Amended Current Report Filing (8-k/a)

February 03 2021 - 4:19PM

Edgar (US Regulatory)

0001747079false00017470792020-07-022020-07-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 8-K/A

(Amendment No. 2)

______________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 3, 2021 (July 2, 2020)

________________________

Bally's Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-38850

|

20-0904604

|

|

(State or other jurisdiction of incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

100 Westminster Street

|

|

Providence

|

RI

|

02903

|

|

(Address of Principal Executive Offices and Zip Code)

|

________________________

(401) 475-8474

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12 (b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common stock, $0.01 par value

|

BALY

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

EXPLANATORY NOTE

Bally’s Corporation (the “Company”) completed its acquisition of the outstanding equity securities of IOC-Kansas City, Inc. (subsequently rebranded “Casino KC”) and Rainbow Casino-Vicksburg Partnership, L.P. (subsequently rebranded “Casino Vicksburg”) from Eldorado Resorts, Inc. (“Eldorado”) on July 2, 2020. The Company filed the financial statements and pro forma financial for the acquisitions on September 14, 2020.

The Company acquired Bally’s Atlantic City Hotel & Casino (“Bally’s AC”) from Caesars Entertainment, Inc. (“Caesars”) and Vici Properties, Inc. on November 18, 2020. As a result of Caesars merger with Eldorado, the Company determined that the acquisition of Bally’s AC was a related transaction to the Casino KC and Casino Vicksburg acquisitions and updated its significance tests to include Bally’s AC in accordance with Regulation S-X 3-05 as of the date of the Bally’s AC acquisition and determined that additional audited annual, unaudited interim and pro forma financial statements of Casino KC and Casino Vicksburg were required. These financial statements are filed as Exhibits 99.1 through 99.4.

This Amendment No. 2 should be read in conjunction with the Company’s July 2, 2020 Current Report on Form 8-K, as amended, and the Company’s SEC filings.

Item 9.01 Financial Statements and Exhibits.

(a)Financial Statements of business acquired.

The unaudited combined financial statements of Casino KC and Casino Vicksburg as of and for the six months ended June 30, 2020 and 2019 and the notes related thereto are filed as Exhibit 99.1 hereto.

The audited combined financial statements of Casino KC and Casino Vicksburg as of and for the years ended December 31, 2019 and 2018 and the notes related thereto are filed as Exhibit 99.2 and Exhibit 99.3, respectively, hereto.

(b)Pro forma financial information.

The unaudited pro forma combined statements of income of the Company for the year ended December 31, 2019 and the nine months ended September 30, 2020, in each case giving pro forma effect to the Company’s acquisition of all outstanding equity securities of Casino KC and Casino Vicksburg, and the notes related thereto are filed as Exhibit 99.4 hereto and are incorporated herein by reference.

(d)Exhibits.

The following exhibits are filed herewith:

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

23.1

|

|

|

|

23.2

|

|

|

|

99.1

|

|

|

|

99.2

|

|

|

|

99.3

|

|

|

|

99.4

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

BALLY'S CORPORATION

|

|

|

By:

|

/s/ Stephen H. Capp

|

|

|

Name:

|

Stephen H. Capp

|

|

|

Title:

|

Executive Vice President and

Chief Financial Officer

|

Date: February 3, 2021

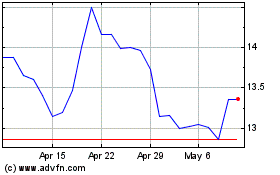

Ballys (NYSE:BALY)

Historical Stock Chart

From Mar 2024 to Apr 2024

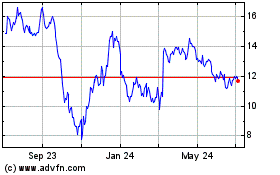

Ballys (NYSE:BALY)

Historical Stock Chart

From Apr 2023 to Apr 2024