million (2019:

150.4 million and 136.1 million).

- Company EBITDA is presented as a net amount attributable to

unitholders and is a non-IFRS measure and is calculated as Company

FFO excluding the impact of realized disposition gains (losses),

interest income (expense), current income taxes, the impact of

realized disposition gains (losses), current income taxes and

interest income (expense) related to equity accounted investments,

and other items. When determining Company EBITDA, we include our

proportionate share of Company EBITDA of equity accounted

investments. A reconciliation of net income to Company EBITDA is

available on pages 8-11 of this release.

- Company FFO is presented as a net amount attributable to

unitholders and is a non-IFRS measure and is calculated as net

income excluding the impact of depreciation and amortization,

deferred income taxes, breakage and transaction costs, non-cash

gains or losses as appropriate and other items. When determining

Company FFO, we include our proportionate share of Company FFO of

equity accounted investments. A reconciliation of net income to

Company FFO is available on pages 8-11 of this release.

Brookfield Business Partners is a business

services and industrials company focused on owning and operating

high-quality businesses that benefit from barriers to entry and/or

low production costs.

Brookfield Business Partners is the flagship

listed business services and industrials company of Brookfield

Asset Management, a leading global alternative asset manager with

approximately $575 billion of assets under management. More

information is available at www.brookfield.com.

Brookfield Business Partners is listed on the

New York and Toronto stock exchanges. For more information, please

visit our website at https://bbu.brookfield.com.

Please note that Brookfield Business Partners'

previous audited annual and unaudited quarterly reports have been

filed on SEDAR and Edgar, and are available at

https://bbu.brookfield.com/reports-and-filings. Hard copies of the

annual and quarterly reports can be obtained free of charge upon

request.

For more information, please contact:

|

Media:Claire Holland Tel:

+1 (416) 369-8236Email: claire.holland@brookfield.com |

Investors:Alan FlemingTel:

+1 (416) 645-2736Email: alan.fleming@brookfield.com |

Conference Call and Quarterly Earnings

Details

Investors, analysts and other interested parties

can access Brookfield Business Partners’ third quarter 2020 results

as well as the Letter to Unitholders and Supplemental Information

on our website under the Reports & Filings section at

https://bbu.brookfield.com

The conference call can be accessed via webcast

on November 3, 2020 at 11:00 a.m. Eastern Time at

https://bbu.brookfield.com or via teleconference at +1 (866)

688-9431 toll free in the U.S. and Canada. For overseas calls

please dial +1 (409) 216-0818, at approximately 10:50 a.m. Eastern

Time. The Conference ID is 5990719. A recording of the conference

call will be available until November 9, 2020 by dialing +1 (855)

859-2056 toll-free in the U.S. and Canada or +1 (404) 537-3406 for

overseas calls (Conference ID 5990719). A replay of the webcast

will be available at https://bbu.brookfield.com.

Cautionary Statement Regarding

Forward-looking Statements and Information

Note: This news release contains

“forward-looking information” within the meaning of Canadian

provincial securities laws and “forward-looking statements” within

the meaning of Section 27A of the U.S. Securities Act of 1933, as

amended, Section 21E of the U.S. Securities Exchange Act of 1934,

as amended, “safe harbor” provisions of the United States Private

Securities Litigation Reform Act of 1995 and in any applicable

Canadian securities regulations. Forward-looking statements include

statements that are predictive in nature, depend upon or refer to

future events or conditions, include statements regarding the

operations, business, financial condition, expected financial

results, performance, prospects, opportunities, priorities,

targets, goals, ongoing objectives, strategies and outlook of

Brookfield Business Partners, as well as the outlook for North

American and international economies for the current fiscal year

and subsequent periods, and include words such as “expects,”

“anticipates,” “plans,” “believes,” “estimates,” “seeks,”

“intends,” “targets,” “projects,” “forecasts” or negative versions

thereof and other similar expressions, or future or conditional

verbs such as “may,” “will,” “should,” “would” and “could.”

Although we believe that our anticipated future

results, performance or achievements expressed or implied by the

forward-looking statements and information are based upon

reasonable assumptions and expectations, the reader should not

place undue reliance on forward-looking statements and information

because they involve known and unknown risks, uncertainties and

other factors, many of which are beyond our control, which may

cause the actual results, performance or achievements of Brookfield

Business Partners to differ materially from anticipated future

results, performance or achievement expressed or implied by such

forward-looking statements and information.

