By Dawn Lim, Jing Yang and Gordon Lubold

U.S. officials are considering prohibiting Americans from

investing in Alibaba Group Holding Ltd. and Tencent Holdings Ltd.,

said people familiar with the matter.

In recent weeks, State Department and Department of Defense

officials have held conversations on expanding a blacklist of

companies that are prohibited to U.S. investments because of

claimed ties to China's military and security services. The U.S.

government announced its original blacklist in November with 31

companies.

The departments have debated with the Treasury Department over

whether adding these firms could have wide capital-markets

ramifications, the people said. The plan is still under

deliberation and may not go through as agencies debate its impact

on markets, the people added.

Tencent and Alibaba are China's two most-valuable publicly

listed companies with a combined market capitalization of over $1.3

trillion, and their shares are held by scores of U.S. mutual funds

and other investors. If enacted, the move would be a major

escalation by the exiting Trump administration on its efforts to

unwind U.S. investors' holdings in major Chinese companies.

The Trump administration has stepped up efforts to sanction

Chinese companies in its final days. On Wednesday, the New York

Stock Exchange said it will move ahead to delist China's three

biggest telecommunication carriers, backtracking an earlier

decision to scrap the plan after receiving "new specific guidance"

from the Treasury Department.

On Tuesday, President Trump signed an order prohibiting U.S.

individuals and companies from transacting with eight Chinese

software apps including Alibaba affiliate Ant Group Co.'s Alipay

and Tencent's WeChat Pay. The order takes effect in 45 days, after

the inauguration of President-elect Joe Biden.

Alibaba and Tencent are tracked by major indexes including those

created by MSCI Inc. and FTSE Russell. Alibaba, listed in both New

York and Hong Kong, and Hong Kong-listed Tencent are heavyweights

in widely followed global stock indexes. Like most foreign

companies, the stocks aren't included in the Nasdaq Composite,

S&P 500 or Dow Jones Industrial Average.

In the last few weeks of the Trump presidency, U.S. government

officials have clashed over the scope of the list of companies off

limits to U.S. investors. Pentagon and State officials have been

pushing for a list with broad reach that includes high-profile

companies and subsidiaries of already-named companies in China. The

agencies have urged a tougher line to curb China's military and

security services' access to data troves, advanced technologies and

expertise. Treasury, fearing forced selling could rock financial

markets, wants a more narrow list.

The Pentagon, the lead agency managing the list, had no

immediate comment. The State Department and Treasury Department had

no immediate comment.

A spokeswoman at Alibaba didn't respond to requests for comment.

A spokesman at Tencent declined to comment.

China's Ministry of Commerce didn't respond to a request sent

outside business hours, and the Chinese embassy in the U.S.

referred to a December comment by the Ministry of Foreign Affairs

that said "China firmly opposes the wanton suppression of Chinese

companies by the United States," and "the Chinese government will

continue to safeguard Chinese companies' legitimate and lawful

rights and interests."

While Alibaba and Tencent aren't controlled by the Chinese

government, the State Department and Pentagon have long said they

feared that the companies could be coerced into sharing sensitive

data on U.S. citizens and businesses with the Chinese government

and serve as a conduit for Beijing to extend its influence.

Scores of Chinese tech companies have raised tens of billions of

dollars from U.S. and international investors in the past few

years, allowing foreign investors to capitalize on China's rapidly

growing economy.

Alibaba and Tencent have been among top constituents in the MSCI

Emerging Markets Index, accounting for a combined 11% weighting as

of Dec. 31. Similarly, the two together have claimed a 12%

weighting in the FTSE Emerging Index as of Dec. 31.

Following the November list, Pentagon expanded its list of

banned companies in December to include companies such as China's

top chip maker Semiconductor Manufacturing International Corp. and

oil major China National Offshore Oil Corp.

The State Department in August said the U.S. needs to address

the threats of cloud-based systems run by Alibaba, Tencent and

Baidu Inc. U.S. officials have become increasingly concerned in

recent weeks as Alibaba and Ant come under intense scrutiny at

home, further putting them at the mercy of Beijing, according to

one of the people familiar with the matter.

The Chinese government has tightened the screws on its tech

champions recently, unveiling a sweeping antitrust regulation aimed

at the country's biggest internet platforms, launching an

investigation into Alibaba and scuttling Ant's blockbuster initial

public offering.

In the latest episode, Chinese regulators are trying to get Ant

to share the troves of consumer-credit data it has amassed with the

central bank's credit-reporting system, The Wall Street Journal

reported.

Tencent operates the hugely popular WeChat app, which has become

one of the most powerful tools in Beijing's arsenal of tools for

monitoring the public. Tencent also owns stakes in several U.S.

videogame companies.

Major U.S. asset managers including T. Rowe Price Group Inc.,

BlackRock Inc. and Vanguard Group are among the top public

shareholders of Alibaba and Tencent through funds, according to

FactSet data.

Asset managers are lobbying to prevent a situation in which

companies such as Alibaba could become blacklisted, said a person

familiar with large financial firms' conversations with U.S.

regulators.

Last week, the Treasury Department published guidelines that

include subsidiaries in the ban if a company named on the list

holds ownership of 50% or more in them. Derivatives, bonds and

depositary receipts, as well as exchange-traded funds, index funds

and mutual funds holding securities issued by these entities in any

jurisdiction will also be restricted to U.S. investors.

Write to Dawn Lim at dawn.lim@wsj.com, Jing Yang at

Jing.Yang@wsj.com and Gordon Lubold at Gordon.Lubold@wsj.com

(END) Dow Jones Newswires

January 06, 2021 15:02 ET (20:02 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

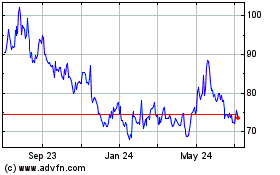

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

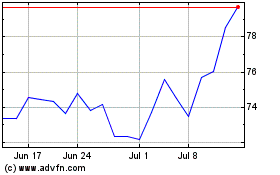

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024