By Newley Purnell

NEW DELHI--The leading player in the battle for mobile payments

in India isn't either of China's pioneers, Alibaba Group Holding

Ltd. or Tencent Holdings Ltd. It isn't Apple Inc., Visa Inc. or

even PayPal Holdings Inc. It's Google.

The Alphabet Inc. unit has for years tried to diversify its

revenues beyond advertising by pushing into new fields like cloud

computing and hardware. While its profits remain healthy, it needs

new ways to make money as the specter of regulation looms at home

and around the globe. Its booming new business in the world's

largest untapped digital market could be the engine of expansion

that it has been looking for.

In India today, the company has one of its fastest-growing hits

ever with Google Pay, a two-year-old app that millions of consumers

are using to spend and transfer tens of billions of dollars.

Resembling a chat app and available in local languages, Google

Pay was the most downloaded financial technology app world-wide

last year, according to SensorTower, a research and marketing firm

for the app industry.

Indian consumers use it to buy train tickets, pay bills and can

even purchase lunchtime meals from street vendors. Tiny mom-and-pop

shops around the country now display a logo with a large "G" and

Google's blue, red, yellow and green colors, signaling that

merchants accept payments via the app.

"There's good reason for Google being bullish," said Satish

Meena, a New Delhi-based analyst with research firm Forrester.

"They're getting good traction. The opportunity in India is

massive."

The app has been downloaded more than 180 million times since it

launched in September 2017 and in the first half of this year, it

clocked more downloads world-wide than PayPal or its Venmo app. It

also outpaced Alipay, from Alibaba affiliate Ant Financial Services

Group, data from SensorTower showed.

"India is setting the global standard on how to digitize

payments," Caesar Sengupta, Google's vice president for its Next

Billion Users initiative and payments, said Thursday at an event in

New Delhi. In the past year, the service has processed transactions

worth more than $110 billion on an annualized basis via the

government's popular real-time payments platform, he said.

Analysts estimate Google Pay is now used as much as or more than

any other service, including apps backed by Tencent and Paytm,

which counts among its investors Warren Buffett's Berkshire

Hathaway Inc., SoftBank Group Corp. and Alibaba.

Google offers other payment systems branded Google Pay around

the world, but Google Pay in India is the only service of its kind

offering real-time payments without the use of credit or debit

cards between individuals and businesses.

Shop owners can display a printed QR code for shoppers to scan,

or two individuals can open the app, hold their phones together and

use audio pairing to connect and make payments.

Hundreds of millions of Indians are entering the digital economy

for the first time thanks to inexpensive mobile data and

smartphones. Cash still rules, but most Indians have bank accounts

and for simple payments they are skipping plastic and going

straight to mobile.

The catalyst for mobile-payment growth came in 2016, when

India's government nullified the largest-denomination cash notes in

circulation to curb corruption. That triggered a crunch and

consumers had to stand in long lines for ATMs. Many downloaded

mobile wallets like Paytm's, learned more about digital payments

and became comfortable making them.

Google, sensing an opportunity to get a digital payments

foothold in the country of 1.3 billion, has used its massive war

chest to capture users with an advertising blitz and cash

awards.

The value of mobile payments in India is well behind China's,

but is ahead of the U.S. The value of mobile payments could nearly

double to hit $450 billion a year by 2023, according to a 2018

report from Morgan Stanley, with Google wringing as much as $4.5

billion annually out of the business should it introduce

advertising or other new services.

Google has an early lead but isn't without challenges. The

biggest one on the horizon is Facebook's WhatsApp. The platform has

400 million users in India, more than any other country, and it

rolled out a trial payments service to a million users in February

2018.

Two months later, the Reserve Bank of India said payment-related

data needed to be stored in the country and a complete rollout of

the service has stalled. WhatsApp says it adheres to those rules

and hopes to be able to fully launch the service to all users in

India in the coming months.

Analysts say that Google, having fully launched Google Pay

before the guidelines were issued, hasn't been affected. A Google

spokesman didn't immediately respond to a request for comment on

Google Pay's adherence to data localization guidelines.

"One year ago no one knew about this app," said Surender Singh,

a sales clerk in a New Delhi smartphone shop.

While customers still use rival apps, Google Pay's usage is

surging more than others, with nine or 10 people a day using it at

his shop to buy items like chargers and headsets, spending as much

as $40 per transfer, he said.

"If people don't have credit cards or cash, they use Google

Pay," said Mr. Singh.

Write to Newley Purnell at newley.purnell@wsj.com

(END) Dow Jones Newswires

September 19, 2019 05:44 ET (09:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

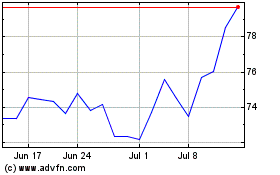

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

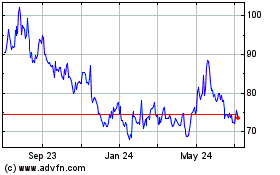

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024