Brookfield Closes US$9 Billion Global Private Equity Fund

November 04 2019 - 8:00AM

Brookfield Asset Management Inc. (“Brookfield”)

(NYSE: BAM, TSX: BAM.A) announced today the closing of its latest

flagship global private equity fund, Brookfield Capital Partners V

(“BCP V” or the “Fund”) with total equity commitments of $9

billion in the program.

Based on strong investor demand, BCP V attracted

total capital commitments exceeding the original $7 billion

fundraising target. BCP V’s predecessor fund closed in 2016 with $4

billion of total capital commitments. Investors in the Fund are a

diverse group of institutional investors, including public and

private pension plans, sovereign wealth funds, financial

institutions, endowments and foundations, family offices, and

private wealth investors. Brookfield Business Partners L.P. (NYSE:

BBU, TSX: BBU.UN) has committed $3 billion to the Fund,

underscoring the alignment of interests with other investors. Cyrus

Madon, head of Brookfield’s private equity business, said “We are

pleased to have reached this milestone based on the ongoing strong

support we have received from our investors. We have already

deployed capital into a number of high-quality businesses and look

forward to continuing to prudently invest where we can bring our

operating capabilities, global scale, and expertise as part of the

broader Brookfield platform to create value for our investors and

our businesses.”

To date, the Fund has committed approximately

$2.5 billion to acquire businesses with high barriers to entry, low

production costs, and the potential for enhanced cash flow

generation, including a leading global automotive battery business

and one of the largest private hospital operators in Australia.

Brookfield Asset Management

Brookfield Asset Management is a leading global alternative asset

manager with over US$500 billion of assets under

management across real estate, infrastructure, renewable power,

private equity and credit. Brookfield owns and operates

long-life assets and businesses, many of which form the backbone of

the global economy. Utilizing its global reach, access to

large-scale capital and operational

expertise, Brookfield offers a range of alternative

investment products to investors around the world—including public

and private pension plans, endowments and foundations, sovereign

wealth funds, financial institutions, insurance companies and

private wealth investors.

Brookfield Asset Management is listed on

the New York and Toronto stock exchanges under

the symbols BAM and BAM.A, respectively. For more information,

please visit www.brookfield.com.

For more information, please contact:

|

Media Claire Holland Vice President,

Communications & Branding Tel: +1 416 369 8236 Email:

claire.holland@brookfield.com |

Investor Relations Linda Northwood Director,

Investor Relations Tel: +1 416 359 8647 Email:

linda.northwood@brookfield.com |

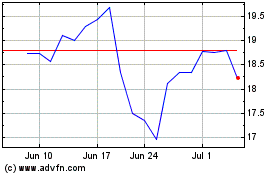

Brookfield Business Part... (NYSE:BBU)

Historical Stock Chart

From Mar 2024 to Apr 2024

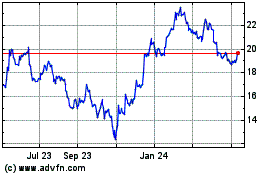

Brookfield Business Part... (NYSE:BBU)

Historical Stock Chart

From Apr 2023 to Apr 2024