By Cara Lombardo

Corporate deal making, prone to unexpected twists and turns in

the best of times, has been upended by the coronavirus

pandemic.

Many companies from Xerox Holdings Corp. to Axalta Coating

Systems Ltd. have been re-evaluating takeover deals as employers

shift their focus to ensuring they have enough cash to stay afloat

and pay workers. Those plotting initial public offerings, such as

Airbnb Inc., may postpone them.

Overall merger volume, which was already having a sluggish start

this year, has come to a virtual standstill in the past two

weeks.

The value of announced mergers in the first quarter through

Monday is down 33% from a year ago to $572 billion, a seven-year

low. In the U.S., the decline is even more acute at more than

50%.

IPOs so far look OK compared with the slow start in 2019, when a

partial government shutdown precluded companies from moving forward

with listings, but bankers now expect this year will fall far short

of last year's relatively strong total. For companies to launch

successful IPOs, they generally need stable -- ideally rising --

markets.

"Almost every variable is changing, whether it be CEO and board

confidence, the availability of plentiful financing or stock

prices," said Steven Baronoff, Bank of America Corp.'s chairman of

global mergers and acquisitions. Aside from those with urgent

needs, most companies have put deal making on hold, he said.

Even if there was a will to pursue mergers and other deals, the

new coronavirus has thrown up a number of new barriers. Debt

financing has dried up as banks turn off the spigot to meet more

pressing client needs. Wild day-to-day swings in stocks make

agreeing on a price that much harder, and the intensive

face-to-face contact normally required to seal a transaction is now

forbidden.

If there isn't a quick and substantial turnaround, 2020 could

mark the end of a historic deal surge that was made possible by the

long-running bull market for stocks and credit. Three of the past

five years were among the top five on record for M&A activity

globally.

That could jeopardize one of Wall Street's biggest moneymakers.

For example, Goldman Sachs Group Inc.'s investment-banking unit,

which advises companies on M&A and IPOs, among other things,

accounted for just under 20% of the firm's revenue last year.

The financial and economic swoon has created opportunity for

deal makers in other corners of the market. Bankruptcy and

restructuring advisers have been inundated in the past two weeks by

calls from potential clients, particularly in such areas as energy

and retail.

Peter Weinberg, founding partner of boutique investment bank

Perella Weinberg Partners, said conversations with clients have

intensified and in some cases pivoted to topics such as credit and

restructuring.

"The breadth of issues has increased," he said.

Private-equity firms, hedge funds and other investors, including

Warren Buffett, who are flush with cash are circling the

hardest-hit companies in the travel, lodging and entertainment

sectors, eager to offer financial lifelines should they be needed,

people familiar with the matter say.

"Cash is at a premium right now," said Jim Woolery, head of

M&A and corporate governance at law firm King & Spalding

LLP.

Traditional consolidation, however, won't ramp up until

companies are again able to forecast their earnings with any degree

of certainty, Mr. Woolery predicts.

Another potential source of deal activity meanwhile, advisers

say, is hostile M&A, with companies emerging from the crisis in

relatively strong positions moving on those that struggle to

recover.

But right now, companies for the most part are slamming on the

brakes. Several merger deals that had the potential to be among the

largest of the year were quickly put on pause as the new

coronavirus began to spread.

Xerox said March 13 it was postponing meetings with shareholders

to push its $35 billion hostile pursuit of printer maker HP Inc. to

give priority to the well-being of its employees and customers. HP,

which has called Xerox's offer inadequate, said March 25 that such

a debt-heavy combination in the current economic environment "could

be disastrous."

Marathon Petroleum Corp. was close to selling its sprawling

Speedway gas-station unit for more than $20 billion before a dip in

oil and stock prices gave its Japanese suitor cold feet. Marathon,

which named a new chief executive officer in March, is likely to

revisit spinning off or selling the unit after things stabilize,

according to people familiar with the matter.

Axalta, a paint maker, had been negotiating a roughly $7.5

billion sale to PPG Industries Inc. and buyout firm Clayton

Dubilier & Rice, people familiar with the matter said. Those

talks have stalled, the people said, after Axalta's stock cratered

and, like many others, the company pulled its financial

guidance.

Airbnb, meanwhile, was set to be the banner IPO of the year

before a decline in travel and mounting losses threw its plans into

doubt. And J.Crew Group Inc. shelved the planned spinoff of its

Madewell brand to focus on debt payments, according to people

familiar with the matter.

There are a few companies forging ahead. EBay Inc. for now at

least is pushing with a sale of its classified-ads unit as activist

investors look on. And Coty Inc., the struggling beauty company

that previously announced plans to sell its professional-hair-care

and Brazilian units, said March 20 the process would continue. It

has been holding virtual meetings with potential buyers, people

familiar with the matter said.

Write to Cara Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

March 31, 2020 07:14 ET (11:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

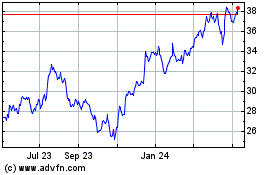

Bank of America (NYSE:BAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

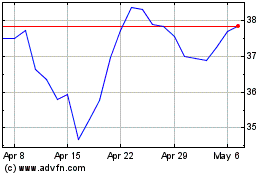

Bank of America (NYSE:BAC)

Historical Stock Chart

From Apr 2023 to Apr 2024