Report of Foreign Issuer (6-k)

May 15 2019 - 6:19AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16

OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2019

(Commission File No. 1-14862 )

BRASKEM S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of registrant's name into English)

Rua Eteno, 1561, Polo Petroquimico de Camacari

Camacari, Bahia - CEP 42810-000 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1). _____

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7). _____

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____.

NOTICE TO THE MARKET

São Paulo, May 14, 2019: Braskem S.A. (“Company” or “Braskem”) (B3: BRKM3, BRKM5 and BRKM6; LATIBEX: XBRK), further to the Material Fact published on May 13, 2019, hereby discloses that received a notification from NYSE informing that the trading of American Depositary Shares issued by the Company (“ADS”) was suspended and it has commenced proceedings to delist such ADS (“Decision”).

NYSE also informed that the Company has a period of ten (10) business days to present its intention to appeal and make an oral presentation, at a day not yet scheduled, to NYSE´S Board of Directors Committee challenging the Decision (“Appeal”).

The Company intends to Appeal and will continue to dedicate significant efforts and resources towards filing the 2017 and 2018 Forms 20-F as expeditiously as possible and resume trading of the Company’s ADS on the NYSE.

As of tomorrow our ADS may be traded in the over-the-counter (“OTC”) market in the United States, under the ticker BRKMY. The Company reinforces that during the suspension period, in accordance with our ADS program, ADS holders may request the depositary bank, The Bank of New York Mellon, to cancel their ADSs and to provide the underlying preferred shares, which are traded on the B3 (Brazilian Stock Exchange), in a ratio of one ADS to two preferred shares class A.

Furthermore, if the holders of ADSs opt to maintain their current position, the migration to the OTC will be automatic and no request to the depositary bank is required.

For more information, please contact Braskem’s Investor Relations Department by calling +55 (11) 3576-9531 or by sending an e-mail to braskem-ri@braskem.com.br.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date:

May

14

, 2019

|

|

BRASKEM S.A.

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Pedro van Langendonck Teixeira de Freitas

|

|

|

|

|

|

|

|

Name:

|

Pedro van Langendonck Teixeira de Freitas

|

|

|

|

Title:

|

Chief Financial Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

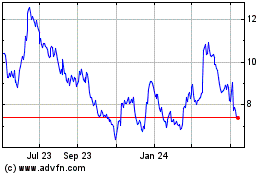

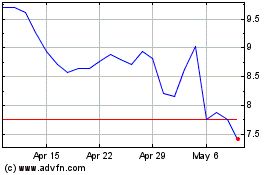

Braskem (NYSE:BAK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Braskem (NYSE:BAK)

Historical Stock Chart

From Apr 2023 to Apr 2024