Factors that could cause actual results to

differ materially from those contemplated or implied by

forward-looking statements include, but are not limited to: the

impact or unanticipated impact of general economic, political and

market factors in the countries in which we do business; including

as a result of the recent novel coronavirus outbreak (“COVID-19”);

the behavior of financial markets, including fluctuations in

interest and foreign exchange rates; global equity and capital

markets and the availability of equity and debt financing and

refinancing within these markets; strategic actions including

dispositions; the ability to complete and effectively integrate

acquisitions into existing operations and the ability to attain

expected benefits; changes in accounting policies and methods used

to report financial condition (including uncertainties associated

with critical accounting assumptions and estimates); the ability to

appropriately manage human capital; the effect of applying future

accounting changes; business competition; operational and

reputational risks; technological change; changes in government

regulation and legislation within the countries in which we

operate; governmental investigations; litigation; changes in tax

laws; ability to collect amounts owed; catastrophic events, such as

earthquakes; hurricanes and pandemics/epidemics; the possible

impact of international conflicts and other developments including

terrorist acts and cyber terrorism; and other risks and factors

detailed from time to time in our documents filed with the

securities regulators in Canada and the United States.

In addition, our future results may be impacted

by the government mandated economic restrictions resulting from the

ongoing COVID-19 pandemic and the related global reduction in

commerce and travel and substantial volatility in stock markets

worldwide, which may negatively impact our revenues, affect our

ability to identify and complete future transactions, impact our

liquidity position and result in a decrease of cash flows and

impairment losses and/or revaluations on our investments and

assets, and therefore we may be unable to achieve our expected

returns. See “Risks Associated with the COVID-19 Pandemic” in the

“Risks and Uncertainties” section included in our Management’s

Discussion and Analysis of Financial Condition and Results of

Operations for the third quarter ended September 30, 2020 to be

made available.

We caution that the foregoing list of important

factors that may affect future results is not exhaustive. When

relying on our forward-looking statements, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Except as required by law,

Brookfield Business Partners undertakes no obligation to publicly

update or revise any forward-looking statements or information,

whether written or oral, that may be as a result of new

information, future events or otherwise.

Cautionary Statement Regarding the Use

of Non-IFRS Measures

This news release contains references to

Non-IFRS Measures. When determining Company FFO and Company EBITDA,

we include our unitholders’ proportionate share of Company FFO and

Company EBITDA for equity accounted investments. Company FFO and

Company EBITDA are not generally accepted accounting measures under

IFRS and therefore may differ from definitions used by other

entities. We believe these metrics are useful supplemental measures

that may assist investors in assessing the financial performance of

Brookfield Business Partners and its subsidiaries. However, Company

FFO and Company EBITDA should not be considered in isolation from,

or as substitutes for, analysis of our financial statements

prepared in accordance with IFRS.

References to Brookfield Business Partners are

to Brookfield Business Partners L.P. together with its

subsidiaries, controlled affiliates and operating entities.

Brookfield Business Partners’ results include publicly held limited

partnership units, redemption-exchange units, general partnership

units and special limited partnership units. More detailed

information on certain references made in this news release will be

available in our Management’s Discussion and Analysis of Financial

Condition and Results of Operations for the third quarter ended

September 30, 2020.

Brookfield Business Partners L.P.

