Hong Kong Listing Boosts Alibaba Stock

November 28 2019 - 7:35AM

Dow Jones News

By Joanne Chiu and Stu Woo

HONG KONG -- Alibaba Group Holding Ltd.'s Hong Kong listing has

given a fresh boost to what was already China's most valuable

technology company.

The e-commerce giant's stock jumped 5.6% to 204 Hong Kong

dollars ($26.07) Thursday, giving investors who subscribed to the

$11.2 billion secondary offering a nearly 16% gain in three days

since the shares began trading on Tuesday morning.

Alibaba leaders said they wanted to list in Hong Kong because,

compared with its primary listing in New York, the semiautonomous

Chinese city has more investors who regularly use its products.

Alibaba dominates Chinese online retail and is pushing into food

delivery, cloud computing and other businesses.

"The U.S. investors probably gave it a discount it doesn't

deserve," said Bernstein analyst David Dai. He said the high share

price will help Alibaba motivate employees with stock options,

raise money in the future and boost the company's international

prestige.

Alibaba's American depositary receipts rose 5.4% over the past

three sessions to US$200.82. That is just a tad off its historic

high in June last year, and gives the company a market value of

more than half a trillion dollars.

The difference between the two share-price moves in the last

three trading days is because the Hong Kong stock was initially

cheaper, since it was priced last week at a discount to the U.S.

securities. After Thursday's action, it is now trading at a

significant premium.

Some Chinese funds in Hong Kong have bought Alibaba stock, and

in coming months investors based in mainland China may rush to do

the same once the company's shares are available via a stock

connect program. If so, Alibaba's stock may rise further, said

David Gaud, Asia chief investment officer and head of discretionary

portfolio management at Pictet Wealth Management.

"Mainland investors are more comfortable with high valuations,"

he said.

At Wednesday's U.S. close, Alibaba was trading at a price of 24

times estimated earnings for the next 12 months, lower than its

rival Tencent Holding Ltd.'s nearly 27 times for the same period,

according to FactSet.

Alibaba leaders wanted its 2014 initial public offering to be in

the Asian financial hub, but at the time the Hong Kong exchange's

"one shareholder, one vote" principle clashed with the company's

complicated structure that gives founders more control over other

shareholders. Alibaba settled for New York, where it raised $25

billion, a record that may be eclipsed in coming weeks by oil giant

Saudi Aramco's IPO. Hong Kong's exchange since relaxed its rules,

paving the way for Tuesday's listing.

The exchange is now reaping extra business. Alibaba shares

valued at HK$8.37 billion traded hands on Thursday, making it the

city's most active stock and accounting for more than a 10th of

total market turnover by value.

On Wednesday, the city's index compiler said Alibaba will join

the Hang Seng Composite Index from Dec. 9. The company isn't yet

eligible for the city's benchmark Hang Seng Index, but the index

compiler will consult investors on whether to include companies

with dual-class shares to its major benchmark in the first quarter

of next year.

Alibaba hasn't laid out detailed plans on how it intends to use

the $11.2 billion it raised. The company already had nearly $33

billion in cash and equivalents as of Sept. 30. Alibaba leaders

have said they simply wanted more flexibility, for example, to

invest in expanding businesses or for potential acquisitions. The

total raised may rise to about $13 billion if bankers underwriting

the deal exercise an option by mid-December to buy more shares.

Write to Joanne Chiu at joanne.chiu@wsj.com and Stu Woo at

Stu.Woo@wsj.com

(END) Dow Jones Newswires

November 28, 2019 07:20 ET (12:20 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

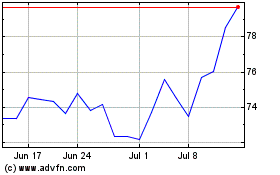

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

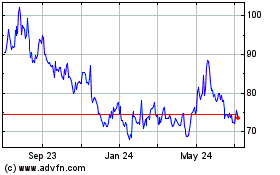

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024