Alibaba Revenue Seen Higher; Chinese Economy in Focus -- Earnings Preview

January 29 2019 - 7:29AM

Dow Jones News

By Yoko Kubota

Chinese e-commerce giant Alibaba Group Holding Ltd. will report

fiscal third-quarter earnings before the U.S. market opens

Wednesday. Analysts expect the New York Stock Exchange-listed

company to post a rise in revenue, with solid demand for items

including apparel and cosmetics and a steady growth in commissions

from vendors, helping to buck China's economic slowdown. Meanwhile,

it is expected to post a decline in net income, as investments into

new business areas as well as spending on content for its online

video platform and other costs weigh on profitability. Here is what

to look for:

EARNINGS FORECAST: Analysts polled by FactSet expect the

Hangzhou-based company to report a 8.5% drop in net income to 21.35

billion yuan ($3.16 billion), compared with 23.33 billion yuan from

the same period a year earlier.

REVENUE FORECAST: Alibaba is expected to post 119.08 billion

yuan in quarterly revenue, up 43.4% from 83.03 billion yuan a year

earlier, the poll showed.

What to Watch

CHINA'S SLOWDOWN: In 2018, China's economy expanded at its

slowest annual pace since 1990. Many companies, including Apple

Inc., have warned about the impact from China's deceleration.

Alibaba runs China's two largest online retail platforms, Taobao

and Tmall, and so its results serve as a barometer for China's

consumer economy. Investors are all ears for what Alibaba

executives say about the economy and any fallout from U.S.-China

trade tensions. They would also be looking for signs Alibaba is

tightening its belt.

CORE COMMERCE: Despite the slowdown, Alibaba in November sold a

record $30.8 billion worth of goods for Nov. 11's Singles Day.

Investors are eager to understand how much Chinese consumers are

paring back spending and for what types of purchases. Last week,

Alibaba Executive Vice Chairman Joe Tsai said demand for smaller

items such as apparel, consumer staples and fast-moving consumer

goods like toiletries has continued to be strong despite slowdown

of big-ticket items such as cars. "People are, sentiment-wise,

tending to be a little bit more conservative, but it's not a

disaster scenario," he said.

OUTSIDE BETS: Alibaba has aggressively invested in businesses

beyond online retail, including food delivery and bricks-and-mortar

stores, moves that have weighed on profit margins. Mr. Tsai last

week suggested that Alibaba will be more conservative with future

investments. "Of course we are going to be selective. We are going

to be disciplined in some cases, but aggressive in other cases. In

the areas we feel we want to invest, we will continue to invest

very aggressively," he said. Signs of where Alibaba could be

cutting back and where it is pouring money into will be closely

scrutinized.

Write to Yoko Kubota at yoko.kubota@wsj.com

(END) Dow Jones Newswires

January 29, 2019 07:14 ET (12:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

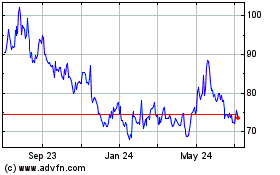

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

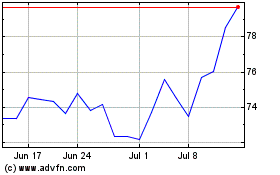

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024