Consolidated Statements of Financial Position

| |

As at |

| US$

millions, unaudited |

September 30, 2020 |

|

|

December 31, 2019 |

| |

|

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

$ |

2,815 |

|

|

|

|

$ |

1,986 |

|

| Financial assets |

|

|

7,794 |

|

|

|

|

6,243 |

|

| Accounts and other receivable,

net |

|

|

5,083 |

|

|

|

|

5,631 |

|

| Inventory and other

assets |

|

|

5,388 |

|

|

|

|

5,282 |

|

| Property, plant and

equipment |

|

|

13,864 |

|

|

|

|

13,892 |

|

| Deferred income tax

assets |

|

|

717 |

|

|

|

|

667 |

|

| Intangible assets |

|

|

10,681 |

|

|

|

|

11,559 |

|

| Equity accounted

investments |

|

|

1,671 |

|

|

|

|

1,273 |

|

|

Goodwill |

|

|

4,961 |

|

|

|

|

5,218 |

|

|

Total Assets |

|

|

$ |

52,974 |

|

|

|

|

$ |

51,751 |

|

| |

|

|

|

|

|

|

|

| Liabilities and

Equity |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

| Corporate borrowings |

|

|

$ |

688 |

|

|

|

|

$

nil |

| Accounts payable and

other |

|

|

17,115 |

|

|

|

|

16,496 |

|

| Non-recourse borrowings in

subsidiaries of Brookfield Business Partners |

|

|

23,241 |

|

|

|

|

22,399 |

|

|

Deferred income tax liabilities |

|

|

1,597 |

|

|

|

|

1,803 |

|

| |

|

|

$ |

42,641 |

|

|

|

|

$ |

40,698 |

|

| Equity |

|

|

|

|

|

|

|

| Limited partners |

$ |

1,725 |

|

|

|

|

$ |

2,116 |

|

|

|

| Non-Controlling interests

attributable to: |

|

|

|

|

|

|

|

|

Redemption-Exchange Units, Preferred Shares and Special Limited

Partnership Units held by Brookfield Asset Management Inc. |

1,361 |

|

|

|

|

1,676 |

|

|

|

|

Interest of others in operating subsidiaries |

7,247 |

|

|

|

|

7,261 |

|

|

|

|

|

|

|

10,333 |

|

|

|

|

11,053 |

|

|

Total Liabilities and Equity |

|

|

$ |

52,974 |

|

|

|

|

$ |

51,751 |

|

Brookfield Business Partners

L.P.Consolidated Statements of Operating

Results

| US$ millions,

unaudited |

|

Three Months Ended September

30, |

|

Nine Months Ended September

30, |

|

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

10,070 |

|

|

$ |

11,794 |

|

|

$ |

27,586 |

|

|

$ |

31,712 |

|

| Direct operating costs |

|

(8,722 |

) |

|

(10,389 |

) |

|

(23,908 |

) |

|

(28,358 |

) |

| General and administrative

expenses |

|

(236 |

) |

|

(215 |

) |

|

(708 |

) |

|

(604 |

) |

| Depreciation and amortization

expense |

|

(547 |

) |

|

(534 |

) |

|

(1,618 |

) |

|

(1,286 |

) |

| Interest income (expense),

net |

|

(371 |

) |

|

(389 |

) |

|

(1,088 |

) |

|

(886 |

) |

| Equity accounted income

(loss), net |

|

17 |

|

|

32 |

|

|

26 |

|

|

62 |

|

| Impairment expense, net |

|

(7 |

) |

|

— |

|

|

(149 |

) |

|

(324 |

) |

| Gain (loss) on

acquisitions/dispositions, net |

|

— |

|

|

16 |

|

|

179 |

|

|

536 |

|

| Other

income (expense), net |

|

(9 |

) |

|

(83 |

) |

|

(77 |

) |

|

(354 |

) |

| Income (loss) before income

tax |

|

195 |

|

|

232 |

|

|

243 |

|

|

498 |

|

| Income tax (expense)

recovery |

|

|

|

|

|

|

|

|

|

Current |

|

(102 |

) |

|

(108 |

) |

|

(200 |

) |

|

(231 |

) |

|

Deferred |

|

(8 |

) |

|

58 |

|

|

157 |

|

|

80 |

|

| Net

income (loss) |

|

$ |

85 |

|

|

$ |

182 |

|

|

$ |

200 |

|

|

$ |

347 |

|

| Attributable

to: |

|

|

|

|

|

|

|

|

|

Limited partners |

|

$ |

(10 |

) |

|

$ |

13 |

|

|

$ |

(136 |

) |

|

$ |

100 |

|

|

Non-controlling interests attributable to: |

|

|

|

|

|

|

|

|

|

Redemption-Exchange Units held by Brookfield Asset Management

Inc. |

|

(9 |

) |

|

11 |

|

|

(118 |

) |

|

93 |

|

|

Special Limited Partners |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Interest of others in operating subsidiaries |

