By Stella Yifan Xie and Serena Ng

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 21, 2020).

HONG KONG -- Ant Group Co., the Chinese technology and

financial-services giant that owns popular mobile-payments network

Alipay, said it is planning initial public offerings in Hong Kong

and Shanghai, bypassing New York as it seeks to accelerate its

growth in China and abroad.

The Hangzhou-based company, which was founded by billionaire

Jack Ma and is one of the world's most valuable startups, said it

is targeting concurrent listings on China's year-old, Nasdaq-like

STAR market for homegrown technology companies and Hong Kong's

stock exchange.

Ant is moving to list closer to home while tensions flare

between the U.S. and China, including threats of sanctions on

Chinese officials and delisting Chinese firms from U.S. stock

exchanges. Back in 2014, e-commerce giant Alibaba Group Holding

Ltd. -- from which Ant's flagship Alipay business was spun out of

-- chose New York as its listing venue and raised $25 billion. It

was the world's largest IPO until Saudi Aramco's listing last

year.

Ant didn't give a time frame for its IPOs or a fundraising

target, but a person familiar with the matter said the company is

aiming for a market valuation exceeding $200 billion and hoping to

list later this year. The combined stock offering could be one of

the largest in history, as companies generally sell at least 10% to

15% of their shares when they go public.

Ant was last valued at $150 billion in a private fundraising

round in mid-2018 that raised around $14 billion from a combination

of domestic and international investors.

Since then, several holders of Ant's shares, including funds

managed by BlackRock Inc., have marked up the value of their

investments, according to regulatory filings.

Ant said going public will help it "accelerate its goal of

digitizing the service industry in China," position the company to

expand with partners globally and enable it to invest further in

technology and innovation.

Its executive chairman Eric Jing also said the listing would

also help the development of Shanghai's STAR market as well as the

stock exchange of Hong Kong by drawing global investors to

companies listed on those bourses. "We are thrilled to have the

opportunity to play a part in this development," he added.

Ant, which is profitable, has long been tight-lipped about its

listing plans. Unlike Alibaba and most of China's most valuable

technology players that have holding companies incorporated in

offshore jurisdictions like the Cayman Islands, Ant is domiciled in

mainland China and needs the blessing of Chinese regulators to list

its shares in other markets.

Its latest plans come at an important juncture for both Hong

Kong and China, which is locked in a dispute with the U.S. over

Beijing's tightening grip over the Asian financial hub.

Last month, China imposed a new national-security law on Hong

Kong that is designed to curb dissent and quell pro-democracy

protests by criminalizing secessionist, subversive and terrorist

activities in the former British colony. The Trump administration

has condemned the move and said it would impose sanctions on

officials and entities that have contributed to the erosion of Hong

Kong's autonomy.

Earlier this year, the Senate passed legislation that would

force U.S.-listed Chinese companies to delist from American stock

exchanges if their audit work papers aren't inspected by U.S.

regulators for three consecutive years. The bill must pass the

House before it can become law.

Ant's listing would draw more global investors to Hong Kong, and

make mainland Chinese companies an even larger part of the city's

$5 trillion stock market. Many U.S. money managers already hold

Hong Kong-listed stocks, and some retail brokers also let

individual investors in the U.S. trade shares on the city's

bourse.

Last year, Alibaba added a secondary listing in Hong Kong and

raised $13 billion from investors. Its move followed listing rule

changes that made it possible for companies with weighted voting

rights to list in the city. Alibaba's market capitalization is now

around $660 billion, according to FactSet, nearly four times what

it was when the company went public in 2014.

"Ant Group is an important member of the Alibaba digital economy

and we believe Ant's listing plan will be beneficial to its future

growth, creating value for its users, partners and shareholders,"

Alibaba said in a statement on Monday. The company currently owns

33% of Ant's shares.

Alipay, which grew out of a digital payments system on Alibaba's

e-commerce websites, now has more than 900 million active users in

China who use its mobile app for everything from online investing

to paying for groceries and utility bills.

Ant used to be known as Ant Financial Services Group before it

changed its name last month. It said it wanted to be known simply

as Ant Group, to reflect a shift in its strategy toward providing

technology to financial institutions and other businesses.

The company also has large small-business and consumer lending

units and operates a private credit-scoring business. It manages

one of the world's largest money-market mutual funds, which is sold

along with dozens of other mutual funds on a popular investment

platform integrated with its Alipay mobile app.

Outside of China, Ant has investments in mobile payments

startups in other countries, including India's Paytm, and payment

processing tie-ups with overseas banks and retailers. Ant in 2017

tried to buy U.S. money-transfer company MoneyGram International

Inc. for $1.2 billion, but the deal was scuttled by a U.S.

national-security panel.

Hao Hong, a managing director and head of research at Bocom

International in Hong Kong, said Ant's plan to list in the city

will make it easier for international investors to profit from

selling their stakes in the company. He said Ant could fetch a

higher valuation on mainland China's A-share market, given a

historical gap in valuations on stocks listed on both bourses.

Virtually all IPOs on China's fledgling STAR market, which is also

known as the Science and Technology Innovation Board, have also

surged upon listing.

"Now may be the best time for Ant to go public as investors'

enthusiasm has been the highest since 2015," said Mr. Hong, adding

that waiting longer could subject the company to higher

geopolitical risk as tensions between the U.S. and China rise.

Write to Stella Yifan Xie at stella.xie@wsj.com and Serena Ng at

serena.ng@wsj.com

(END) Dow Jones Newswires

July 21, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

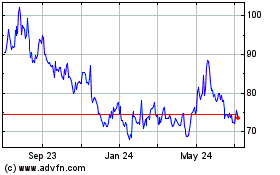

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

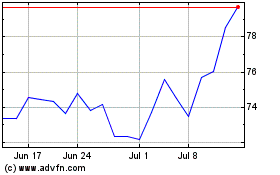

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024