FingerMotion Provides Corporate Update

August 01 2019 - 9:47AM

FingerMotion, Inc. (OTC QB: FNGR), a US fintech company with mobile

payment and recharge platform operations in China, today provided a

corporate update in a letter from its CEO Martin Shen to its

shareholders.

| |

To Our

ShareholdersFirst, I want to thank all our stockholders for their

commitment to the Company and belief in our ability to execute our

business plan. Many investors have not yet had the

opportunity to see me in person to get a sense of what drives me to

pursue excellence. In the coming months, I hope to change

that with a greater investor outreach program - for now I hope this

brief summary will suffice. My foundation in business and

finance comes from 10 years in the audit, tax and advisory groups

at PriceWaterhouseCoopers. As a CPA, I understand the

required governance and control procedures needed for a public

company to be compliant with the SEC, while balancing my fiduciary

obligation to maximize stockholder value. I also want

investors to know that I take the matter of signing periodic

reports containing our financial statements very seriously.

My years as an auditor engrained in me a disciplined approach to

financial reporting. In the past, many Chinese companies that

were publicly traded in the U.S. failed to file accurate financial

statements or statements that were in compliance with Public

Company Accounting Oversight Board (“PCAOB”) standards. As a

result, investors have questioned the reliability of financial

reports from companies with operations based in China. Furthermore,

only a handful of Chinese e-commerce companies are U.S.-based

filers, and we are among this group. Therefore, as a U.S.

company, we pride ourselves on providing accurate, Sarbanes-Oxley

compliant reports to our stockholders. When we started the

predecessor company to FingerMotion, we were an on-line gaming

company and our biggest challenge was gaining users and developing

a loyal user base. In the process of growing our user base,

we were able to capitalize on an even bigger business opportunity -

the Chinese mobile phone top-up market - a market that is

generating $23 billion a month and growing. We are strongly

positioned to become one of the major providers in the market as

one of only a handful of licensed top-up wholesalers in

China. Unlike some of our competitors, our top-up portal is

open to all mobile phone users, and we expect to be the first to

market with our 5G top-up capability. We believe our company

is on an accelerated pathway toward profitability and we anticipate

break-even results as soon as the quarter ending November 30,

2019. Our entire management team is committed to making

FingerMotion, Inc. a profitable company; we believe in what we are

doing, and we are focused on building stockholder value. We are

also investing some of our working capital to pursuing

revenue-generating opportunities with higher gross margin potential

while we continue our mobile phone top-up business with high Gross

Transaction Value (GTV) revenues and low profit margins. In

the past 6 months, we successfully integrated our top-up platform

with Pinduoduo’s (NASDAQ: PDD) portal. Next, we launched our

SMS aggregation business for major retail clients, which will boost

our gross margin significantly.Finally, and most significantly, we

took over the management of China Unicom’s (NYSE: CHU) portals on

e-commerce sites such as PDD, JD.com (NYSE: JD), and Alibaba’s

(NYSE: BABA) TMALL sites. This arrangement reflects China Unicom’s

confidence in our underlying capability to accurately and

efficiently manage their online business. Managing China Unicom’s

portal provides our Company the opportunity to branch away from

just the top-up business. We will now generate revenues on all

mobile phone and accessory sales generated through the portal,

which we expect will result in a large volume of business at better

margins. Our growth in this new revenue stream will not be

constrained by our ability to deposit funds with China Unicom

because we will not be required to use our own capital to process

the China Unicom orders.The common underlying theme of all these

achievements is the aggregation of a large number of users and

deploying our limited capital resources to market channels with

higher returns.In the next few days, we will be issuing a

supplemental announcement to our stockholders explaining our

current business profit centers and how we intend to monetize our

huge end-user base. We will also address our plans to adopt

Sarbanes-Oxley oversight regulations and other value-enhancing

steps. Be sure to look for our upcoming release.SincerelyMartin

Shen CEO, FingerMotion, Inc. |

About FingerMotion, Inc.

FingerMotion, is an evolving technology company

with a core competency in mobile payment and recharge platform

solutions in China. It is one of five companies in China with

access to wholesale rechargeable minutes from China’s largest

mobile phone providers that can be resold to consumers. As

the user base of its primary business continues to grow, the

company is developing additional value-added technologies to market

to its users. The vision of the company is to rapidly grow

the user base through organic means and have this growth develop

into an ecosystem of users with high engagement rates utilizing its

innovative applications. Developing a highly engaged ecosystem of

users would strategically position the company to onboard larger

customer bases. FingerMotion eventually hopes to serve over 1

billion users in the China market and eventually expand the model

to other regional markets.

Safe Harbor Statement

This release contains forward-looking statements

that involve risks and uncertainties. Forward-looking statements

give our current expectations of forecasts of future events. All

statements other than statements of current or historical fact

contained in this release, including statements regarding our

future financial position, business strategy, new products,

budgets, liquidity, cash flows, projected costs, regulatory

approvals or the impact of any laws or regulations applicable to

us, and plans and objectives of management for future operations,

are forward-looking statements. The words “anticipate,” “believe,”

“continue,” “could,” “should,” “estimate,” “expect,” “hope,”

“intend,” “may,” “plan,” “project,” “will,” and similar

expressions, as they relate to us, are intended to identify

forward-looking statements. We have based these

forward-looking statements on our current expectations about future

events. While we believe these expectations are reasonable, such

forward-looking statements are inherently subject to risks and

uncertainties, many of which are beyond our control. Our actual

future results may differ materially from those discussed or

implied in our forward-looking statements for various reasons.

Factors that could contribute to such differences include, but are

not limited to: international, national and local general economic

and market conditions; demographic changes; the ability of the

Company to sustain, manage or forecast its growth; the ability of

the Company to manage its VIE contracts; the ability of the Company

to maintain its relationships and licenses in China; adverse

publicity; competition and changes in the Chinese

telecommunications market; fluctuations and difficulty in

forecasting operating results; business disruptions, such as

technological failures and/or cybersecurity breaches; and the other

factors discussed in the Company’s periodic reports that are filed

with the Securities and Exchange Commission and available on its

website (http://www.sec.gov). Given these risks and uncertainties,

you are cautioned not to place undue reliance on such

forward-looking statements. The forward-looking statements included

in this release are made only as of the date hereof. We do not

undertake any obligation to update any such statements or to

publicly announce the results of any revisions to any of such

statements to reflect future events or developments.

For further information e-mail:

info@fingermotion.com

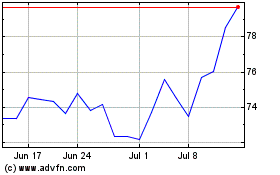

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

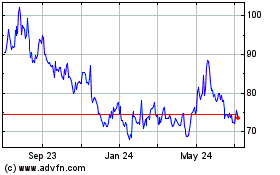

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024