|

$ |

104 |

|

|

$ |

158 |

|

|

$ |

454 |

|

|

$ |

154 |

|

Brookfield Business Partners

L.P.Statements of Company Funds from

Operations

| For the

three months ended September 30, 2020 US$ millions, unaudited |

Business Services |

|

|

|

Infrastructure Services |

|

|

|

Industrials |

|

|

|

Corporate and Other |

|

|

|

Total |

|

|

| Revenues |

$ |

6,124 |

|

|

|

$ |

1,058 |

|

|

|

$ |

2,888 |

|

|

|

$ |

— |

|

|

|

$ |

10,070 |

|

|

| Direct operating costs |

(5,724 |

) |

|

|

(774 |

) |

|

|

(2,219 |

) |

|

|

(5 |

) |

|

|

(8,722 |

) |

|

| General and administrative

expenses |

(105 |

) |

|

|

(31 |

) |

|

|

(82 |

) |

|

|

(18 |

) |

|

|

(236 |

) |

|

| Equity accounted Company

EBITDA |

3 |

|

|

|

45 |

|

|

|

36 |

|

|

|

— |

|

|

|

84 |

|

|

| Company

EBITDA attributable to others |

(202 |

) |

|

|

(156 |

) |

|

|

(457 |

) |

|

|

— |

|

|

|

(815 |

) |

|

| Company

EBITDA1,2,4 |

96 |

|

|

|

142 |

|

|

|

166 |

|

|

|

(23 |

) |

|

|

381 |

|

|

| Realized disposition gain,

net |

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

| Other income (expense),

net |

(1 |

) |

|

|

(18 |

) |

|

|

2 |

|

|

|

— |

|

|

|

(17 |

) |

|

| Interest income (expense),

net |

(58 |

) |

|

|

(88 |

) |

|

|

(221 |

) |

|

|

(4 |

) |

|

|

(371 |

) |

|

| Equity accounted current taxes

and interest |

(1 |

) |

|

|

(16 |

) |

|

|

(7 |

) |

|

|

— |

|

|

|

(24 |

) |

|

| Current income taxes |

(46 |

) |

|

|

(4 |

) |

|

|

(61 |

) |

|

|

9 |

|

|

|

(102 |

) |

|

| Company

FFO attributable to others (net of Company EBITDA attributable to

others) |

72 |

|

|

|

62 |

|

|

|

207 |

|

|

|

— |

|

|

|

341 |

|

|

| Company

FFO1,3,4 |

62 |

|

|

|

78 |

|

|

|

86 |

|

|

|

(18 |

) |

|

|

208 |

|

|

| Depreciation and amortization

expense |

|

|

|

|

|

|

|

|

(547 |

) |

|

| Impairment expense, net |

|

|

|

|

|

|

|

|

(7 |

) |

|

| Other income (expense),

net |

|

|

|

|

|

|

|

|

8 |

|

|

| Deferred income taxes |

|

|

|

|

|

|

|

|

(8 |

) |

|

| Non-cash items attributable to

equity accounted investments |

|

|

|

|

|

|

|

|

(43 |

) |

|

|

Non-cash items attributable to others |

|

|

|

|

|

|

|

|

370 |

|

|

|

Net income (loss) attributable to

unitholders4 |

|

|

|

|

|

|

|

|

$ |

(19 |

) |

|

Notes:

- The Statements of Company Funds from Operations above are

prepared on a basis that is consistent with Brookfield Business

Partners’ Supplemental Information and differs from net income as

presented in Brookfield Business Partners’ Consolidated Statements

of Operating Results on page 7 of this release, which is prepared

in accordance with IFRS. Management uses Company FFO and Company

EBITDA as key measures to evaluate operating performance. Readers

are encouraged to consider all measures in assessing Brookfield

Business Partners’ results.

- Company EBITDA is presented as a net amount attributable to

unitholders and is a non-IFRS measure and is calculated as Company

FFO excluding the impact of realized disposition gains (losses),

interest income (expense), current income taxes, the impact of

realized disposition gains (losses), current income taxes and

interest income (expense) related to equity accounted investments,

and other items. When determining Company EBITDA, we include our

proportionate share of Company EBITDA of equity accounted

investments.

- Company FFO is presented as a net amount attributable to

unitholders and is a non-IFRS measure and is calculated as net

income excluding the impact of depreciation and amortization,

deferred income taxes, breakage and transaction costs, non-cash

gains or losses as appropriate and other items. When determining

Company FFO, we include our proportionate share of Company FFO of

equity accounted investments.

- Attributable to limited partnership unitholders, general

partnership unitholders, special limited partnership unitholders

and redemption-exchange unitholders.

