Alibaba Switches Lazada CEO Again in Tough E-Commerce Market

June 26 2020 - 8:39AM

Dow Jones News

By Liza Lin and Phred Dvorak

SINGAPORE -- Alibaba Group Holding Ltd. replaced the chief

executive of its Southeast Asia e-commerce unit for the third time

in just over two years, as the Chinese technology giant continues

to struggle to get its international business on track.

Alibaba said it has tapped Chun Li, the head of Lazada's

Indonesia operations, Southeast Asia's biggest market, to take on

the CEO post as well. The move puts a tech expert and veteran of

one of Alibaba's domestic online markets atop Lazada. He succeeds

Pierre Poignant.

Singapore-based Lazada operates in six markets in the

region.

Alibaba has for years been trying to replicate its huge success

at home in markets outside of China. The Hangzhou-based company,

which owns China's two largest e-commerce platforms, has sought to

expand its operations overseas as growth in its domestic market

begins to slow.

Lazada is Alibaba's most high-profile and costliest investment

outside of its home market. It was the biggest e-commerce company

in Southeast Asia -- a region where demand for such services is

expected to explode -- when Alibaba bought a controlling stake in

2016. The Chinese company has poured in at least $4 billion in

investments, revamped Lazada's technology and sent a host of

Alibaba executives to help lead the unit.

Yet Lazada's revenue growth rate overseas has lagged behind

Alibaba's growth in Chinese retail markets, and it has fallen

behind local and regional rivals in important markets -- most

notably Shopee, the e-commerce unit of Singapore-based Sea Ltd.,

which counts another Chinese tech giant, Tencent Holdings Ltd., as

a backer.

About 3% of the region's $587.5 billion in total retail

purchases were conducted online, according to a joint report by

Bain & Co. and Facebook Inc. this year, leaving a lot of space

for the e-commerce market to grow.

During the past year, Lazada fell behind Shopee in the

fast-growing markets of Vietnam and Malaysia in terms of the

average number of people who use the app every month, according to

rankings from data tracker App Annie. Lazada continues to lag

behind in Indonesia, although it has recently shown faster growth

there, analysts and market watchers said.

"The political, economic and cultural differences of the various

Southeast Asian markets makes it difficult for a one-size-fits-all

strategy, as Alibaba has been accustomed to in China," said Tan

Yinglan, a managing partner at Insignia Venture Partners.

Part of Alibaba's challenge has been culture clashes and a

failure at times to understand local markets, people familiar with

the operations said.

The appointment of Mr. Li is an attempt to bridge those cultural

gaps, since he has spent time both in Alibaba's Hangzhou

headquarters, as well as in the region with Lazada, Mr. Tan

said.

Mr. Li had made "huge impact contributions" to Lazada since

joining in 2017, said Lucy Peng, the company's chairman in a letter

to its staff. A former chief technology officer in Alibaba's

enterprise e-commerce unit, Mr. Li had overseen a major technology

upgrade at Lazada and had held the fort for the company in a tough

and competitive market such as Indonesia, Ms. Peng said.

Lazada's new CEO faces both rising competition and opportunity

in the Southeast Asian market, said Florian Hoppe, a partner at

Bain in Singapore. The coronavirus pandemic has led to a huge wave

of new users entering the Southeast Asia e-commerce market,

providing tremendous opportunities for all the players in the

market.

Still, the company continues to face a fierce fight with Shopee

and local operators within individual Southeast Asia for market

share, and the new CEO will need to help Lazada retain the new

users it has attracted recently, Mr. Hoppe said.

Write to Liza Lin at Liza.Lin@wsj.com and Phred Dvorak at

phred.dvorak@wsj.com

(END) Dow Jones Newswires

June 26, 2020 08:24 ET (12:24 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

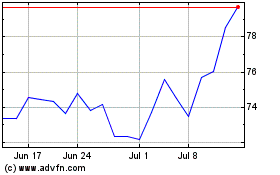

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

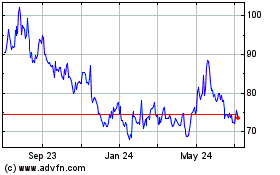

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024