Brookfield Business Partners

L.P.Statements of Company Funds from

Operations

| For the

nine months ended September 30, 2020 US$ millions, unaudited |

Business Services |

|

|

Infrastructure Services |

|

|

Industrials |

|

|

Corporate and Other |

|

|

Total |

|

|

Revenues |

$ |

16,706 |

|

|

$ |

3,348 |

|

|

$ |

7,532 |

|

|

$ |

— |

|

|

$ |

27,586 |

|

| Direct operating costs |

(15,745 |

) |

|

(2,373 |

) |

|

(5,780 |

) |

|

(10 |

) |

|

(23,908 |

) |

| General and administrative

expenses |

(276 |

) |

|

(122 |

) |

|

(247 |

) |

|

(63 |

) |

|

(708 |

) |

| Equity accounted Company

EBITDA |

18 |

|

|

122 |

|

|

79 |

|

|

— |

|

|

219 |

|

| Company

EBITDA attributable to others |

(524 |

) |

|

(529 |

) |

|

(1,175 |

) |

|

— |

|

|

(2,228 |

) |

| Company

EBITDA1,2,4 |

179 |

|

|

446 |

|

|

409 |

|

|

(73 |

) |

|

961 |

|

| Realized disposition gain,

net |

186 |

|

|

— |

|

|

(7 |

) |

|

— |

|

|

179 |

|

| Other income (expense),

net |

8 |

|

|

(47 |

) |

|

3 |

|

|

— |

|

|

(36 |

) |

| Interest income (expense),

net |

(168 |

) |

|

(253 |

) |

|

(668 |

) |

|

1 |

|

|

(1,088 |

) |

| Equity accounted current taxes

and interest |

(5 |

) |

|

(40 |

) |

|

(15 |

) |

|

— |

|

|

(60 |

) |

| Current income taxes |

(98 |

) |

|

(10 |

) |

|

(122 |

) |

|

30 |

|

|

(200 |

) |

| Company

FFO attributable to others (net of Company EBITDA attributable

to others) |

41 |

|

|

173 |

|

|

605 |

|

|

— |

|

|

819 |

|

| Company

FFO1,3,4 |

143 |

|

|

269 |

|

|

205 |

|

|

(42 |

) |

|

575 |

|

| Depreciation and amortization

expense |

|

|

|

|

|

|

|

|

(1,618 |

) |

| Impairment expense, net |

|

|

|

|

|

|

|

|

(149 |

) |

| Other income (expense),

net |

|

|

|

|

|

|

|

|

(41 |

) |

| Deferred income taxes |

|

|

|

|

|

|

|

|

157 |

|

| Non-cash items attributable to

equity accounted investments |

|

|

|

|

|

|

|

|

(133 |

) |

|

Non-cash items attributable to others |

|

|

|

|

|

|

|

|

955 |

|

|

Net income (loss) attributable to

unitholders4 |

|

|

|

|

|

|

|

|

$ |

(254 |

) |

Notes:

- The Statements of Company Funds from Operations above are

prepared on a basis that is consistent with Brookfield Business

Partners’ Supplemental Information and differs from net income as

presented in Brookfield Business Partners’ Consolidated Statements

of Operating Results on page 7 of this release, which is prepared

in accordance with IFRS. Management uses Company FFO and Company

EBITDA as key measures to evaluate operating performance. Readers

are encouraged to consider all measures in assessing Brookfield

Business Partners’ results.

- Company EBITDA is presented as a net amount attributable to

unitholders and is a non-IFRS measure and is calculated as Company

FFO excluding the impact of realized disposition gains (losses),

interest income (expense), current income taxes, the impact of

realized disposition gains (losses), current income taxes and

interest income (expense) related to equity accounted investments,

and other items. When determining Company EBITDA, we include our

proportionate share of Company EBITDA of equity accounted

investments.

- Company FFO is presented as a net amount attributable to

unitholders and is a non-IFRS measure and is calculated as net

income excluding the impact of depreciation and amortization,

deferred income taxes, breakage and transaction costs, non-cash

gains or losses as appropriate and other items. When determining

Company FFO, we include our proportionate share of Company FFO of

equity accounted investments.

- Attributable to limited partnership unitholders, general

partnership unitholders, special limited partnership unitholders

and redemption-exchange unitholders.

Brookfield Business Partners

L.P.Statements of Company Funds from

Operations

| For the

three months ended September 30, 2019US$ millions, unaudited |

Business Services |

|

|

Infrastructure Services |

|

|

Industrials |

|

|

Corporate and Other |

|

|

Total |

|

|

Revenues |

$ |

7,427 |

|

|

$ |

1,133 |

|

|

$ |

3,234 |

|

|

$ |

— |

|

|

$ |

11,794 |

|

| Direct operating costs |

(7,150 |

) |

|

(759 |

) |

|

(2,478 |

) |

|

(2 |

) |

|

(10,389 |

) |

| General and administrative

expenses |

(93 |

) |

|

(29 |

) |

|

(71 |

) |

|

(22 |

) |

|

(215 |

) |

| Equity accounted Company

EBITDA |

9 |

|

|

21 |

|

|

31 |

|

|

— |

|

|

61 |

|

| Company

EBITDA attributable to others |

(129 |

) |

|

(227 |

) |

|

(527 |

) |

|

— |

|

|

(883 |

) |

| Company

EBITDA1,2,4 |

64 |

|

|

139 |

|

|

189 |

|

|

(24 |

) |

|

368 |

|

| Realized disposition gain,

net |

— |

|

|

— |

|

|

17 |

|

|

(1 |

) |

|

16 |

|

| Other income (expense),

net |

(2 |

) |

|

(17 |

) |

|

— |

|

|

— |

|

|

(19 |

) |

| Interest income (expense),

net |

(65 |

) |

|

(93 |

) |

|

(240 |

) |

|

9 |

|

|

(389 |

) |

| Equity accounted current taxes

and interest |

(2 |

) |

|

(5 |

) |

|

(7 |

) |

|

— |

|

|

(14 |

) |

| Current income taxes |

(19 |

) |

|

(4 |

) |

|

(91 |

) |

|

6 |

|

|

(108 |

) |

| Company

FFO attributable to others (net of Company EBITDA attributable to

others) |

55 |

|

|

75 |

|

|

235 |

|

|

— |

|

|

365 |

|

| Company

FFO1,3,4 |

31 |

|

|

95 |

|

|

103 |

|

|

(10 |

) |

|

219 |

|

| Depreciation and amortization

expense |

|

|

|

|

|

|

|

|

(534 |

) |

| Impairment expense, net |

|

|

|

|

|

|

|

|

— |

|

| Other income (expense),

net |

|

|

|

|

|

|

|

|

(64 |

) |

| Deferred income taxes |

|

|

|

|

|

|

|

|

58 |

|

| Non-cash items attributable to

equity accounted investments |

|

|

|

|

|

|

|

|

(15 |

) |

|

Non-cash items attributable to others |

|

|

|

|

|

|

|

|

360 |

|

|

Net income (loss) attributable to

unitholders4 |

|

|

|

|

|

|

|

|

$ |

24 |

|

Notes:

- The Statements of Company Funds from Operations above are

prepared on a basis that is consistent with Brookfield Business

Partners’ Supplemental Information and differs from net income as

presented in Brookfield Business Partners’ Consolidated Statements

of Operating Results on page 7 of this release, which is prepared

in accordance with IFRS. Management uses Company FFO and Company

EBITDA as key measures to evaluate operating performance. Readers

are encouraged to consider all measures in assessing Brookfield

Business Partners’ results.

- Company EBITDA is presented as a net amount attributable to

unitholders and is a non-IFRS measure and is calculated as Company

FFO excluding the impact of realized disposition gains (losses),

interest income (expense), current income taxes, the impact of

realized disposition gains (losses), current income taxes and

interest income (expense) related to equity accounted investments,

and other items. When determining Company EBITDA, we include our

proportionate share of Company EBITDA of equity accounted

investments.

- Company FFO is presented as a net amount attributable to

unitholders and is a non-IFRS measure and is calculated as net

income excluding the impact of depreciation and amortization,

deferred income taxes, breakage and transaction costs, non-cash

gains or losses as appropriate and other items. When determining

Company FFO, we include our proportionate share of Company FFO of

equity accounted investments.

- Attributable to limited partnership unitholders, general

partnership unitholders, special limited partnership unitholders

and redemption-exchange unitholders.

Brookfield Business Partners

L.P.Statements of Company Funds from

Operations

| For the

nine months ended September 30, 2019US$ millions, unaudited |

Business Services |

|

|

Infrastructure Services |

|

|

Industrials |

|

|

Corporate and Other |

|

|

Total |

|

|

Revenues |

$ |

21,707 |

|

|

$ |

3,527 |

|

|

$ |

6,478 |

|

|

$ |

— |

|

|

$ |

31,712 |

|

| Direct operating costs |

(21,097 |

) |

|

(2,489 |

) |

|

(4,766 |

) |

|

(6 |

) |

|

(28,358 |

) |

| General and administrative

expenses |

(227 |

) |

|

(104 |

) |

|

(214 |

) |

|

(59 |

) |

|

(604 |

) |

| Equity accounted Company

EBITDA |

28 |

|

|

77 |

|

|

52 |

|

|

— |

|

|

157 |

|

| Company

EBITDA attributable to others |

(241 |

) |

|

(649 |

) |

|

(1,146 |

) |

|

— |

|

|

(2,036 |

) |

| Company

EBITDA1,2,4 |

170 |

|

|

362 |

|

|

404 |

|

|

(65 |

) |

|

871 |

|

| Realized disposition gain,

net |

522 |

|

|

— |

|

|

15 |

|

|

(1 |

) |

|

536 |

|

| Other income (expense),

net |

(2 |

) |

|

(17 |

) |

|

2 |

|

|

— |

|

|

(17 |

) |

| Interest income (expense),

net |

(123 |

) |

|

(291 |

) |

|

(495 |

) |

|

23 |

|

|

(886 |

) |

| Equity accounted current taxes

and interest |

(5 |

) |

|

(13 |

) |

|

(11 |

) |

|

— |

|

|

(29 |

) |

| Current income taxes |

(76 |

) |

|

5 |

|

|

(176 |

) |

|

16 |

|

|

(231 |

) |

| Company

FFO attributable to others (net of Company EBITDA attributable to

others) |

(81 |

) |

|

205 |

|

|

491 |

|

|

— |

|

|

615 |

|

| Company

FFO1,3,4 |

405 |

|

|

251 |

|

|

230 |

|

|

(27 |

) |

|

859 |

|

| Depreciation and amortization

expense |

|

|

|

|

|

|

|

|

(1,286 |

) |

| Impairment expense, net |

|

|

|

|

|

|

|

|

(324 |

) |

| Other income (expense),

net |

|

|

|

|

|

|

|

|

(337 |

) |

| Deferred income taxes |

|

|

|

|

|

|

|

|

80 |

|

| Non-cash items attributable to

equity accounted investments |

|

|

|

|

|

|

|

|

(66 |

) |

|

Non-cash items attributable to others |

|

|

|

|

|

|

|

|

1,267 |

|

|

Net income (loss) attributable to

unitholders4 |

|

|

|

|

|

|

|

|

$ |

193 |

|

Notes:

- The Statements of Company Funds from Operations above are

prepared on a basis that is consistent with Brookfield Business

Partners’ Supplemental Information and differs from net income as

presented in Brookfield Business Partners’ Consolidated Statements

of Operating Results on page 7 of this release, which is prepared

in accordance with IFRS. Management uses Company FFO and Company

EBITDA as key measures to evaluate operating performance. Readers

are encouraged to consider all measures in assessing Brookfield

Business Partners’ results.

- Company EBITDA is presented as a net amount attributable to

unitholders and is a non-IFRS measure and is calculated as Company

FFO excluding the impact of realized disposition gains (losses),

interest income (expense), current income taxes, the impact of

realized disposition gains (losses), current income taxes and

interest income (expense) related to equity accounted investments,

and other items. When determining Company EBITDA, we include our

proportionate share of Company EBITDA of equity accounted

investments.

- Company FFO is presented as a net amount attributable to

unitholders and is a non-IFRS measure and is calculated as net

income excluding the impact of depreciation and amortization,

deferred income taxes, breakage and transaction costs, non-cash

gains or losses as appropriate and other items. When determining

Company FFO, we include our proportionate share of Company FFO of

equity accounted investments.

- Attributable to limited partnership unitholders, general

partnership unitholders, special limited partnership unitholders

and redemption-exchange unitholders.

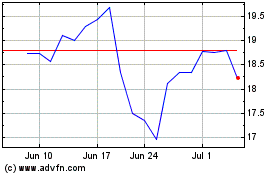

Brookfield Business Part... (NYSE:BBU)

Historical Stock Chart

From Mar 2024 to Apr 2024

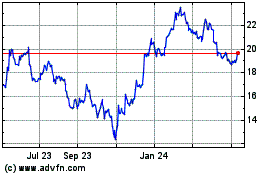

Brookfield Business Part... (NYSE:BBU)

Historical Stock Chart

From Apr 2023 to Apr 2024